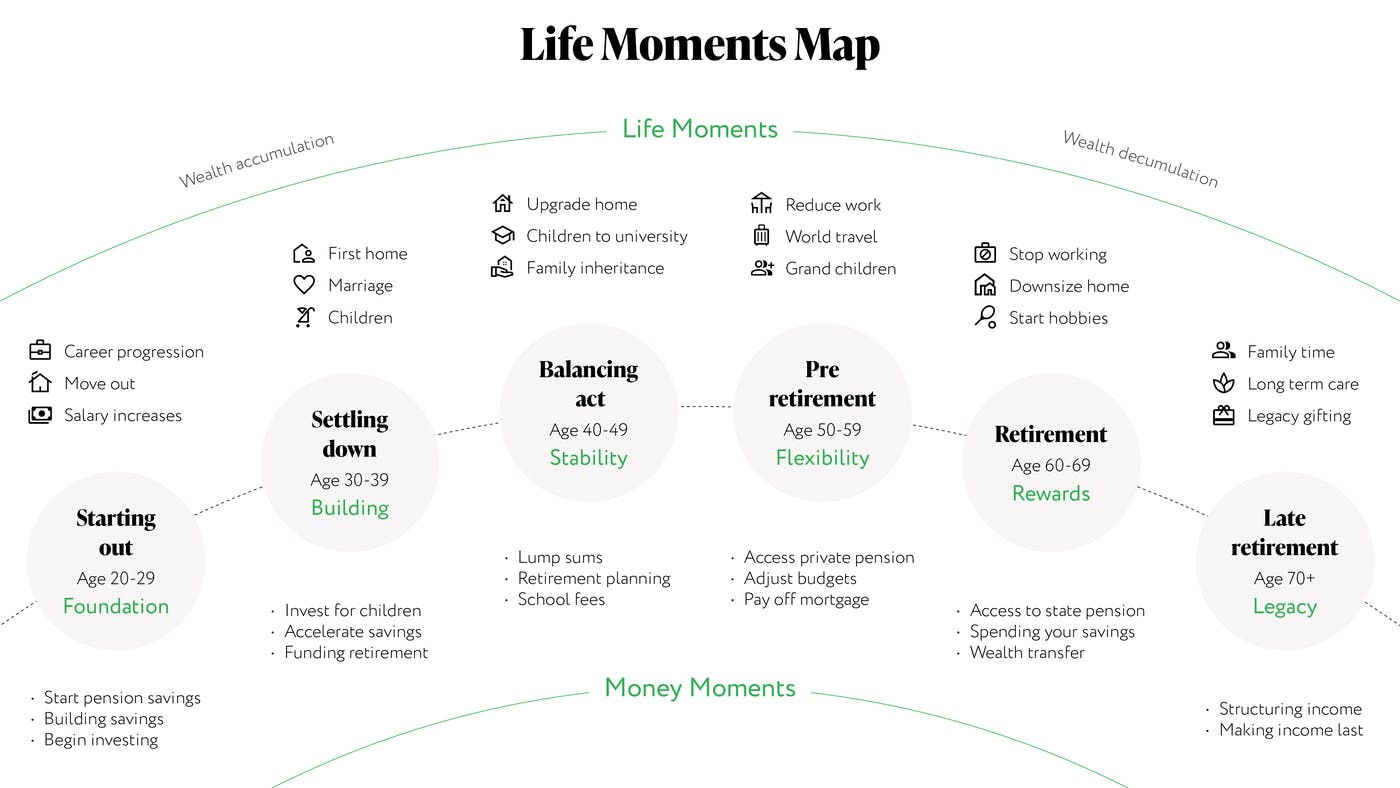

Whether you’re in your twenties and just starting to explore investing or in your fifties and lucky enough to have paid off your mortgage, our life moments map aims to help you understand your financial options at each stage of life. We look at the products available to you, and how you may want to steer your investment goals.

We understand that everyone’s financial life journey is unique and many of us will experience these milestones at different times, so this guidance is to help you visualise the different moments you may wish to prepare for – you may even find milestones and tips from other decades relevant to you.

We have linked to each life moment below:

Investing in your 20s – Starting out

For many people, their twenties can bring about significant changes to their financial circumstances. From completing qualifications, such as apprenticeships or graduating university, to embarking on exciting milestones like starting a career and moving out of home, this decade brings with it many new financial opportunities, challenges and obstacles.

