Expert financial guidance to help you get the most from your money

When you’re ready to take control of your financial future, we’re here to help guide you every step of the way.

With investment, your capital is at risk.

What is financial guidance?

We believe that everyone should have the information they need to feel empowered about their finances, make informed decisions about their money, and feel more confident about their future.

Our free financial guidance provides just that: it can include explaining how our different investment styles work, talking you through the benefits and risks of long-term investing, and identifying which products would best help you reach your goals.

Book a free call

What's the difference between financial guidance and financial advice?

At Nutmeg we offer both financial guidance and restricted financial advice. We often find that although many people believe they need financial advice, their questions can often be answered simply by speaking to one of our team at no cost.

With our financial planning and advice, you'll get a personalised recommendation for how to achieve your financial goals based on bespoke cash-flow planning of your income and outgoings to help you structure your finances to achieve your goals, and it costs £575. Financial guidance, on the other hand, is free for both those new to Nutmeg and existing Nutmeg clients. Financial guidance can help you with things like choosing the right products for you, help understanding markets and volatility and can help you to feel more confident when investing for your future.

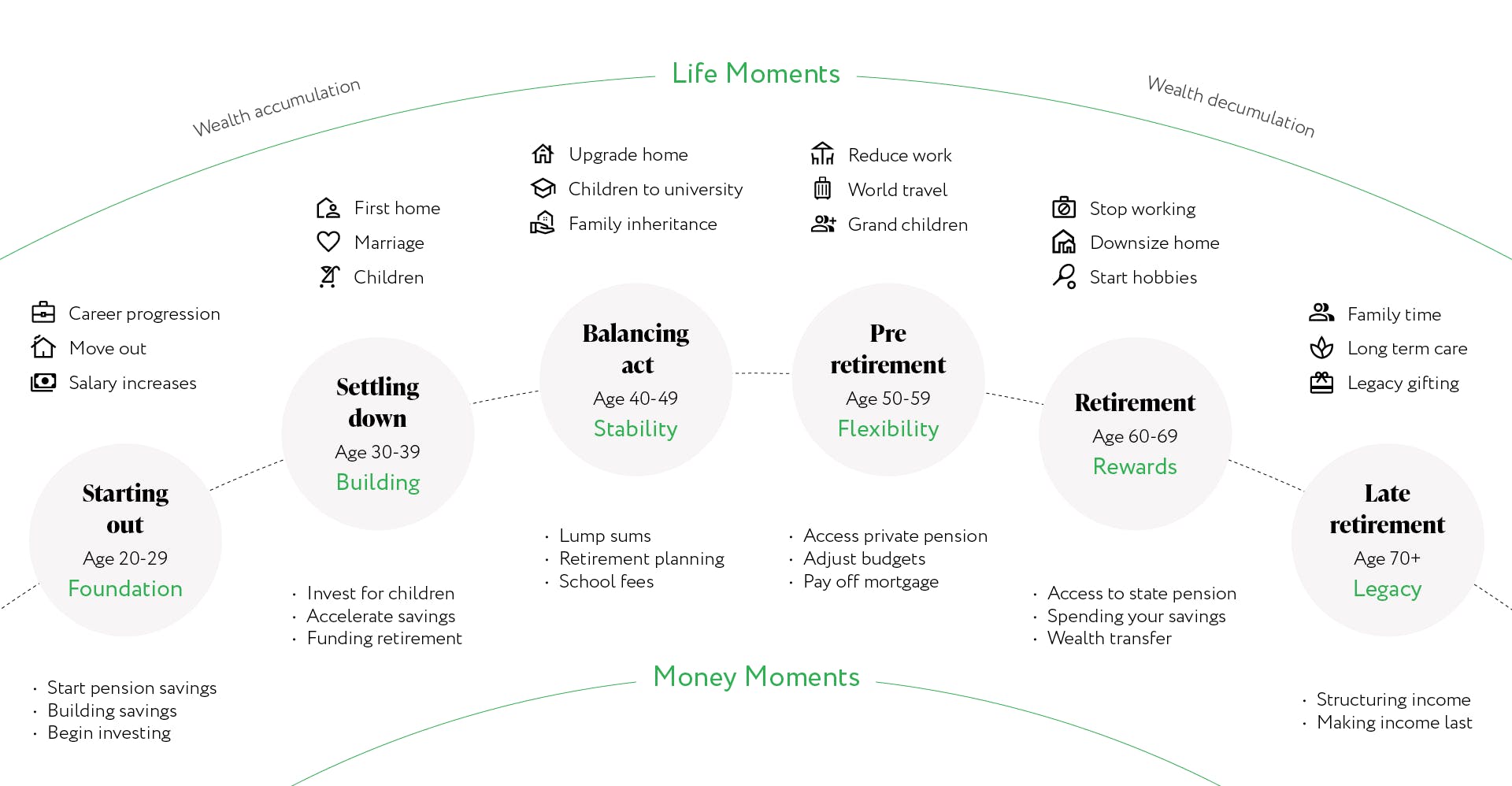

Which life moments are you financially ready for?

We understand that our goals and life journeys are completely unique, but many of us will experience similar milestones that impact our finances. Our life moments map shows when these milestones could be for you and which money moments you may need to prepare for.

Life Moments Map

How can financial guidance help me?

Looking to understand the markets and what products are right for you?

Book a free call

Want to make sure you’re making the most of your money?

Book a free call

Are you looking to adjust your finances ready for retirement?

Book a free callFinancial guidance at Nutmeg

Tailored to you

No matter your life stage, experience, or goals, we’ll tailor our guidance to you.

Available to all

There's no minimum investment required to get our expert support.

Here when you need us

Life can be unexpected; we’re on hand when life changes, or you need extra help.

Hear from our expert team

Financial planning and advice

Our financial planning team can provide personalised recommendations when you’d like support making important financial decisions, at any stage of life. This starts with a detailed analysis of your assets, spending and goals, followed by cash flow planning to work out the best way for you to achieve your objectives.

We’ll provide you with a tailored financial plan to help you live the life you want now, and in the future.

Find out moreExpert advice, for every goal

Our financial advisers are here to help you master the challenges life throws at you – including:

Retirement

To help tune up your portfolio and plan your cashflow as you near retirement, to prepare your future income

Consolidation advice

When you want to make your pensions, ISAs and other investments more transparent and efficient to manage

Investment

If you would value insights from our team of experts as you design your investment strategy

Investing a lump sum

If you have a sum to invest and want to move ahead with confidence, making the most of your allowances

Learn more about investing and finance

Our most recent awards

Tax treatment depends on your individual circumstances and may change in the future.