Fresh into the 2023/24 tax year which began today, 6th April, there’s several rule changes – both in terms of allowances and taxation rates – that investors need take note of. Here’s our summary.

Following on from last November’s Autumn Statement, Chancellor Jeremy Hunt used the Spring Budget on March 15th to set out further changes that can impact those investing in both tax-efficient and non-tax-efficient products.

Pensions

The annual allowance has risen

For those investing for their retirement, it’s important to note that the annual allowance – the amount of money you can put into your pension in any single tax year without paying tax – has risen from £40,000 (or 100% of your salary, whichever is lower) to £60,000.

As we covered in depth following the Budget, many who can afford to decide to max out their annual allowance towards the end of their careers when they need to bump up their retirement pot and make up for years when they may have contributed less. Raising the annual allowance can help people do this and may also provide an incentive for some higher rate taxpayers to stay in the workforce.

The lifetime allowance to be scrapped

A second key announcement regarding pensions was the removal of the Lifetime Allowance (LTA) – the amount you could draw from your pensions, both workplace and personal, in your lifetime without paying extra tax. In the last tax year, 2022/23, this was set at £1,073,100, with a previous announcement that it would remain until 2026.

Technically, it is only the Lifetime Allowance charge, a 25% tax levy that would apply to pensions that exceed the LTA limit, that has been removed from this April, before the LTA is completely abolished from April 2024. This is only a technicality, as in practice it means people that contribute more to their pension would be taxed by LTA charge from April 6th 2023.

The Money Purchase Annual Allowance has more than doubled to £10,000

The Money Purchase Annual Allowance (MPAA) limits how much some people can contribute to a pension after they have started to take payments from their defined contribution pension pot.

If you withdraw any taxable money from your pension plan – either through drawdown or from cashing in your pension savings – then you may see your allowance reduce. If you’re considering taking money out of your pension, it would be a good idea to speak to a financial adviser before doing so in order to check if you will, or won’t, trigger the MPAA.

For the previous tax year, the MPAA was set at £4,000, though this has now more than doubled to £10,000.

As we outlined in March, the MPAA is designed to prevent people from gaming pensions rules by getting tax relief on their pension contributions, withdrawing money and then putting it back into their pension to receive tax relief again.

Taxes

Capital gains tax

In basic terms, capital gains tax (CGT) is a tax on the profit when you sell or ‘dispose’ something that’s increased in value. A capital gain is the difference between the price you paid for the asset, such as shares, and the price you sell it for. The tax you pay is on the gain only – not the total sale price.

The previous CGT annual allowance – the threshold at which your tax liability will kick-in – was £12,300, but as announced in the Autumn Statement, this has been reduced to £6,000 for this new tax year. A further reduction to £3,000 is planned for the 2024/25 tax year.

The amount, or rate, of CGT tax you will need to pay will depend on your income level and the asset – CGT rates are different for residential property than they are for other assets.

For people who pay income tax at the higher or additional rate (more on these bands later), your capital gains tax rate is 28% for gains from residential property, and 20% on gains from other assets.

For basic rate taxpayers, we’ve outlined how to calculate your CGT liabilities in our recent blog, which also takes a deep dive into the intricacies of the tax and how it may apply to you and your investments in more detail.

This is particularly relevant for clients in a general investment account, who may be required to pay CGT on investment returns.

Dividend allowance and income tax

Also announced in last year’s Autumn Statement, the dividend allowance – the amount of dividend income you can earn before you have to pay tax – has been halved from £2,000 in 2022/23 to £1,000 in this tax year. This will be halved again to just £500 next year for the 2024/25 tax year.

There has also been a change to income tax bands, with the threshold at which high earners will start paying the top ‘additional’ rate of income tax reduced from £150,000 to £125,140. This rate is 45% in England, Wales and Northern Ireland, and 47% in Scotland.

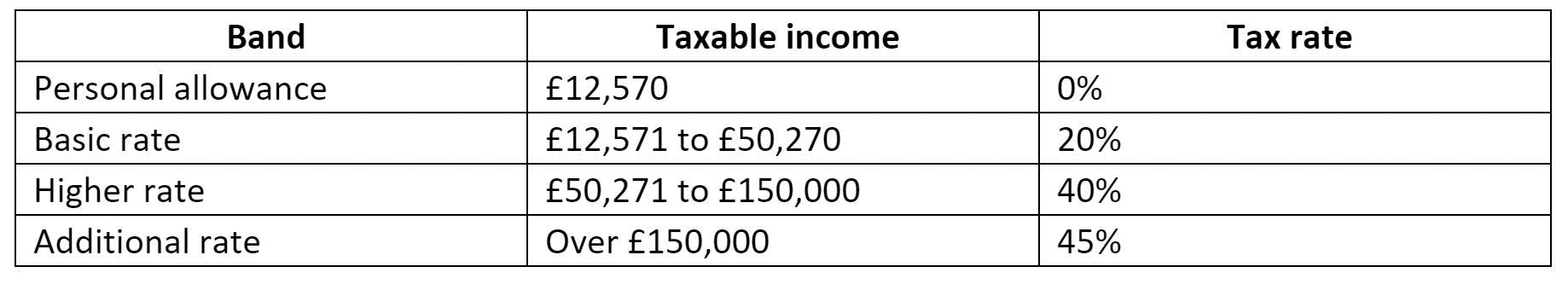

The other income tax bands in England, Wales and Northern Ireland remain unchanged:

In Scotland, however, the taxable income bands and rates are different.

These changes are, again, especially relevant to investors in a general investment account, who will be required to pay income tax on income you receive from your investments beyond your allowance, as well as CGT on any realised gains.

Nutmeg clients will receive a tax pack after the end of the tax year which includes a consolidated tax certificate (CTC) that details the dividends and interest income paid (and reinvested), as well as information on capital disposals to assist in preparing your UK income tax return, if required.

Keeping you on track to meet your goals

A new tax year always brings plenty of changes and opportunity to reassess your finances and, provided you can afford to do so and it’s suitable for you, invest towards your future goals. If you require any help in understanding tax changes, or the options open for you in planning your financial future, consider booking a free call with one of our experts who will be able to point you in the right direction.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

The information provided in this blog is intended to be an aid to decision-making and should not be relied upon as financial advice. If you are thinking about investing and need some help, please seek financial advice. Nutmeg’s advisers are available if you need them, offering restricted financial advice.