Investing for beginners – Is it right for you, and how does it work?

Thinking of investing, but want to learn more? We’re here to help. This guide is designed to walk you through some important questions to ask and things to consider before you start investing.

At a glance

- This guide explains the basics of investing, as well as the key benefits and risks.

- Investing should be long-term, helping to balance risk and reward.

- Investment strategies can prioritise long-term capital growth or income, depending on your financial goals.

- Equities and bonds are widely used and perform slightly different functions in a portfolio, but typically both will be used to manage risk and create greater balance.

Whether you’re new to investing, or would just like to refresh your knowledge, this guide is a good place to start to feel more empowered.

Prefer to speak to someone? Book a free call with our wealth experts who can help you understand which products could work for you, understand your risk appetite and how that could impact the investments in your portfolio. There are more details further down.

Is investing right for me?

We believe investing should be open to the many, not the few. There are no set rules around who can or cannot invest, the amount of experience you need or your level of wealth. If you are confident that you have sufficient cash savings for emergencies, and will not need to use the savings within the next three to five years, then you can probably consider investing. Exactly how much emergency cash saving you need will depend on your personal circumstances. We would usually suggest a pot with between three and six months’ essential spending.

Investing shouldn't be seen as an alternative to saving cash, which is still important. Typically, investors are advised to leave invested money alone for a minimum of three to five years, and to expect to see fluctuations in value over that time. However, provided you are aware of the way investing differs from saving, including the risks involved – that we will explain later – investing could be more effective in helping you achieve long-term financial goals than only saving cash.

If you think you will need the money in the next three years and are uncomfortable with the thought that your account value can go down as well as up, investing might not be right for you. If you have long-term goals, and enough cash savings to mean you can cope with putting your invested money away for a few years and see the value move around, then investing might be for you.

What is investing?

When you invest, you buy different kinds of assets that you think will either increase in value over time, will produce an income, or a bit of both. The way your money is invested will be determined by a variety of factors, including your risk tolerance and your financial goals.

The two most commonly used asset classes are equities (also known as ‘stocks’ or ‘shares’) and bonds (also known as 'fixed income'). We’ll explain what these are in more detail later.

How much money do you need to start investing?

The minimum investment depends on how you are investing and which investment or brokerage firm you have chosen.

At Nutmeg you don't need much to get started:

- For ISAs, general investment accounts and pensions, the minimum investment is £500

- For Lifetime ISAs, the minimum investment is £100

- For Junior ISAs, the minimum investment is £100

- Our income strategy requires a higher £10,000 minimum, in order to be effective in delivering against the investment goal.

What are the benefits of investing?

There can be several benefits of investing for the long term. It puts your hard-earned money to work, giving it the chance of increasing in value over time, or generating an income (or a blend of both). If you choose to invest with us, you can choose from a number of options that best suit you and your goals. Because of the power of compound returns, investing could help you reach these goals more effectively than cash. Even an interest-earning savings account sometimes doesn't keep up with inflation (although cash does not carry the same risks as investing).

If you’re so inclined, it can also become an extension of your values through investing more mindfully: in recent years, socially responsible investing (SRI) has become increasingly popular.

It can help beat inflation

Inflation reflects how much the price of goods and services has risen over time. It can rise and fall depending on many factors, and a moderate level of inflation is normal in an economy. However, inflation can erode the purchasing power of cash over time, which means the amount of goods or services you can buy with the same amount of money falls.

Investing could help you to combat this erosion of purchasing power. This is because investing offers the potential for growth and return in excess of inflation over time. Below you can see the average annual return of a medium risk Nutmeg portfolio versus inflation since the investment service was launched.

Inflation | Nutmeg 'fully managed' portfolio |

|---|---|

2.8% | 4.1% |

Source and note: January 2025, ONS, Nutmeg. Inflation is Consumer Prices Index (CPI), the measure of inflation the Bank of England uses, average annual inflation rate since 2012. Portfolio is 'fully managed', risk 5 out of a possible 10, average annual net return, since inception in 2012. These figures refer to past performance, which is not a reliable indicator of future performance.

