Markets are going through another volatile period, and your investments may well have fallen in value recently. However, if you are investing with a long-term horizon of at least three years, could now be the right time to put more of your money to work?

Look for ‘investments’ in your favourite search engine, and there are plenty of articles and investor questions about market timing. We’ve all heard of ‘buy low, sell high’, a maxim that suggests that downturns in markets may look like a promising opportunity to invest more. This is often referred to as trying to ‘time the market’.

Nutmeg’s investment principles, which are rooted in helping clients to maintain the investment plan that’s right for their own circumstances over the longer-term, mean that we would never suggest that investors try and ‘time the market’. After all, if you invest now, no one can be sure that markets won’t fall further in the short term?

However, while timing the markets is not something we would ever recommend, we do advocate time in the markets, which we believe will, over time, likely recover from a downturn. For us, it’s never a bad time to invest, and stay invested, so long as you have reviewed your current financial situation to ensure you will retain enough cash on hand for emergencies and have chosen the appropriate risk level and timescale that suits your goals.

While it’s understandable that recent market volatility may seem like an exceptional, and worrying period for clients, from an historical perspective it’s not abnormal to see markets going through choppy periods like this.

Recent global events, such as the fallout from the failure of Silicon Valley Bank, questions around central bank policy in managing ongoing inflationary pressures, and the wider implications of the war in Ukraine, all bring uncertainty which creates fluctuations in markets.

Our positioning

Since mid-2021, high inflation has been a defining factor influencing markets and economic health. All eyes have been on central banks, such as the Federal Reserve in the US and the Bank of England, and their action through monetary policy – which is the influencing of money flow in an economy and how much it costs to borrow. The subsequent hiking of interest rates, and the fine line in attempting to cool price rises without being detrimental to economic growth, has understandably unsettled both equity and, in particular, bond markets.

When both of these bedrock asset classes are volatile, multi-asset portfolios – such as those we offer at Nutmeg – can also fluctuate. However, while investors may understandably be nervous in the short term, as discretionary managers we can act on their behalf to keep investing with the goal of long-term growth. We make the big decisions and invest as market conditions dictate suited to our clients’ risk levels.

In late 2022 we reduced our equity holdings across the portfolios and increased our exposure to fixed income assets. While acknowledging the adverse impact that elevated inflation continues to have on companies and their earnings, the positioning still reflects a long-term view on growth.

For example, we still see long-term value in emerging market equities (where we increased our exposure at the expense of trimming US equities), particularly given China’s re-opening after strict Covid controls. Another area where we still see value is UK large-cap stocks, which tend to be multi-national by nature.

We also see immediate opportunities in corporate bonds in some markets, which we increased our exposure to in medium-risk portfolios. High-yield bonds, which offer the potential for higher income though with a higher level of volatility given the trade off with investing in lower-quality credit, are also selectively attractive for high-risk portfolios.

If inflation has indeed peaked, as recent data suggests, there’s further reason for optimism, though we’ll be keeping a very close eye on monetary policy decisions as they happen.

The point is, despite the volatility, we would much rather stay invested than not with some attractive multi-year opportunities, though of course returns are never guaranteed.

