The pandemic has brought the importance of being financially prepared into the spotlight. Coupled with concerns around climate change, growing numbers of adults have been investing in socially responsible investments for their child’s future.

We carried out research with Opinium, and found that nearly two in three (64%) UK adults are now more likely to start investing on behalf of a loved one under the age of 18 than they were before the pandemic. Of those who already have a Junior ISA (JISA), 56% say they are contributing more than they were previously and will continue to do so over the next 10 years.

A third (35%) of JISA investors say the main motivation for investing more is because the pandemic has made them realise they need to plan for the future. The majority (78%) also say they are now more likely to opt for a socially responsible JISA than they were previously, with 48% of those who would opt for a socially responsible JISA saying the pandemic has encouraged them to re-evaluate their perspectives. A fifth (20%) say it is because their child or loved one has expressed an interest in climate change or a similar issue.

We carried out the research as it has been ten years since the JISA was launched in November 2011. We wanted to see how attitudes towards saving and investing on behalf of under-18s has changed – after the Covid-19 outbreak, and in the midst of a climate crisis.

People have become acutely aware of how important it is to build up a nest egg for the next generation, who may one day need help to fund their studies, buy a home or fulfil their dreams of travel – or all three.

Junior ISAs have a clear advantage over other kinds of saving accounts:

- There is no tax to pay on interest or investment returns earned – a perk which really adds up over 18 years.

- Only the child can make withdrawals from the age of 18 so the temptation to withdraw and spend is removed. (There’s an exception for terminal illness or death)

Don’t fear investing

Our research suggests that cash remains the most common option for saving on behalf of children. People worry about losing money with investing – and there is always that risk – but it’s not the only risk to consider with your finances. There’s also ‘shortfall risk’, which is the risk that you won’t reach your financial goals.

Drip-feeding money into an investment portfolio so that you ‘buy’ investments as they fluctuate in price is a good way of handling market volatility. Over time the ‘cost’ of buying those investments at high and lower prices averages out – it’s called ‘pound cost average’ in investment-speak.

Doing this over the longest possible timeframe could increase the chances that the return on your investments meet your goals.

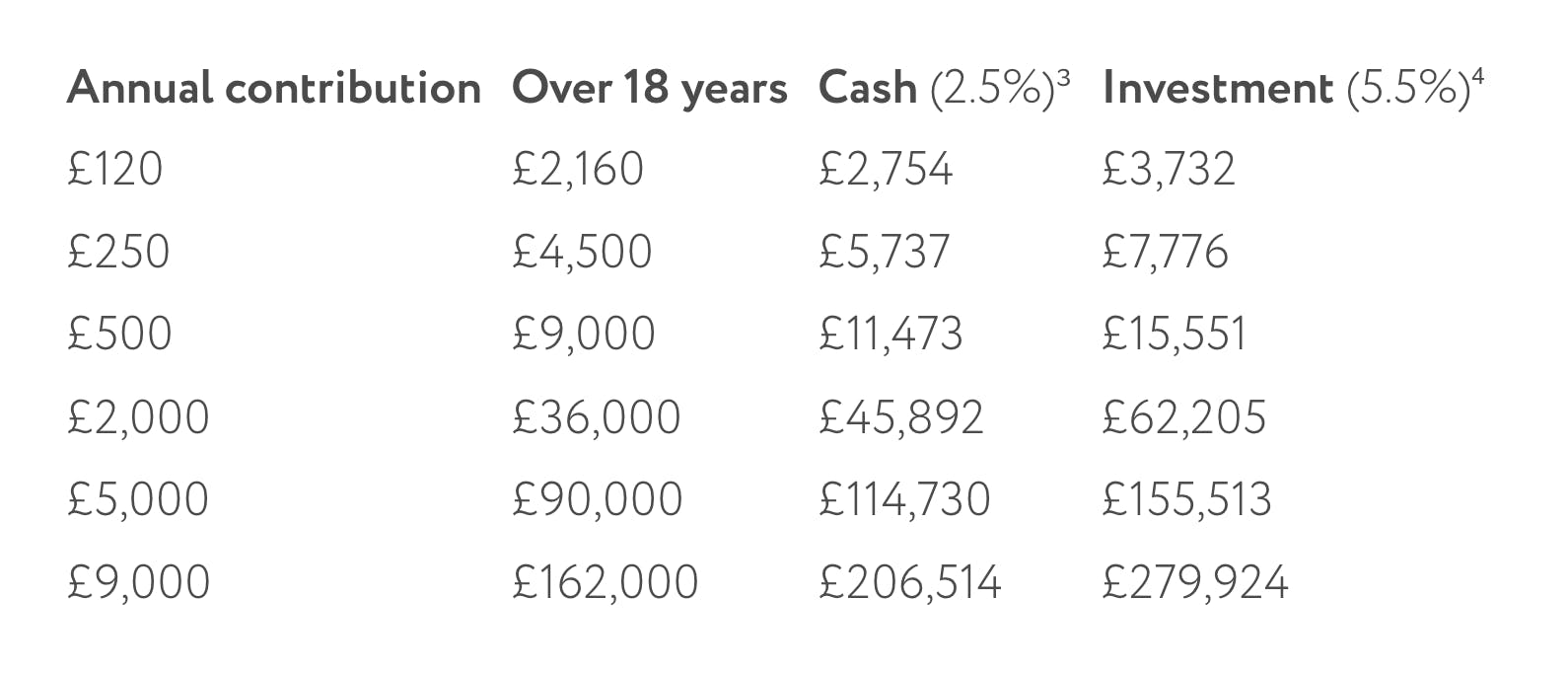

Contributing £120 at the start of the year – equivalent to £10 a month – and adding the same amount again annually could mean building up £2,160 over 18 years.

In the table below you can see how that money has the potential to grow:

If it was saved in an interest-earning cash Junior ISA it could be expected to grow to £2,754 in 18 years. If it was invested in a stocks and shares Junior ISA, delivering an average of 5.5% returns over 18 years, it could be worth £3,732.

Returns* based on cash vs investment over an 18-year period

*Assumes payment made at the beginning of year. Projected returns are net of fees.

It is important to remember that inflation will erode the spending power of money contributed, saved or invested over time. For example, inflation at the Bank of England’s target rate of 2% over 18 years could mean that £100 today would be valued at approximately £70 in 18 years’ time. And while investing could help combat the effect of inflation, market performance cannot be guaranteed.

Research:

- Research conducted among 2,000 adults with children or loved ones under the age of 18 by Opinium in October 2021

- ONS Individual Savings Accounts (ISA) statistics: https://www.gov.uk/government/collections/individual-savings-accounts-isa-statistics

- Cash interest rate: 2.50% interest rate best available for a Junior ISA as of 18 October 2021. This rate is not fixed and may go up and down over time with changes to the Bank of England base rate decisions. Source: MoneySavingExpert: https://www.moneysavingexpert.com/savings/junior-isa/#jisatable

- Investment returns: Predicted net returns based on all-time performance of fully managed Nutmeg Portfolio 7. Calculations assume returns are reinvested and are net of fees. Calculation does not take into account inflation. Costs may vary.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. Projections are never a perfect predictor of future performance, and are intended as an aid to decision-making, not as a guarantee. The projection includes the effect of Nutmeg’s fees, investment fund costs, and market spread.

To open a Nutmeg JISA, your child must be under the age of 16 and funds cannot be withdrawn until your child turns 18. Tax treatment depends on your individual circumstances and may be subject to change in the future.

If you are unsure if a Junior ISA is the right choice for you and your child, please seek financial advice.