It’s an issue that affects billions of lives, entire economies and receives far too few column inches. We take a look at how Nutmeg investors, and investors more generally, can limit their exposure to – and even alleviate – water stress.

There’s scarcely a resource we take for granted more than fresh water. The fact that so many of us access it cheaply and at a twist of the wrist obscures a very serious problem – the World Economic Forum has in fact listed “water crisis” as a top five impact risk in each of the last four years.

At Nutmeg, our socially responsible investing (SRI) portfolios score higher on water stress reduction and water efficiency relative to our non-SRI portfolios. But what does this mean and why does it matter to investors?

Why water stress is an issue

Water stress, put simply, is when demand for water exceeds the available amount during a certain period, or when poor quality restricts its use.

According to the UN, over two billion people live in countries under high water stress. Already, nearly two thirds of the world’s population are experiencing severe water scarcity during at least one month of the year. By 2040, it’s estimated that one in four of the world’s children – some 600 million in all – will be living in areas of extremely high water stress.

The coronavirus pandemic has again highlighted the link between access to clean water and poor health. Experts have shown that washing hands thoroughly and frequently can reduce the risk of infection – those without access to water simply cannot do this.

Not only is water relied upon by individuals but by businesses too. Many companies are facing natural capital constraints, with rising demand coming from industrial, domestic and agricultural sectors, as well as limited supply, mostly due to environmental stress and climate events.

The question for investors is at what point these constraints are internalised and, more specifically, which companies are proactively managing water-related risks? Some, for example in the agriculture sector, are inherently more exposed to the risks, whereas others – naming no names – put themselves at increased risk due to mismanagement.

How do we measure water stress?

Investors are only now waking up to both the potential impact of water stress on their investments and to the opportunities in water supply, management and treatment.

To evaluate a company’s exposure to water stress we use environmental, social and governance (ESG) ratings and data from one of the world’s largest investment research and financial index businesses, MSCI. We rely on two parameters: the typical direct and indirect water intensity of the industry and the level of water stress at a company’s operations.

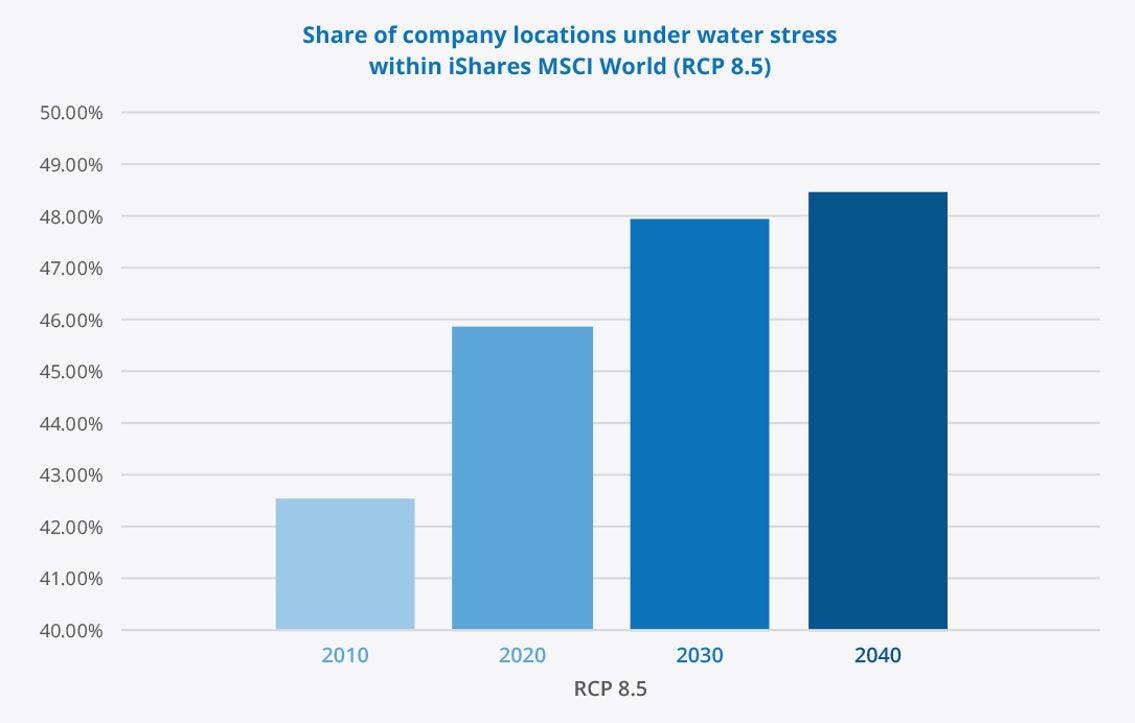

Factors such as rapid population growth, an extreme climate or a record of intensive resource exploration reveal a great deal about whether a location is likely to experience water stress. Companies in these locations are more likely to experience production disruptions, stranded assets, operational and fixed costs and community conflicts. Such areas, and so companies, are likely to grow in the years to come.

Figure 1: Number of locations in the iShares MSCI World ETF* severely affected by water stress in the RCP8.5 (high emissions pathway) using Baseline Water Stress

After looking at the location, researchers must then ask how the company itself manages water use. Does it commit to water targets or recycling initiatives? Does it have water efficient processes in place? Answers to these questions and others reveal where the investment opportunities – and pitfalls – lie.

How are Nutmeg portfolios positioned to fight water stress?

Our SRI portfolios, on average, score 26% better on water stress and 32% higher on water efficiency relative to fully managed portfolios. This means that the companies in these portfolios proactively employ more water efficient processes, recycling and do more to waste less water relative to their industry peers.

Nutmeg SRI portfolios also score higher, 35% better on average, in water stress reduction. This means the underlying companies have done a better job at articulating a strategy in reducing water intake. On the execution of water intensity reduction, SRI portfolios perform strongly as well. They exhibit, on average, 29% higher scores in water stress management.

Water is just one area we measure our SRI portfolios against. More broadly, these portfolios perform significantly better on climate change, scoring on average 18% higher on issues across carbon emissions, energy efficiency and toxic emissions and waste.

Sources

- Information accurate as of 13th May 2020

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.