We know that the performance of socially responsible investment (SRI) strategies can be an area of concern for our clients. It’s sometimes assumed that investing with an SRI focus will incur trade-offs when it comes to performance, and potentially lead to lower returns. Here, we lay out how our socially responsible portfolios have performed and what we expect from them in the future.

Why would we assume underperformance for socially responsible investments?

Today, SRI is at the core of many clients’ savings goals, and very much a mainstream concern in the personal finance pages. However, the origins of this approach were philanthropic, and largely focused solely on excluding certain investments based on moral considerations without necessarily focusing on investor reward.

This was typically termed ‘ethical’ investing. But there was often little consideration for how Environmental, Social and Governance – or ‘ESG’ – factors could improve the rewards on offer to investors.

Additionally, investments labelled ‘sustainable’ or ‘ethical’ can come with significant risk. For example, the financing of small-scale clean energy projects is typically long term in horizon, often with significant risk of capital loss. This means that these investments may not be suitable for a wide range of investors.

However, investors in traditional equity and bond markets now recognise that to ignore ESG criteria is to ignore both opportunities and risks in these areas. Each have the potential to have a material effect on investor outcomes – or in other words, investor returns.

Most investors have long had a framework to incorporate non-financial factors into their investment analysis, and the benefits of doing so are well understood. But the quality of non-financial data is improving, allowing us to better understand topics such as climate change, working practices, health and social impact.

Rather than assume that incorporating these factors into an investment process will lead to lower returns, there is increasing evidence that SRI could in fact lead to higher returns.

The premise is simple: the companies that are best placed to operate successfully in the future are those with strong social responsibility profiles. They do business in a fair and progressive way, with a management team that addresses short-term risks while ensuring the company is positioned to adapt to long-term transformational changes – such as climate change.

And this premise is supported by academics and practitioners alike. NYU Stern Centre for Sustainable Business examined more than 1,000 academic papers from 2015 to 2020 and found positive relationship between ESG and financial performance of companies, which turn to outperform in long term. Another 2021 study from MSCI – Deconstructing ESG Ratings Performance: Risk and Return for E, S, and G by Time Horizon, Sector and Weighting – also found notable correlation between ESG ratings and risk-adjusted returns.

How have socially responsible investments performed?