Although it can be difficult to balance new responsibilities and short-term budgets with longer-term goals, this is a valuable time to assess the financial products available and think about which may be suitable for your current income.

The idea of being able to set money aside to save might seem completely unattainable but building some savings early on is a helpful habit to start – even if you’re only setting aside a small percentage of your monthly salary.

First steps to investing

Investing may feel like something exclusively for the wealthy or experienced, but there are many options available to people who are completely new to investing too.

Some wealth managers have high barriers to entry in terms of the amount of money they require you to invest. It’s important to find a financial provider that suits your needs.

The good news is that there are specific financial products available that are tailored to those starting out on their investment journey, with some even targeting the goals of younger investors.

For example, a stocks and shares Lifetime ISAs (LISA) can be a great option for those trying to get on the property ladder; if you’re aged 18-39 years you can open one, and the government pays a 25% bonus on any contributions you make (up to £4,000 a year).

You can use your stocks and shares LISA to buy your first home worth up to £450,000 or invest into it until you turn 50, and access it at 60, if you wish to invest for your retirement. In either instance, you can withdraw your money free of tax on growth and returns, including the 25% bonus.

However, note that withdrawing outside of these scenarios means you will incur a penalty, and you may end up getting less than you originally contributed.

Read more: Why first-time buyers need the Lifetime ISA

Another option which may be suitable for long-term investment goals is a stocks and shares ISA.

Like the LISA, you will not have to pay tax on growth or returns within an ISA. Anyone aged 18 or over can contribute £20,000 per year to a stocks and shares ISA for the current 2022/23 tax year, and can hold one alongside a LISA (though the £4,000 LISA limit is part of that overall £20,000 annual ISA allowance).

Unlike a LISA, the money within an ISA can be accessed at any time, though if you are investing in a stocks and shares ISA then it is advisable to take a long-term horizon of several years to maximise your chances of returns.

There are different options available – from those that allow you to pick your own individual stocks and determine your asset mix, to those that will build a portfolio and manage it on your behalf.

Nutmeg offers four different investment styles: fully managed, socially responsible, fixed allocation, and Smart Alpha powered by J.P. Morgan Asset Management. You select the investment style and risk level that suits you the best, and our experts will do the rest.

Read more: ISAs at Nutmeg

At this early stage in your financial life, it can be challenging to know where your priorities should be. Is it better to start investing, pay off debt, or increase your pension contributions? If you want to learn more about whether investing is right for you at this time, our experts are on hand to provide free financial guidance, whether you’re a Nutmeg client or not.

Read more: Investing for beginners

Start investing in a pension

Thinking about your retirement might be the last thing on your list of priorities during your twenties, but starting early is the best way to build a pension pot that will support your retirement goals.

A recent Which? study found that couples need an annual income of about £25,000 to fund basic living costs as well as hobbies, socialising and trips away.

In the UK, the average life expectancy is 81 years and the average retirement age is just over 64 years. This means the average pension needs to last for around 17 years.

The earlier you begin contributing to your pension, the more likely you’ll be able to retire early and spend this time in the way you deserve. Many workplaces also offer pension schemes which match your individual contributions., so it’s good to make the most of these schemes, if you can afford to, for as long as you can during your professional life.

Read more: The different types of UK pensions explained

Investing in your 30s – Settling down

Many people in their thirties will be beginning to take on greater financial responsibilities, such as marriage, purchasing a first property, and raising a family. As a rule of thumb, most people aim to have the equivalent of their annual salary in savings by the age of 30 – but the likelihood of this is heavily influenced by personal circumstances, living costs, and income.

As well as adjusting your budgets to accommodate for these changes, it can also be a good time to increase savings and pension contributions and begin investing for any children should you have a family.

Investing for children

It’s natural to want to give your children as safe and secure a life as possible, which could mean giving them a financial head start later in life. The benefits of compounding returns means that regularly investing even a small amount on a child’s behalf can help them reach significant milestones, such as studying at university or moving out of home, more comfortably.

If you’re thinking about setting up an investment for your child, a stocks and shares Junior ISA (JISA) could be a great option. Investing in stock markets over the long-term has historically delivered better long-term returns than a standard savings account, and JISAs have their own annual allowance of £9,000 where any returns or growth is free of tax.

Although the earlier you invest the better, it’s never too late to start putting money aside for your child’s future.

