Our investment team give their views ahead of the new year

At a glance

- Nutmeg's investment team are optimistic overall as we move into 2025, but are aware of reasons to be slightly more cautious.

- The US economy looks especially robust, and we expect "US exceptionalism" to persist in 2025.

- We believe China faces a range of headwinds, which could pose challenges for emerging markets overall.

- Data suggests the UK is in better economic shape to face the year ahead than Europe.

- We expect that the central banks of the UK and the US will continue to cut policy rates in 2025, but that the process will be gradual.

- Ongoing conflicts around the world, and a number of major planned political events, could increase the potential for market volatility in 2025, and might distract investors – unhelpfully – from longer-term investment goals.

We’re optimistic for 2025, but aware there are some challenges

There is no doubt that the overall environment for investors has been largely positive over the last two years.

Multi-asset portfolios, like Nutmeg's, have benefited from above-historical-average performance. What’s more they have experienced below-average intra-year drawdowns, supported more by equities than fixed income. To put it simply, on average a typical multi-asset portfolio that mixes bonds and equities could expect to experience periods each year in which the value falls – called a "drawdown" – even if it subsequently recovers. Investors might expect to see a peak to a trough (highest to lowest point) drawdown of about 10% for any given year. In 2024, it was only around 5%.

These have been happy days, but as we jump into 2025, will this environment last?

Let’s start with the reasons to be cheerful…

First, it is worth noting that the general economic environment remains supportive across the world. This is particularly true for the US, which has certainly been the main driver of economic growth and equity performance in 2024.

Because of this, the most prominent risk for equities in general is of a recession in the US, which seems quite remote for now. Looking at the strength of the job market on both sides of the Atlantic as a representative indicator, only one word can describe it: strong. While it is less vibrant than in the aftermath of the COVID pandemic, US workers benefit from a robust job market. The unemployment rate at 4.2% is significantly below the 20-year average of 5.8%.

Inflation, which was a cause for concern worldwide, has significantly reduced. Average core inflation for the US, UK, Japan, and European Monetary Union (EMU) is now at 2.7% year-over-year, down from a peak of almost 6% in 2023. While it is above the pre-COVID period and above the 2% long-term target of most central banks, it is much less of a cause for concern. We have also seen rate cuts across developed economies and while rates might still stay higher than was expected a couple of months ago, the trend has reversed from the large rate increases of 2022.

US equity earnings continue to be better than expected. One of the key pillars of the US and, by extension, the world economy has been the resilience and strength of consumer spending. This is of extreme importance, and while some of the money distributed and saved during COVID has been spent, most countries on both sides of the Atlantic see consumers benefiting from real wage growth (increases in salaries beyond inflation), which helps to save and consume.

Therefore, many of the building blocks that were present during the 2023/2024 period still appear to be well in place to continue in 2025, which we expect to support risky assets, like equities, in general.

Challenges can’t be totally ignored

While there is a good degree of confidence in a “no-recession” scenario – bolstered by the resilience of consumers and solid profit growth – we recognise there are some reasons to be more cautious.

First, valuations can’t be totally ignored. Valuations are still on par with historical averages, and in many regions are relatively cheap (see exhibits ‘a’, the UK, or ‘b’ China), but US equity valuations are quite materially above the long-term average. As we explain later in the article, if something were to change in the environment that has been so supportive for returns, it could hinder momentum. One very important point when looking at equity valuations is that it is often a very poor indicator of market performance in the short- or mid-term. Even so, it should still be considered in the global allocation process.

Similarly, the geopolitical landscape remains uncertain globally. While there is always some geopolitical risk, usually adding more “noise” than real insight for long-term investors, it wouldn’t be totally surprising if the Trump administration elevated instability. From questions over the relationship with the Federal Reserve (Fed) to potentially destabilising tariffs and the risk of seeing another large amount of rotation among key cabinet members, it might increase the level of volatility compared to what investors have recently seen. Similarly, the policies from the Trump administration could reignite short-term inflation, bringing a temporary halt to the Fed rate reduction cycle.

Other technical factors could have an impact, like the recent rally in the US dollar, which could further destabilise some emerging countries with liabilities in US dollars. There is also the possibility that US equities fall victim to their own success. As confidence in US equity outperformance increases, especially among investors who missed the solid performance to date, even a minimal degree of disappointment in the economy or in profits could create some volatility.

