Retirement planning and advice

Get expert pension and retirement planning advice with Nutmeg.

With investment, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future. Nutmeg provides restricted advice. This means our advice is limited to our own products and services.

Planning for your retirement

If your pension feels like a mystery, you’re not alone. Many of us underestimate how much we need for our retirement, so there can be a gap between the retirement we’re expecting, and the one we’re on track for.

It’s important to get to grips with what you’d like to do when you retire, how you plan to fund it, and what you can do now to achieve it. Our experts can help you to understand what to do with your money today to create a future you can be excited about.

See how our retirement experts could help you today.

Book a free call

Plan your retirement income step-by-step

It’s generally better to start planning sooner rather than later, so you can maximise your savings and investments.

Step 1: Find out how much you have saved

Find out your likely sources of income for retirement by tracing old pension pots, your state pension and any other savings or investments you could use.

Step 2: Set yourself a goal

Think about what you’d like your retirement to look like, whether that’s reducing work, starting a new hobby or travelling the world, and work out how much you’ll need.

Step 3: Create a plan of action

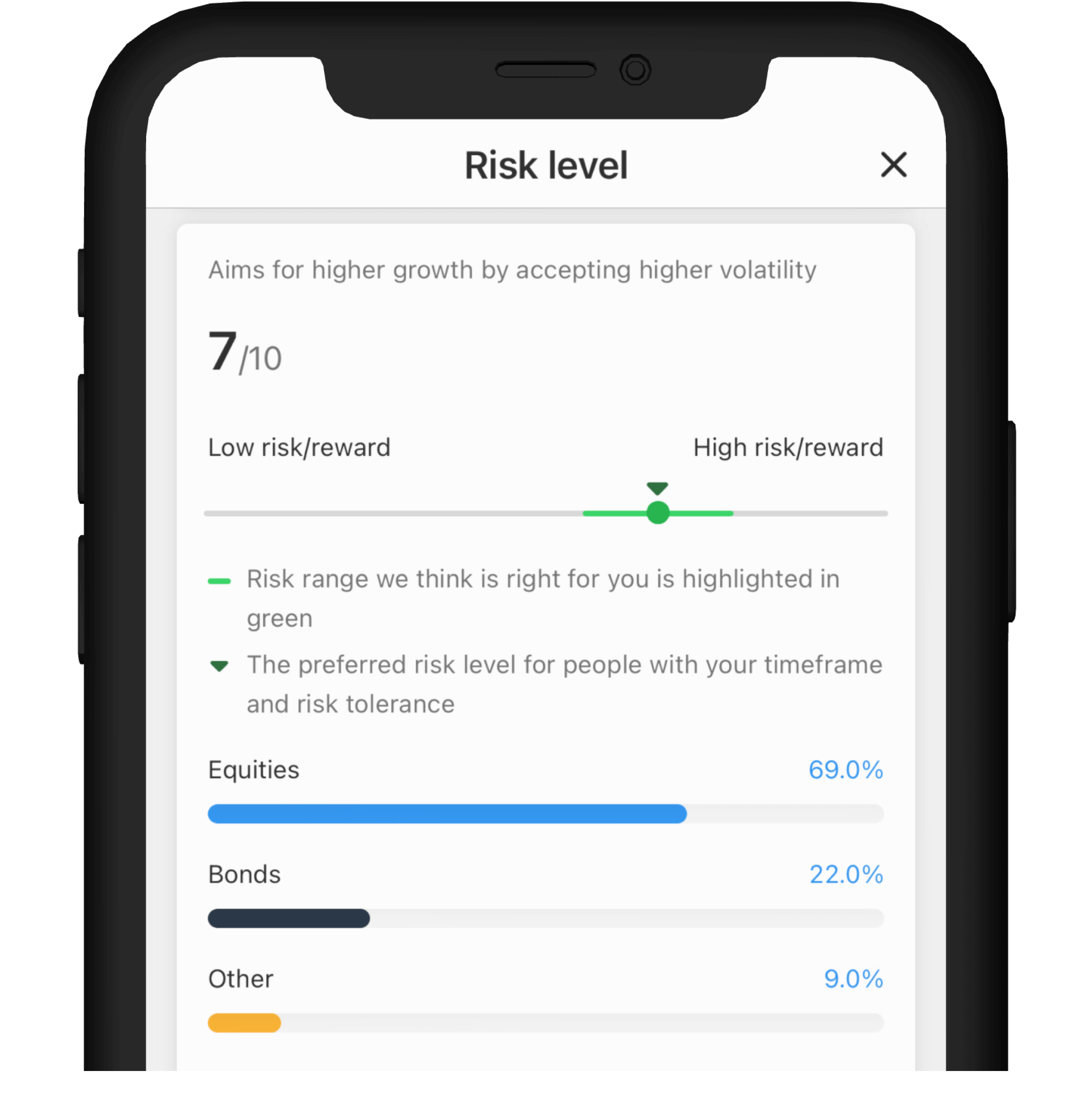

You can start calculating what changes you might need to make to achieve your goals, from combining your pension pots, to adjusting risk level, or increasing contributions.

Step 4: Review your progress regularly

Review the changes you’ve made and check on your plan regularly to make sure you’re still on track to achieve your dream retirement.

Book a free call to see how our retirement experts could help you

Our team can create a retirement plan tailored for you. Whatever your future goals may be, we'll help you get there.

Book a free call

What is a retirement plan?

For many people, the transition from accumulating wealth to spending it can be a difficult one. How can we be confident we have enough savings to live a comfortable retirement, and how should we access our savings efficiently both now and in the future?

This is where the Nutmeg Retirement Plan comes in. For £575, one of our financial planners will analyse your specific circumstances, both in terms of finances and retirement goals, and put together a tailored plan for the remainder of your financial life. This can help you to gain clarity around the future, understand your current situation, and reduce the stress which can come with entering retirement.

Speak to our team to find out more. There’s no obligation to go ahead.

How much does it cost?

£575 (including VAT)

We charge a one-off fee of £575 to create a fully bespoke retirement plan for you. The scope of Nutmeg's services and the products we offer are set out in the disclosure document.

Disclosure document PDFWhy transfer your pensions to Nutmeg?

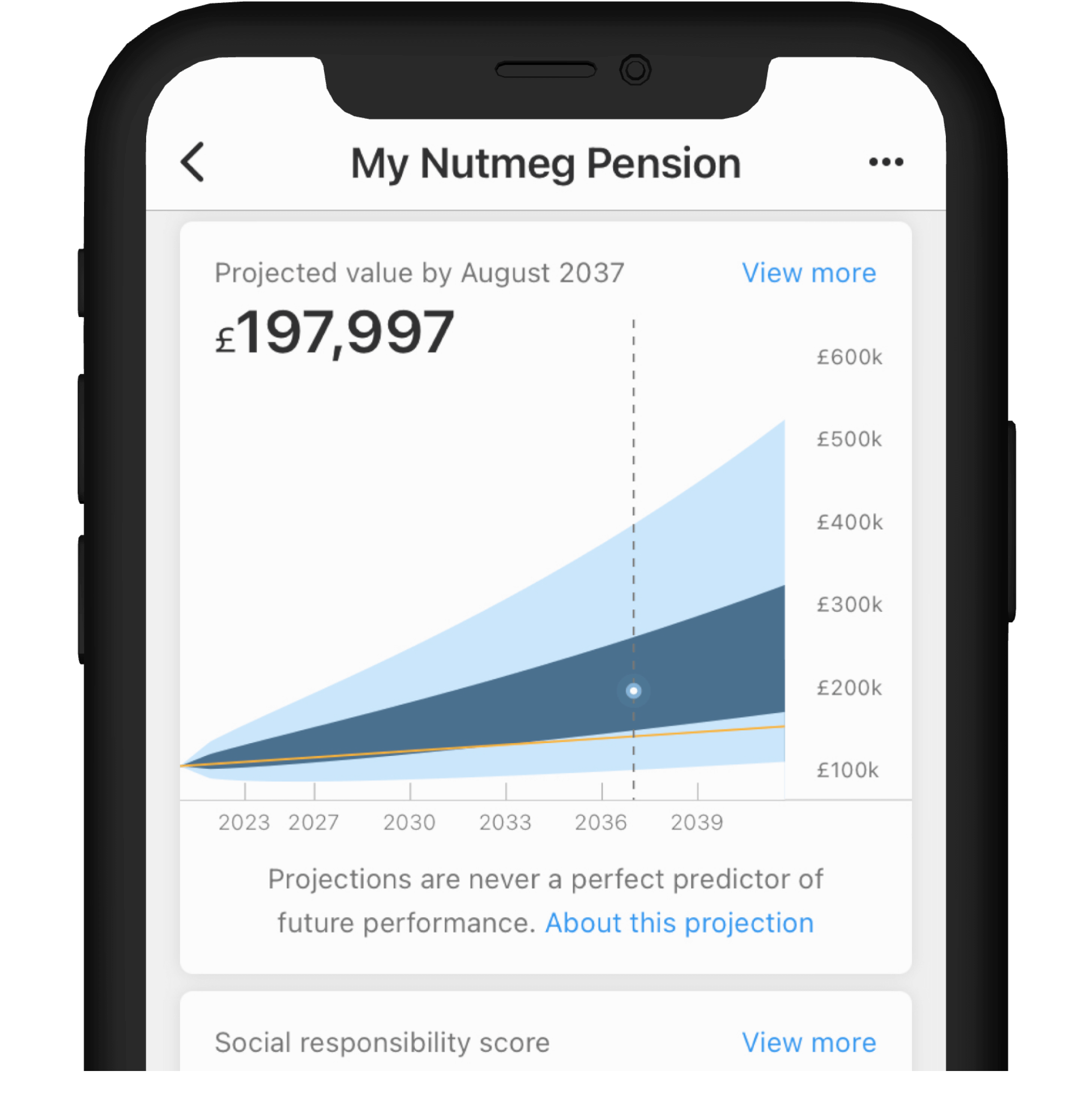

Pensions are a tax-efficient way to save for your retirement and combining your pensions into one easy-to-see pot with Nutmeg could be a great place to start. When you open a Nutmeg pension you’ll get total visibility into how much is in your pot now, and if you need to make any changes to get you on track for the future. You also get access to our team of experts who offer free financial guidance no matter what stage of life you're at.

Tax treatment depends on your individual circumstances and may change in the future. Before you transfer your pensions, check you won’t lose any benefits and that you know what charges you may incur.

Take control

Choose how you want us to manage your pension and what risk profile is right for your goals.

Stay on track

See how much your pension could be, and exactly where it's invested with our easy to use tools.

Trust the experts

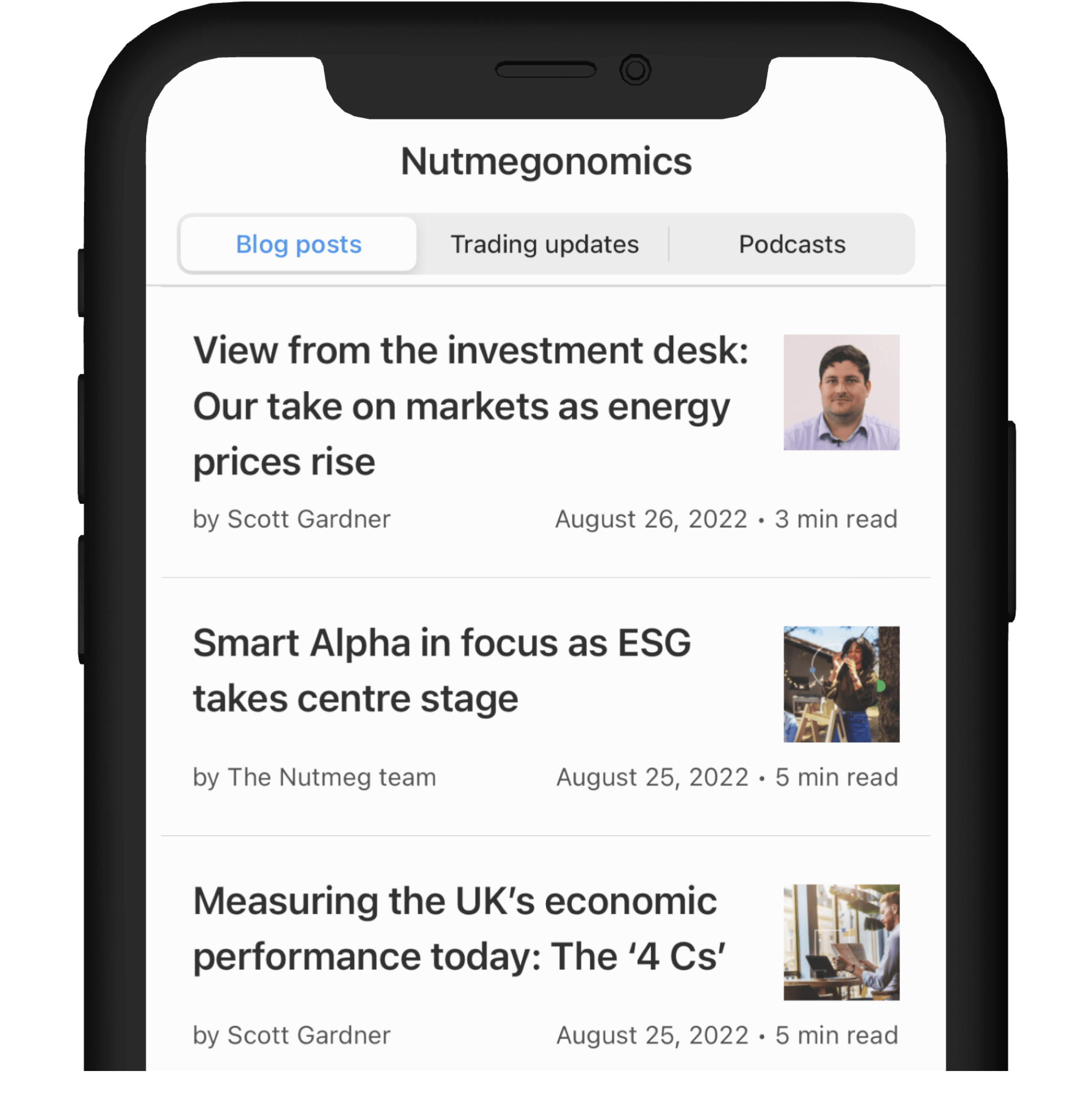

Our expert investment team will manage your pension for you and keep you updated.

Forecasts are not a reliable indicator of future performance. The projection includes the effect of Nutmeg’s fees, investment fund costs, and market spread.

How much will you have for retirement?

See how much you should be saving to achieve your dream retirement with our easy-to-use pension calculator.

Pension calculatorRetirement guidance, planning and advice

Does your pension line up with your life stage?

It's never too early to think about your retirement goals and ensure your pension is on track and set up appropriately.

Book a free call

Is your pension enough to fund your retirement?

We can help you understand if you’re on track to achieve your dream retirement, or establish how you can get there.

Book a free call

Looking to make a pension withdrawal?

Our team can help you organise your finances into a sustainable income that suits your desired retirement lifestyle.

Book a free call

Watch our webinar to learn about retirement planning

Learn more about pensions

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. A pension may not be right for everyone and tax rules may change in the future. Please note that during any transfer, your investments will be out of the market. If you are unsure if a pension is right for you, please seek financial advice.

Our most recent awards