The lifetime allowance (LTA) can have a big impact on your wealth planning – but it’s a complex topic that takes time to understand. We’re here to help.

This content relates to the 2022/23 tax year, and some information may be out of date.

Earlier this year, Holly Graham, one of our financial planners, delivered a webinar on the Lifetime Allowance. In it, she deconstructed the lifetime allowance, explained the complex jargon associated with the lifetime allowance and broke down the key things you need to know to make the most of your pension. Click here to watch a recording of the webinar on YouTube.

Here, we revisit the most frequently asked questions about the LTA.

What is the lifetime allowance?

The LTA is how much you can build up in a pension over the period of your lifetime without having to pay extra tax.

The lifetime allowance for pensions (LTA) is set at £1,073,100 for the current tax year.

The lifetime allowance limit (2022/23)

The £1,073,100 figure is set by the government.

It applies to your workplace pension(s) and any private or personal pensions, but does not include the state pension.

It has changed 11 times since the LTA was first introduced in 2006, at an initial level of £1.5m. It’s been as high as £1.8m in April 2011, and as low as £1m in April 2016.

From April 2018, the LTA was increased in line with the consumer price index (CPI). However, in 2020, it was frozen until 2026.

As you progress towards your retirement, it’s worth bearing in mind that the limit could change again. A higher LTA could work in your favour, while a reduction in the LTA could mean that you have to make some changes to your retirement strategy.

What happens if I exceed the lifetime allowance?

If you exceed the LTA, you pay tax on anything above the limit. The level of tax you pay depends on the kind of withdrawals you take from your pension.

How does the lifetime allowance work?

When do you start paying tax on anything over the LTA?

In short, when it is ‘tested’.

Your pension is ‘tested’ when a ‘benefit crystallisation event’ (BCE) occurs. The most common benefit crystallisation events are: designating funds into drawdown, accessing tax free cash, a scheme pension coming into payment, and a pension holder turning 75.

When a BCE occurs, the scheme administrator compares the value of the member’s pension benefits to the member’s LTA that is still available. Any crystallising amount that exceeds the level of LTA available is subject to tax under the LTA charge.

There are difference BCEs, which take into account different personal circumstances and scenarios. If you’re unsure which may apply to you, a financial adviser could help you understand your circumstances.

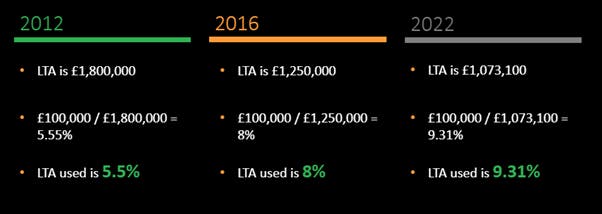

To work out the percentage used you simply divide the crystallisation valuation (for example, £100,000) by the LTA of the tax year in question.

For example, in 2012, if you divided £100,000 by £1,800,000, you’d have used 5.5% of the LTA.

A reduction in the lifetime allowance means that withdrawals of the same monetary value in 2016 and 2022 used a greater percentage of LTA. For instance, a £100,000 withdrawal using the current allowance uses 9.31% of the LTA.

So, you start paying a tax charge if total crystallisations exceed the LTA, and when you’re in retirement.

The LTA is mainly a concern for individuals between the age of 55 and 75, as they’re in what’s known as the ‘crystallisation window’, or the process of retiring.

You can access your pension from the age of 55, and state and workplace pensions are usually paid from the age of around 65. Many people continue working well into their 70s and beyond, so it depends how you decide to retire.

Age 75 is known as the ‘final test’, where all remaining uncrystallised pensions are tested, as well as investment growth within a drawdown plan. After age 75, there is no lifetime allowance test on your pension for the vast majority of people (with one rare exception for scheme pension increases that exceed set limits). So, when it comes to the lifetime allowance, the ‘lifetime’ is a potential 20-year period between age 55 and 75.

There are, of course, exceptions to the rule. If you move your pension overseas, it is tested against the current LTA at that point in time, for example. If you pass away before 55 and your pensions are fully tested against the LTA before being distributed to your beneficiaries.

How much tax does the LTA incur?

The rate of tax you pay depends on your circumstances.

If you take a lump sum, you pay a rate of 55% tax. If you take income, you pay a rate of 25% tax. What’s the difference?

The lump sum LTA tax charge is less common. For this to be paid you have to take your uncrystallised LTA excess in its entirety as one lump sum. For example, if you are £100k over the LTA, you’d pay a 55% tax charge in one go, and receive a £45k net lump-sum payment.

If the amount over the lifetime allowance is not taken as a lump sum, you pay a one-off 25% tax charge. Thereafter, any withdrawals are subject to your marginal rate of income tax.

Is it worth exceeding the pension lifetime allowance?

It depends on your financial goals. At Nutmeg, we can help you with your retirement planning, reviewing your pensions and your goals holistically to help you navigate the LTA and other tax challenges that may arise during this period of your life.

Understanding your lifetime allowance limit – key takeaways

Pension planning can be complex, and this blog only scratches the surface of some of the areas that you may need to consider with regard to the lifetime allowance.

Everyone’s circumstances are different; from relationship status, and number of dependents, to taxpayer status, as well as everyone having different retirement goals.

If you have questions about your own financial strategy, book a call with one of our experts to understand your options.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. A pension may not be right for everyone and tax rules may change in the future. If you are unsure if a pension is right for you, please seek financial advice.