As the US Republican administration's 90-day pause on its "Liberation Day" tariffs draws to its planned end, we ask one of our expert portfolio managers what it might mean for investors.

At a glance

- Many of the Republican administration's sweeping 2 April tariffs were paused for 90 days, on 9 April, after a market backlash.

- The pause – intended to provide time for negotiation with US trading partners – is due to end on 9 July.

- Markets have recovered strongly – investors now want to know if the recovery can be sustained if tariffs are reintroduced.

The announcement of sweeping tariffs by the US Republican Administration in early April sent shockwaves through financial markets. Investors and policymakers around the world were sent scrambling to assess the implications and figure out how – or if – they should respond.

On 9 April, a pause on some of the most punitive tariffs was announced for 90 days and markets have since settled down. With days ticking down until the pause is due to end on 9 July though, investors are asking what comes next and if more instability is in store.

Nutmeg portfolio manager Bolanle Onifade explains what has happened in markets over recent weeks, and what she thinks investors should prioritise as we move to a new phase of the tariff story.

The so-called "Liberation Day" tariffs introduced a lot of uncertainty for investors, but markets seem to have recovered...

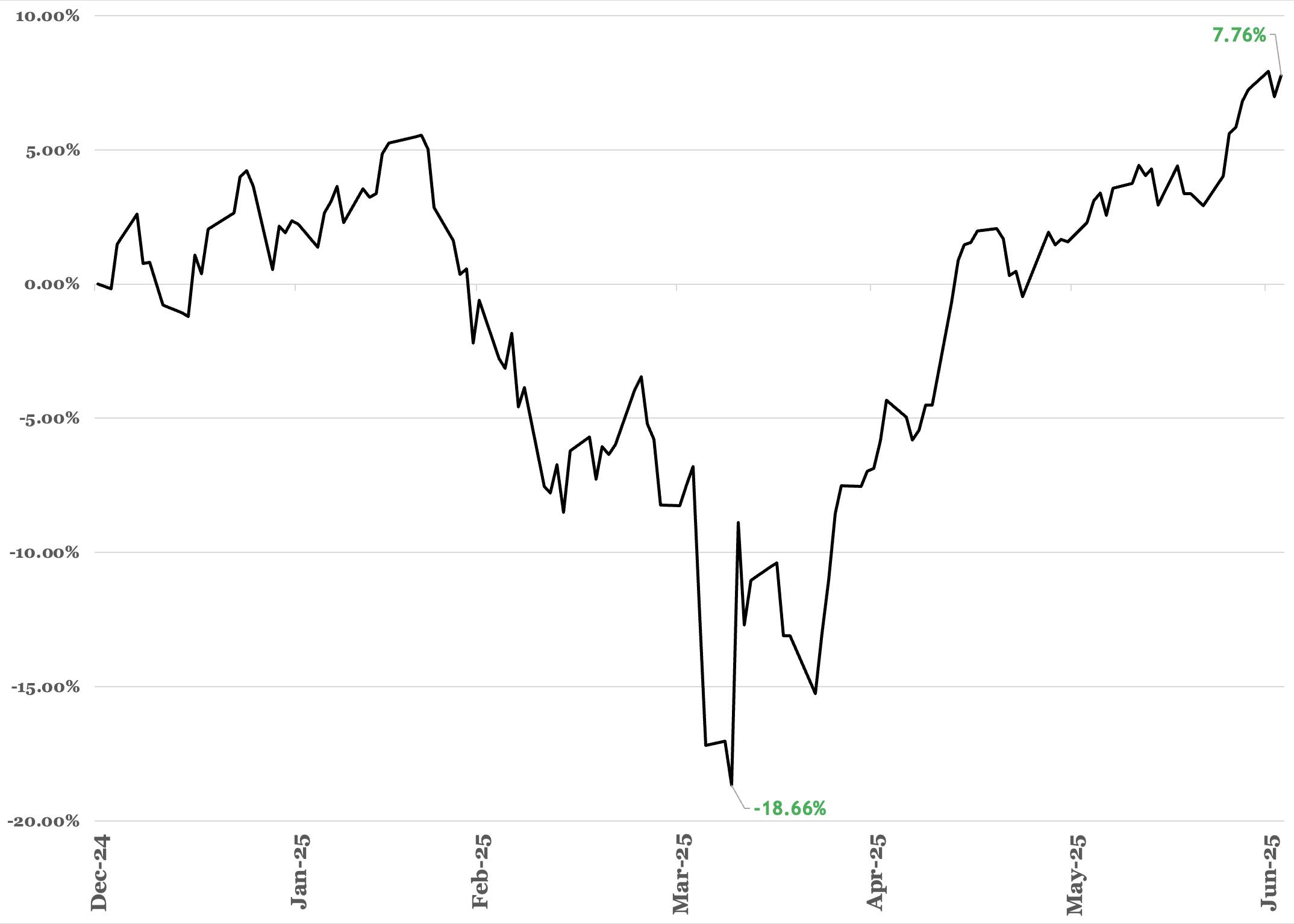

Investors don’t often look over their shoulders, but the fast-approaching end to the 90-day pause on US tariffs has provided a moment to reflect on a great comeback for markets. Markets declined sharply when the "Liberation Day" announcements were initially made. Since the tariff suspension though, trade negotiations and deals have provided a tailwind for markets, propelling the Nasdaq to recover by over 30% since its low and the S&P 500 to hit an all-time high.

NASDAQ performance year to date

Source: Nutmeg, Refinitiv July 2025.

Markets now appear cautiously optimistic and calmer, with the VIX index – a popular index for calculating volatility in the S&P 500 market – falling from over 50 points in early April to 17 now.

How we got to this place of market strength may seem remarkable, or even unbelievable, to commentators and investors, but shows the real impact of the White House’s softening stance on global trade. The rising tide has also lifted the indices of strong trading countries like Taiwan and South Korea, which have been buoyed by the US President’s willingness to cut deals with other countries like the UK and China. Promisingly, the tariffs have failed to deal a hammer blow to the US or global economies, with inflation and labour market data largely unmoved.

So can investors relax over the summer?

Despite this cautious optimism, investors shouldn’t overlook the continued risk that tariffs pose to the global economy and markets. We do not expect as our base case to see tariffs ramp back up to the early April levels, but we certainly can't rule out any surprises that unsettle markets. We are closely watching how the White House may react to a number of potential developments if negotiations go awry. This could include digital taxes on tech giants from foreign governments, new Chinese export controls, and any potential currency devaluation to counteract tariffs. If this period teaches us anything, it is that prevailing narratives and policies can change more quickly than many expect.

While uncertainty is a challenge, it is also an opportunity for investors. Many who invested in a globally diverse portfolio over the last few months should have been able to weather the market volatility and may have achieved strong returns. On the flip side, investors who stayed out of the market or crystalised any losses may have missed some great opportunities to capture returns as the market has reached new all-time highs in certain segments. Predicting the future may be tricky but focusing on the fundamentals of long-term investing is crucial during periods of flux.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not a reliable indicator of future performance.

We do not provide investment advice in this article. Always do your own research.