As we watch the tragic events unfold in Ukraine, the thoughts of all of us at Nutmeg are with all of the Ukrainian people, and their families and friends who are impacted by the conflict. We know that, just as we have been thinking about the exposure of our portfolios to Russian assets, some of our clients may also be doing the same. With this in mind, we wanted to take a moment to provide an update on our portfolios and the steps we are taking.

Russian assets in Nutmeg portfolios have historically been limited due to the size of Russia’s economy and government debt issuance. For example, in the widely followed MSCI emerging markets equity index, Russian stocks accounted for just 3.25% of the index universe at the end of January (Source: Bloomberg, 31 January 2022).

However, prior to the events that began to unfold at the end of February, Russia was considered a regular part of global financial markets and in certain respects, was a significant contributor.

Russia has played a key role in global commodity supply for example, responsible for an estimated 30% of global wheat supply, 40% of palladium, 10% of Crude Oil and 17% of natural gas in 2021 (source IG Markets, as at 31 Dec 2021).

In this context, and by the virtue of Nutmeg portfolios being globally diversified, we held some Russian assets. In total, 10 exchange traded funds (ETFs) of the more than 70 we hold had some Russian securities exposure – four equity ETFs and six fixed income ETFs. Among the equity ETFs, allocation to Russia was shared between emerging market equity and a global ETF. In fixed income, Russian securities are predominantly held through emerging market debt funds. The full list is included below:

Source: Nutmeg, MSCI Barra, 21st February 2022

What do holdings in portfolios look like now?

In short, Russian assets in our portfolios are now negligible.

Like many, if not all, investment managers, when Russia launched an invasion into Ukraine and Western governments announced far-reaching financial sanctions, the Nutmeg investment team started to evaluate the implications for our portfolios and clients. Critically, because we use ETFs, we knew exactly what exposure we had and have full transparency over our investments.

In the last week, Nutmeg actively worked with ETF and index providers as they applied the requirements of sanctions to their products. Treatment of existing Russian assets is managed differently by indices and ETF providers, but all sanctioned entities are being removed from the investable list and no new issuance of debt or equities is deemed investable.

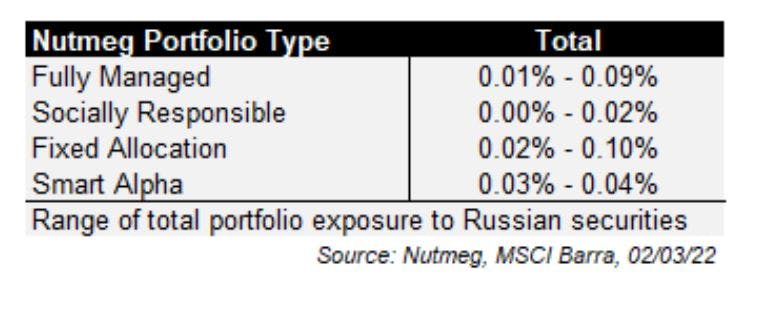

The following table highlights the range of exposure for Nutmeg portfolios as at 2nd March.

The equity market exposure in our portfolios is governed by the MSCI global market indices, where Russia has historically been included as one of 27 emerging market nations. Since 24th February, all Russian equity exposure has been frozen in MSCI Indices, and MSCI has now confirmed that all Russian stocks (sanctioned and unsanctioned) will be removed from these indices with effect from 9th March. This means the equity ETFs we hold in portfolios will no longer hold Russian equities, and it no longer forms part of what global investors would consider the investable universe of assets.

Separately, unsanctioned Russian financial assets remain part of global bond market exposures. However, here too there are currently consultations underway from index providers that would look to remove Russian securities from the typically defined investment universe. Nutmeg will continue to actively participate in these consultations and we expect to communicate the outcome within the next week.

Instigating change

A little over a week ago, Russia was a regular and active part of the global investment universe. Sanctions were applied and, like all investment managers, Nutmeg was swift to ensure full compliance. But the circumstances in which we are operating are unprecedented and there are significant challenges for investment managers, global indices and ETF providers to remove exposure immediately.

First, sanctions are being applied by different governments across the globe and at different paces, complicating the picture for investors who must respond to each instruction and ensure their compliance. Second, the Russian stock exchange has been closed since the weekend of 26th February with access restricted to foreign investors. And with Russian securities moving from everyday exposure to being widely rejected by the global community so quickly, finding buyers for securities, or firms that want to facilitate transactions, is not easy given the need of most global investors to remove them.

We are actively involved in discussions and consultations and acting swiftly to implement changes.

Has Nutmeg’s investment strategy changed?

The situation in Ukraine is fast evolving, as is sanction activity for financial assets. It is likely that we may see further sanctions implemented in the coming days and weeks, and we expect index and ETF providers to continue to adjust allocations in-line with these. Our investment team will review exposure on a daily basis to ensure our portfolios are adjusted accordingly.

Meanwhile, we expect financial markets to remain volatile in the near term. Russia and Ukraine are small parts of the global stock and bond market complex, but they have key trade links that will experience lasting effects from this geopolitical crisis. In particular, we think the effects are likely to be felt most keenly in global commodity markets and European economies in the near term.

European economies rely heavily on Russia for their energy needs, and rising costs across the energy complex are likely to add further pressure, not just to household consumption but also to Europe’s industrial and goods export base.

From a portfolio perspective, we have adjusted our fully managed portfolios to lower our weightings to European equities, which we see as more vulnerable given their trade and energy links. We have allocated funds to UK equities, which, with their relatively higher exposure to energy and mining companies, we see as more defensive in this environment.

We continue to take a medium-term perspective on the global economy. Rising commodity prices increase global inflationary pressures and introduce a new headwind to growth near-term. But the underlying global economic fundamentals remained robust going into this crisis, and we expect US and UK central banks to continue on their path to normalising interest rates in 2022 (though possibly not at the same pace as expected just a few weeks ago).

Recent activity indicators in western manufacturing and services sectors have remained resilient, global trade volumes elevated, and US and European labour markets continue to show signs of strength. Combined with strong corporate earnings, we continue to hold the view that equities are attractive in this environment.

As always, our investment team will continue to assess the implications for the medium-term economic outlook and stand ready to adjust portfolios where required.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.