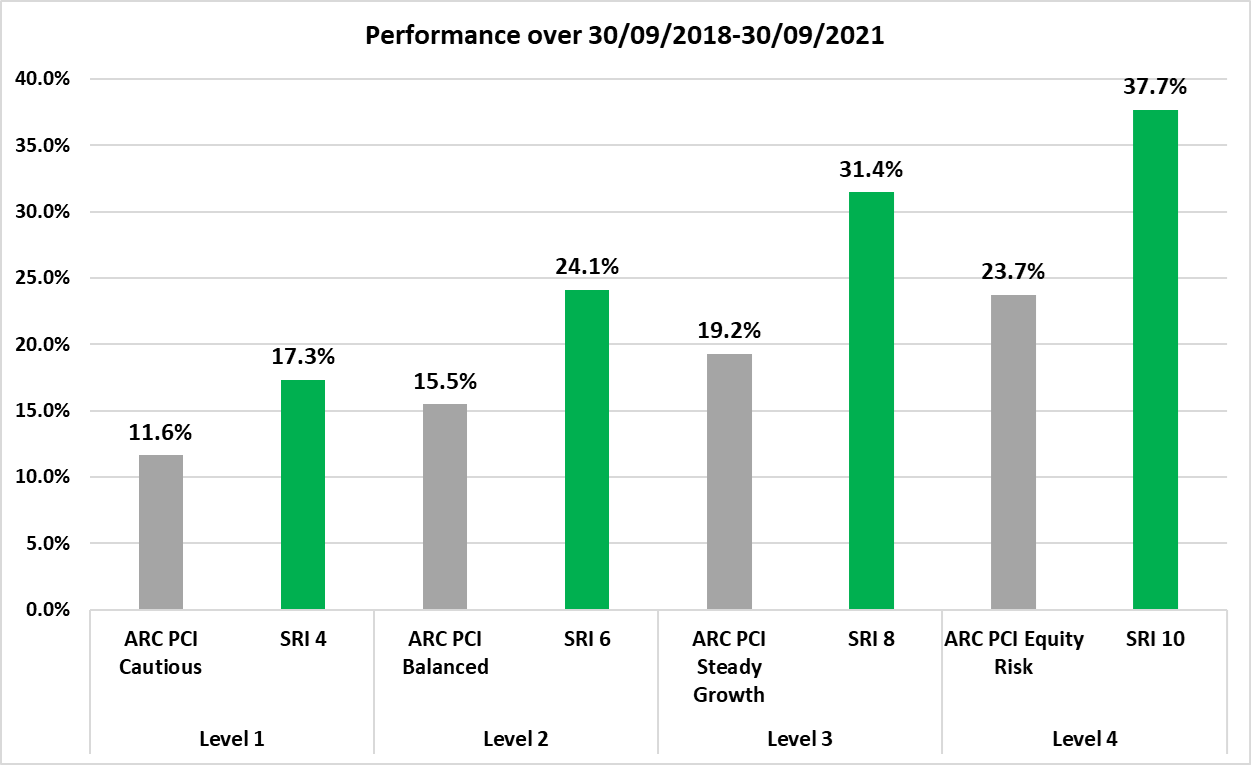

We’re happy to say that since their inception on 30 September 2018, our SRI portfolios have significantly outperformed the average returns of our competitors, as measured by the private client indices from Asset Risk Consultants (see chart below).

Performance of Nutmeg socially responsible portfolios at risk levels 4, 6, 8 and 10 against the comparable private client index (PCI) from Asset Risk Consultants (ARC) between the inception of Nutmeg’s socially responsible portfolios on 30/09/2018 and 30/09/2021

We’re really pleased with this three-year performance, but we recognise that some of our customers would like to examine the performance of SRI portfolios over a longer period. That’s why our investment team has conducted extensive studies to quantify the performance impact of these kinds of portfolios over the past decade and beyond.

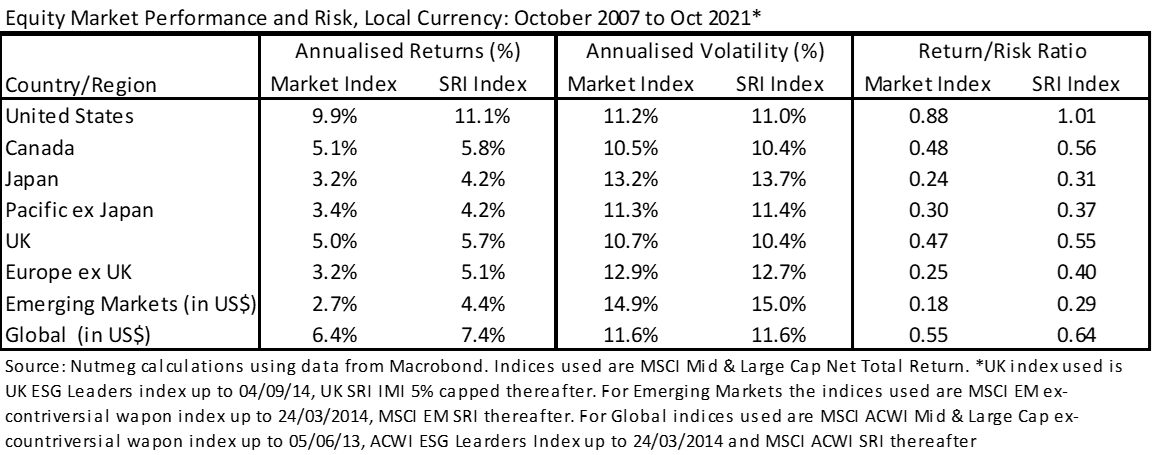

Our analysis has shown that the SRI indexes have outperformed in major markets with exposure to a similar level of risk (measured in volatility), which means a superior risk-adjusted return. Our studies used the same established SRI investment strategies that underpin many of the SRI-focused exchange-traded funds in our portfolios. These returns can be seen below, from the date of inception for the socially responsible indices.

It is worth noting that the same measurements observed at the inception of our SRI portfolios three years ago showed a much less meaningful difference in returns between SRI indices and their non-SRI focused equivalents. The much stronger performance from SRI indices in recent history, in particular over the past three years, is a positive sign that aligns with academic and industry findings that good management and ethical agenda could lead to better performance. It is, however, never overstated that short-term deviations in performance would also be dependent on the stage in economic cycle or market conditions.