The case for long-term investing

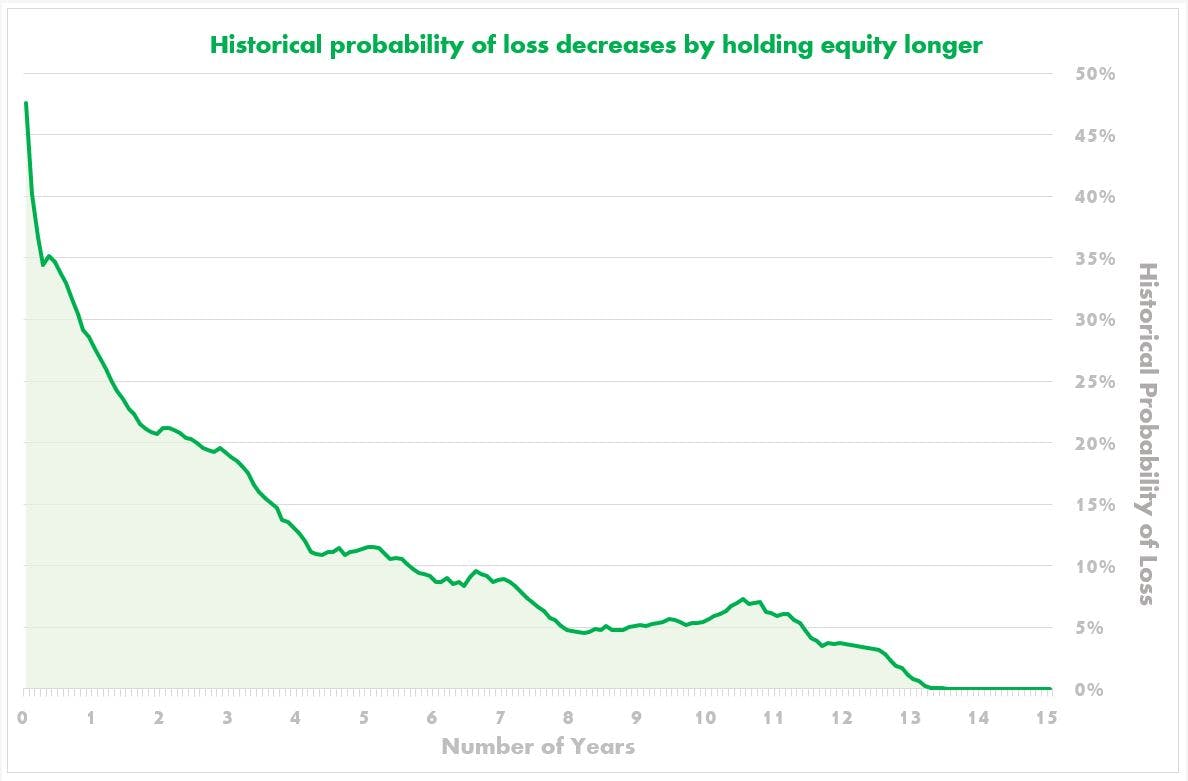

As the global economy and markets ebb and flow, so the strategy of staying the course on your investment goals may reveal its benefits. In fact, the longer you invest, the less likely you are to lose money. Below is a chart we’ve referenced in a previous blog, but it’s worth repeating here. Looking at data from developed equity markets between March 1972 and March 2023, the chances of suffering a loss went down over time.

As shown below, no matter when you invested during this period, long-term investing dramatically increased your probability of avoiding losses. Although future market performance can never be guaranteed to play out the same way as it has in the past, as investors we can still gain a sense of longer-term perspective from this. Yes, big movements over one day, or even several months, might seem of big significance today but are more likely to appear as a blip when viewed over several years.

Historical probability of loss decreases by holding equity longer (1972 – 2023)

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 1 March 1972- 13 March 2023

With this long-term view of the markets in mind, rather than waiting for what might seem the ‘perfect’ time to invest, investors might instead consider what is called ‘pound-cost averaging’, or drip-feeding money into their portfolios at regular, say, monthly intervals via a Direct Debit instead of putting in lump sums in one go.

If thinking about investing in the context of a tax wrapper, Nutmeg’s drip-feed feature allows you to use your annual allowance before 5th April and then invest your money gradually over the months to come.

This means that you can enjoy the tax benefits of a stocks and shares ISA and the reassurance that your money will be invested slowly but steadily rather than all at once. You can reduce the risk of buying-in just before markets drop and stay invested for the market recovery – the speed of which can be very difficult to predict.

It’s always a good time to think about your financial future

If you are happy to take a long-term view on your investments, ideally at least three years, then there are plenty of different products and structures available that can help you reach your financial goals.

For example, for those that qualify, a Lifetime ISA (LISA) can be a great way to build towards a deposit and get on the property ladder. Launched by the government to encourage people aged between 18 and 39 to put money aside for their first home or retirement, you can contribute up to £4,000 per tax year and the government will give you a 25% bonus – that’s up to £1,000 every year.

For clients looking to build a pot for retirement, a personal pension can be an effective way of investing for your future with a potential 20% tax relief on any contributions you make being added to your pot. Tax treatment depends upon your individual circumstances and depends on your individual circumstances and may change in the future.

Regardless of how you invest, choosing a wealth manager like Nutmeg can be of great help in being able to navigate your portfolio through different market environments. Our expert investment team have strong experience of managing money through both bull and bear markets and will adjust portfolios accordingly in ways which they have the most potential to best deliver growth for your chosen risk level, though returns are not guaranteed and you may get back less than you invested.

For those still unsure about investing and who may need help to map out their financial future and find out how to make the most of different investment products, consider booking a free call with our experts who will be able to point you in the right direction.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.