If you can afford to, and are happy to take on some risk, investing could be a good way to help protect some of your money against the effects of inflation. In turn, this can help you continue to progress towards your financial goals and objectives. You can learn more about inflation here.

It can make compound returns work to your advantage

Compounding is sometimes referred to as the 'eighth wonder of the world' and can be an investor’s best friend.

The basic concept is simple.

Any growth a portfolio generates is earned on the original sum invested and any growth accrued in previous invested years/months. If for example, a £100 investment were to receive an annual 5% return, in the first year the investor would receive £5. However if the £5 return is reinvested (and assuming the same level of return), then the next year the return is £5.25 (5% of £105) and so on.

You can get a better idea of how it could impact your financial plans by trying out our compound returns calculator.

Of course, investing is always subject to the ups and downs of financial markets, so returns aren’t guaranteed every year. However, investing over a long timeframe could help make up for any shorter periods in which your portfolio's value falls, and give you the best chance of growing your money overall.

Compounding can be particularly effective for very long-term goals like a comfortable retirement. If you start early enough, it could mean that you have to invest substantially less each month than if you had started later – because compounding starts to do the hard work for you.

Is investing safe?

Investing carries risk. But it also carries the potential for reward.

There are three ways you can think about risk in the context of investing for the first time.

- Your tolerance for risk

Over the short-term, the value of your investments will go up and down. How comfortable are you with this? It’s important to be honest with yourself here. If you feel comfortable investing your money, choose a level of investment risk that you won't be tempted to change through stronger and weaker periods, and that won’t cause you to lose sleep at night. Changing your risk profile should be determined by your personal circumstances, rather than market movements. - Your capacity for loss

What can you afford to lose in the short-to medium-term? Before investing, it’s important to have a good buffer of cash savings (three to six months' living expenses is often used as a guide) that you can draw on in an emergency. Even with some cash set aside though, if you’re likely to need the money you are considering investing within three to five years, it’s probably a good idea to keep your savings in cash rather than invest it. - What you’re investing in

Different assets have different levels of risk. High risk assets usually have higher rates of return over the long-term, but a higher possibility of loss, and vice versa. Here at Nutmeg, we build our portfolios based on different risk levels, so you’re investing in assets that align with the level of risk you’re comfortable taking.

As an investor, while you can't control the markets, you can control the amount of risk you want to take. You can decide what the balance between risk and reward feels like for you.

Choosing the right level of risk will help you stay invested for longer and make it easier to stay on track to achieve your goals. So, if you’re new to investing, it’s worth taking plenty of time to explore and understand investment risk.

At Nutmeg, we help people establish their attitude to risk by asking them to complete a risk questionnaire. These questions will help you understand how you feel about investment risk and determine what the right investment strategy and style is for you. Our friendly team of experts can chat to you about this in more detail.

How does investing work?

When you invest, your money will typically be invested in – or exposed to – different assets. Assets in this context refers to securities that can be bought and sold in financial markets. Professional investors categorise different kinds of investment into 'asset classes' according to certain characteristics. While financial markets are extremely large and varied, two of the main asset classes are equities and bonds.

Investing in equities

Equities represent partial ownership of a company (hence 'shares'), and if the company grows, your shares can grow over time. Companies are also connected to and affected by what is going on in the wider world, so the value of their shares can fluctuate in the short-term. Over the long-term however, historic data supports that equities overall tend to rise in value, benefiting patient investors. Some companies also pay dividends to shareholders, which can contribute to overall investment return.

