Us Brits love to talk about our homes and house prices but are sometimes more hesitant to talk about other investments. But can buying property really be compared to investing in stock markets? And which is better suited for you?

As the biggest purchase most of us will make in our lifetimes, it makes sense for homeowners to see property as an investment – it is nice after all to hear your home’s value has risen even if you don’t intend to move any time soon.

Over the long term, UK residential property has historically proven to be solid investment – though regional price differentials can be wide. According to calculations made using the latest data from the Land Registry, the average residential property bought in the UK for £101,164 in February 2002, would be worth £276,755 two decades later in February 2022. It makes sense then that those with spare capital have been tempted by buy-to-let and other initiatives which, in the ideal scenario, can provide both solid rental yield and capital growth.

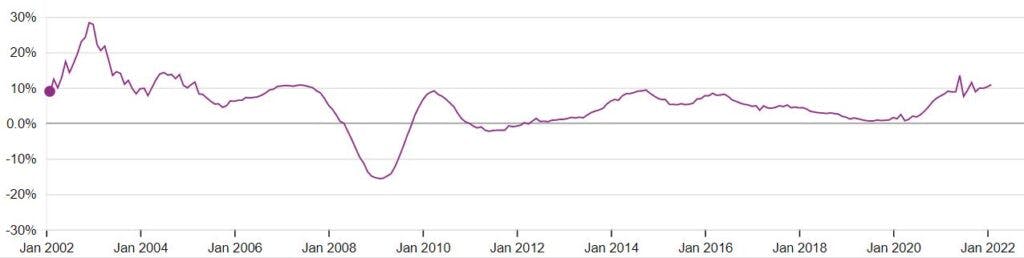

Still, that does not mean residential property values have gone up in a straight, unblemished line. As you can see from the chart below, which shows percentage change (on a year-on-year basis) over the same 20-year period, there have been some particularly volatile periods – especially during the 2008 financial crisis.

Chart 1: Percentage change (yearly) of UK property prices 2002 – 2022

Source: UK House Price Index, Landregistry.data.gov.uk

Still, for most people, the only property they will own will be where they live – not an asset that’s easy to trade or liquidate for profit; and if it’s your home, why would you?

Property as an investible asset class

There are other more liquid and less capital-intensive ways to invest in property. Open and closed-ended funds for example let you buy into both commercial property (such as offices and shopping malls), and residential buildings (such as student accommodation) without a significant outlay.

However, it is worth noting that open-ended property funds (which can issue unlimited new shares, priced daily on their net asset value) have come under scrutiny in recent years. Some have been forced to suspend trading or even close, due to valuation concerns.

Open-ended property funds must offer investors daily or weekly liquidity, meaning that you can redeem your shares, should you wish to do so, on this basis. However, property is not an asset class that can be so readily traded, taking months to finalise sales. It doesn’t matter if it is commercial or residential property, illiquidity can be a huge stumbling block for investors.

Closed-ended funds, namely real estate investment trusts (REITs) in the UK, can to some extent counter this problem in that they hold a fixed pool of capital that is not so readily affected by investors buying or selling. However, as listed companies, these can be sensitive to movements in equity markets, meaning the diversification benefits of investing in property are compromised. Given the nature of the structure, REITs can also trade at a discount to fair value, especially during periods of market stress and low liquidity. This is not a good scenario for those who wish to sell the funds during the tougher times but can present a good buying opportunity for those who believe values will rise.

One important aspect of physical property versus paper-traded property, or even stocks, is the direct ability to add leverage over time, i.e., through a mortgage where the lender will provide most of the cost as a loan upfront. In a period of rising property prices since the early 2000s and considering low interest rates, it has been an important factor in the appeal of the asset class.

However, with interest rates rising and property prices topping the historical range in terms of the ratio of house price to average income, the risk/reward might be much less attractive than before.

The case for equities

In terms of liquidity, equities offer a very different profile to property, with stockmarkets open to trading on a minute-by-minute basis. Mutual funds, a sensible way for retail investors to diversify across different companies and markets, are generally traded on a daily basis. That means in most cases you can sell out of a fund over the course of one day, something which some property funds do not necessarily offer in the current climate.

Equities can also offer fantastic opportunities for diversification. Within one portfolio you could, for example, hold shares in some of the world’s largest and most recognisable companies, such as Amazon or Apple, as well as staple UK companies like HSBC and GlaxoSmithKline, and Asian powerhouses like Tencent and Samsung. That’s just through buying some of the larger markets, with lesser-known up-and-coming names in small and mid-cap indices also hopeful to become tomorrow’s winners.

That kind of dynamism is simply not obtainable through owning just one house, or though part ownership of a selection of buildings offered in a property fund. The growth on offer can be encouraging too – Chart 2 shows UK equities versus listed REITs on a 15-year basis.