Staying prepared for any opportunities that arise

Overall, many elements of the picture that made us optimistic in 2024 – reflected in the portfolios – are still in place. Nevertheless, we are alert to some heightened risk of volatility, and are reflecting this among our portfolios, with a higher level of cash than usual.

While we think that in aggregate, the environment is attractive, we aim to have some “dry powder” in the form of cash to take advantage of opportunities if the market becomes more volatile.

To use another analogy, while one could go outside the house in summer clothes in 2024, we think it is probably worth taking an umbrella this time.

Below, the Nutmeg investment team dig into the themes we think are going to be most important for 2025 in more detail.

1. US Exceptionalism – bet against it at your peril

At the time of writing, it looks like the US’ S&P 500 will finish 2024 having gained in the region of 30%. Much has been said of the dominance of the so-called "Magnificent 7" in driving this (that's the "mega-cap" companies like Tesla, Amazon and Nvidia). At times, we ourselves have bemoaned it, but each sector has had its part to play in delivering positive returns. The lowest return, from the healthcare sector, was still in excess of 9% (as of 3 December 2024).

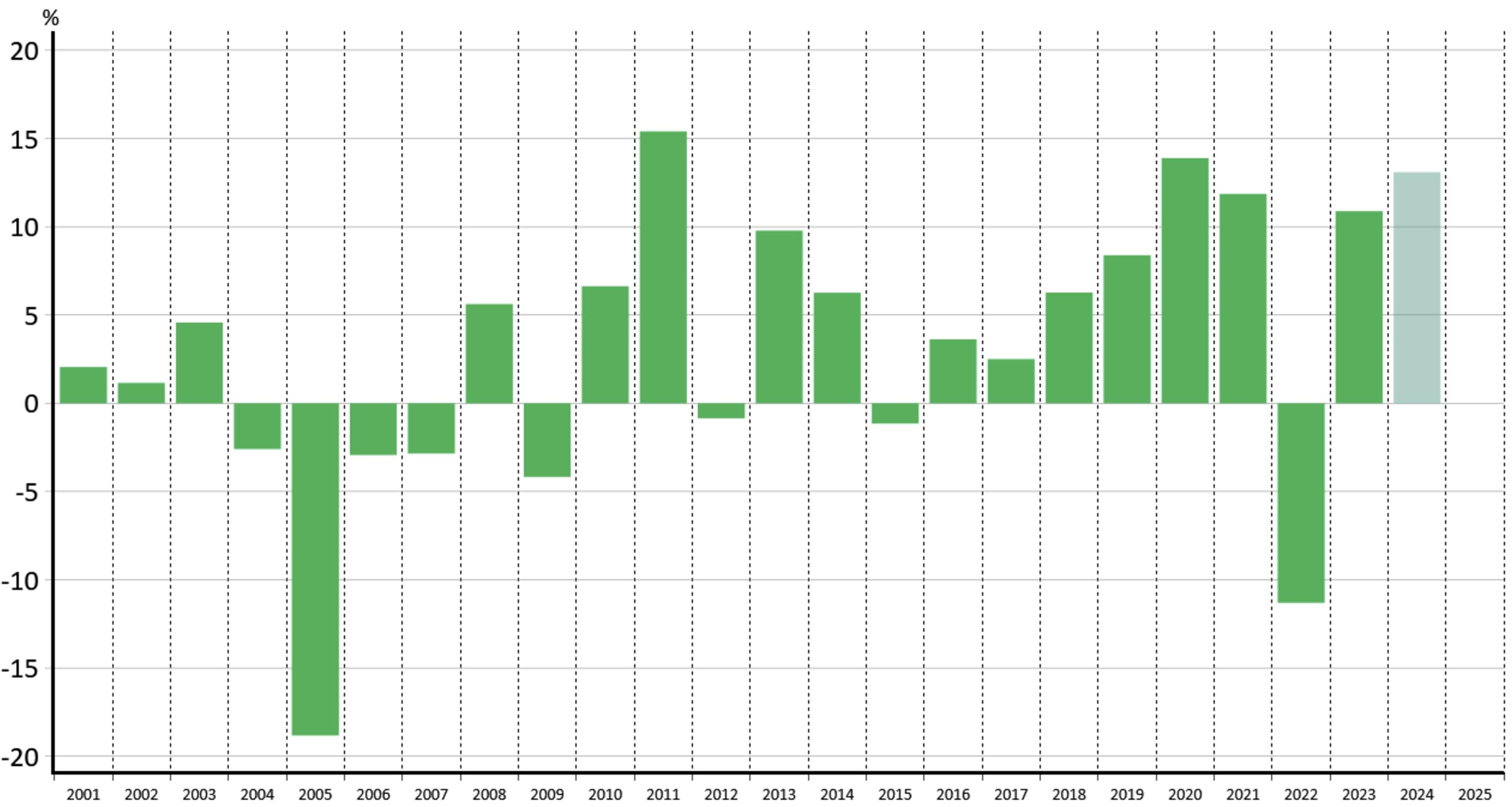

Looking around the world, it is hard to find a region with stronger positive momentum than the US. What has grown to be called “US exceptionalism” has been exhibited in every one of the 15 years since the Global Financial Crisis or "GFC" which unfolded 2007-2009, save three: 2011, 2015 and 2022. The chart below shows how much more or less the US market has returned each year, versus equities in the rest of the world, with very few years of underperformance in the 15 years since the crisis.

Chart 1: US excess performance versus World ex-US