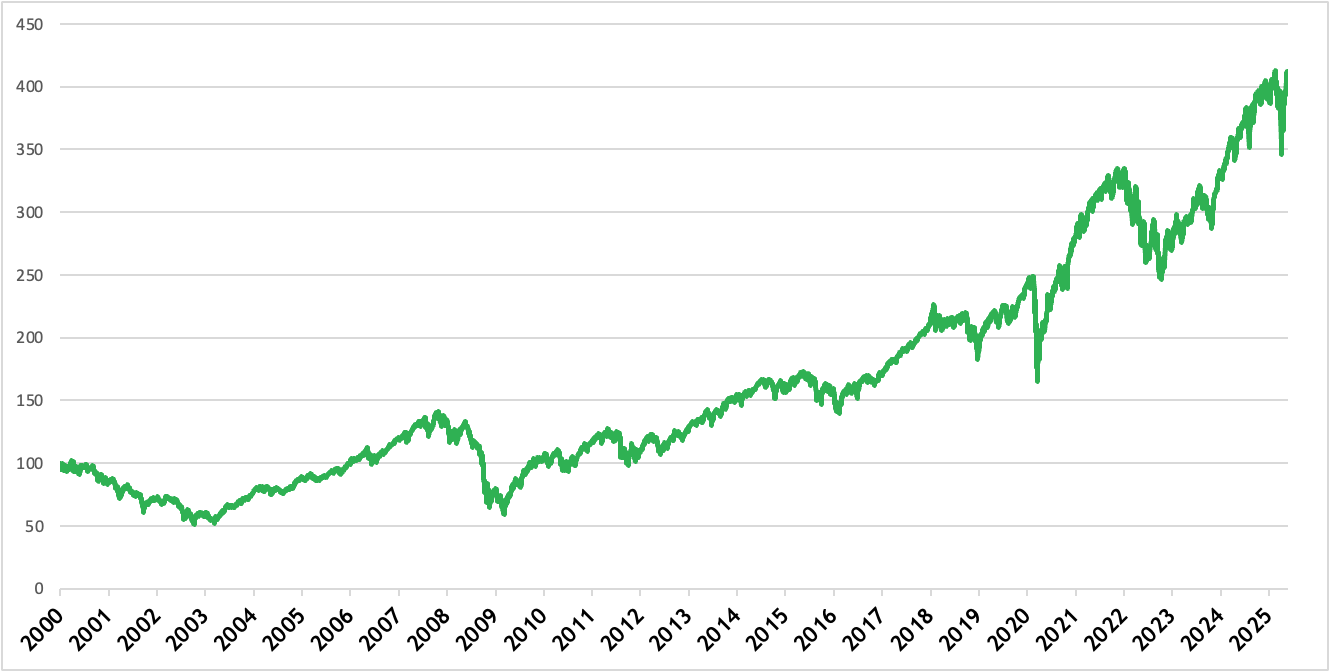

Chart 1: MSCI All Country World Net Index USD (end of day, rebased)

Sources: Refinitiv Workspace, Nutmeg May 2025. This graph shows the MSCI All Country World Net Index USD, rebased to 100 to be easier to understand. The MSCI World All Countries Index is a global equity benchmark that includes stocks from both developed and emerging markets worldwide.

Investing in bonds

Bonds are a form of debt. They are 'issued' by companies and governments around the world. This means the company or government is asking to borrow from investors, usually for a fixed term.

Bonds typically pay a return to investors in the form of coupons, until such time as the bond 'matures' and the sum initially borrowed from the investors is returned. Because bonds should represent a predictable flow of returns, they are often considered to be lower risk than equities. Historically, bonds have returned less than equities over the long-term. They are also more sensitive to interest rate changes and expectations for future inflation.

A word on ETFs

Nutmeg builds its portfolios using exchange traded funds – or 'ETFs'. ETFs are essentially a basket of securities. They are an easy, versatile way to gain access to multiple equities and bonds without having to buy each one individually. An ETF can track (follow the performance of) an index like the FTSE 100. They can also focus on specific asset classes, regions, sectors or market segments – such as bonds maturing in fewer than five years. The list is (almost) endless.

What makes ETFs attractive is that they are low cost, transparent, flexible and provide a lot of choice. Investing in ETFs also makes it easier to diversify your portfolio. ETFs unlock diversification for investors because they typically follow broad and well-diversified indices, spreading the risk of your investments.