For example, the SRI emerging markets index had a structurally lower allocation to China than its non-SRI equivalent in 2018. This has changed massively, especially since 2020; the fast-evolving structural change in SRI indices may cause performance to deviate between the two when the Chinese equity market experiences strong gains or losses.

The ever-evolving impact from the Covid also adds fuel to the complexity. Since the pandemic began in early 2020, we’ve seen sudden and significant changes to people’s living behaviours which result in huge uncertainty to financial markets. Some companies or sectors benefit/suffer more than others from these changes – for example, energy prices fell dramatically in 2020 as demand fell from locked-down economies but rose again in 2021 as the recovery gathered pace.

It’s also worth acknowledging that most indices incorporating an SRI focus don’t have the same history as equivalent non-SRI market indices (many have only existed since around 2007), so our studies of performance have some limitation in time. However, we believe this timeframe is long enough to be reliable given it incorporates over 10 years of history, including the period of the global financial crisis.

Overall, we expect our SRI portfolios to deliver performance over the long term that is on par with that of a similar portfolio without an SRI focus. That is, by incorporating a social responsibility focus we don’t expect there to be a sustained performance trade-off for investors. Of course, the marginally higher cost of underlying fund fees for socially responsible portfolios can slightly reduce this return, the impact is expected to be diminishing as SRI/ESG focused market grows rapidly.

What about Nutmeg’s different portfolio styles?

When it comes to the difference in performance between Nutmeg portfolio styles, we expect any divergence to come from differences in asset allocation, ETF selection, and the availability of suitable assets.

Despite following the same investment strategy and process, the range of available asset classes that embed an SRI focus is more limited than with our current Fully Managed Portfolios at present. With a different investment universe available to each portfolio type, the portfolios won’t carry an exact like for like exposure. Therefore, we expect them to diverge in time due to this difference. For example, high-yield corporate bonds (or ‘junk bonds’) in pound sterling are not yet available with a social responsibility focus.

Much like in the example of exposure to China in emerging markets, this means we expect there to be deviations in performance between portfolio types over time, and our historical simulations have demonstrated a divergence in calendar year performance. But we also expect there to be more assets available with a socially responsible focus in the future, given the rapid growth in investments managed in this way, narrowing the differences in allocation.

What about performance projections for SRI portfolios?

We use the same methodology to calculate projected returns for all our portfolios. However, each projection is adapted to account for the difference in asset allocation and underlying investment style – in this case, a social responsibility focus.

Our projection calculations show that over the long term, we expect the Socially Responsible Portfolios to deliver very slightly lower returns when compared to our Fully Managed Portfolios, due to the difference in asset allocation. On an annualised basis, the impact of the lower returns is limited, with the maximum difference in any projected return and its non-SRI equivalent being just 0.05% lower per annum.

Critically, despite the slightly lower returns projected for the SRI portfolios, they do this with a lower level of volatility. This means there is no expected long-term trade-off in the risk-adjusted returns for socially responsible portfolios i.e. the return generated per the unit of risk taken isn’t lower.

Read more: Nutmeg’s socially responsible investing white paper

Sources

NYU Stern Center for Sustainable Business, ‘Determining the Financial Impact of ESG Investing’, https://www.stern.nyu.edu/experience-stern/about/departments-centers-initiatives/centers-of-research/center-sustainable-business/research/research-initiatives/esg-and-financial-performance

Guido Giese, Zoltan Nagy, Linda-Eling Lee, ‘Deconstructing ESG Ratings Performance: Risk and Return for E, S, and G by Time Horizon, Sector and Weighting’

Nutmeg analysis: For long-term equity return projections, Nutmeg uses data on historical volatility (1996-2020) to come up with a return rate. We project equity returns equal to 30% of the projected volatility (risk) for that asset, which we consider to be a conservative assumption. Projected cash interest return is shown in these projections. Finally, long-term bond projected returns are calculated based on our estimates of long-term economic growth, which are sense-checked from official and independent forecasts. The projections include the effect of all costs, including Nutmeg fee, investment fund costs and effect of market spread. They don’t include the effects of inflation, of tax on investment income or on capital gains, or of future changes to your risk level or investment style.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance.