We assess what drove markets in the first half of the year and consider how the rest of 2023 may play out for investors

Interest rates continued to rise in the first half of 2023 – and the impact is starting to be felt.

The reality of higher rates was pulled into focus in Q1, as several US banks experienced much tighter lending conditions, raising fears of contagion across the global banking sector.

In Q2, the effect of higher rates started to play out more broadly, as manufacturing activity started to trend down in Europe and Asia. Cooling demand impacted some emerging markets, with China experiencing a slowdown in Q2 and Taiwan also downgrading its GDP forecast for the year.

But global inflation is resilient, so central banks still have work to do. Interest rates are likely near the peak in the US, but in the Eurozone and especially in the UK, further hikes are expected between now and the end of the year.

The question for investors – and central banks – is whether further tightening could tip economies into recession. Strong consumer demand means that this could be avoided, but should inflationary pressures persist, the greater the possibility of further rate rises and a subsequent contraction.

And finally, artificial intelligence cannot go unmentioned. As debates about the future of humanity and the pros and cons of generative AI filled the headlines, investment in AI and AI adjacent companies also rocketed.

From April onwards, a handful of tech stocks rallied, lifting the US markets and helping them outperform their peers year to date. The AI rally has been driven by a small number of players, and has made the US more expensive, so we remain cautiously positioned here for now, but remain optimistic about long-term technological innovation and the opportunity it presents to investors.

1.Inflation has been more stubborn than expected

Inflation should still peak in 2023 – but the rate at which it is coming down is slower than many hoped or anticipated. Why?

Food, profit margins, and wage growth.

