A lot has changed since we first wrote about bitcoin three years ago; indeed, even since January this year when we took another look. We have witnessed an incredible rise in volatility and expansion of the crypto offering, which led the FCA to issue the following statement at the start of 2021.

A common understanding of how Bitcoin and the other ‘coins’ might benefit the financial system remains elusive, despite January 2021 marking the 12th anniversary of Bitcoin’s creation. In this piece we predominantly focus on Bitcoin as the centre of gravity in the crypto market and as the established barometer for this asset class.

This article updates our own assessment of cryptocurrencies from three viewpoints:

- as a global payments system

- as a store of value

- as an investable asset

We conclude that cryptocurrencies still face significant technical and institutional challenges, which are preventing them from becoming a store-of-value.

Finally, we offer the suggestion that if these new coins do somehow gain wide traction in their current form, then the organisation of human social/financial systems will have to have changed dramatically. Such a scenario is unlikely for a technology whose creator has yet to emerge from the shadows.

Nutmeg does not currently invest in this non-transparent and volatile financial instrument. The winners from the cryptocurrency market in its present form are unlikely to be long term investors, but rather high-risk hedge funds or trading platforms springing up to benefit from coin volatility. Other major beneficiaries are those wishing to shield their financial affairs from regulatory and enforcement scrutiny. The recent ransomware attack on US fuel infrastructure reportedly extorted 0 million in Bitcoin value from the operators – not a model case for Bitcoin usage.

Blockchain’s distributed ledger technology will very likely have its place in the future economy, but the transaction-software underpinning that system (the cryptocurrency clothing) remains – for now – a conceptual riddle. There is no guarantee or likelihood that any currently available crypto coin will suit the purpose of a future digital global currency.

1. Is cryptocurrency a global payment system?

Our key concerns:

1. Payment systems are still limited and rely on government-backed (or ‘fiat’) currency: Although Amazon is allowing indirect purchase of products using gift cards purchased with cryptocurrencies, the bulk of cryptocurrency-related activity remains on exchanges. ‘Data from Chainalysis estimates merchants made up only about 1% of cryptocurrency activity in North America between mid-2019 and mid-2020, while exchanges accounted for almost 90%.’ Famously now, Elon Musk offered Bitcoin exchange for Tesla vehicles in February 2021, but retracted the offer three months later citing environmental concerns.

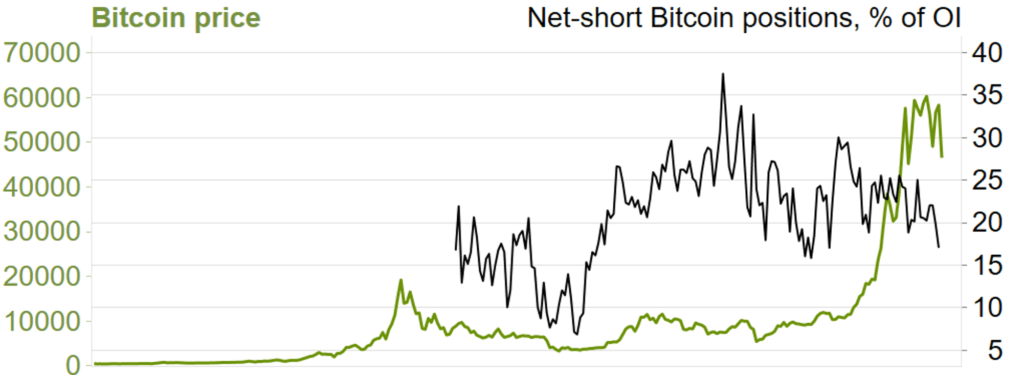

2. There is limited liquidity: In October 2020, PayPal began offering select US customers the chance to hold Bitcoin – but not yet use it as a means of payment. PayPal was late to arrive – lagging two and a half years behind rival Square – and is thought to be buying more than the 6.25 Bitcoins that are mined every ten minutes. This Bitcoin shortage, combined with the new access channels, is likely to have contributed to the price bubble since October. See green line on chart 1A below.

