Generating an income is one of the most powerful things your investments can do. Here we walk you through some of the ways investors can unlock an income from different asset classes, and explain the unique approach we take in our income investing portfolios.

At a glance

- Investors can use their portfolios to provide an income. Both equities and bonds can play a role in producing income, but in different ways.

- Equity income is generally in the form of discretionary dividends. Not all companies pay dividends, and dividends can be stopped or lowered.

- Bond income is typically received in the form of regular 'coupon' payments. Because these payments are usually contractual obligations, bonds have traditionally played a significant role in producing income for investors.

- We believe our innovative approach to income investing, powered by J.P. Morgan Asset Management, can help our portfolios produce a strong, stable income, with well managed risk.

Whether you manage your own investments or leave the hard work to professionals, your portfolio should be constructed in a way that best suits your needs and objectives. Many people are not fully aware of how much flexibility there is to fine-tune a portfolio.

If you're already a Nutmeg customer, you'll be familiar with our different investment styles and risk levels, which allow you to choose a portfolio in line with your interests and risk tolerance. Now, you can also choose whether you want to prioritise the long-term capital growth of your investments, or earning a passive income from them today (or a blend of both).

What are the sources of income?

The two most typical ways of drawing an income from a portfolio are by investing in the equity of dividend-paying companies, and buying bonds which pay a regular ‘fixed income’.

Income from equities

Equity income is usually in the form of dividends, which are payments made to shareholders (investors) of a company. Not all companies pay dividends and it is important to remember that equity dividends are usually discretionary. A company's board of directors may decide that it is in the best interests of the company and its shareholders to pause, lower or stop paying dividends to its investors.

There are several reasons why some companies pay dividends, including:

- Attract and keep investors: companies may decide to distribute a portion of their profits (also known as earnings) to their shareholders to encourage investment in the company. Some investors, particularly those focused on earning income through their investments, favour companies that pay attractive dividends.

- Indicate financial health: a company’s ability to distribute healthy dividends is seen as a positive financial metric, especially if the dividends regularly increase and are well covered by earnings.

- Return profits to investors: Some companies pay dividends because they have reached a scale that makes further growth challenging, and at this point may start to pay investors a dividend. For example, the firm could acquire another company, but there may not be an appropriate target at that moment. Instead, management may feel it is better to return cash to shareholders. This can be true for more mature companies, potentially with limited growth projects.

Do all stocks pay dividends?

No. While it is common practice, especially for mature companies with stable revenues and earnings, there are a variety of reasons why a listed company may choose not to.

- Focus on growth: Companies in earlier stages of development may choose to reinvest available cash in pursuit of this higher growth, aiming to create a more profitable company in the future.

- Financial caution: a company may prefer to retain its cash for self-preservation if experiencing cashflow issues or weaker earnings. Investors may, however, react badly if a company that typically pays a dividend decides not to.

Is a high-dividend company regarded as a better investment?

Dividend-paying equities are not inherently 'better' than companies that don't pay a dividend. A company's strategy and priorities will dictate how it uses capital, and paying dividends is just one approach.

Dividend yield is the annual dividend payment of a company or index, divided by the current share price. Investors looking to seek out income from their investments might look for companies with a higher dividend yield, but it's important to know that dividend yield doesn't indicate how risky an investment is.

Equally, some equity indices around the world, and some sectors within indices, have more dividend carrying companies than others. Therefore, if an investor were to target only higher income equities, they may find that they are over-exposed to certain industries (such as utilities or consumer staples) or geographies.

Income from bonds

Bonds fall into a category of investments known as 'fixed income', and sometimes people use the terms interchangeably. The reason they're called 'fixed income' is because they typically provide regular, set payments (the income from the bond, sometimes called the 'cashflow') to the bond holder over a specific period of time. Floating rate bonds are less common, which, as the name suggests, have yields that move with a benchmark rate.

Bonds are debt securities, meaning they represent a loan made by an investor to a borrower. The bonds typically held in our portfolios are tradable securities issued by governments (government bonds) and companies (corporate bonds).

Payments are usually in the form of ‘coupons’. The payment is usually made every six months but can also be monthly, quarterly or yearly. Bond investors normally know the value of the payments they should receive and the schedule on which they should receive them (including the final payment returning the initial loan amount).

What is 'bond yield'?

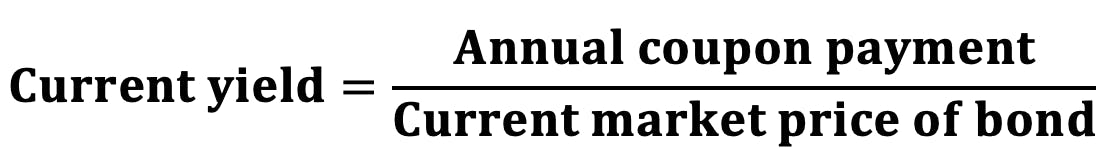

Bond yield is the most common way that the return generated from an investment in a bond is shown. It is usually expressed as an annual percentage of the bond's annual income (from interest) as a percentage of the bond's current price (illustrated below).

At the individual bond level, as an investor knows the expected annual coupon payment, you can calculate the yield received from a bond based on its market value. This is called bond yield or "current yield". The bond's current market price is 'live', and is influenced – as with equities – by a lot of factors affecting investor perception of the bond's worth.

As an illustration of the above, a bond paying £5 per year currently priced at £95 would have a current yield of 5.26%.

If an investor holds a portfolio of bonds over a given timeframe, the income produced will rise and fall as the yield of the bond portfolio changes. Overall, while the immediate income from existing bonds remains unchanged if yield changes, the potential income from new bond investments or reinvestments can be lower when yields fall.

