While we may be living through tough times economically, if you can afford to, investing more each month could accelerate you towards your investment goals.

Those who invest regularly, with Nutmeg or not, we salute you! A monthly Direct Debit or easy bank transfer can be key to realising your long-term financial goals, whatever they may be.

In this article, we’ll explore how contributing more on a regular basis can make a real difference when investing for at least three years; it could unleash the potential for your pots to grow faster. Whether you can afford to invest more now, or it’s something you’re thinking about for the future.

Is my investment suitable?

So, let’s start by assuming you’re already investing on a regular basis. While you may have set up your ongoing contributions to happen automatically, it still makes sense to regularly review your outgoings as part of healthy budgeting. An annual investment check-up (all wealth managers, including Nutmeg, are obliged to periodically review the suitability of the recommendation given to its clients ) is a great opportunity to make sure you’re investing suitably and in-line with your goals and personal circumstances.

It may be that your financial circumstances have taken a turn for the worse – in which case you may want to temporarily reduce or pause your contributions. That’s understandable, especially if your employment status has changed for example, or perhaps your family has grown and so your spending has too.

Alternatively, you may feel more comfortable financially now than when you first started investing. Perhaps you’ve had a pay rise, or received a bonus payment that you want to put to work.

Your priorities may have also changed. As you grow older, building a bigger retirement pot through a personal pension may have become more of a focus for you, or maybe you’re taking advantage of a Lifetime ISA with a plan to take your first steps on to the property ladder.

How much should I contribute to my investments?

If you can afford to invest more, how much more should you contribute? You may wish to talk to an expert first to discuss your investment options, in which case consider booking a free call with a member of the Nutmeg team who can help you in this regard.

For many, a round number makes perfect sense. Let’s say, for example, your current monthly contribution to a stocks and shares ISA is £100. What difference would, say, an extra £50 a month make? You may be surprised, as we’ll find out later.

It’s important to remember that with all investing, past performance is no guide to future performance and returns are not guaranteed. Still, historically, investing in an appropriately risk rated diversified portfolio of equities and bonds over the long term has been worthwhile, and increasing the amount you put to work each month could potentially make a big difference.

Leaving this money invested over the longer term can also be boosted through what is known as compounding returns.

What is compounding?

So, what is compounding, and how does it work? Say that in the first year of investing you generate modest returns on your initial investment. Without withdrawing that money, and leaving it invested, in the second year you will automatically invest the initial capital plus those returns, and so unleash the potential to generate further returns on the total. Over multiple years of investing, this can have a profound impact.

For your convenience, Nutmeg has its own compound calculator, which you can use to see how your investments could potentially fare over time. Our tool is an indicator of future performance designed to aid to decision-making – it is not a guarantee.

Investing an extra £50 or £100 per month over 10 years: example illustration

For our first example, let’s begin your 10-year investment journey with a starting contribution of £500. We’ll assume that you then invest £100 at the beginning of each month and receive an annual return of 5% (a fairly middle-of-the-pack number in the context of long-term investing).

Before we give the results, it’s important to note that with investments, your returns will fluctuate. Some months may see higher returns, some months may see lower, depending on the performance of your portfolio and the broader market. The illustrations we’ll give here do not take into account inflation or any costs and charges.

Our compound calculator shows a final value after 10 years of £16,314. Of this amount, returns (the money you get back in excess of the total amount you contributed) total £3,814.

However, let’s look at a second example and see the impact if you were to boost your monthly contribution by £50, to a total of £150 per month? The 10-year figure then rises to £24,063 with returns beyond the amount you invested of £5,563.

In this second example, you’ve contributed an extra £6,000 more than in the first example over the course of 10 years (£50 for each of the 120 months).

The additional returns total compared to example no. 1 is £1,749 (£24,063 minus the £16,314 to make the difference between the first and second examples, minus the extra £6,000 contribution), which is due to putting more money to work in rising markets, with the returns continuing to compound.

For the third example, let’s accelerate things further and say you invested an extra £100 per month making a total monthly contribution of £200, again for 10 years with a consistent annual return of 5%.

The final value, according to our calculator, comes to £31,813, with returns of £7,313. So, what would be the difference that investing more and the effect of compounding on these returns make compared to our first example of £100 per month contribution? In this case, the extra contribution would be £100 multiplied by 120 months over 10 years (£12,000).

