If you're not quite ready to invest, but want to make use of this tax year's allowance before the 5th April deadline, our cash pot could help you drip-feed money into markets on a regular basis or when it suits you best.

Did you know that Nutmeg clients can have access to a cash pot? This gives you the chance to hold money in cash within a Stocks and shares ISA wrapper until you’re ready to invest it. When you’re ready, you can invest it all at once, or 'drip-feed' your money into the markets. Drip-feeding simply means investing regularly rather than all at once - you can set up a regular amount to invest on a monthly basis. Here, we explain why drip-feeding can be a sound investment strategy and show how to set it all up.

What is a cash pot?

A cash pot is not a cash ISA and isn’t intended to be used for long-term savings – think of it as a waiting room for your cash before it gets invested. If you have a Stocks and shares ISA, cash pots can be held alongside investment pots within the same ISA wrapper.

Any money added to a cash pot held within your stocks and shares ISA wrapper will count towards your ISA allowance for the current tax year even if it has not been invested in anything yet.

If you decide a cash pot’s right for you, you can create one and add money via your Nutmeg dashboard. Then, you can set up a regular monthly transfer into an investment pot to drip-feed your cash through to the markets. We'll outline how this is done shortly, but first let's outline the benefits of taking this approach.

Benefits of drip-feeding: compounding and pound cost averaging

We recommend you should always invest for the long term, of at least three to five years, and while past performance is not a reliable indicator of future performance, history suggests that the longer you invest the less chance you have of negative returns. Drip-feeding may help you build a long-term investing habit, while also helping you benefit from compound returns.

Our recent blog, The power of compound returns, explains this concept in more detail. In basic terms, you could potentially earn returns on not just your initial investment, but also on any accumulated returns you may achieve over time. It’s less about how much you can afford to invest straight away, and more about for how long the money has to grow.

Our drip-feed feature also takes advantage of what is known as pound cost averaging. This is all about contributing smaller amounts on a regular basis, which buys you into the markets during the various ups-and-downs, meaning you’re less exposed to short-term market movements. Investing into an ISA via Direct Debit also works in a similar way, though this method means you fill up your ISA allowance over the course of the tax year. With drip-feeding, you can use your cash pot to secure your full tax year allowance right away, and then put this money to work in markets when suits you best without taking up more of your annual allowance. However, note that if you do take money out of your investments and back into cash, this does not 'give back' some of your allowance, as it has already been used up.

How our drip-feeding feature works

Our drip-feed feature is available for our Stocks and shares ISA and you can use it outside of an ISA wrapper without the tax benefits with our General investment account. This feature is not presently available on our Lifetime ISA (LISA), Junior ISA (JISA), or pension.

It works by connecting two Nutmeg pots with a monthly transfer. So, you’ll need two pots – one will be a cash pot, and the other will be an investment pot.

Here’s how Nutmeg clients can get a drip-feed going, in simple steps taken via our website:

- Firstly, create a cash pot if you don't already have one. Simply log in to your dashboard and 'Create cash pot' underneath your existing pots, then follow the steps. Then, pay in to the pot to secure your ISA allowance. Once the money has arrived with us, you're ready to get going.

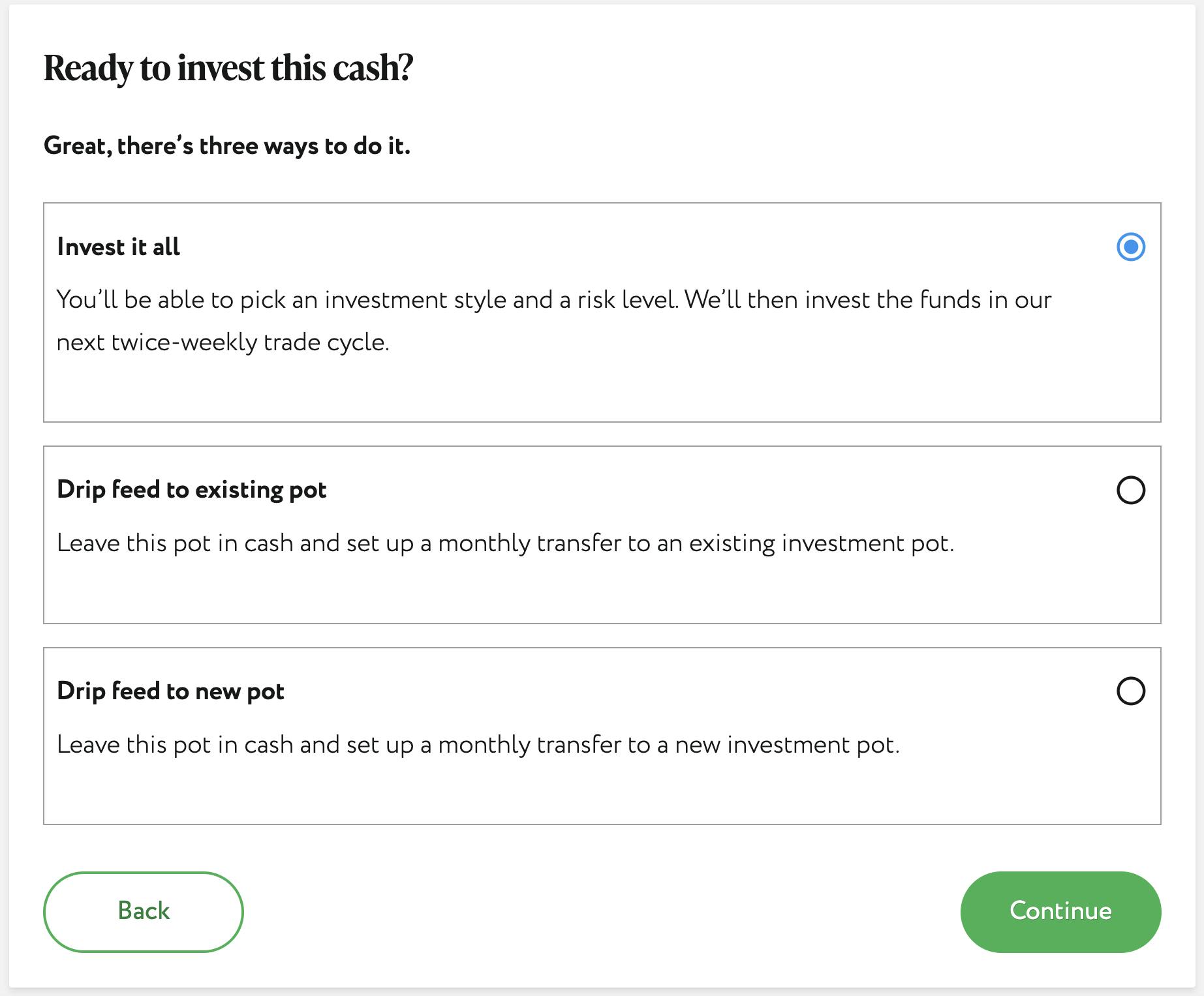

- Secondly, set up a pot-to-pot transfer. Select 'Transfer between pots' from the 3-dot menu next to your pot and choose the pot you want to transfer to, or select 'Invest your cash' in the banner underneath. Then, as you can see from the dashboard screenshot below, you can set up your drip-feed to invest monthly and let us do the rest.

If you're not yet a Nutmeg investor you can set up a cash pot when you sign up for Nutmeg.

Get started with this year's ISA allowance today

It may be that you don't feel ready to invest right now, perhaps because of personal circumstances, recent market volatility, or because you are unsure of which investment style would suit you best. The flexibility of a cash pot and drip-feed means you don't have to give up on investing altogether.

Make the most of your ISA allowance with a Nutmeg cash pot held within a Stocks and shares ISA wrapper and you’re perfectly poised to move money into the markets at your own pace, when the time’s right for you.

You can also book a free call to speak to a member of Nutmeg’s team of experts if you have any questions about different investment styles, tax wrappers, or making the most of your money. We're on hand if you need us.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may change. If you are unsure if an ISA is the right choice for you, please seek financial advice.

Cash pots are only intended to be used to hold money in between investments and are not for long-term use. If you do not use your cash only pot for its intended use, we may take action under the terms and conditions to stop providing you with services or freeze your portfolio.