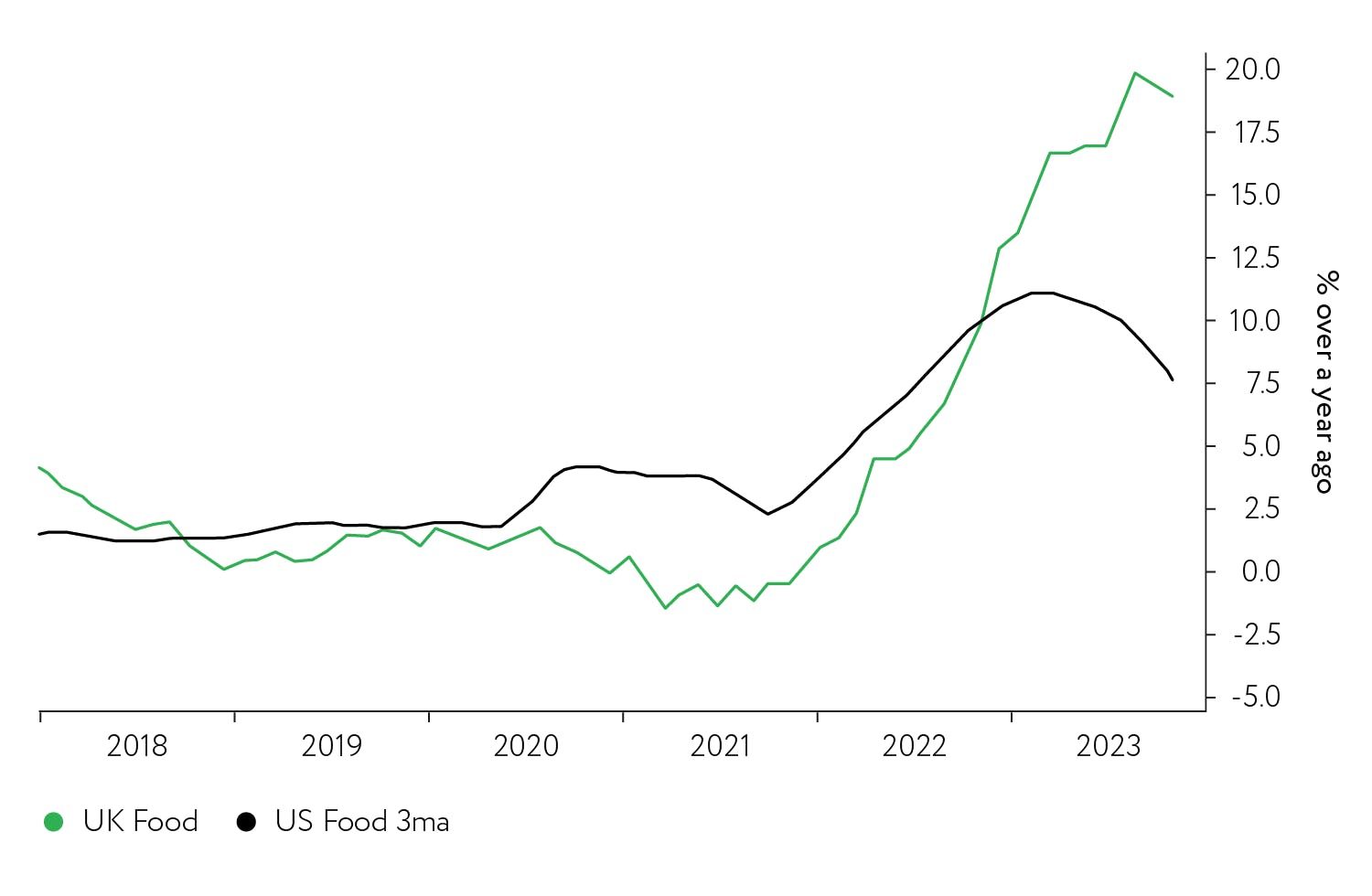

In the UK, food inflation is twice as severe than it is in the US (see chart 1). The same is true for energy prices. The latter can be explained by the fact that the UK’s energy position was more challenged than the US, which is almost self-sufficient, and has no link to Russian gas.

The 20% depreciation in the UK currency in the year to September 2022 also made the cost of energy imports more expensive.

The difference in food inflation is more difficult to explain and may be to do with less competition in the UK food sector.

Chart 1: The price of food in the UK is rising at twice the rate of food in the US