Source: Macrobond, Nutmeg, 6 December 2024

What’s more, we believe there are reasons the exceptionalism will continue, and the Nutmeg investment team go into 2025 continuing to embrace it, remaining overweight US equities.

The US economy appears to have escaped a rate hiking cycle more or less unscathed. A rate cutting cycle has begun that is likely to continue, even if it is at a slower pace, in 2025. This will likely be especially welcome for domestically-exposed smaller US companies, because they tend to have more "floating-rate" debt on their balance sheets. This means the interest they pay on borrowing is tied to policy rates; and if the Fed rate is falling, floating-rate debt costs do too. We also expect support from the US consumer. Even as consumers spend the savings built up during the pandemic, they are experiencing real wage growth, which should be supportive of consumer spending growth in 2025. Finally, pre-tax corporate profit margins have climbed higher in recent years and continue to display signs of strength in 2024.

There are reasons for caution. Equity valuations are stretched. The S&P 500 last traded at similar levels in 2021, after which markets subsequently dropped. At least some of the returns we’ve experienced this year can also be attributed to the promise of artificial intelligence, and expectations of associated productivity growth. Few people now question the long-run direction and potential of AI, but investors are starting to question the “when” of this delivery. The longer the question remains outstanding, the higher the threat to the continued momentum in US equities.

2. Tempted to allocate more to emerging markets? Tread carefully...

Emerging markets have travelled a tough path in the last year. In fact, emerging market equities have under-performed developed markets counterparts for much of the post-GFC period.

2025 presents further challenges.

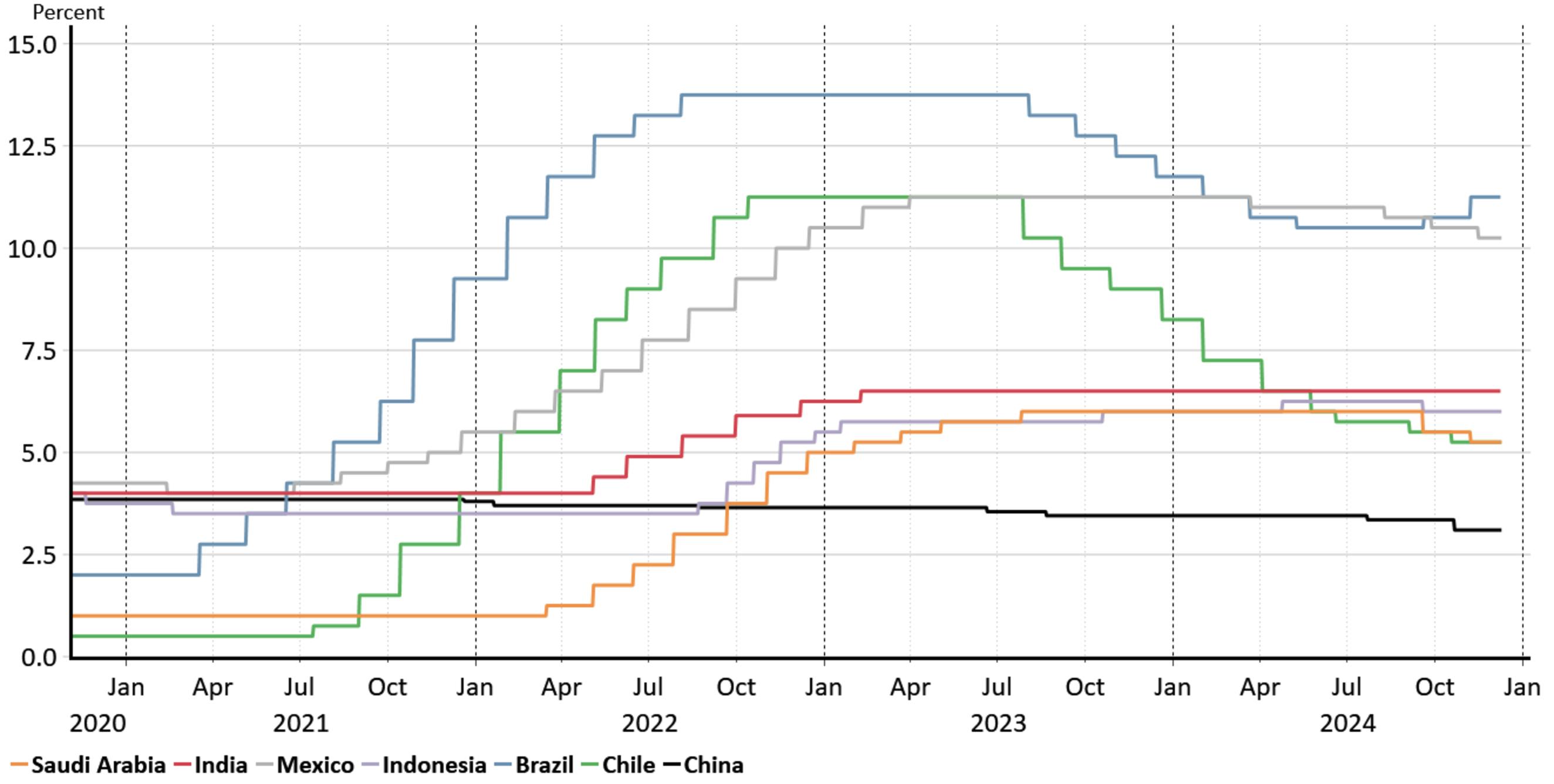

The prospect of tariffs from the US and retaliatory counter-tariffs by China is likely to unsettle emerging markets overall, as they get caught in the cross-fire of potentially lower trade volumes and weaker sentiment. Emerging market central banks, many of which had been in the process of cutting rates to help with economic growth, may be hindered by slowing US rate cuts. This is because slower rate cuts in the US may result in US dollar strength, which is typically problematic for emerging market economies.

Chart 2: Emerging market central bank policy rates

Source: Macrobond, Nutmeg, 10 December 2024

However, it would be a mistake to tar all emerging markets with one clumsy brush. Many dynamics are at play in each country.

The outlook for China is a lot more uncertain. It is in the process of building more resilience into its drivers of economic growth, by shifting from being an export-led economy to one driven more by its consumers. But as it tackles this transition, very challenging in its own right, the Chinese economy is also embattled by deflation and ailing real estate markets.

Now on the one hand, the Chinese government has already demonstrated that it will implement substantial, supportive policy changes quickly. On the other hand, policy shifts carried out so far this year are not, in our estimation, sufficient. We continue to monitor the situation, looking for signs policy shifts are translating into better market dynamics, and with them, investment opportunities.

