Clear fees with no surprises

We want you to reach your financial goals, so we keep our fees low and straightforward to help make it happen.

With investment, your capital is at risk.

It's free to join Nutmeg

We never charge you to withdraw money if you need to, either. You pay us a fee to manage your money, which depends on your pot's value and investment style.

You'll also get regular investor updates about the markets, year-round free access to our Insights hub, and access to free financial guidance from our experts whenever you need it. You can check how much you're paying at any time in our app.

What you'll pay to invest with us

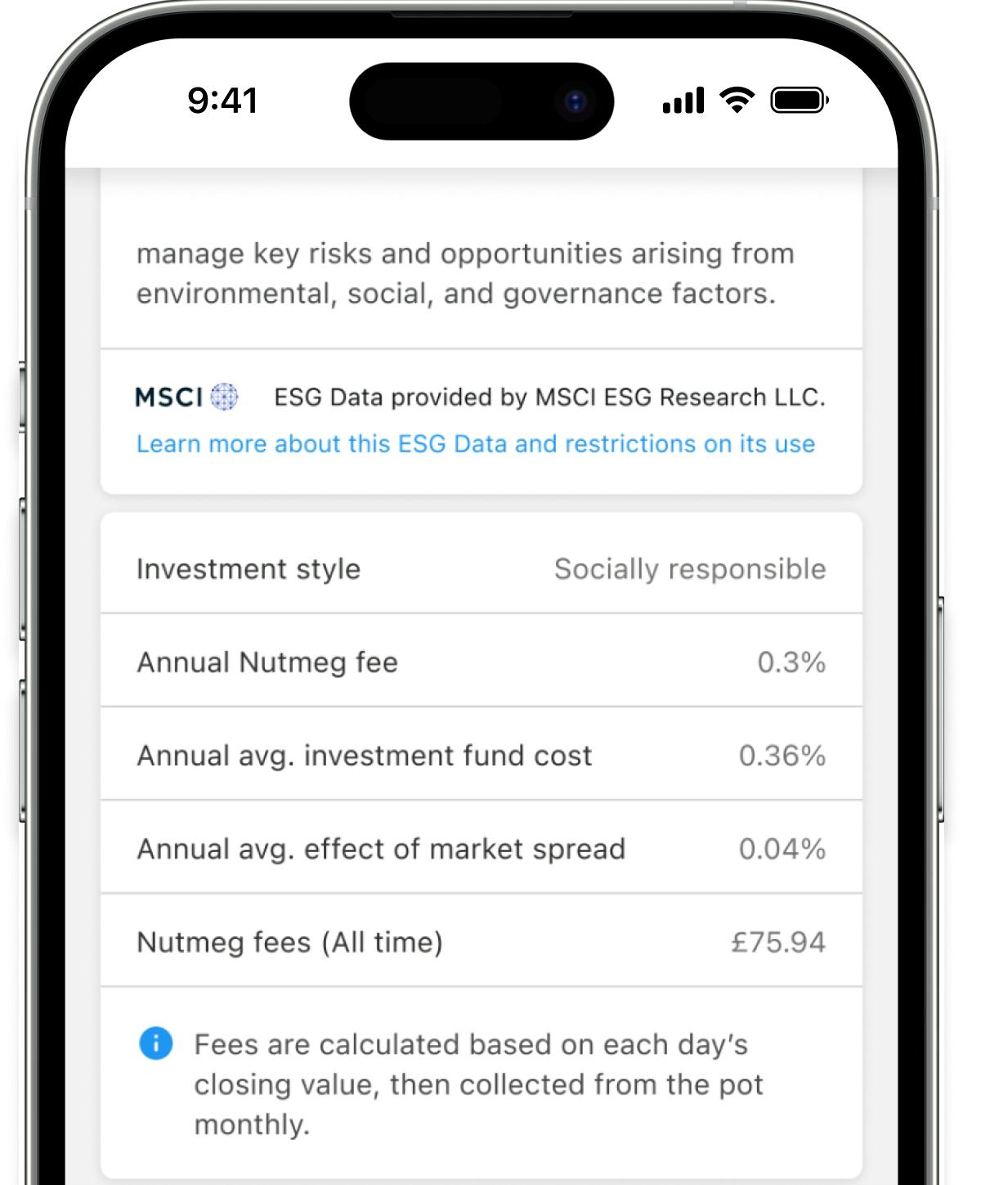

We want our clients to understand exactly what they're paying for. You'll see three separate charges on your account:

Our management fee

We'll take this from your Nutmeg account automatically – you won't need to pay it separately. The amount depends on the investment style you choose, and if you have a mix of styles across your pots, we'll combine these into one cost. Learn more about our investment styles.

Investment fund charges

As with all investing, there are set-up and transaction charges for buying and selling stocks or bonds. We use your money to cover these admin and operational costs, and they're absorbed into your investments.

Market spread

This is the difference between the price to buy and the price to sell assets. To keep this to a minimum, we combine orders and choose ETFs with smaller spreads.

Calculate and compare fees

What you'll pay depends on the investment style or strategy you choose. Use our calculator to see an estimate of what your fees could look like for the next 12 months if you opened a pot with us today. To keep it simple, these figures don't take any returns into account.

A high-value portfolio doesn't mean a higher fee

On every pound over £100,000 in your Nutmeg portfolio, we'll charge you a lower management fee. So if you transfer in high-value investments, you invest more with us or your portfolio generates returns, there's no need to worry about a sudden increase.

Speak to us about fees

Our advice and guidance team can explain what you could pay to invest, and help you decide which product and style might suit you the most.

Book a free callAs with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules vary by individual status and may change.

Frequently asked questions

How, when and where do I pay my fees?

How, when and where do I pay my fees?

You'll pay your management fees monthly, which we'll take from your Nutmeg account automatically. You'll also pay fund and market spread costs, which are absorbed in the investments themselves.

You can find a breakdown of all your fees and charges in your dashboard. Learn more about how and when we charge fees.

How do you calculate my fees?

How do you calculate my fees?

We calculate your fees at the end of every day. The amount will be a percentage of your portfolio value and will depend on the investment style you choose. Learn more about how we calculate fees.

Where can I see what I'm paying?

Where can I see what I'm paying?

You can see the fees that have been deducted from your account at any time by accessing the 'portfolio valuation and fees' menu in your pot valuation chart. You can also see the fees of a specific pot by accessing 'pot valuation and fees' in the pot menu. All the details about your fees are also in your quarterly valuation reports – go to the 'key figures' page and you'll see these under 'breakdown of costs and charges'.

Can I withdraw my money?

Can I withdraw my money?

We never charge you to withdraw your money, but depending on the type of product you have, there are some important details to remember:

You can withdraw money from a Stocks and Shares ISA whenever you need to. But as our ISA isn't 'flexible', this means anything you withdraw will still count as part of your annual ISA allowance – so if you put it back in later in the same tax year, it will count as an additional part of your allowance.

You can withdraw money from a General Investment Account whenever you need to.

Junior ISAs, Lifetime ISAs and Pensions have some restrictions:

- Only the child named on the account can withdraw funds from a Junior ISA, after they turn 18. If they don't, the account will automatically become a Stocks and Shares ISA. Learn more about withdrawing money from a JISA.

- You can only withdraw money from a Lifetime ISA for a qualifying first house purchase or when you retire, otherwise government withdrawal charges may apply. Learn more about withdrawing money from a LISA.

- Government rules apply to pensions, so you'll only be able to withdraw after you turn 55 (57 from April 2028). Learn more about withdrawing money from a pension.

Will I earn interest on cash?

Will I earn interest on cash?

If you have an ISA, JISA, LISA, GIA or Pension, the cash in your pot will earn interest at the current Bank of England rate, minus 0.75%. If you have a cash-only pot, you’ll earn interest at a fixed rate, which is set by us and subject to change. We don't charge fees for cash pots. Cash that is in transit – for example, pending withdrawal or transfer – won't earn interest. Learn more about cash in your portfolio.