We've rebalanced our managed investment portfolios

So far this year, our portfolios have been slightly underweight equities. Within this asset class, we were underweight US equities, which funded an overweight position in UK and emerging market equities.

We’ve recently neutralised our overall equity exposure, removing our overweight UK and emerging market positions, and moving to overweight the US instead. We’ve funded this by taking an underweight position in Japanese stocks.

Why the change?

Developed market economies have fared much better than widely expected so far in 2023. This is remarkable given the many headwinds that have been operating.

The ongoing uncertainty of Russia’s war on Ukraine, and the ensuing food and energy price shock that affected most countries, is one example.

Another is the rapid rise in interest rates, as central banks moved from ultra-easy to tight conditions in only 18 months. This potentially impacts the interest rate sensitive parts of the economy, such as credit card lending, home buying and business investment.

Finally, the pauses in the global manufacturing cycle that took place in late 2022 and the first half of 2023. The backlogs from the Covid shutdown initially resulted in bulging order books and a boost to manufacturing, but that bulge had ‘passed through’ the system by late 2022 and a period of manufacturing weakness followed as activity levels normalised.

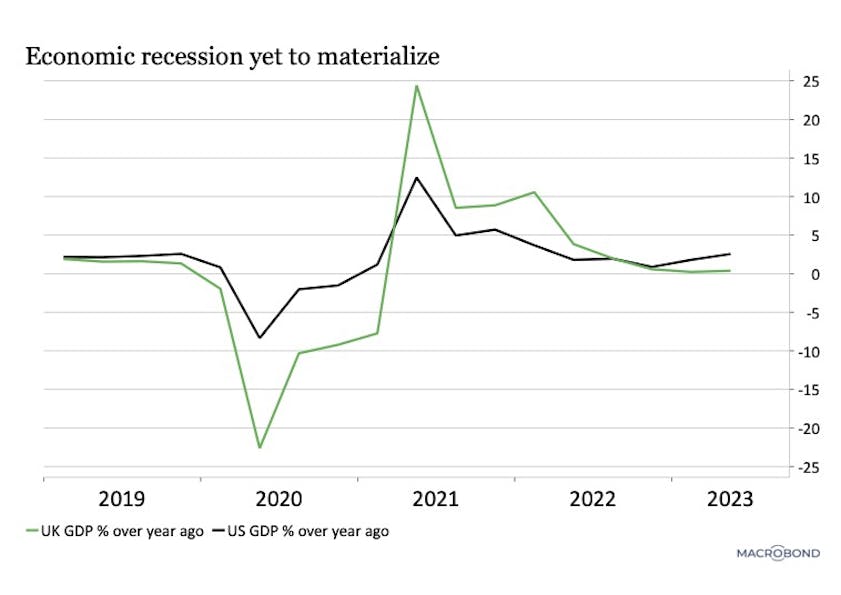

So, as Chart 1 shows, after the lockdown-based recession of 2020, an ‘economic recession’ has failed to materialise in either the UK or the US (a recession typically requires negative GDP growth over several months). This is despite a recession being the base case in the forecasts for the UK economy from both the Bank of England and the IMF earlier this year.

Chart 1: UK GDP vs US GDP (%, Jan 2019 to Jul 2023)

Source: Nutmeg, Macrobond

When facts change…

In the UK and the US, household consumption and business investment have rebounded in the first half of 2023. Why?

Wages growth is strong, as labour markets have remained tight due to shortages in skilled and unskilled labour. This supports household spending.

Commodity prices have descended from the lofty heights reached at the peak of the supply chain problems and the invasion of Ukraine in 2021/22. This has provided relief to households (as energy and food inflation have passed their peaks) and businesses as pressures on their cost base has eased, improving consumer and business confidence overall.