Investors should consider other markets on their own merits. Taiwanese equities, lifted by its leaders in chip-making, can be expected to benefit from the continuing boom in demand for chips. India’s expanding middle-class has resulted in a rapid increase in domestic investment in financial markets. Consequently, we may see equity valuations in India remain relatively elevated in 2025 and possibly beyond. Brazil, with its economy much reliant on commodities trade, may yet see another difficult year in the face of trade headwinds. The Nutmeg portfolios reflect our cautious approach, with an underweight position in emerging markets, particularly China, which we continue to monitor actively.

3. UK and Europe on diverging paths in 2025?

In Europe and the UK, the Covid-19 pandemic response caused stubborn inflationary effects, that were later exacerbated by Russia's invasion of Ukraine. During 2024, inflation cooled on both sides of the English Channel, but economic growth remained sluggish due to aggressive policy tightening by central banks in 2023. With inflation now sufficiently under control, the European Central Bank (ECB) and the Bank of England (BoE) are beginning to ease interest rates.

Looking ahead to 2025, the UK appears to be in a relatively better position than Europe, thanks to consumption and trade.

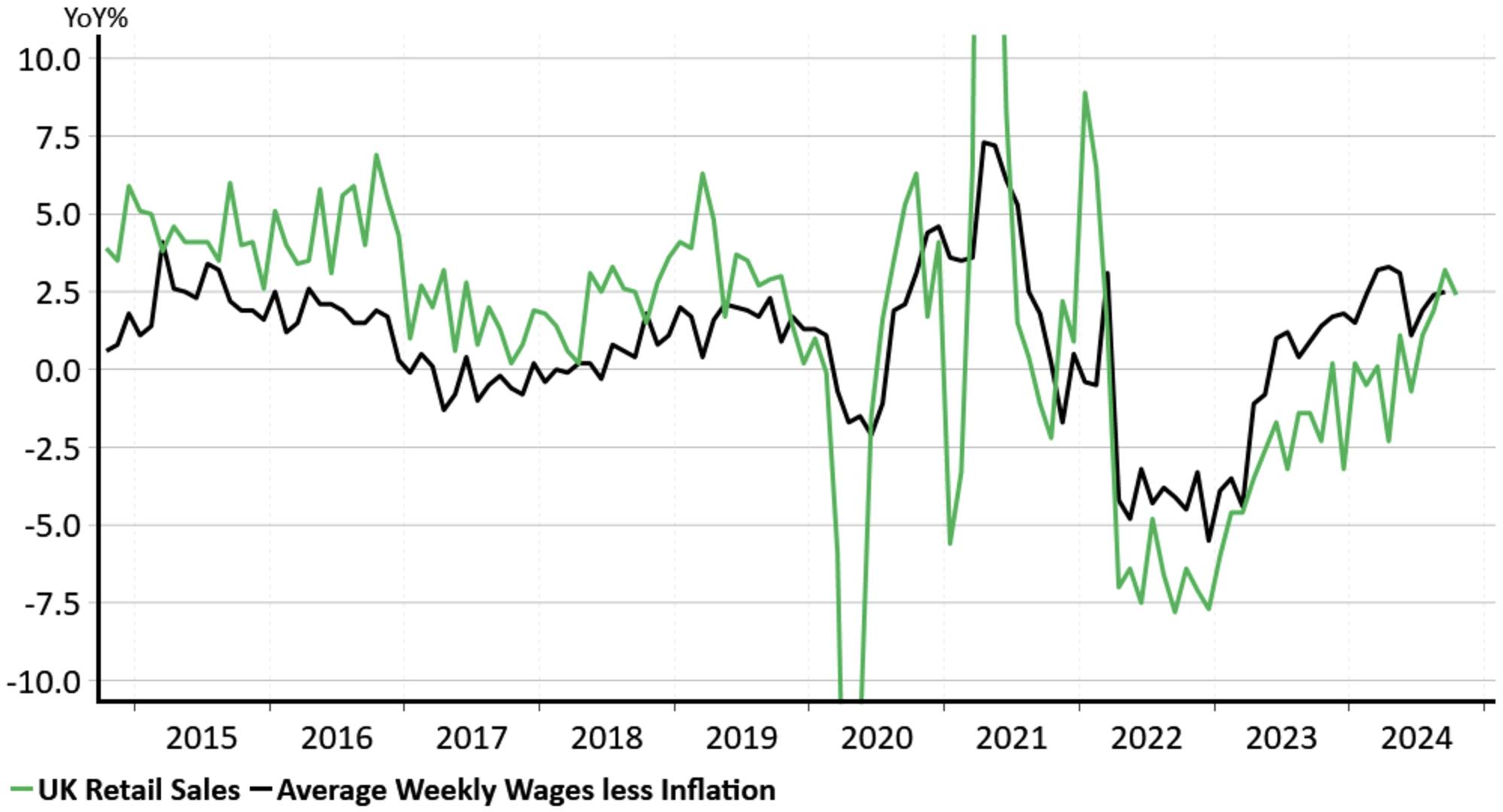

In the UK, household incomes relative to inflation continue to grow, which we expect to support increased consumption growth throughout the year.

Chart 3: UK spending and income

Source: Macrobond, Nutmeg, 9 December 2024

The UK housing market is expected to recover due to lower interest rates, which should boost spending in areas like retail sales and durable goods. The UK also benefits from its strong position as a leading global exporter of services, while Europe is known for its high-end goods. This key difference means the anticipated “universal tariff” on goods entering the US poses a significant challenge to Europe's fragile economic recovery, particularly for Germany.

Germany faces additional hurdles as it recovers from supply and demand disruptions. In the past, cheap Russian gas and Chinese consumption have been important for the German economy, and both dynamics have faded. The country's path to recovery will also be influenced by the results of a snap general election in late February 2025, following the collapse of the governing coalition in late 2024.

We express this view in our portfolios by tilting our UK exposure towards the FTSE 250, which as an index is more sensitive to the domestic UK economy, while our European exposure is tilted away from eurozone smaller companies (small caps).

4. How interest rate policy could develop

Between late 2022 and early 2024, central banks responded to spiking inflation by raising policy rates dramatically. As prices have steadied during 2024, central banks have justifiably begun to lower rates.

What could stoke a possible rise in inflation?

Low unemployment

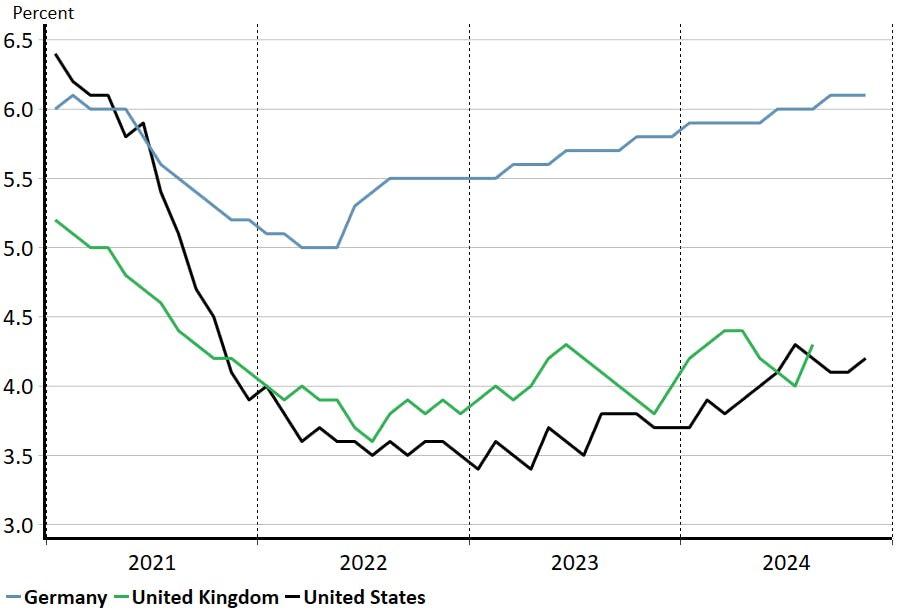

With COVID-related inflationary pressures now almost fully passed, a different threat to inflation is arising – tight labour markets. In the US, UK and Germany unemployment rates remain between 1% and 1.5% below long-term averages, indicating tight labour markets. Low unemployment rates are usually associated with high inflation, so in 2025, central banks may need to dust off their pre-GFC policy playbooks.

Conventional central banking rules would caution against excessive rate cuts when unemployment is low. By this metric, the ECB has more scope to cut rates in 2025 than the BoE or the Fed. See chart.