Average quarterly percentage rise in food prices in UK and US, 2018-2023

Source: Macrobond, June 2023

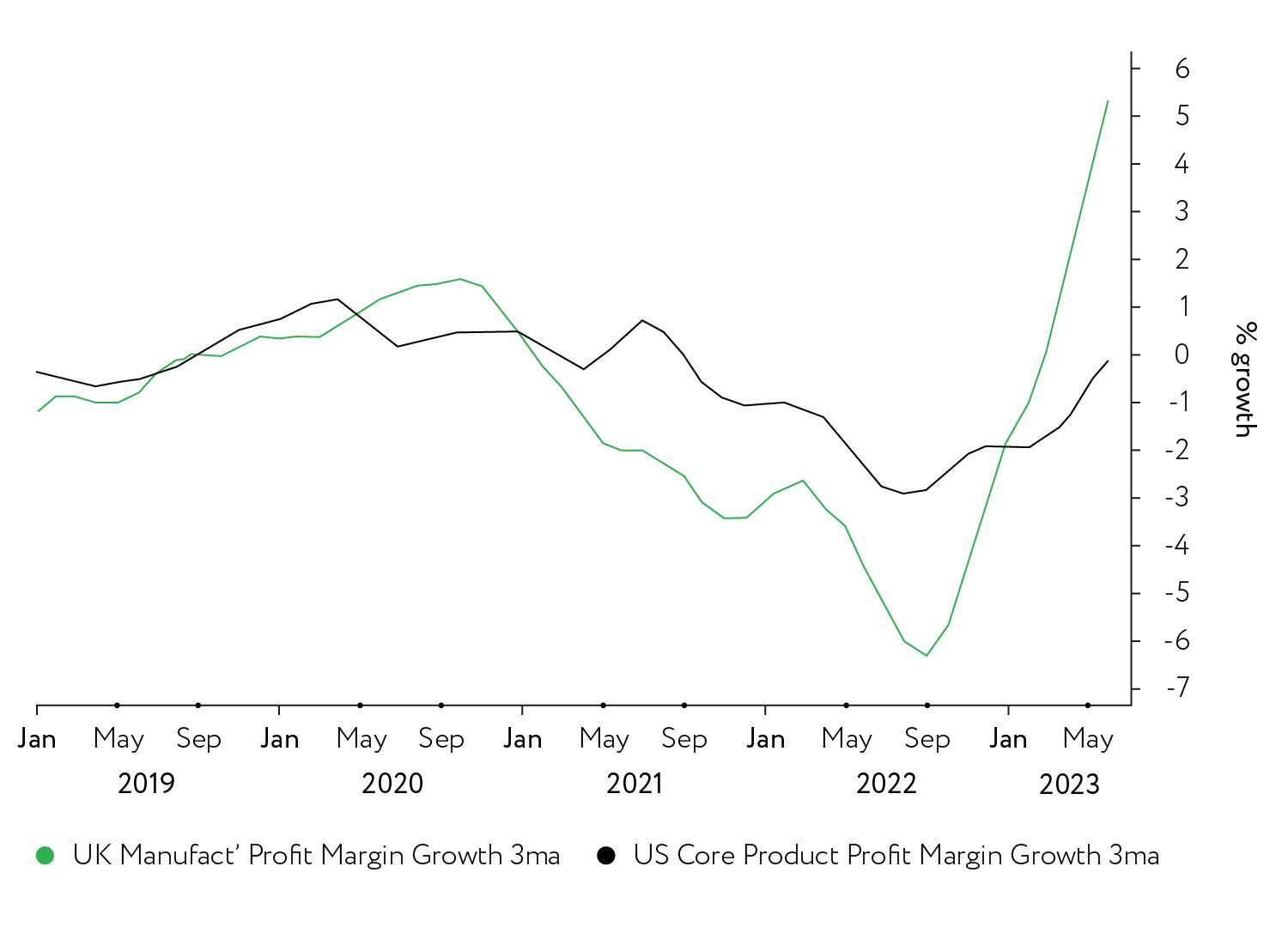

This idea of a less competitive UK food sector is supported by profit margins calculated from input and output price information (see chart 2). UK companies are raising prices faster than their cost base is increasing. This is often called ‘price-gouging’ and represents opportunistic behaviour of businesses that know consumers are willing to pay up when supply is scarcer.

Chart 2: Profit margins are expanding faster in the UK than in the US

Average quarterly UK manufacturers profit margin growth vs US core product profit margin growth, expressed in percentage terms, 2019-2023

Source: Macrobond, June 2023

Another cause for global inflation resilience is wage growth. Businesses are not the only ones that can take advantage of tight supply conditions.

With unemployment low around the world, workers are driving hard wage-bargains. From the UK, through Germany, and to the US, wage growth is between 5-6% over the same time last year. That’s a good deal higher than the 2% annual inflation target of all developed economy central banks and a chief concern of monetary policy makers.

The good news is that energy and metal commodity prices are well lower than the start of the year, and agricultural commodity prices growth this year has been tapered. So, this part of the inflation equation has played out as we and many others expected.

How have countries responded? The US is the closest to its final interest rate hike, while the UK and European central banks still have some work to do. The impact of higher interest rates on risk-assets will rest on whether such tight monetary policy causes a harder-edged recession.

For now, we see any slowdown as contained. We remain slightly underweight equity risk and hold average interest rate risk within our fixed income holdings.

Brad Holland, Director of investment strategy

2.Hard or soft landing?

In trying to tackle inflation, central banks have aggressively tightened their monetary policy. They’ve taken interest rates to highs not seen since before the 2008 crisis in the space of only 18 months.

The question we and the market have been battling with is: hard or soft landing?

A hard landing is when a central bank tightens monetary policy to tame inflation and ends up causing a recession. A soft landing is when the economy cools, but doesn’t contract. The US has only achieved a soft landing once (in the mid-1990s), and it’s something the UK has never managed to pull off.

Is this time different?

Maybe. In the US and the UK, the consumer’s balance sheet is notably healthier than 2008. The amount of debt isn’t the issue, but the servicing of that debt (namely mortgage payments) might be. The American real estate market has been holding up better, thanks to improving consumer demand, but also the structure of their mortgage debt. The entire term of a US mortgage is predominately fixed.