Using the same method of calculation (£31,813 minus the £16,314 figure from the first example, minus in this case an additional contribution of £12,000), the impact of compounding and returns on your additional contributions would give you extra.

Table 1: Illustrations of long-term value growth, assuming £500 initial investment and 5% p.a. returns, examples 1-3

Source: Nutmeg compound returns calculator. All returns, including dividends, are reinvested. Results do not account for inflation or any costs and charges (visit nutmeg.com/compound-interest-calculator for full details).

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Forecasts are not a reliable indicator of future performance.

Investing an extra £100 per month over 25 years: example illustration

Using this methodology, assuming once again for the purpose for this example a consistent annual return of 5%, the longer you invest the longer your money will benefit from putting more money to work and the impact of compound returns.

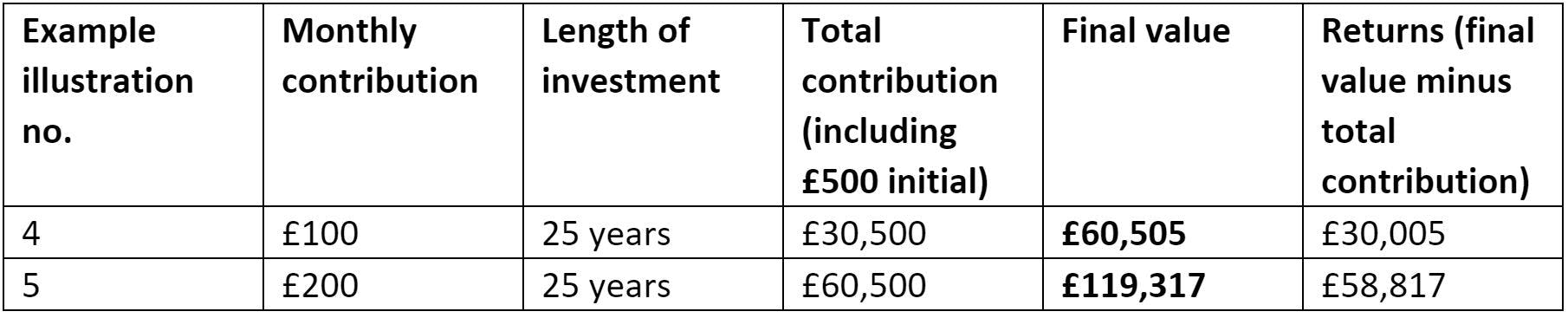

What if, for a fourth example, you were saving for the very long term for your retirement, say 25 years? Our calculator shows that from investing £100 per month over this timeframe (from an s this moved below? initial investment of £500, again with an annual return of 5%), your final value would come in at £60,505 with returns in excess of what you contributed at £30,005.

Finally, for example five, using the same calculations, but investing £200 per month instead of £100, the final value would come in with returns of £58,817.

The difference due to putting more money to work and the impact of compounding on returns? That comes in at £28,812 (£119,317 minus the £60,505 figure from the first example, minus an additional £30,000 contribution over the course of that 25 years).

We’ve included all the examples below in this table, so you can see and compare all the figures in context.

Table 2: Illustrations of long-term value growth, assuming £500 initial investment and 5% p.a. returns, examples 4-5

Source: Nutmeg compound returns calculator. All returns, including dividends, are reinvested. Results do not account for inflation or any costs and charges (visit nutmeg.com/compound-interest-calculator for full details).

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Forecasts are not a reliable indicator of future performance.

Extra money made per year: example illustration

One note to make from these examples is the amount of extra money made per year the longer you invest, which is again attributed to a mixture of compounding returns and extra contributions.

Looking at the examples using £500 initial investment, £200 monthly contributions, and 5% annual returns – over 10 years the £7,313 returns comes out as £713 per year. But the same example over 25 years comes out at £58,817 overall, and £2,353 per year.

That’s quite a significant difference, if you are able to invest for a longer timeframe. Again, these examples are made on basic assumptions, and in reality your returns will fluctuate, some months may see higher returns, some months may see lower, and there is no guarantee of future performance.

Investing for a future you

While these are very much theoretical illustrations, we hope we’ve shown how contributing more to your investments – considering affordability, and with an appropriate timescale – has the potential to deliver better outcomes.

If you require more help in reaching your financial goals, consider speaking to one of our experts to help you make the most of your money.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. Forecasts are not a reliable indicator of future performance.