Stocks and Shares ISA .

Go after your goals with our award-winning ISA, designed to help you keep more of what you make.

Capital at risk. Tax rules vary by individual status and may change.

Best Buy ISA 5 years running

What is a Stocks and Shares ISA?

An ISA protects investment returns from UK Income and Capital Gains Tax. Open ours with just £500, and discover what your wealth can do.

Invest up to £20,000 a year

Take advantage of your ISA allowance

Pay no tax on returns

What you do with the extra is up to you.

Grow your wealth

Due to inflation, investing can be better than saving.

Why choose our Stocks and Shares ISA?

Personalised to you

Select the investment style and risk level that best suits your goals

Managed by us

Our team manages your globally diversified portfolio, which you can track anytime.

Expertise built in

Get real human support, expert insights, and regular market updates.

Speak to our wealth experts

Our team is here as often as you need to discuss your strategy, check you're still on course, and refine your options – so you can make the most informed decision, every time.

Questions about anything else to do with investing? Just ask.

Book a free call

Make our ISA your own

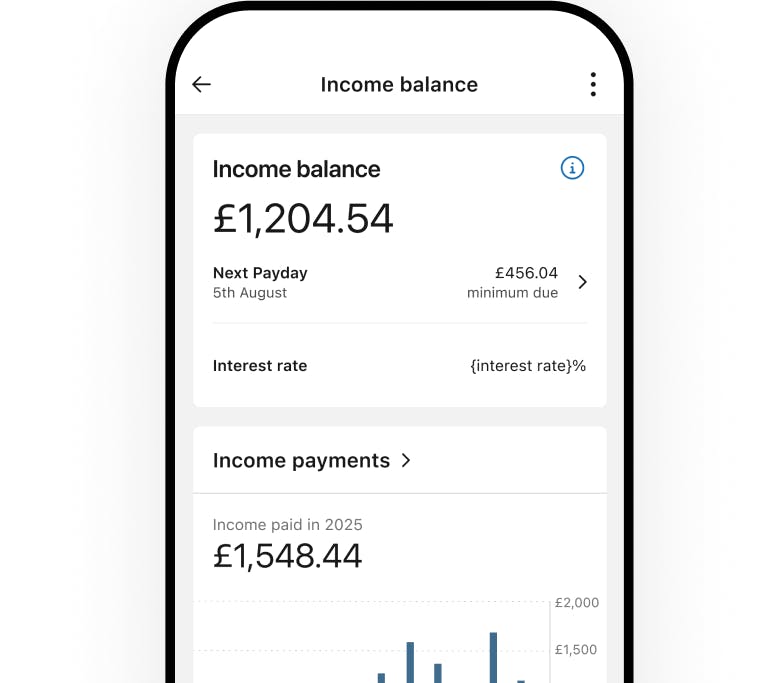

You can choose from five investment styles that prioritise long-term growth, or invest for income for an option that's designed to pay you sooner. Find the right fit for your plans, and we'll take care of the rest.

See our industry-beating results

Below you can see a detailed breakdown of our performance over the past few years, as well as how our investments are allocated across countries and assets.

- Track record

- Asset allocation

- Countries allocation

Track record

Explore our full 10-year track record for each of our 10 risk-based, Fully managed portfolios and see how our results compare against our competitors.

The past performance shown represents a composite of asset-weighted average returns for Nutmeg client portfolios, net of all fees. A composite return represents the average return of all client accounts for a given risk level on a given day, weighted by assets. Past performance is not a reliable indicator of future performance.

*The annualised figure is the return since inception expressed as a compound annual rate. For example, a portfolio with an annualised return of 6% corresponds to an actual return of 19.1% over three years (rather than 18% as you might expect) due to the effect of compounding.

Capital at risk. ISA rules apply

Invest like the experts

"Stocks and Shares ISAs are amongst the most generous tax breaks offered by the UK government, providing tax-free returns on up to £20,000 each tax year. With a range of globally diversified investment options to choose from, this can be an efficient way to invest towards your future goals."

Financial advice tailored to you

Need a hand with planning? Our team of advisers are ready to step in with our paid advice service.

We'll do an in-depth assessment of your portfolio, strategy and goals to detect areas where your investments could run more smoothly. You'll get a personalised financial plan based on our products and services, and your relationship manager will help you put it into action. You'll also receive expert recommendations on how to structure your finances to enjoy a stress-free retirement, leave an inheritance, and more.

What you'll pay for an ISA

It's free to join us. The only fee is for our experts to manage your money, plus the cost and market spread of the funds we buy into for you. Investing with us also gives you year-round free access to our Insights hub, free financial guidance whenever you need it, and regular updates sent from our investment desk.

Check our feesIt's simple to transfer an ISA to us

Do some checks first

Make sure you won't lose any benefits or get charged unexpected fees.

Open your new ISA

Set up a new home where you can bring your existing investments together.

Start your transfers

Give us your existing ISA details and we'll get started on the admin.

Learn more about ISAs

Other ways to invest

Invest for every goal with our range of products, all expertly managed by our in-house investment team.

Questions about ISAs

Are ISAs tax-free?

Are ISAs tax-free?

You don't pay Capital Gains Tax (CGT) or Income Tax on any returns from an ISA. Outside of an ISA, the CGT allowance is currently £3,000 for each tax year. So if you have other investments, you’ll pay tax on any gains over this – how much depends on your tax band. Try our CGT calculator.

How much should I put in an ISA?

How much should I put in an ISA?

This depends on your current situation and your personal goals for the future. To see how much your money could grow over time with our Stocks and Shares ISA, try our ISA calculator.

Can I have more than one type of ISA?

Can I have more than one type of ISA?

Yes – and you can open and pay into multiple cash ISAs and Stocks and Shares ISAs in the same tax year, but you can't pay in more than £20,000 in total.

Can I put £20,000 in a cash ISA and £20,000 in a Stocks and Shares ISA in the same year?

Can I put £20,000 in a cash ISA and £20,000 in a Stocks and Shares ISA in the same year?

No – you can open or pay into multiple types of ISA each tax year, but you can't pay in more than £20,000 in total.

If I transfer an ISA, does that use up my ISA allowance?

If I transfer an ISA, does that use up my ISA allowance?

You can transfer an ISA any time during the tax year and, if you use your provider’s transfer service rather than withdrawing and reinvesting the money yourself, it won't affect your tax benefits or annual allowance.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.