The UK housing market is a different beast. Refinancing has a big impact on cash flow for owner-occupiers, landlords, and ultimately renters, onto whom landlords will pass the cost of higher interest rates.

Our calculations for interest payments on a 2 year fixed 75% Loan to Value Mortgage has more than doubled since June last year and is around 5x that of 2018 levels for a proxy on those coming off a 5-year fixed (most common term in the UK). These higher interest payments will negatively impact the consumer’s balance sheet, which could weigh on economic growth.

Despite a potential cash flow crunch, consumption data has been improving. This is down to falling energy inflation and recent wage inflation offsetting some cost pressures. However, wage inflation is also extending the inflation cycle.

Business’ input inflation is slowing and even deflating within components of the Producer Price Index (PPI). Business activity has been mixed in manufacturing/production related industries, whilst services, which is the bulk of the UK and US economies, are continuing to expand per recent activity surveys.

Our expectations have been that if a recession (or a ‘hard landing’) were to occur in either country, it would be mild compared to recent recessions. The Bank of England, prior to May’s inflation and wage data, no longer expected a recession in 2023, and they are due to update their forecasts at the August meeting.

The recent inflection in the consumer data had made us more confident that the US & UK would be on the trajectory for a soft landing – but should inflation pressures persist, especially in the UK – the odds of this occurring will reduce.

Scott Gardner CFA, Investment strategist

3.Equity earnings have been more resilient than anticipated

Equity earnings are a key indicator for the health of the equity market.

Different measures are important, but corporate earnings growth (known as earning-per-share growth or EPS growth), along with the current forward price-to-earnings ratio (called forward P/E) are two of the easiest metrics to use when following corporate results and the valuation of the equity market.

Earnings in the US have been better than expected year to date. In Q1, analysts predicted that earnings would fall around -8%, but they ended up at -3%, a strong improvement compared to the consensus and a positive surprise for investors.

Since Q1, the US has outperformed other equity markets as the S&P 500 and the Nasdaq have rallied, lifted by a small number of technology and AI companies.

However, the US has also seen a decline in EPS growth. When combined with the performance of its equity market, this means that it is now significantly more expensive than at the end of last year and the only region to trade at a significant premium compared to its own history.

In Europe and the UK, EPS growth has been positive this quarter, with the former up 11% and the latter up 9%. The UK market is trading at a significant discount to its long-term average.

Looking ahead to the second part of this year, we think that valuations in the US appear stretched, and believe that US corporate earnings might disappoint. We remain underweight US equities, and prefer other regions like UK large cap stocks, which seem to offer better value over the medium-term despite the uncertainties of the current environment.

Pacome Breton, Head of portfolio management

4.The outlook for emerging markets is mixed

The first quarter of the year was good for China, the world’s second largest economy, whose influence looms large over other emerging markets. But growth slowed in the second quarter, disappointing analysts. Why?

Several reasons. Demand across the global economy is losing momentum, which affects Chinese imports and exports. There is a lack of domestic demand in credit growth and fixed asset investment, home sales are weakening as government support for the property market tapers out, and record high youth unemployment and near zero inflation illustrate weak demand in comparison to supply.

However, it's not all doom and gloom. The Chinese government’s strong willingness to stimulate economic growth is evident, with several pro-growth measures already in action, including a policy rate cut and a mortgage rate cut. Economic activity in some areas, such as transport, electricity, and ecommerce has rebounded above pre-pandemic levels.

The second half of the year will require close monitoring of Chinese government monetary and fiscal policy, the progression of China-US conflicts, and the ability of developed economies to avoid a recession.

Despite Q2’s relatively weak recovery, over the rest of year, China could see a stronger effect from economic stimulus, given more time and the likelihood of new rounds of supportive policies arriving in the summer and onwards.

Across emerging markets more broadly, we expect to see the tightening monetary policy cycle reach its peak as inflation is projected to be more contained in the next half of the year. Global transport delay and cost have reverted to pre-covid levels, and shortage of chips and other critical resources are much less severe. We anticipate that stabilising emerging market economies will continue to recover throughout the rest of the year.

Yang Yang CFA, Investment analyst, performance and risk

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.