Chart 1A: The rise of Bitcoin price and number of short positions

Source: MacroBond / Nutmeg

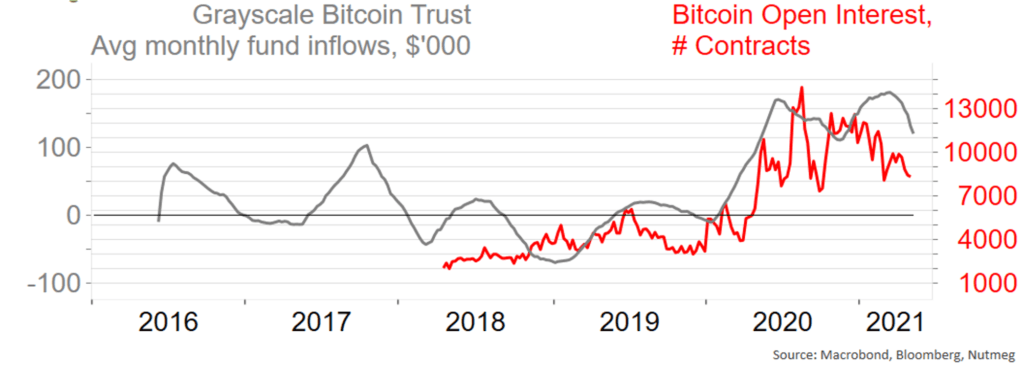

Chart 1B: Rise in liquidity and inflows in to Bitcoin

Source: MacroBond / Nutmeg

3. Volatility makes it a vehicle for trading, not transacting: Chart 2 reveals Bitcoin’s attractiveness to platforms and traders who benefit from its high volatility. The red line in chart 1B reveals the liquidity (Open Interest) these platforms have added over the past year; the black line in 1A shows that the net position held by these traders is a short position (% of Open Interest). These platforms are not themselves betting on price appreciation via coin ownership, but have set up servicing businesses which benefit from price volatility and the wide spreads charged on ‘coin’ conversion.

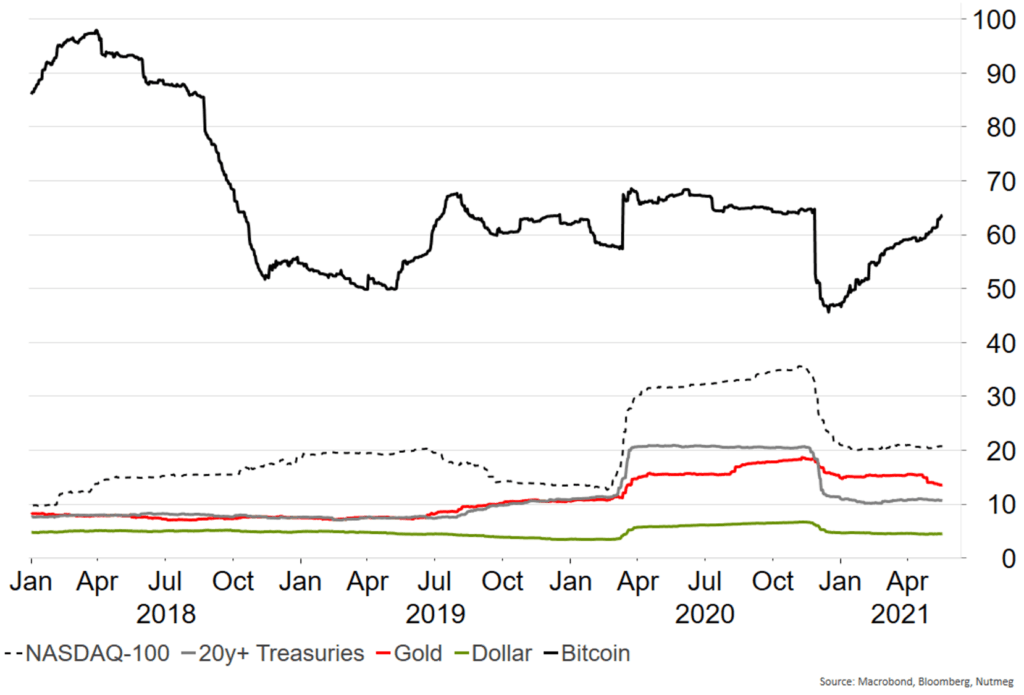

Chart 2: Bitcoin’s volatility compared to other traditional stores of value (Y axis = historical 1yr volatility)

Source: Marcobond / Bloomberg / Nutmeg

4. There is no dispute resolution: Just as a standard working use of blockchain distributed ledger technology is yet to be established, a centralised system to resolve transactional disputes between anonymous cryptocurrency counterparties is yet to develop. Cryptocurrency proponents suggest such systems are best in-built within the blockchain technology. Even if this is true, dispute resolutions should have transparency. Just as judicial justice must ‘be seen to be done’, dispute resolution must be transparent if trust in the system is to be built.

2. Can we view crypto as a store of value (safe-haven)?

Safe storage of liquid or illiquid assets must guard against various types of risks. Below we explain these and whether crypto is currently able to mitigate them:

1. Loss of transactional value: Inflation is a well understood, though often invisible, threat to purchasing power. Perhaps a more visible threat is government ‘fiat.’ Currencies such as pounds, dollar and euros can be manipulated by central bank printing and other forms of non-market price fixing. Cryptocurrency advocates highlight this second type of risk as the main rationale for digital alternatives. This, though, remains only a theoretical argument: the major inflationary levels predicted by crypto advocates, following ten years of global quantitative easing within fiat currencies, have not materialised. Meanwhile, Bitcoin’s volatility is a more prevailing threat to purchasing power.

2. Loss of ownership: Blockchain technology seeks to preserve ownership rights without the backing of any official, national or corporate entity. However, anonymity of counterparties poses a major obstacle of trust and stolen digital wallets have been commonplace.