As the money cannot be withdrawn from a Junior ISA until the child turns 18, for younger children this is very much a long-term investment. While only parents or guardians with parental responsibility can open a JISA, once it’s active then grandparents, other family members or friends can also contribute.

However, if accessing this money at any time is a concern of yours, a child’s savings account, not offered by Nutmeg, may be a more suitable option.

As with our other products, Nutmeg offers a range of diversified portfolios available to suit your risk appetite and values.

Accelerate savings

For many people, their savings will play a crucial role in helping to achieve specific goals during their thirties.

Whether this is withdrawing money for a particular milestone – like buying a new car, carrying out building work on a house, or getting married – or increasing monthly savings contributions, there are a few options which may help you achieve these goals.

If promotions or bonuses mean that you’re in a position to put some of your money away for a little longer, long-term investment accounts like stocks and shares ISA could be a good option to consider.

Read more: Property vs equities

Funding retirement

Though retirement may seem a long way off at this point, with the average person in the UK retiring at 64.55, it’s important to start preparing for this early on.

At this point you’re still investing for the long-term, so it’s important to think carefully about your risk appetite and how you can increase your potential for higher long-term growth.

Depending on when you plan to retire, and the type of retirement you want, the amount you need to reach will vary: travelling the world in your later years is going to cost a lot more than taking up gardening, so it’s useful to start thinking about what your retirement could look like earlier on.

Use our pension calculator to work out what your monthly contributions should be to reach your dream retirement.

With Nutmeg, you can open or transfer a pension and track its performance using our dashboard, and there are socially responsible investment options available too.

Read more: How to become a pension millionaire

Investing in your 40s – Balancing act

By the time people reach their forties, they may be lucky enough to have reached a level of financial stability. You may own assets such as property or investments, and continue accumulating wealth through your career, as well as contributing to pension pots.

Upgrading your home, paying education fees, or receiving family inheritance are all key life moments which may impact your finances at this stage, and will require readjusting your budgets to ensure you’re still on track to reach long-term goals.

Making best use of lump sums

Receiving large amounts of money can present a range of complex choices, which is especially overwhelming if you’re grieving the loss of a loved one. After a significant life event, like receiving inheritance or selling a house, it’s important to check what tax you’re liable to pay.

From here, the best options will be dependent on your individual circumstances; it may be most beneficial to pay off debt, increase pension contributions, or invest in stocks and shares.

This is a time when you may wish to seek professional financial advice to help you make the right financial decisions and manage any tax liabilities.

You may wish to make use of Nutmeg’s paid for, restricted financial planning service to create a retirement plan that’s right for you. Book a free call to speak to the team to understand your options.

Retirement planning

Your forties are a great opportunity to assess your retirement goals once again and ensure you’re on track to achieving the retirement you’re hoping for.

This may involve aligning any savings you’ve accumulated with investment portfolios and deciding whether the risk level for any pension pots is still suitable for your current circumstances. If you haven’t already done so, this could also be a great time to trace, consolidate and transfer any old pensions you may have.

Read more: A guide to tracing, consolidating and transferring your pension

School fees

If you’re raising a family, you might be re-evaluating budgets in terms of affording school fees or helping to support children at university, if this is available to you.

If you chose to invest in a JISA for your children, when they reach 18 they’ll be able to access these investments, so now may be a good opportunity to discuss whether they want to use this money, or reinvest it into a stocks and shares ISA account with a tax-free allowance of £20,000 per year.

Investing in your 50s – early retirement?

By the time many people reach their fifties, they might be reaping the benefits of saving earlier in life and having fewer financial responsibilities, such as dependent children. How does this impact our finances during this period? It’s necessary to take another look at savings goals and ensure they align with plans in the short, medium, and long-term.

It could be an appropriate time to downsize homes, reduce work, or begin to do the travelling you’ve always dreamed about. You may even be on the way to retiring at 55, depending on how much you’ve saved up.

Investors at this life stage should also review their attitude to risk and make necessary adjustments to their portfolios, the closer you get to approaching your retirement date, the less likely you may be to want to take large risks with the wealth you’ve accumulated.

Read more: Will your pension be big enough for you to retire at 55?

Accessing private pension in your 50s

Changes to the state pension have really impacted our expectations about how long we must work, but retiring in your fifties isn’t completely out of the question.

Although 55 may be a decade too early to access a state pension, this is the age at which accessing a personal pension becomes possible – although it’s rising to 57 from 2028, and may rise further in the future. And, planning early by making use of tax allowances, pension plans and other options could mean the potential to retire during this decade.

