Clients invested in the Nutmeg Smart Alpha portfolios, powered by J.P. Morgan Asset Management, should benefit from a change which brings broader, active exposure to the domestic equity market.

Our Smart Alpha portfolios combine Nutmeg’s core investment principles, ETF and fractional investment expertise with the in-house research, multi-asset knowledge and experience of one of the world’s leading investments houses.

They’ve been designed to provide investors with access to a globally diversified and actively managed investment portfolio, and include innovative active exchange-traded funds (ETFs) from J.P. Morgan Asset Management that look to benefit investors through research-driven security selection.

In line with this objective, the Smart Alpha portfolios’ exposure to active ETFs has recently been further enhanced through the inclusion of the J.P. Morgan UK Equity Core UCITS ETF.

What’s changed?

Previously, the Smart Alpha portfolios – at all risk levels – invested in UK large-cap stocks through exposure to iShares Core FTSE 100 UCITS ETF. While an efficient way to track this major index, this ETF takes a passive approach which simply looks to replicate, rather than outperform, the FTSE 100.

The Smart Alpha team has chosen to replace this ETF with the J.P. Morgan UK Equity Core UCITS ETF, meaning the portfolios can benefit from exposure to J.P. Morgan’s breadth of investment resources. The new solution aims to achieve long-term returns in excess of the wider FTSE All-Share index by actively investing in a wide portfolio of UK companies, based on the views of J.P. Morgan Asset Management’s UK specialist portfolio managers and research analysts.

The fund is still an ETF and maintains a diversified approach to managing risk. The difference is that the managers of the new solution can moderately overweight the equities they think have the highest potential to outperform across the index, while also underweighting, to a similar degree, the stocks in which the team has less conviction.

What are the benefits of the new solution?

The strategy is very similar to the active J.P. Morgan Research Enhanced Index Equity ETFs already used within the Smart Alpha Portfolios, especially given its integration of fundamental stock research from the team at J.P. Morgan Asset Management.

However, while the Research Enhanced Index Strategies predominately focus their stock selection using fundamental analysis – that is teams looking at a company’s real or ‘fair’ market value – the J.P. Morgan UK Equity Core UCITS ETF combines both fundamental analysis with a quantitative approach, using mathematical and statistical modelling.

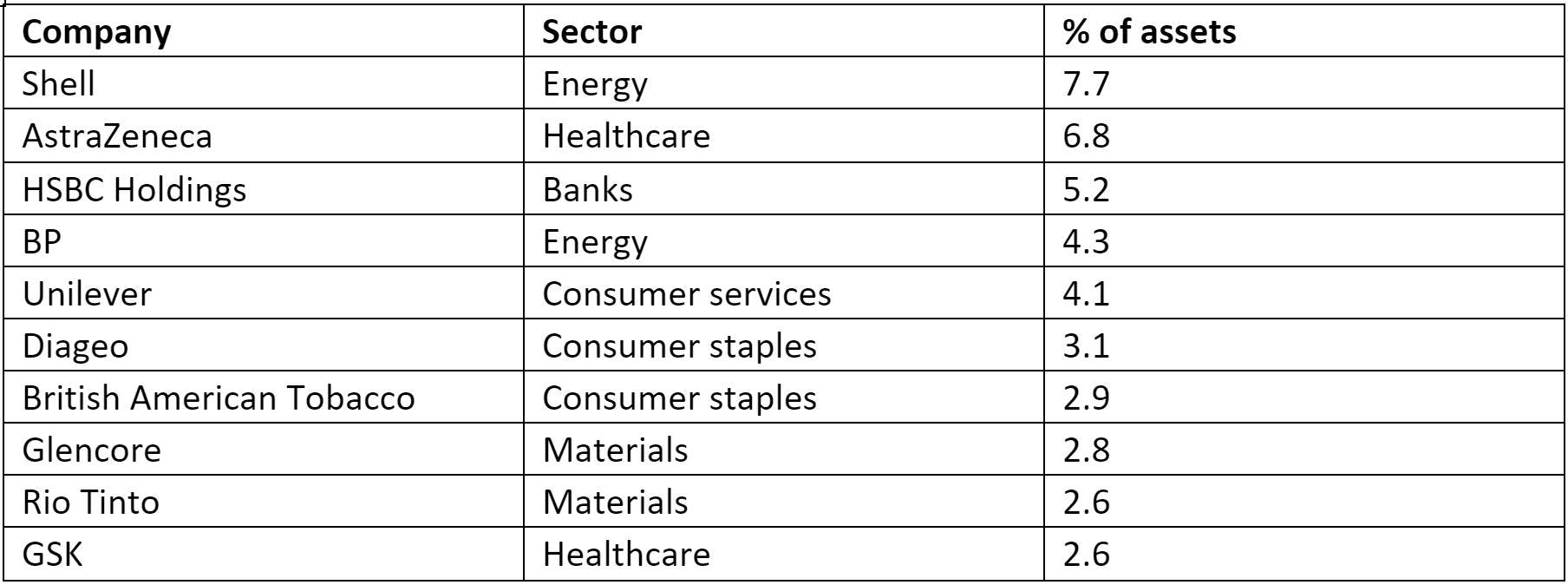

The fund also has a wider remit than the previous solution, and can invest across the UK market, rather than be restricted to the large-cap FTSE 100 index (larger companies still dominate the top-10 holdings, as seen in the table below).

Investing in mid- and small-cap UK stocks adds a further level of diversification to the portfolios. These stocks tend to have a more domestic focus than the larger, multinational blue-chips in the large-cap index, and exposure to these markets introduces a new source of potential long-term returns from companies not necessarily represented in the ‘old economy’ of the FTSE 100.

Where is the fund invested?

As noted above, J.P. Morgan UK Equity Core UCITS ETF aims to beat the FTSE All-Share index. This index captures around 98% of the total market cap of the UK stock market. This index has 580 constituents, 350 of which are in the FTSE 350 Index (incorporating the FTSE 100 and FTSE 250) and 230 of which are in FTSE Small-Cap Index.

The J.P. Morgan UK Equity Core UCITS ETF holds a diversified set of stocks, and broadly maintains its sector exposure so as to be aligned with that of the FTSE All-Share to help manage risk. And while the managers use stock specific insights to overweight and underweight individual companies, turnover in holdings, and the cost of changing positions, are important considerations in the team’s management of the strategy in order to minimise transaction costs.

JPM UK Equity Core UCITS ETF – Top 10 holdings

Source: J.P. Morgan Asset Management (as of 8 March 2023)

All risk levels of the Smart Alpha portfolios now have exposure to the J.P. Morgan UK Equity Core UCITS ETF.

You can hear more about the Smart Alpha strategies, and the team’s views on the global economy and outlook for 2023 in our recent video. Our guide to the portfolios, and the methodology behind them, is also available to download from the Nutmeg website.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicators of future performance. Tax treatment depends on your individual circumstances and may change in the future.