What should I invest in?

The mix of assets used in a portfolio depends on the investor's overall goals. Investors often hold a combination of asset classes at the same time.

Using different kinds of assets with different characteristics helps to build what is referred to as diversification. Diversification seeks to combine different investments into a portfolio so performance is not reliant on the movements of one or a few individual holdings. It is the same concept as avoiding putting 'all your eggs in one basket'.

In most cases, your portfolio will be a balance of bonds and equities. A lot of this depends on stage of life, how much you have in savings, and what you need them to do. You can also fine-tune your portfolio to target specific themes, like technology or healthcare, or seek to back investments aiming to create better social and environmental outcomes.

If you invest with our team, you will be taken through a short questionnaire to find out more about what you need from your investments.

Any investment returns generated by a portfolio are typically a combination of income and capital growth. The split between how much of the return is income and how much is capital growth is determined largely – although not entirely – by the type of assets it contains. Investors with an income priority might allocate more of their portfolio towards bonds, while if an investor wants to grow their portfolio value as much as possible, they might use more equities, provided this is appropriate to your risk tolerance.

Our team of investment experts will build your portfolio based on your goals and risk tolerance. Depending on which investment style you choose, the investment team will also make changes to which exact ETFs are in the portfolio you select, dependent upon the economic outlook and market movements but always in line with the risk level and investment style parameters you choose.

Whatever your needs, we can help you to achieve your personal goals, in a way that best suits you.

How much tax do you pay on investments?

How you buy and sell the assets you invest in can affect the amount of tax you pay. Tax rules vary by individual status and may change.

If you invest using an Individual Savings Account (also known as an ‘ISA’), you do not have to pay tax on the returns you make. ISAs are a tax-efficient way of investing, and there are different kinds available:

- Stocks and shares ISAs allow you to invest your money – up to the annual allowance of £20,000 – without having to pay tax on the returns.

- Lifetime ISAs allow you to invest up to the annual allowance of £4,000 toward your first home (currently up to a value of £450,000) or your retirement (after age 60), and get a government bonus. LISA contributions count towards your personal annual ISA allowance. There are eligibility rules for LISAs, and government withdrawal charges may apply.

- Junior ISAs allow you to invest up to £9,000 a year on behalf of your child or a child you have parental responsibility for. JISA contributions do not count towards your personal annual ISA allowance, but rules apply for these accounts.

If you invest using a General Investment Account, you may have to pay tax on any returns you make.

Get some help from a wealth expert

You don't have to go it alone. Our wealth experts are here to help.

We provide free financial guidance, where we can work with you to explore your options, answer questions and get to understand your risk appetite, including which investment style could be right for you.

We also offer paid financial advice where we get to know you and build a recommended financial plan for you to follow based on analysis of your income, savings, and spending habits. You will pay a one-off fixed fee and you can book a free consultation first to see if it's right for you. It is called 'restricted' advice, because the plans and solutions we build for our clients are based on our own products and services, not those available outside of Nutmeg.

We're all about helping you to make the most of your money and planning for your future, in a way that works for you. Speak to our experts to find out more.

Invest with Nutmeg

We offer a range of portfolios that are transparent, globally diversified, and managed by our highly experienced investment team. You can choose your risk tolerance, pick an investment style, and leave us to select and manage your investments.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

Tax rules vary by individual status and may change. Nutmeg does not provide tax advice. For personalised advice tailored to your specific situation please consult with a qualified tax adviser or financial planner. ISA and JISA eligibility rules apply. With LISAs, if you need to withdraw the money before you’re 60, and it’s not for a qualifying purchase of a first home, you may pay a 25% government withdrawal charge.

We provide 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.

If you are unsure if investing is right for you, please seek financial advice.

Past performance and forecasts are not a reliable indicator of future performance. We do not provide investment advice in this article. Always do your own research.