From the age of 55, you can opt into pension drawdown: this means you can withdraw from your pension while keeping the rest invested. Another option available is to buy an annuity when you stop working; this gives the person who bought it a guaranteed annual income for the rest of their life.

Both drawdown and annuities have their benefits and drawbacks. For instance, drawdown gives you more flexibility over the money you can access, but there’s no certainty your money will last the rest of your life, while annuities provide security and are not subject to stock market inflations, but rates have been falling in recent years.

The best decision for you will depend on your circumstances, but a pensions expert can help you to make this important financial decision.

Read more: What is the difference between drawdown and annuity

Adjust budgets

Whether you’re lucky enough to retire at this stage or are planning to do so in the next 10 years, it’s necessary to look at your monthly incomes and outgoings to ensure your lifestyle is still affordable.

Read more: The accounts you need in your financial life

Pay off a mortgage

Although everyone’s circumstance is different, many people are tempted to pay off their mortgage before retiring. Having no mortgage repayments will reduce monthly outgoings and mean you’ll have to withdraw less from your pension portfolio.

However, it’s worth considering how many mortgage-free years you’ll be able to enjoy in your home. For some, increasing pension contributions during your final working years could be a more effective use of your money than increasing mortgage repayments.

Read more: Overpaying your mortgage or investing?

Managing your wealth in your 60s – Retirement

For many of us, our sixties will be a transitional decade in our professional lives. Most people will stop working in their sixties, with the average retirement age for women in the UK being 64, and 65.1 for men.

With this extra time, you may decide to take up new hobbies or achieve some goals that you’ve never got around to previously. But everyone’s ideal retirement is unique to them, so it’s crucial to understand how much you need to fund this new lifestyle.

If you’re still living in a larger family home, this could be a suitable time to assess how much space you actually need. Downsizing your home could be an effective way of balancing your financial needs with your desired retirement.

Access to state pension

The state pension age is currently 66 – although this is expected to rise to 67 by 2028, and constant reviews mean this could be increased again over the coming decades.

The full state pension amount is £185.15 a week (£9,627.80 a year), but the amount each person receives depends on the number of years they’ve made national insurance contributions. Check how many years you’ve been contributing on the Government Gateway website.

Will this be enough to fund a comfortable retirement? This amount will vary significantly depending on your retirement plans, so it’s essential to calculate how much you personally need to achieve your goals.

Read more: An essential guide to the state pension

Spending your savings

Ideally, now is the time to start spending your savings and enjoy the retirement you deserve. But it can be difficult to feel in control, with many people unsure of what they’re entitled to or how much their ideal retirement will cost.

If you’d like some expert advice around the topic, our financial planners can develop a tailored retirement plan and help demystify your pension.

Wealth transfer

You may begin to think about transferring your wealth at this point, so it’s important to fully understand your allowances and any exemptions.

Although Capital Gains Tax (CGT) does not have any age limits, this type of tax is not charged when someone dies. This means that if the value of an asset – like a property, antiques or shares – has increased, there will be no CGT applied to the profit made, which could save quite a significant amount of money.

However, these assets may still be subject to Inheritance Tax: estates valued over £325,000 could potentially be charged at 40%. If you’re concerned about your children or loved ones having to pay a considerable tax bill after your death, there are some life insurance policies which can cover this amount.

Another important thing to remember is to draw up a will to ensure your valuable life earnings are passed onto the people you intended.

Read more: How to reduce Capital Gains Tax in 2022

How to manage wealth in your 70s – Late retirement

During your seventies, it’s important to structure your state and private pensions accordingly to fund your lifestyle. The average life expectancy is currently 79 years for men, and 82.9 years for women – meaning you could have more than 20 years of retirement to fund if you’re lucky enough to stop working at 55.

If you have money leftover in your pension when you pass away, this money is called ‘death benefits’. Many workplace or private pensions will give your spouse or named heir the remainder of your pension, but it’s important to check the specific terms to see what death benefits they offer.

Your spouse or civil partner may also be entitled to some of your state pension payments, but they must claim for this additional state pension – it’s not paid automatically.

Making your income last might seem like a daunting task, but it’s never too late to improve your understanding, get your pensions on track and move one step closer to achieving the retirement you’re hoping for.

Read more: The six-most Googled pensions questions answered

No matter what financial stage you are currently in, our team of experts are here to help. Book a free call today.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.