Oil prices have been on the rise again in recent weeks, edging closer to the symbolic $100 per barrel mark. But what does this mean for long-term investors?

To put a recent spike into context, a popular benchmark, US West Texas Intermediate futures, touched $95.03 per barrel on 28 September, the highest point since August 2022.

Oil is a literal and metaphorical lubricator of the global economy, with markets remaining incredibly sensitive to supply and demand shocks. As such, pronouncements from The Organization of the Petroleum Exporting Countries (OPEC) and oil-rich governments can have a sizeable impact on market confidence.

In September, the International Energy Agency (IEA), which provides policy recommendations on the global energy sector, warned of a substantial oil deficit through the last three months of 2023 given an extension of output cuts from two of the world’s biggest suppliers, Saudi Arabia and Russia.

Without getting bogged down in the whys and wherefores and political ramifications of supply dynamics, markets now anticipate the US Government will be a forced buyer of oil in the months ahead. This is given the country’s need to replenish its Strategic Petroleum Reserve (SPR). Reserves had been drawn down aggressively by President Biden during 2022 in a bid to reduce gasoline prices in the lead up to the US mid-term elections last November.

While oil prices then settled somewhat, prices spiked again in October given the latest news of conflict in the Middle East.

Will oil prices stay higher for longer?

While these supply constraints have helped push up prices recently, demand had generally been weaker in the first half of 2023, in part due to slower economic growth in Europe and a drop in Chinese activity in the middle of the year.

If we were to see a rebound in economic activity in these regions, or indeed on a wider scale globally, this could provide further support for an elevated oil price. This is in addition to the aforementioned rise in demand from the US, despite the country becoming a net exporter of petroleum in 2020 for the first time since 1949.

How do high oil prices impact global inflation?

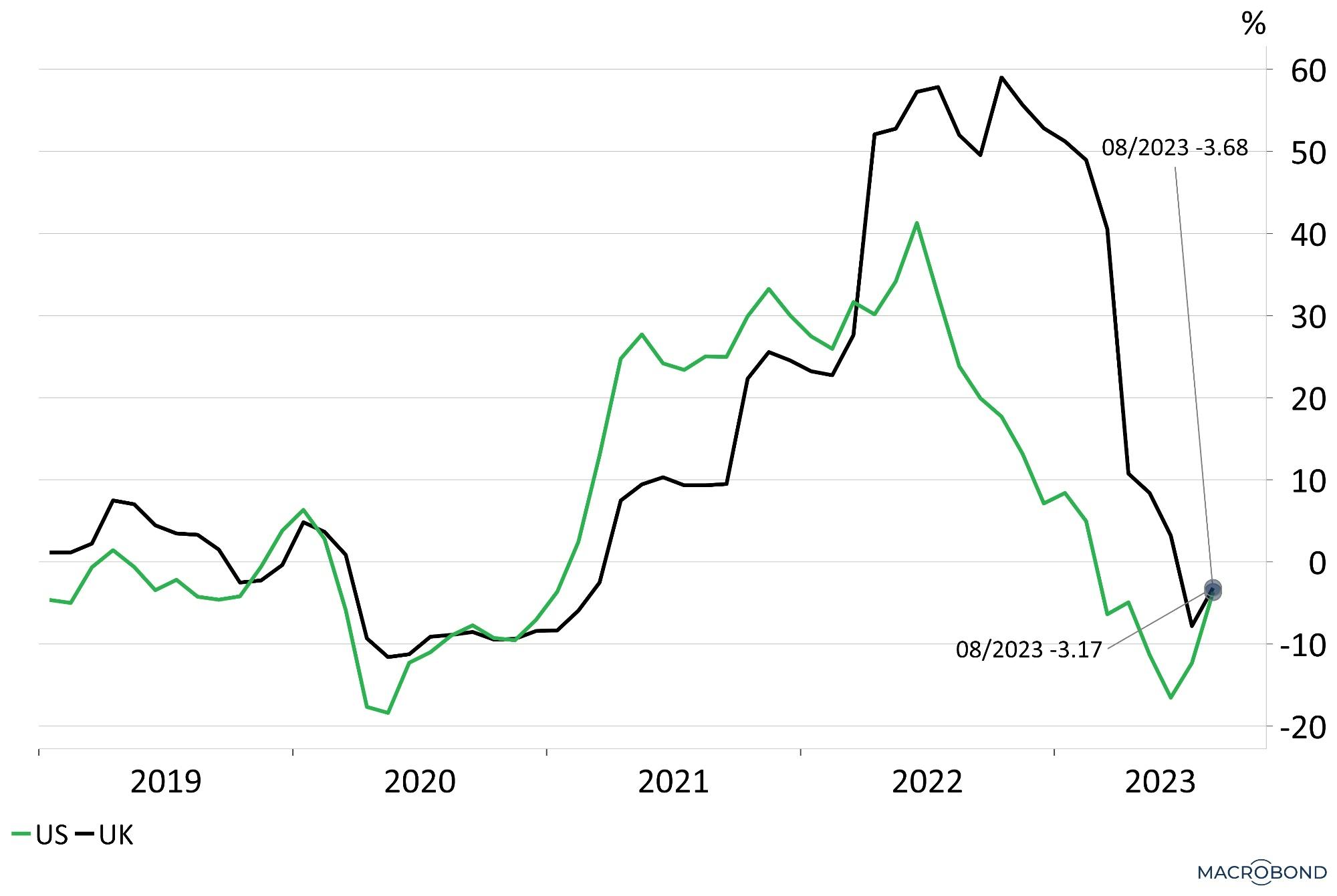

Despite the recent oil price spike, energy prices are currently disinflationary year-on-year in the US, meaning price rises are slowing. The rate was at around -3.7% in the year to August 2023 (see Chart 1 below). However, we believe that this is likely to reverse modestly into 2024 should oil remain above $90 per barrel.