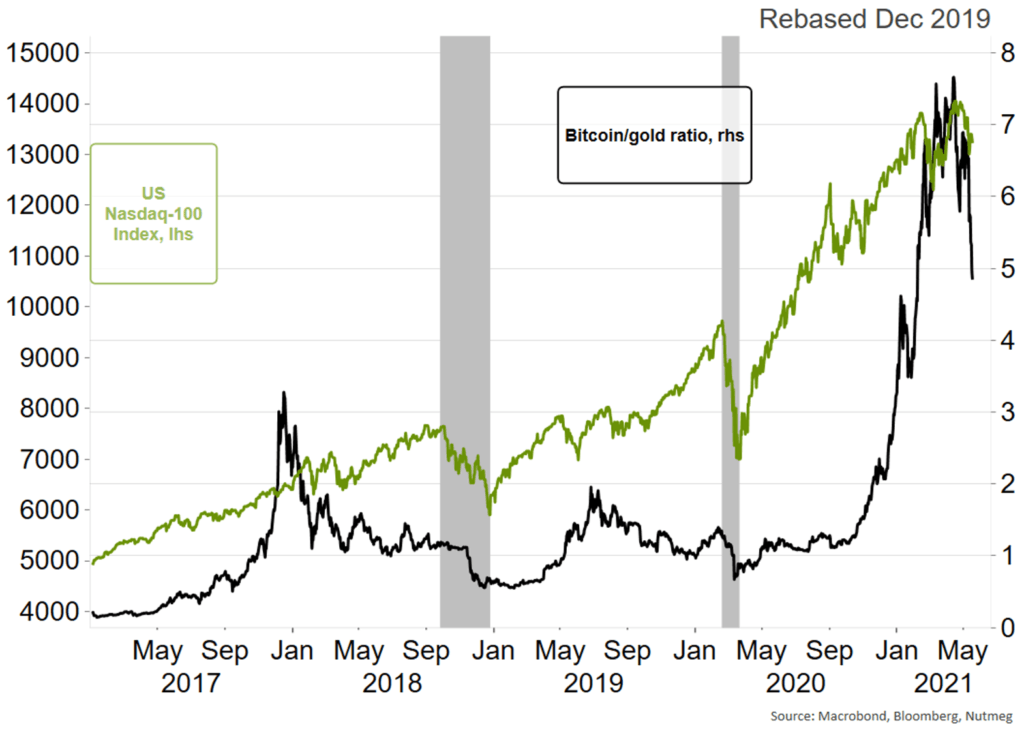

3. Volatile market prices: Bitcoin was ‘created’ in the aftermath of the 2008 Global Financial Crisis (“GFC”). Chart 1B shows persistent inflows into the Grayscale Bitcoin Trust Fund in the US during 2020; the surge in interest in Bitcoin presumably a response to the aftermath of the Covid-19 pandemic that delivered negative oil prices and one of the largest equity market collapses since the Great Depression. But was this strategy a wise one? One way to answer this question is to look at the relative performance of Bitcoin and gold (Chart 3). The shaded regions represent two recent market panics: high volatility in 2018 and Covid in 2020. The chart shows Bitcoin’s value against gold, indicating that gold kept its value in comparison to Bitcoin during these two major market downturns.

Chart 3: Bitcoin devaluing against gold during market downturns.

Source: MacroBond / Bloomberg, Nutmeg

4. Regulatory oversight: We do not believe regulation is currently satisfactory – a status quo that is unlikely to change anytime soon. The crypto asset class remains firmly outside of regulatory oversight. The US Department of Justice recently released its early thinking on the cryptocurrency industry. It raises many questions that must be answered before broader trust can be placed in crypto. Furthermore, central banks the world over are responding by announcing their own intentions to create digital money – The Bank of England is the latest. These are a critical threat to the whole crypto-complex, underlining the policy pushback against anonymous transactability.

5. Limited supply: Arguably, its future fixed supply is the biggest source of value for Bitcoin advocates. It is expected that the full quota of 21 million Bitcoins will be ‘mined’ by 2040. In the meantime, the ‘value’ of these coins will partially depend on the slow mining process of about 900 per day. This drip-feed is designed to push up the price; the major difference to the (potentially) unlimited supply of conventional fiat currency. However, Bitcoin’s constrained supply has encouraged competitor coins and their cross-markets. Fungibility between these coins needs to be safeguarded but the space remains unregulated.

Secondly, constrained supply might feed its own volatility – something we are seeing at the moment as emerging trading platforms attempt to build inventory (PayPal’s purchasing of coins mentioned above) – making the instrument less attractive as a store of value. Furthermore, if the ever-expanding size of the future economy cannot be serviced by Bitcoin, or other crypto supply, then incentive will always exist to look elsewhere to store value (e.g. precious metals, property, land).

3. Is cryptocurrency an investable asset?

If cryptocurrency is an asset, it is a very unusual one. It has no claim on any issuer and no income is earned to underpin its present value. Here we touch on three other characteristics of conventional assets: ownership, investment performance and system of valuation.

1. There are several reasons to own cryptocurrencies and traditional buy-and-hold strategies are not key among them – save for speculative retail.

- Trading platforms: As mentioned already, the decision of PayPal to provide a trading platform for Bitcoin does not make PayPal a long-term investor in the coin. It is merely servicing the current retail appetite for speculation on the coin’s value – and profiting from its volatility.

- Retail investors: Grayscale Bitcoin Trust is a US fund established in 2013 offering indirect retail exposure to Bitcoin (grey line on chart 1B above). It shows persistent inflows in 2020. We have already mentioned Tesla’s ill-fated, if brief, excursion into the retail space.

- Hedging strategies: A more significant investment has been made by the Ruffer Investment Company. This position is an extension of an existing hedge, not a bet on price: Ruffer trimmed 2.5% of its defensive multi-strategy portfolio out of gold into Bitcoin to diversify its hedge against a view that governments seek “devaluation of the world’s major currencies.”

- Black economy: Bitcoin is a currency of choice for the black economy. The secretive nature of distributed ledger technology is a watershed for crime, terror, and illegal organisations. We have already mentioned the recent ransomeware attack facilitated by Bitcoin payment.

- Covert activism: Likewise, Bitcoin and the crypto phenomenon, is attractive to the nefarious aims of political bodies via geopolitical disruption, informal economies, tax evasion and asset shielding.

