As house prices have risen, the rules and thresholds around Lifetime ISAs (LISA) have become a pain point for some, with no additional help given to savers or investors in these products by the Chancellor in this year's Autumn Statement.

LISAs have proved popular for those who are working towards their first home or their retirement. It’s easy to see why: there is a bonus of 25% of the amount deposited per tax year, up to the annual £4000 deposit limit. So, for every £4,000 saved or invested, the Government gives you a £1,000 top up, and interest or investment returns are tax-free.

Yet, campaigners are calling for the LISA to be updated. Rules and thresholds, including the property price cap, haven't been updated for over five years, despite property prices soaring by almost 30% in that time.

And with LISAs not discussed in this year’s Autumn statement, the question remains: are they still a good deal?

What are the Lifetime ISA limits?

You can open a LISA if you’re aged 18-39, and you can use it for two purposes: working towards your first home or your retirement.

If you’re saving or investing for your retirement, you can contribute a maximum of £4,000 a year until you turn 50. You can access your LISA funds when you’re 60. If you access them before, you face a withdrawal charge of 25% (which is likely to be more than the 25% bonus accrued on the original amount, as this is now 25% of the original amount plus the bonus), unless you’re terminally ill.

If you’re using your LISA for your first property, you can contribute a maximum of £4,000 per tax year. The property you're buying must be within the price cap of the LISA.

Can you use a Lifetime ISA for a property worth more than £450,000?

Unfortunately not. Homes bought with LISA savings or investments can’t cost more than £450,000, a limit that was set when the LISA was launched in 2017.

If you buy a property that costs more than £450,000 and you still want to use your LISA funds for the deposit, you face a 25% withdrawal charge. This means that for every £1,000 you saved, you’ll only get £937.50 back, assuming in this case no changes in investment value or interest.

Why is the Lifetime ISA limit challenging for London homebuyers?

Since the LISA was launched in 2017, house prices have risen considerably.

This is starting to cause issues for first time buyers when they come to access their LISA savings or investments, particularly in London, where the average price of a property for first time buyers is now over £458,000, according to Land Registry and Nutmeg research*.

Buyers who want to purchase properties for more than £450,000 either face a hefty charge if they withdraw from their LISA, or the challenge of finding a cheaper property.

The annual contribution limit of £4,000 is also restrictive for would-be homeowners, especially those who want to save more for a deposit, due to higher average purchase costs.

In London, the average deposit for a first-time buyer is £45,858. Under the current limit, this would take over nine years to accumulate if just using a LISA, in which time the cost and affordability of buying a home could change significantly.

What is the average price of a property across the UK?

House prices have declined this year as mortgage costs have risen, and the average cost of a home is now £260,828.

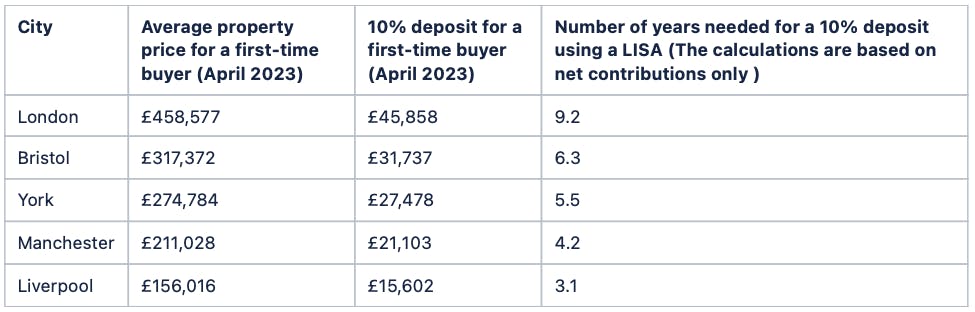

Across the UK, there’s a lot of regional variation. Nutmeg found that in the five most expensive cities, the average price for first time buyers of a property ranges from around £381,000 in Brighton and Hove to more than £458,000 in London (see table below). In the five cheapest areas, including Liverpool and County Durham, average prices for first time buyers ranged from £111,000 to £150,000.

The research revealed that some areas are getting cheaper, and others more expensive. Average prices for first-time buyers in Canterbury, for example, have risen 6.4% in the last 12 months, while prices in Bournemouth have fallen by 3.2% over the same period. Prices in some of the more expensive cities – such as London, Cambridge, and Oxford – have decreased in the last 12 months, while some locations that have traditionally been cheaper are seeing a substantial price increase, such as Northumberland, where prices rose by 4.7% in the last 12 months.

How long would it take me to save for a deposit using a Lifetime ISA?

Where you’re looking to buy makes a big difference. On average, first-time buyers need to save for nearly five years to raise the average 10% deposit needed to get onto the property ladder. But this timeframe almost doubles to nine years and two months if you’re looking to buy in London.

Research conducted by Opinium Research on behalf of Nutmeg.

If you’re putting money towards your first property, it’s also important to think about the other costs that accompany purchasing a home. You may need to save or invest for longer to afford them, particularly given the current environment.

"With the cost of living still high and mortgage rates at their highest level for years, there are a lot of financial considerations for first-time buyers looking to get onto the ladder,” says Claire Exley, head of wealth services at Nutmeg.

According to our research, in the last year alone, over 60% of would-be homeowners have delayed or avoided buying a property due to the cost of a deposit, rising house prices in their area, the cost of living and higher interest rates on mortgages. It’s a time when – despite the rules and thresholds that are in place – the 25% government bonus on LISA contributions can give first time buyers a boost.

Claire continued, “while the area you want to live in may be determined by factors such as where you work, it's worth making sure you're making the most of the help available. Those not making the most of the government bonus offered on Lifetime ISAs may find it takes even longer to achieve their dream of owning a home."

The Lifetime ISA allowance applies per person. Things do become significantly easier if you’re choosing to buy a property with a partner or friend (they do not have to be a first-time buyer so long as you are) as this means you’ll be able to save for your deposit faster. Also, the money from your LISA can be used to purchase property under a shared ownership scheme, provided the full value of the property falls within the £450,000 limit.

What if I can’t use my Lifetime ISA for a property?

A LISA can offer a tax-efficient way to start investing for later life. However, for many people, it is also worth investing in a pension alongside, or instead of, a LISA. Pensions have a more generous annual allowance — of up to £60,000 in the current tax year, or potentially more in circumstances when an allowance is carried over from a previous year — so can allow you to build a bigger pot.

Book a free call with one of our experts to discuss how to make the most of your allowances and see which products may be most suitable for your goals.

Are Lifetime ISAs still worth it for first-time buyers?

On balance, we think yes, if you are saving or investing towards your first home and looking to buy a property under the £450,000 limit.

“While it may seem that the dream of home ownership is only getting further away, there are initiatives and products available to help people wanting to get onto the property ladder,” says Claire. The LISA’s government bonus – and the fact that you can pair up with someone else who has one – are two useful features.

But if you want to buy your first home in London, or other expensive pockets of the UK, the Lifetime ISA may prove restrictive until the government decides to lift the price cap.

*Research conducted by Opinium Research on behalf of Nutmeg. Research carried out online between 27 June and 30 June 2023. Sample size of 2,000 UK adults and results have been weighted to be nationally representative.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

A stocks and shares Lifetime ISA may not be right for everyone. You must be 18–39 years old to open one. If you need to withdraw the money before you’re 60, and it’s not for the purchase of a first home up to £450,000, or a terminal illness, you’ll pay a 25% government penalty. So, you may get back less than you put in.

Compared to a pension, the Lifetime ISA is treated differently for tax purposes. You may be better off contributing to a pension.

If you choose to opt out of your workplace pension to pay into a Lifetime ISA, you may lose the benefits of the employer-matched contributions.

If you are unsure if a Lifetime ISA is the right choice for you, please seek financial advice.

A pension may not be right for everyone and tax rules may change in the future. If you are unsure if a pension is right for you, please seek financial advice.

The time taken to save the 10% deposit assumes that individuals can save the maximum £4,000 annually into their Lifetime ISA and includes the 25% government bonus. The calculation does not taken into account any potential investment returns or interest on cash LISAs.