Chart 4: Germany's unemployment rate remains elevated relative to the US and UK

Source: Macrobond, Nutmeg. Data shown is seasonally adjusted and most recent available: UK (September), US and Germany (November) 2024.

Rising wages

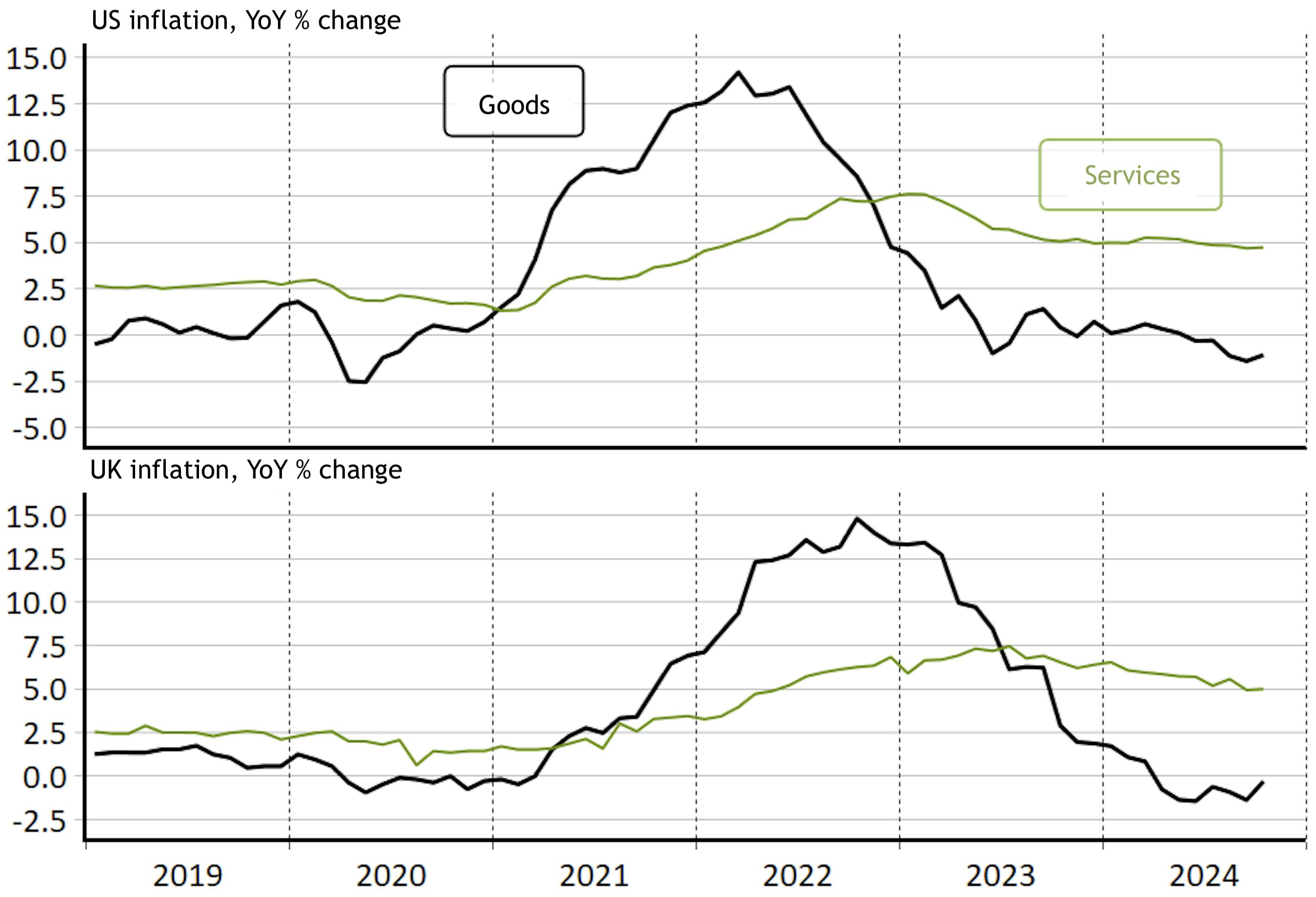

While goods-price pressures spiked sharply during COVID and have subsequently eased, services prices and associated wages have been on a more gradual path upwards. The chart below shows the goods-price shock we saw as a result of very extreme supply disruptions in both the UK and the US vs. services prices, which are up around 5% over the last year and sit at around the same rate as services wage growth.