Factors that affect bond yields

Maturity (how long the loan is for) and credit risk (how risky the government or company borrowing the money is judged to be) are big drivers of bond yield.

If we think of the bond yield as the minimum interest rate at which investors are willing to lend to a borrower, it explains why both longer maturity and higher credit risk typically result in higher bond yields.

If a company is borrowing money for a longer period, it increases the possibility that something could affect the borrower’s ability to repay a debt or cover all the interest/coupon payments due until the bond matures. It also introduces greater risk that the future payments will be worth less in real terms (because investors have no control over inflation).

If credit risk is higher, it means investors think the borrower is less reliable at paying back debt. This might be because the issuer is a younger company with a limited record of borrowing or business success, or because the company has missed debt payments in the past.

A debt issuer’s (borrower’s) creditworthiness is grouped into one of several main categories called 'credit ratings'. For the purposes of this article, we'll stick to a couple of high-level categories. Bonds with higher credit ratings are called 'investment grade' and bonds with lower credit ratings are 'high yield' bonds.

Typically bonds issued by the governments of large, robust economies – like the US, UK, Germany or Japan – are seen as the safest bonds with very high credit ratings and therefore normally lower yields (lower income). This is because of the general rule that investors typically require less in return to take on less risk, and vice versa. Some government-issued bonds can, however, be significantly riskier than G10 government bonds.

Indeed, a stable company in a developed market might have a stronger credit rating than the government bonds issued by less developed countries. As a general rule though, corporate bonds usually carry a higher credit risk than major government bonds. The additional yield that a corporate bond provides over a government bond is known as 'credit spread'. It indicates the need to offer investors a more attractive return to compensate for the risk of 'default' (a failure to pay any part of the bond's agreed cash flows). The chart below shows the difference between UK government bond yields (also known as 'gilts', as in the chart) and corporate bond yields over time, and while you can see they move in similar ways, corporate bonds have consistently offered a higher yield.

Importantly, while bonds are often considered to be 'safer' than equities, neither government bonds nor corporate bonds are risk-free, and investors must be aware that bond prices can experience significant moves for a range of reasons.

Comparing UK government bond yields and UK corporate bond yields

Source: Bloomberg/Macrobond/Nutmeg, 2 May 2025. Note: From around 2008 to 2010 the Global Financial Crisis caused a so-called 'credit crunch' which meant borrowing became extremely challenging.

Income in multi-asset portfolios

As a general rule, investors prioritising capital growth might allocate more of their portfolio to equities. An investor prioritising income may make greater use of bonds. Multi-asset portfolios provide a mix of bonds and equities.

Blending equities and bonds can help to increase diversification. It is common for investors to hold a mix of equities and bonds to even out periods in which performance in one is weaker. In theory, the prices of bonds and equities should move in opposite directions – it’s called ‘inverse correlation’. In broad terms, this is because equities tend to perform well when investors are optimistic about growth. When investors are less optimistic, they may seek out more exposure to government bonds, because of the greater certainty they can offer in terms of return (there are numerous examples – particularly when market volatility is high – of this inverse relationship weakening, or unravelling entirely). Because the current bond yield is dependent on the coupon payments and the current bond price, applying the calculation above, rising bond prices means yields falling. In an environment in which bond yields are falling, it can be harder to maintain income at the same level.

From an overall portfolio perspective, having an additional source of uncorrelated yield – meaning it does not behave the way bonds or equities do – could contribute even more to the stability of the income generated in an income portfolio. This is where our approach comes in.

Why our income strategy is different

Our income portfolio uses a mix of equities and bonds as described above. What makes our approach different is the addition of innovative ETFs, developed by J.P. Morgan Asset Management, which use what is called an 'options overlay'. The overlay applies only to the equities portion of the income strategy for now.

Options are a type of financial instrument, and are essentially contracts that help investors manage risk. In summary, our income portfolio uses an options overlay to allow the portfolio to generate higher income than that normally achievable by a typical portfolio of higher yielding stocks.

The options overlay means that if the equity market performs very strongly in the short term, the portfolio will participate in some but not all of the rise. In return for this however, the portfolio is paid an additional income stream. The strategy is intended to perform better in periods of flat or falling equity market return, and is also designed to capture some of the gains in a stronger equity market. We explain the specifics of our options strategy in our white paper for those who would like the detail.

Why use an option overlay?

Even if a portfolio is focused only on high-income stocks, it might not offer a significant enough increase in income compared to a normal balanced portfolio. The addition of the options overlay is designed to allow for a more significant income generation.

In the US for example, dividend yields are not typically very high. Further, choosing to focus only on the highest-dividend paying stocks might create imbalanced portfolios in terms of sectors or style. Using an options overlay allows us to preserve a high level of diversification and what we believe is the most attractive portfolio allocation, while still having a strong and steady level of income.

We believe a fundamentally strong portfolio coupled with this disciplined options overlay could enhance the income investors receive, while helping to manage risk. Our approach also means our investors' portfolios have the potential for capital gains alongside their income, in a way that is harder to achieve when only targeting higher-dividend stocks or bonds with high yields.

To discuss if Nutmeg's new 'Income Investing' investment style could be right for your portfolio, you can book a free call with our wealth experts. We can talk you through how it works, chat about your current investment strategy and answer any questions you have. Just choose a time that works for you.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg, and any income from it, can go down as well as up and you may get back less than you invest. Income isn’t guaranteed. £10,000 minimum investment required for a Nutmeg income investment portfolio.

Past performance and forecasts are not a reliable indicator of future performance. We do not provide investment advice in this article. Always do your own research.