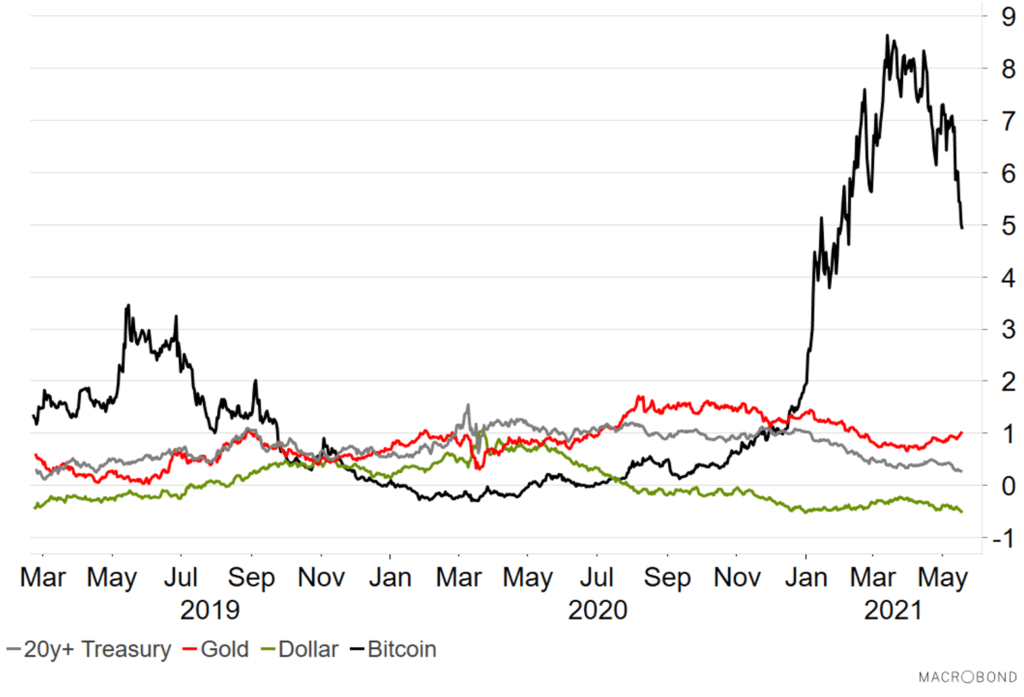

2. Bitcoin’s investment performance is unproven. Chart 4 shows a three-year Sharpe ratio for Bitcoin and a variety of ‘safe-haven’ assets: dollar, gold and US Treasuries. A three-year window is traditionally used in investment to reveal the medium to longer-term risk/reward trade-off of an asset. The chart reveals Bitcoin’s Sharpe ratio swings widely from negative to +8, while the same measure for gold (red line) and US Treasuries (grey line) remain positive and within a tight range. Bitcoin’s short history further limits price discovery.

3. Bitcoin lacks a valuation framework. Investment assets should possess a system of valuation. For example, equities tend to use the dividend discount model, price-to-earnings multiples and equity-risk premia. Bond assets are based around monetary policy expectations and premiums for inflation, fiscal and credit risk. Currencies deploy ‘purchasing power parity’ or relative wealth frameworks. However, for Bitcoin there is no agreed valuation system, leaving only speculation. Some commentators attempt to categorise cryptocurrencies as commodities, allowing their ‘intrinsic value’ to be linked to their marginal cost of production (i.e. electricity costs). This approach omits, incorrectly in our view, the far more important technical drivers of supply and demand discussed in this article.

Chart 4: Contenders for “Store of value” status – 3yr sharpe ratios

4. Are cryptocurrencies moving with the times?

If there is a cryptocurrency that is to become a mainstream investable asset, it may not even exist yet. For all their innovation, we believe the current crop of cryptocurrencies, including Bitcoin, look set to be on the wrong side of progress.

- Governments looking to regulate crypto. The tenet of most existing coins is secrecy and opacity. Yet regulators and policy makers are increasingly seeking to centrally control them.

- Bitcoin and Crypto is an ESG nightmare. From an ESG risk-exposure perspective, energy use (carbon footprint) makes Bitcoin mining extremely inefficient. As this piece states: The bitcoin ecosystem is very resource and energy-intensive, relying on the latest state-of-the-art cooling and equipment technology. That energy demand is so large that it consumes as much as seven gigawatt hours in a whole year, or almost as much as 0.21 per cent of global energy demand. With the same amount of electricity, you could power a whole country the size of Switzerland; while a single Bitcoin transaction consumes as much electricity as 18 US households in a full day. From a corporate governance perspective, Bitcoin’s opacity means we will never understand the ESG risks in the system, let alone provide relative scoring on risk management.

- China is pushing back. Beijing has banned Bitcoin exchanges and fundraising via cryptocurrencies. As an increasingly key part of the global financial trading and capital system, China’s resistance to cryptocurrencies is a major hurdle to overcome if these coins are to gain global traction as mainstream investments. Clearly, the authoritarian nature of the management and oversight of the Chinese economy cannot tolerate clandestine and secretive cryptocurrency and transaction technology.

5. Can crypto live alongside fiat currencies?

If one or more versions of cryptocurrency become the workhorse for a future, secret, blockchain ledger system, several aspects of human organisation may need to change forever. All this illustrates how far away the widespread use of cryptocurrency and blockchain technology is from reality.

- Banks traditionally operate by transforming risks (liquidity risk, credit risk, maturity risk, collateral, etc) but the 2008 global financial crash was an example of a time when banks and their regulators failed to properly oversee this process. Regulation has since moved to prevent this from happening again. For cryptocurrency, their secretive blockchain ledger and account keeping means banks and regulators will not have access to data with which to measure and manage individual, corporate, or systemic risks. Neither will the securities market have full visibility, blinkering its ability to allocate capital efficiently.

- With the ability of individuals, companies and organisations to hide wealth within blockchains, the re-distribution of wealth – which lies at the heart of western democratic social bargains – will be impaired. The tax-base of governments will be undermined, as will be their ability to provide public services.

- Business investment decisions by boardrooms depend on a flow of available capital finance and knowledge of their customers. The first bullet point above touched on the impact that ‘secrecy’ may have on capital financing. But this same secrecy is also a potential barrier between a business and its customers.

- The links between the real economy and financial markets will depend on the fungibility of digital and fiat currencies. Furthermore, if more than one blockchain cryptocurrency technology exists, the ability to exchange one coin for another must be possible. Workers will need to be paid in digital currency and be able to purchase items using digital wallets.

- Generations Y (Millennials) and Z faced chaos and lost opportunity in the aftermath of the 2008 global financial crisis. Bitcoin was ‘born’ out of this crisis. If Bitcoin is the ‘baby’ of these younger generations, GFC was its ‘midwife’. The technological underpinning of the crypto industry offers the younger generation an asset in which they retain a comparative advantage over the ‘Baby Boomers’ who “created the GFC mess in the first place. This intergenerational friction provides the single-most compelling narrative for the existence of crypto. Yet, however compelling the narrative, the current crop of crypto currencies all must still overcome the stumbling block of anonymity discussed above. With central banks intent on creating their own digital currency solutions, time is running out if crypto currencies are to stamp a lasting legacy onto the future financial landscape.

In conclusion:

Last year the Australian Stock Exchange provided an example of the gulf between theory and practice when it shelved a blockchain project: ‘In order to get this project back on track we really need a robust governance framework which isn’t there today …’

A similar line comes from the US Department of Justice’s report referred to earlier:

‘Cryptocurrencies and distributed ledger technology present tremendous promise for the future, but it is critical that these important innovations follow the law.’

Bitcoin and cryptocurrency remain an intriguing space. Bitcoin’s extreme price volatility continues to make it attractive to short-term investors who can afford to tolerate extremely elevated levels of risk, though potentially encouraging another bubble like those seen in 2017/18 and 2020/21.

While some established investment houses have invested in Bitcoin, their motivations in doing so do not represent a full backing of the cryptocurrency model. At the heart of Nutmeg’s investment position on cryptocurrency is whether the current crop of coins can achieve the aim of providing a viable alternative to fiat money. This article has endeavoured to show that is by no means clear. It seems to us the lack of transparency and poor utility as a store of value, or means of payment, need to be overcome. As an investment proposition, there is no guarantee that any of the current coins will meet this challenge.

Risk Warning:

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Forecasts are not a reliable indicator of future performance.

Nutmeg does not invest in Bitcoin or any other cryptocurrency.