Chart 5: The goods price shock has passed; services remain a concern

Source: Macrobond, Nutmeg. Data as at October 2024.

The danger of high wage growth is if productivity does not offset it. Five percent wage growth must be offset by a rise in output if the Bank of England's inflation target of 2% is to be met. To be more precise, if wages growth is 5%, output-per-unit-of-input (also known as productivity) needs to grow by 3% if the 2% inflation target is to be safeguarded. That rate of productivity growth is around twice the long-term average in the two countries. So, not a likely sustained outcome.

What this might mean for central banks

Price shocks come and go. The trouble is that central banks never know if there is a new shock just around the corner.

We think the UK and US will try to reduce base rates to as close to their “neutral” levels as possible. The “neutral rate” is the level at which an economy can maintain price stability, i.e. inflation sits at its target, which in the UK is 2%.

However, the BoE and Fed face two pressing problems. First, they do not know with any certainty what this "neutral" rate is. Secondly, as rates approach “neutral” – and if unemployment stays low – they risk rekindling inflation. We think they will proceed with care.

Keeping it in perspective

There are some economic commentators who think inflation is in general decline, allowing central banks to continue deeply cutting their official interest rates. That's a big vote for continued strong productivity growth and/or a major deceleration in wage growth.

We're more cautious. We don't share quite such an optimistic view about productivity. We think wage growth will continue to moderate as economic demand growth will be positive, but not so strong as to ignite a fresh wage and price spike. We see wage growth being underpinned by demographic changes and skilled labour shortages.

Still, we believe moderate demand and productivity growth will allow central banks to continue, in 2025, the cautious series of rate cuts they began in 2024. But the extent of easing will depend on this balance of demand strength and resultant inflationary pressures.

Our cautiously optimistic view that central banks will continue their rate cut cycle means we have a modest overweight in bond exposure across our portfolios. Bond prices typically have an inverse relationship with policy rates and therefore as policy rates fall, bond prices should be pushed up. Even if we might be slightly early, we want to anticipate future moves in 2025.

5. Navigating a new political era without losing sight of long-term goals

The year 2025 promises to be eventful on the geopolitical stage. The ongoing war in Europe and instability in the Middle East are unlikely to recede easily. The conflict in Ukraine is approaching the beginning of its fourth year, with little hope for an easy resolution. Similarly, in the Middle East, the ongoing conflict between Israel and its neighbours, along with tensions with Iran, is expected to persist into 2025. In Syria, the fall of Bashar al-Assad's regime adds another layer of instability to the region, as history has shown that the collapse of autocratic regimes rarely leads to a smooth and peaceful transition of power.

On the political front, a new administration in the United States, with concentrated power, introduces a degree of uncertainty compared to the more predictable Biden administration. In Germany, a potential change in government, with the traditional CDU/CSU (Christian Democratic Union/Christian Social Union) possibly returning to power, could steer the Eurozone's largest economy in a different direction. Meanwhile, France, which has enjoyed a relatively stable political landscape, is entering a period of instability that is likely to intensify in 2025.

Despite these developments, it is crucial not to become overly distracted by geopolitical events when it comes to investments.

The Trump administration, despite its potentially less predictable nature, aims to be business-friendly, which is often positive for risky assets. Tensions in the Middle East and the war in Ukraine have had a limited overall impact on commodities, oil, and gas prices beyond the initial shock. Oil prices, for instance, are now well below the levels seen in the aftermath of the initial invasion of Ukraine.

Chart 6: The oil price now sits around pre-COVID levels

Source: Macrobond, Nutmeg, as at 6 December 2024

While geopolitical events are significant, their impact on a portfolio is usually much lower than the headline impact and they should not generally be the primary drivers of long-term investment strategies.

In sum, while the outlook is promising, we're prepared for any shifts in the market.

The Nutmeg Investment Team

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance. We do not provide investment advice in this article. Always do your own research.