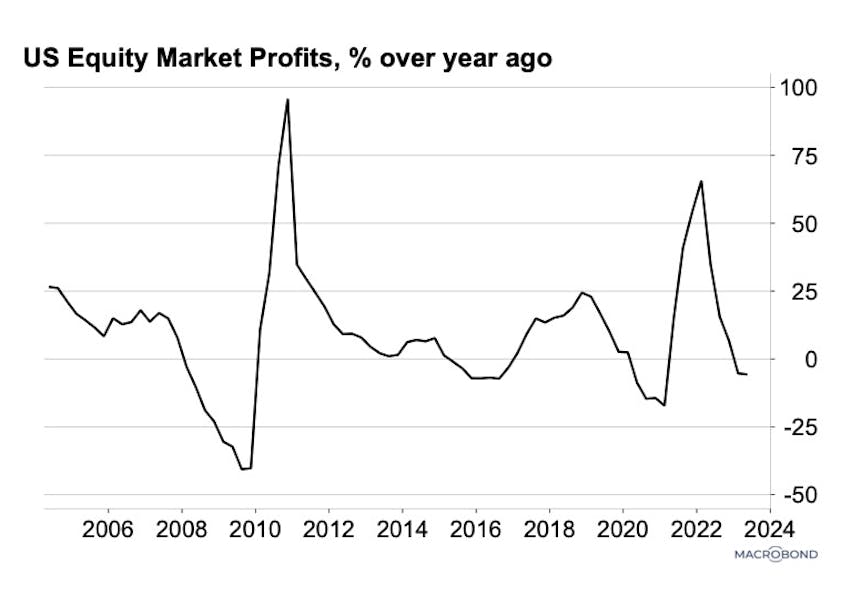

Profit growth has surprised on the high side, as Chart 2 demonstrates. It’s not that it has been strongly positive, it’s that it hasn’t been weaker.

Equity Index based profit growth was only mildly negative despite the significant cost challenges of the last 18 months. So, companies have been proactively managing their cost bases, despite their ballooning wage bills. Earnings this year have provided positive surprises, and this has boosted equity values.

Chart 2: US Equity Market Profits (%, Jan 2006 to Jul 2023)

Source: Nutmeg, Macrobond

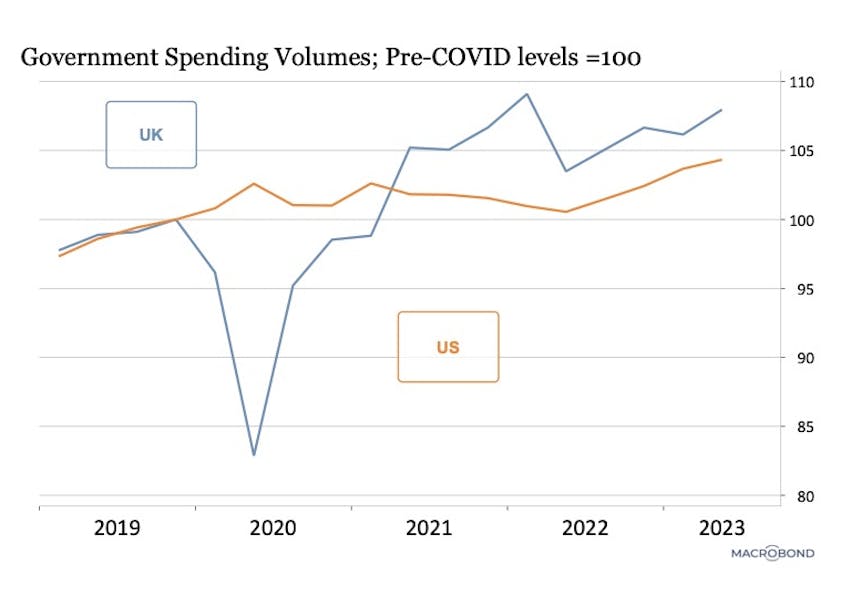

Government support has also played a part in underwriting economic growth. UK furlough payments during 2020/21 was one factor that helped create a pool of savings ready for households to draw upon when needed. This helped create the excess demand for goods and services (and a supply shortage) that drove inflation up in 2021/22. Chart 3 compares government fiscal spending between the US and UK. After initially falling very short, the UK government outspent the US in the following years.

