Thematic investing

Invest in the trends shaping our future. Globally diversified portfolios, managed to your risk appetite and tilted towards one of our future-focused themes.

With investment, your capital is at risk.

What is Thematic investing?

Thematic investing is a long-term strategy that invests in the growing trends shaping our future, such as artificial intelligence adoption, energy generation, and the ageing population. This approach invests in the companies that are likely to benefit from the development of these trends.

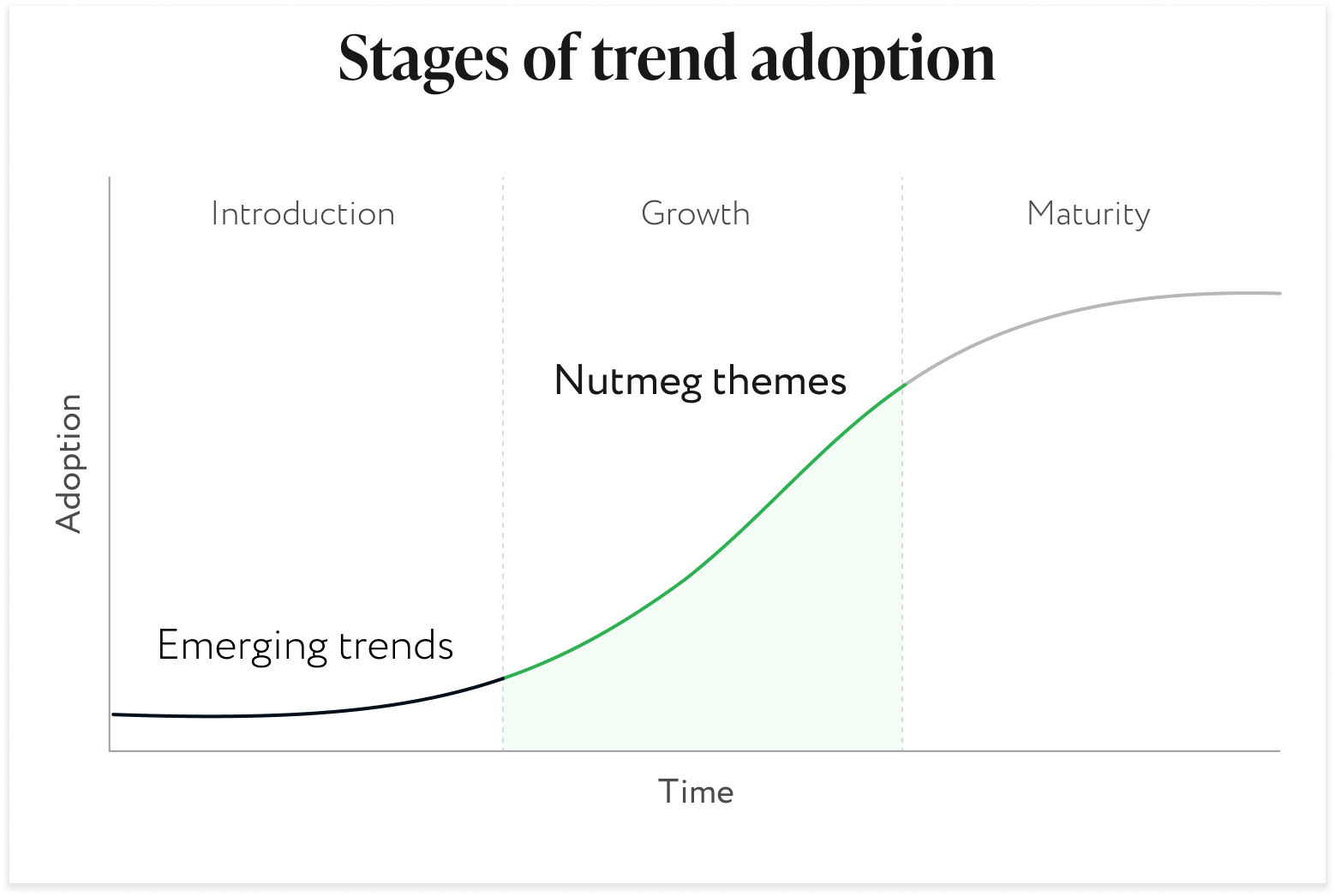

Focusing on long-term trends

Emerging trends

When trends first enter the market and are in the first stages of adoption, they’re seen as a riskier choice for investors. While they have the potential to yield significant growth opportunities, they could easily lose market interest – resulting in negative returns for investors. Current examples of trends at this stage include the metaverse and blockchain technology.

Nutmeg themes

Instead, our expert investment team have carefully selected themes based on more established trends that are likely to reach full adoption in the next 10 to 20 years – such as healthcare innovation or machine learning. These trends are a result of structural change, already ingrained in society, and look set to continue accelerating. With Nutmeg’s three future-focused themes, investors can benefit from exposure to fast-growing trends while remaining globally diversified.

The graph does not represent past or future investment performance and is for illustrative purposes only.

How does Thematic investing work?

1

Choose one of our future-focused themes: Technological innovation, Resource transformation, or Evolving consumer.

2

Select risk level. Thematic investing is only available for risk level five and above.

3

We manage your diversified portfolio, a portion of which is tilted towards your chosen theme.

Our Nutmeg themes

Choose the theme you think has the greatest potential

Technological innovation

Invest in technological advances and innovation driving the modern world. With exposure to the:

Resource transformation

Invest in the ways we utilise energy and resources to meet our future needs. With exposure to the:

Evolving consumer

Invest in the evolving demands and needs of our global population. With exposure to the:

The themes do not incorporate environment, social and governance (ESG) considerations.

Get startedHow is a Thematic portfolio built?

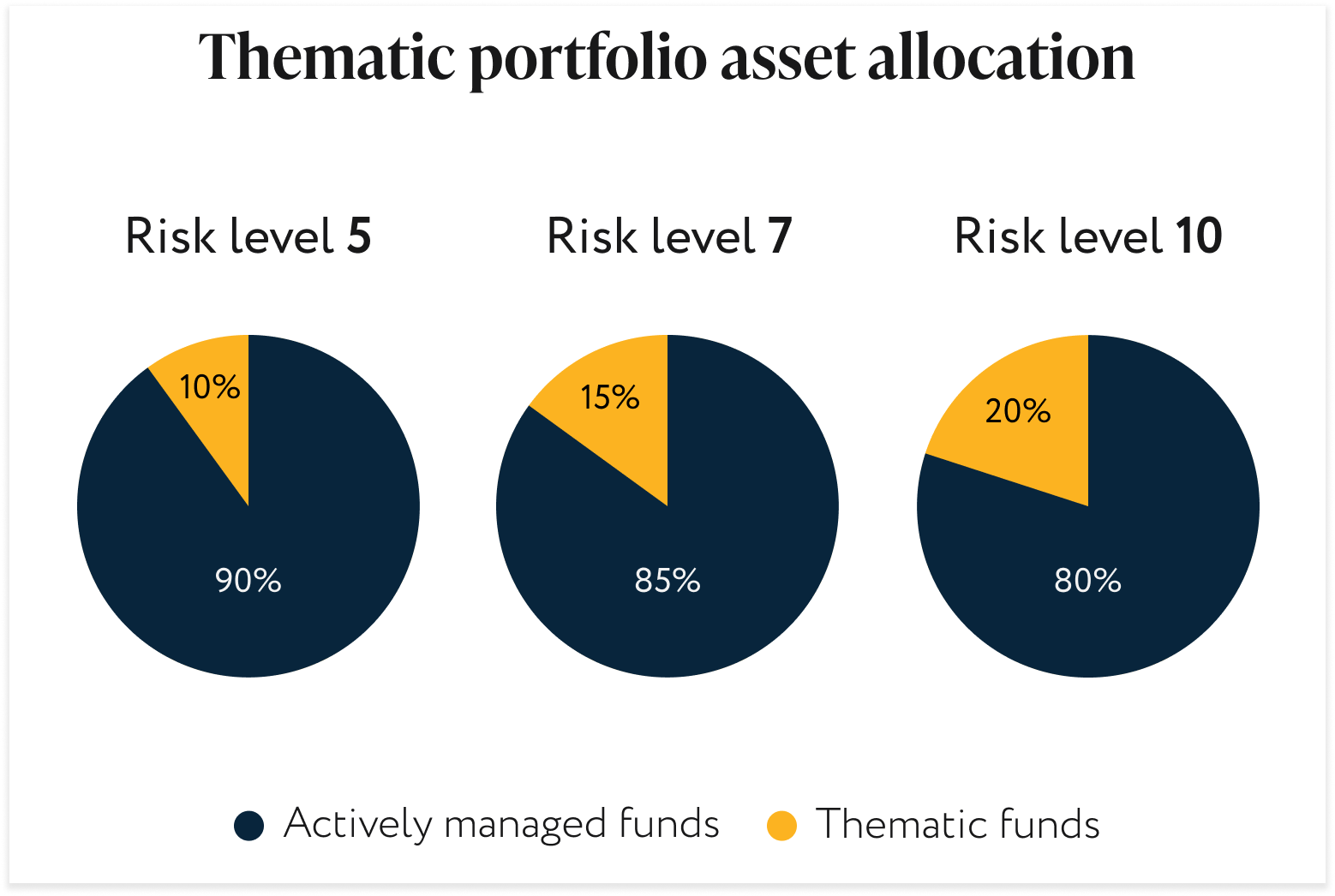

Your Thematic portfolio will be split into two portions:

Thematic

This portion of your portfolio will invest in exchange traded funds (ETFs) that focus on your chosen theme. The size of this portion depends on your risk level – the higher your risk level, the greater your Thematic exposure. Our investment team will review this portion annually and rebalance it at regular intervals.

Actively managed

The rest of your portfolio will invest in a globally diversified range of ETFs that are not specific to your chosen theme. This portion will be actively managed by our experienced investment team, who regularly rebalance your portfolio and make strategic adjustments.

This style of investing is only available for risk level 5 and above.

The portion of your Thematic exposure depends on your risk level.

Why should I choose a Nutmeg Thematic investment style?

It's always free to speak to one of our experts

Is Thematic investing right for me?

Thematic investing isn’t suitable for everyone, so our team can help you explore if this is the best long-term strategy for you.

Book a free call

How are the Nutmeg themes built?

Our team can help you understand how our Thematic portfolios are researched, built and managed.

Book a free call

How does Thematic investing fit into my investment strategy?

Thematic investing has a long-term outlook and can be a great way of having more say over your investments, while remaining diversified.

Book a free callLearn more about Thematic investing

What other investment styles are available?

All five Nutmeg investment styles are built by experts and use exchange traded funds (more on ETFs here) to diversify across stocks, bonds, industries, even countries.

Choose the one that works for you.

Our fees

As with any investment, there are underlying costs. At Nutmeg, there are no set-up, transaction, trading or exit fees. Simply enter an amount below to see how much you would pay across each of our five investment styles.

Input estimated investment

Your Thematic investing questions answered

Is Thematic investing risky?

Is Thematic investing risky?

Thematic investing carries different risks compared to our other investment styles. For example:

- It provides exposure to smaller companies that could be more likely to fail than larger, established ones.

- The underlying trend may not evolve as expected. For this reason, thematic investments are typically left for longer to allow them to benefit from the trend’s potential growth.

- The Thematic portion of these portfolios has a greater exposure to foreign currencies.

To allow for sufficient exposure to thematic ETFs, Thematic investing is only available for risk level five and above. However, your portfolio will always be managed by our experts in line with your risk appetite, and in a globally diversified portfolio, so your pot should experience the level of volatility that you’re comfortable with.

Why is Thematic investing only available for risk level five and above?

Why is Thematic investing only available for risk level five and above?

The investment style Thematic investing is only available for clients with a risk level of five or above due to the nature of this investment strategy. To ensure your Thematic investing pot is focused on your chosen theme it must be exposed to a certain amount of equities that focus on the trends underlying this theme. For risk levels one to four – which have a higher overall allocation to bonds, a lower-risk asset – the thematic allocation would be too small, and could no longer be considered ‘thematic’.

In risk levels one to four, portfolios are managed with a greater emphasis on minimising foreign currency risk. The Thematic portion of Thematic portfolios has a greater exposure to foreign currencies, particularly the US Dollar. This makes these portfolios unsuitable for lower risk investors.

Are there any minimum requirements?

Are there any minimum requirements?

You can start investing with £100 for a Junior ISA or Lifetime ISA, or £500 for a stocks and shares ISA or General Investment Account. Thematic investing is not currently available for pensions. You will also need to have a suitable risk appetite, as this investment style is only available for risk level five and above.

How long should I be invested for?

How long should I be invested for?

While we recommend all clients invest their money for three to five years, Thematic investing is a longer-term strategy due to its future-focused nature. You should be comfortable leaving your investments for long enough to give them enough time to benefit from the trend’s growth. If you plan to withdraw in the shorter term, you may be better suited to one of our other investment styles.

Is this investment style actively managed?

Is this investment style actively managed?

Our investment team actively manages the majority of your globally diversified portfolio, making frequent adjustments based on news, data and analysis. The Thematic portion of your portfolio is solely focused on your chosen theme and requires less intervention, so is not actively managed. However it will be regularly rebalanced, and reviewed at least annually. Due to the long term nature of Thematic investing, the ETFs in the Thematic portion will likely not change frequently.

Do I have to be an experienced investor?

Do I have to be an experienced investor?

Nutmeg manages your investments for you, so you don’t need to be an experienced investor to choose Thematic investing. However, you should plan to leave your investments for enough time to allow them to benefit from the trend’s potential growth. We always recommend investors have short-term access to at least three months' worth of living expenses before investing.

How do I choose a theme?

How do I choose a theme?

Each of our themes are based on extensive research and built by our team of experts. So, all you need to do is choose the theme that you think has the greatest potential.

Is Thematic investing right for me?

Is Thematic investing right for me?

Thematic investing is suited to investors who are keen to harness the growth opportunities of long-term trends and are comfortable leaving their investments to grow. As Thematic investing may experience more volatility (ups and downs) and has greater risk for potential losses during times of market stress than our other investment styles, you should be somewhat comfortable with these potential risks and will need to have a risk level of at least five out of ten.

How much does Thematic investing cost?

How much does Thematic investing cost?

Our management fee is 0.75% on the first £100k and 0.35% thereafter, including VAT where applicable. All Nutmeg portfolios are also impacted by investment fund costs and are subject to the effects of market spread. Read more about Nutmeg cost and charges.

What is a trend?

What is a trend?

Trends emerge as a result of innovation and structural change – such as ageing populations or advances in technology. They shape our future – from how we live and work to the infrastructure of the world around us – are already ingrained in our day to day lives, and the growth of these trends is set to accelerate in the coming decades.

Is the Resource transformation theme a sustainable portfolio?

Is the Resource transformation theme a sustainable portfolio?

The themes, including Resource transformation do not incorporate incorporate environmental, social and governance (ESG) considerations. This theme will likely have exposure to a variety of renewable and non-renewable materials and energy sources.

For those looking to incorporate ESG considerations into their investment portfolio, we’d recommended looking into our Socially responsible portfolios.

Is Thematic investing available for all products?

Is Thematic investing available for all products?

You can choose a Thematic investment style for a stocks and shares ISA, Junior ISA, Lifetime ISA and General Investment Account. However, this investment style is not currently available for pension pots.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. See how we help manage the risk at nutmeg.com/risk. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome.