Your award-winning wealth partner

Supported by the world-class expertise of J.P. Morgan, and made for modern investing.

With investment, your capital is at risk.

Our only goal is achieving yours

When you join us, you gain access to a unique blend of human support, a digital experience that seamlessly integrates into everyday, and exclusive ways to invest.

We build your globally diversified portfolio using smart technology and exchange-traded funds, and manage it with a clear aim of growing your wealth in the most efficient way.

Our management approach is based on the investment style you select. We have six for you to choose from – including Smart Alpha powered by J.P. Morgan Asset Management, which you can't get anywhere else.

On-hand expertise, included as standard

You'll have a dedicated relationship manager to help define your strategy and keep it on course. We also offer complimentary check-ups from our wealth experts, who can review whether your strategy is set up to help you get the best out of investing.

A tailored fee structure

We offer an exclusive fee structure for clients who invest £500,000 or more with us. To find out how this could apply to your investments, speak to our wealth experts at a time that suits you.

Book your appointment

Financial advice tailored to you

Complex finances make a busy life even more so – that's where our team of advisers are ready to step in, with our paid, regulated advice service.

We'll do an in-depth assessment of your portfolio, strategy and goals to detect areas where your investments could run more smoothly. You'll get a personalised financial plan, and your relationship manager will help you put it into action. You'll also receive expert recommendations on how to structure your finances to enjoy a stress-free retirement, leave an inheritance, and more.

We provide 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.

Your journey with us

Trust the experts

Our investment team builds a globally diversified portfolio in line with your priorities.

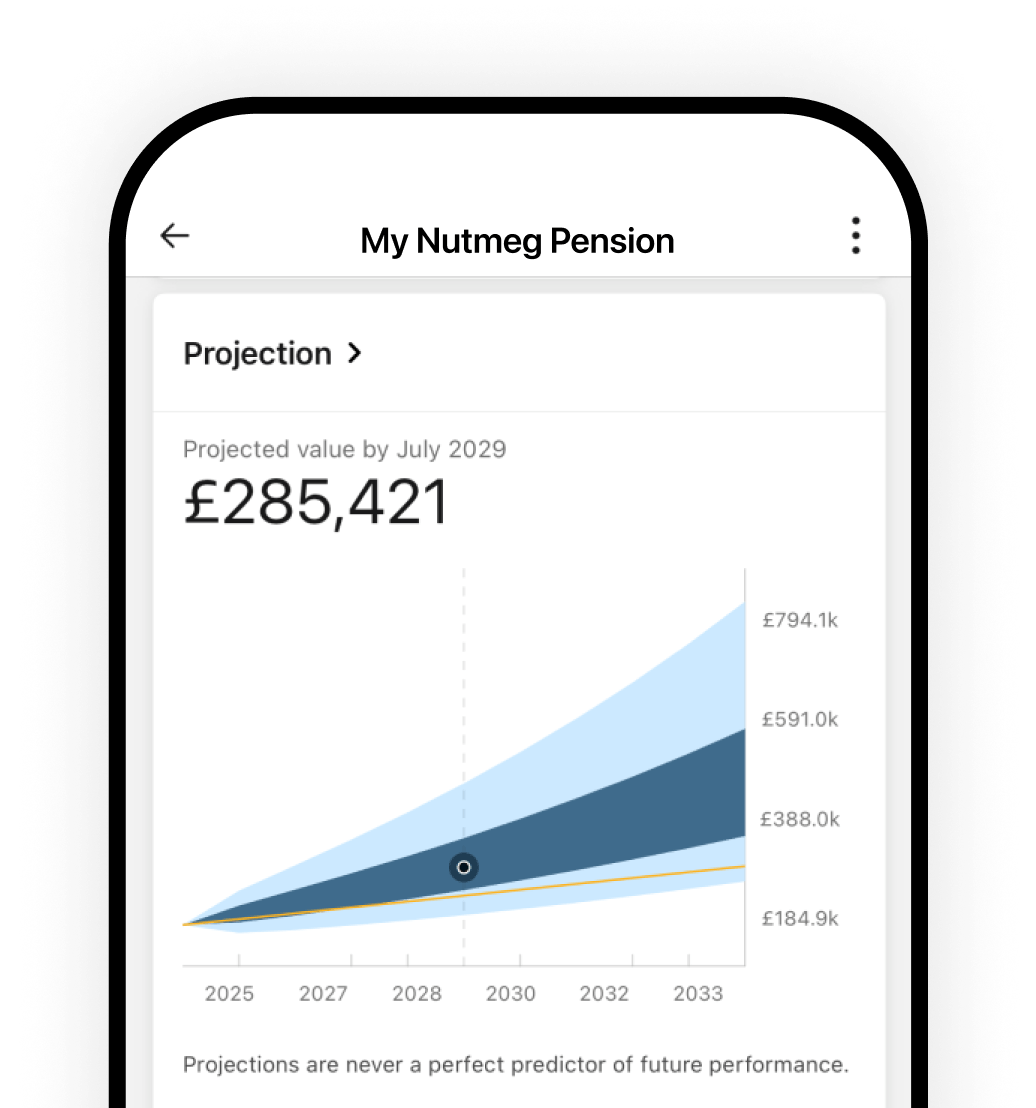

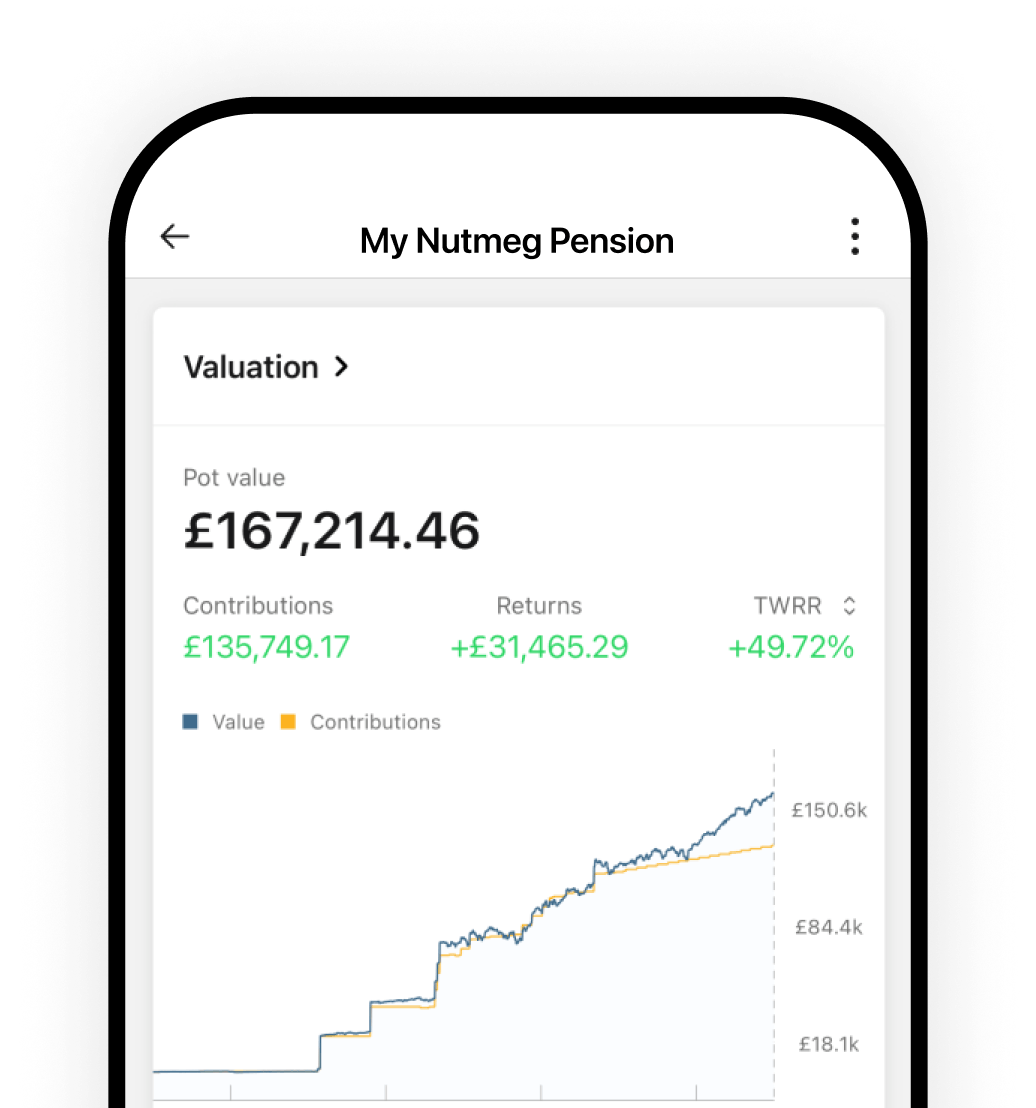

Track performance

Use our app or your online dashboard to keep tabs on your investments and any returns.

Stay in touch

Contact your relationship manager or book a wealth check-up whenever you need.

Explore our investment styles

How we manage your investments is up to you. We have six styles to choose from, each designed to support your strategy, personal priorities, and long-term financial goals.

Fully managed

Your portfolio in expert hands.

Thematic Investing

Invest in trends shaping the future.

Smart Alpha powered by J.P. Morgan Asset Management

An extra layer of active management.

Socially Responsible Investing

Aim to invest more mindfully.

Fixed Allocation

Automated rebalancing for a lower cost.

Income investing

Designed to deliver a monthly payout.

Not sure? Help me choose

Our track record

Explore our full 10-year track record for each of our 10 risk-based, fully managed portfolios and see how our results compare against our competitors.

- Track record

- Asset allocation

- Countries allocation

*The annualised figure is the return since inception expressed as a compound annual rate. For example, a portfolio with an annualised return of 6% corresponds to an actual return of 19.1% over three years (rather than 18% as you might expect) due to the effect of compounding.

The past performance shown represents a composite of asset-weighted average returns for Nutmeg client portfolios, net of all fees. A composite return represents the average return of all client accounts for a given risk level on a given day, weighted by assets. Past performance is not a reliable indicator of future performance.

Latest from the investment desk

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg, and any income from it, can go down as well as up and you may get back less than you invest. Investment products and services are provided by Nutmeg and not guaranteed by J.P. Morgan.