Chart 2: FTSE AllShare vs FTSE Real Estate Investment Trusts – 15 years

Base 100 – 2007. Source: MacroBond, FTSE

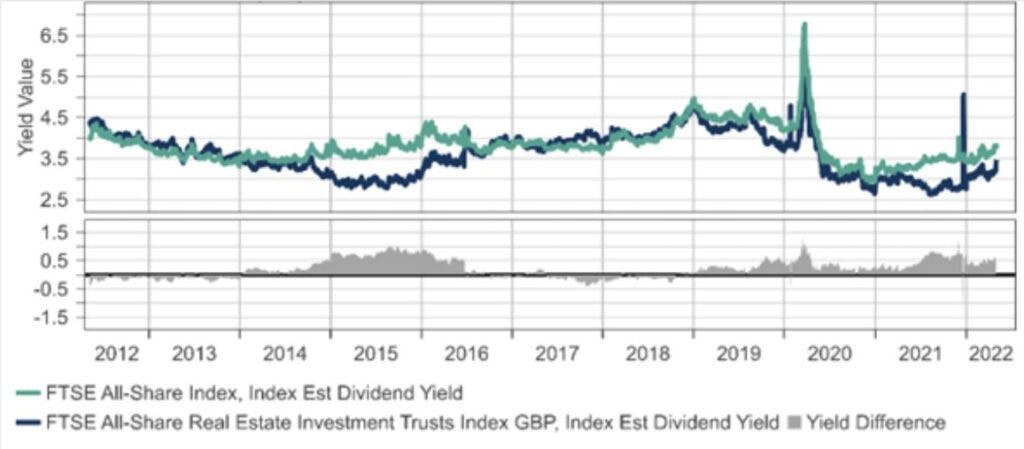

On a 10-year basis, the FTSE All-Share index has also delivered a greater income yield versus the same REIT index, this despite the widespread dividend cuts we have seen during the Covid crisis of the past couple of years.

Chart 3: FTSE AllShare vs FTSE Real Estate Investment Trusts yield – 10 years

Source: MacroBond, FTSE

How commercial property funds adapt and perform in the years ahead will be interesting to watch, especially given how most will hold office buildings and public spaces at a time when many of us continue to work from home.

Tax treatment

Compared to bricks and mortar residential property, equities offer a distinct advantage in being able to be held within an ISA or personal pension, with the associated tax advantages. While its common to hear people say: “my property is my pension”, that doesn’t really work out well in reality. Firstly, where are you going to live once retired if not in your home? And, if you instead plan to sell a second home to fund your later years, then you are likely to be subject to capital gains tax (CGT). Only those that sell a property that is their main residence benefit from Private Residence Relief, with no CGT payable.

You may also be liable to pay CGT on the sale of equities you hold, though this can be avoided if you make use of your ISA and pension allowances. You can invest up to £20,000 per year into an ISA without paying tax on any gains. For pensions, the standard annual allowance is £40,000 for the current tax year. A personal pension is a tax-efficient way of investing for retirement. Thanks to tax relief, a contribution of £1,000 into your pension effectively turns into £1,250 – or even more if you are a higher rate taxpayer.

Of course, you will be taking a risk investing that money into equities and you could get back less than you invest. However, that can also be said of property.

What about the LISA?

For many of us, equities are a first port of call for investing especially as not everybody has the means to own bricks and mortar property. In this case, equities, combined with other asset classes such as bonds as part of a well-diversified portfolio, can be a route to saving for your first home.

Any UK resident aged 18-39 can open and save into a Lifetime ISA (LISA), contributing up to £4,000 each year. The Government will give you a 25% bonus on every contribution you make until you reach the age of 50. So, for every £4 you invest you receive a £1 top-up. That’s a potential bonus of £1,000 each year to put towards your first home up to the value of £450,000, or retirement if you choose not to go down the property route.

Why Nutmeg doesn’t invest in property

Both property and equities can be savvy investment choices, provided the investor takes time to understand the characteristics of the asset classes, and the advantages and disadvantages of both. The good news is that those with enough capital can invest in both, with the correlation between both historically quite low – meaning they do not generally perform in the same way, with growth of each driven by different factors.

Whether you own bricks and mortar property, are engaged in buy-to-let, or invest in dedicated property funds, a well-diversified stocks and shares portfolio can make for an ideal companion holding. Given the aforementioned liquidity issues, and the fact that you cannot invest in physical property within an ETF structure, the Nutmeg investment team does not hold any property holdings within portfolios.

For those looking to invest for the first time, Nutmeg portfolios can be accessed for as little as £500 initial investment (or £100 minimum for a JISA or LISA) which can be a cheaper point of entry than most property funds. It is indeed significantly cheaper than the huge outlay required for buying physical property, not forgetting the associated legal and mortgage costs.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.