Chart 3: UK vs US government spending volumes (Jan 2019 to Jul 2023)

Source: Nutmeg, Macrobond

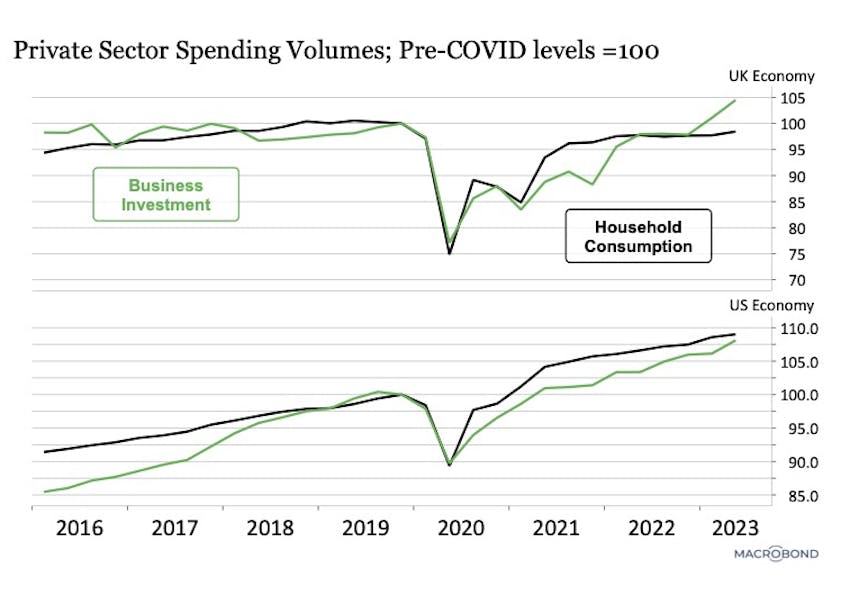

As mentioned, private spending has kept the UK and US economy from slipping into recession. In Chart 4, the lower panel shows that in the US, the gradual recovery in both household consumption and business investment since 2021 was not interrupted by the 2022 headwinds we mentioned earlier. So much so that they are both around 10% higher than their pre-Covid levels.

The top panel shows that in the UK, household consumption remains below the pre-Covid level, though business investment began to accelerate in 2023, and is currently 5% higher than before Covid. So, the UK household has remained quite cautious, but businesses are seeing reason to accelerate investment despite the higher interest costs. One factor here may be the health of business balance sheets, which were protected by the UK furlough payments during the shutdown.

Chart 4: UK vs US private sector spending volumes (Jan 2016 to Jul 2023)

Source: Nutmeg, Macrobond

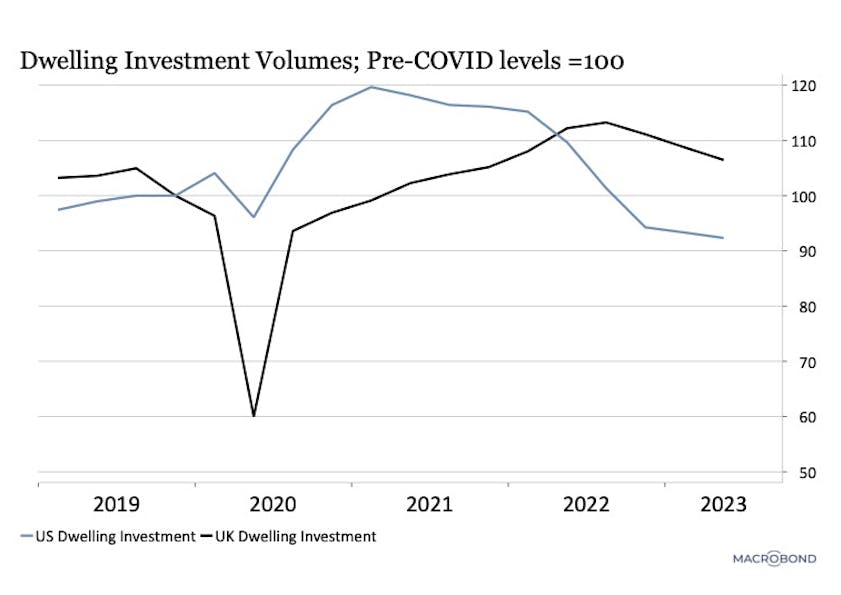

Another surprise this year is the relative resilience of the housing market. Though house prices have softened, activity levels have not collapsed under the weight of higher interest rates, as shown in Chart 5. Again, the comparison in the chart between the US and UK shows the impact of different policy approaches to the crisis. The UK government lowered the stamp duty on home purchases till late 2022. Dwelling investment volumes have since reduced, but remain above pre-COVID levels.

Chart 5: US dwelling investment vs UK dwelling investment (Jan 2019 to Jul 2023)

Source: Nutmeg, Macrobond

The labour market is key

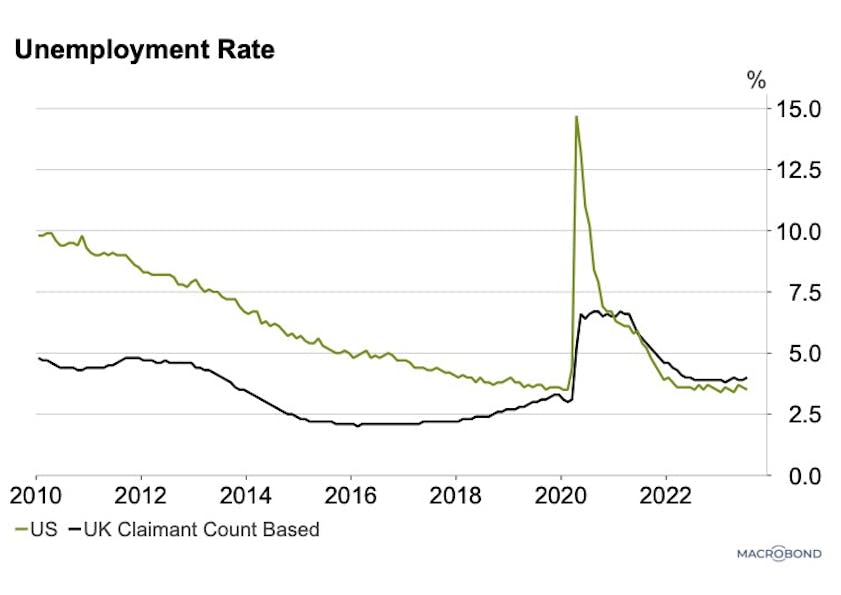

Underpinning the resilience of economies in 2023 has been the ongoing strength of the labour market (Chart 6). This is perhaps the single most impressive metric of all, with unemployment rates barely lifting above 2022 levels. Typically thought of as a ‘lagging indicator’ of economic activity (weak growth today will not show up in higher unemployment rate for a year or so), the rate today is flagging another issue – the shortage of skilled and unskilled labour.

We are in the midst of the ‘Great Retirement’, a period of several decades where baby boomers are leaving and will leave the workforce. As this happens, skill gaps are opening, and businesses are needing to pay higher wages for key staff. This income stability has been important in sustaining demand during 2023, though it presents a challenge to central banks, because wage rises feed through to inflation.

Chart 6: US vs UK unemployment rate (%, Jan 2010 to Jul 2023)

Source: Nutmeg, Macrobond

Developed vs emerging economies

The better news has come out of the developed markets in 2023. Although some emerging markets have shown economic recovery, the Chinese economy has greatly underperformed our expectations for a boost after reopening from COVID lockdowns. Given its size and importance in the emerging market index, we have reduced our small overweight in emerging markets to neutral.

Implications for investment portfolios

Conventional wisdom has it that equity market valuations are challenged in late-stage monetary policy tightening. There has been good reason to be cautious about equities – US equity markets entered the year above long-term valuations and have since seen three consecutive quarters of negative earnings per share growth – known as an earnings recession.

But the lesson of 2023 is that the current economic cycle is not conventional, in that it follows the aftermath of the Covid shutdown and a conflict disruption to energy markets, rather than any pre-existing economic imbalance. On top of that, various demographic and structural changes are underpinning growth in income and private sector spending.

The absence of recession in the US (the most important global economy) and growing likelihood of a soft landing (where policy makers orchestrate lower inflation without causing recession) should be supportive of equity markets – the US in particular.

This, coupled with the fact that monetary policy is now close to the endpoint of the tightening phase, shows the profit and policy threat to equities has diminished. Advances in the application of artificial intelligence in 2023 have also been a major boost to the US equity market.

As noted in the introduction, we have adjusted our fully managed portfolios to reflect these developments, shifting away from emerging markets and increasing our exposure to developed markets like the US. We continue to monitor economic, policy and market factors daily on your behalf, and you can hear our latest thoughts on markets and the global economy here.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Simulated past performance is not a reliable indicator of future performance.