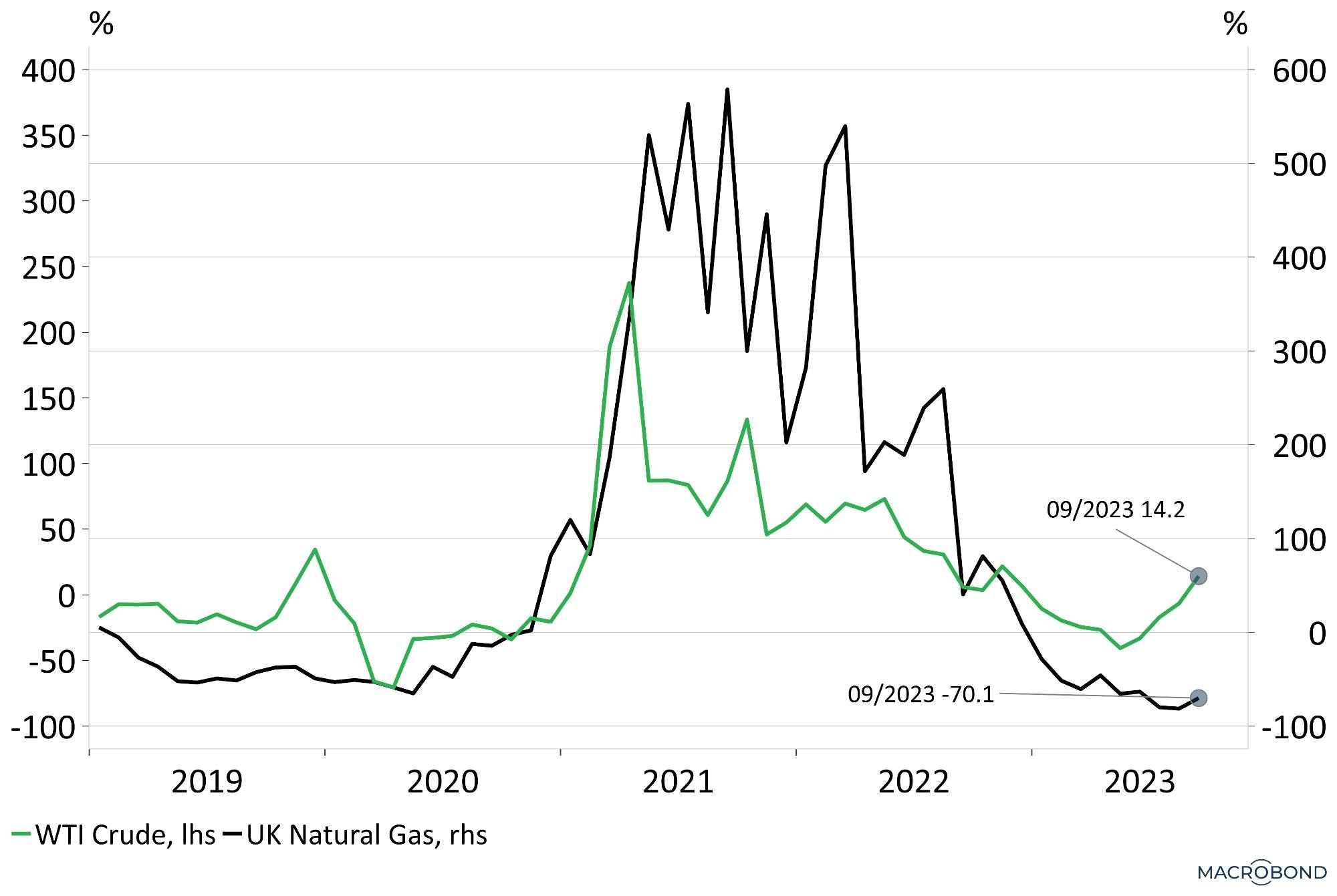

The UK’s energy inflation contribution is also disinflationary (-3.17% year-on-year in August, see Chart 1). However, unlike the US these figures are more impacted by natural gas compared to crude oil, though movements in the two commodities are usually highly correlated but have diverged recently (Chart 2).

Chart 1: Energy consumer prices index, year-on-year %

Source: Nutmeg, Marcobond

Natural gas prices for the UK are currently running at -70% below levels a year ago (see Chart 2 below, left axis is Crude oil, right is natural gas), and we believe the disinflationary contribution is also likely to dissipate over the next six to 12 months. The principal driver of UK inflation now is coming from service inflation, namely wages, as my colleague Brad Holland discussed in a recent video.

Chart 2: Energy commodities (oil and gas), year-on-year %

Source: Nutmeg, Marcobond

What does the oil price rise mean for socially responsible investors?

Socially responsible or environmental, social, and corporate governance (ESG) focused investment funds or portfolios – such as the ones we offer at Nutmeg – often have limited to no energy commodity exposure. This is because of the importance of a lower carbon impact prioritised by many investors in these portfolios. However, all investments should be looked at on a case-by-case basis, with research showing some asset managers do invest significantly into bonds or major coal, oil and gas companies.

Even if your socially responsible portfolio does not have direct exposure to oil, it can still be impacted by price movements, depending on what’s driving the prices up. If demand is increasing as a result of a strong global economy, then socially responsible portfolios may also trend upwards as that increased demand can also be reflected in prices of other areas, such as renewable energy sources.

However, if as is the case recently, the market is reacting to issues around supply shortages, then this could be a headwind for socially responsible investors. Compared to those portfolios and funds that do have exposure to fossil fuels, socially responsible investments are unlikely to benefit significantly from a rise in oil prices specifically.

What do high oil prices mean for Nutmeg portfolios?

Given the nature of how we invest, in both equities and bonds through exchange-traded funds (ETFs), Nutmeg portfolios across all of our styles do not have direct exposure to oil, or any other commodities.

However, we do have indirect exposure, especially though our equities held within the ETFs we invest in. For example, an ETF investing across the FTSE 100 will have some exposure towards energy majors, such as BP and Shell.

Inflation in energy prices also feeds through to headline Consumer Prices Index (CPI) data, which in turn can impact the price of bonds via expectation on what central banks, such as the Bank of England, will do with interest rates. While the current consensus is that global inflation has plateaued, if oil prices were to continue to rise significantly it’s easy to see how this could eventually translate to higher prices at the petrol pump, and in home energy bills.

Our investment team is keeping a watchful eye on energy markets and the impact movements have on portfolios. We remain ready to act should the data warrant a pivot back to including an explicit energy position within portfolios, which would come via a dedicated energy sector ETF.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.