Have you looked at your portfolio and wondered what ‘bonds’ are? This article will tell you everything you need to know to better understand this asset class – and the shape of your returns.

If you’re a low to medium-risk investor, your portfolio will contain a mixture of ETFs investing across equities and bonds.

Equities – also known as stocks and shares – are relatively well known and easy to understand. We often hear about companies and their share prices in the news, and see their value rise and fall over days, months, and years.

Bonds, on the other hand, are more mysterious. They get less attention in mainstream media, behave differently to equities, and can be more technical.

However, in 2022 the global bond market was measured at a staggering 33trn in size – and as bonds may be responsible for a solid proportion of your investment returns, it’s worth knowing a thing or two about how they work.

What is a bond?

A bond is a loan made by investors to a government or a company. Think of it as an IOU, or a unit of debt. All bonds have lifecycles that can last anywhere from a few days to a few years, or even a few decades.

First, they are ‘issued’ to the market by governments or companies that are looking to raise money. Then, they are bought by investors.

Most bonds then pay a fixed rate of interest throughout their term, which is called a ‘coupon’. When the term ends, and they reach maturity, the investor gets their principal payment back.

Some (more complex) bonds give the issuer the option to buy the bond back at a certain point in their term – but we won’t go into those here.

Why do investors buy bonds?

Bonds provide investors with a stable and consistent income. This makes their return profile less unpredictable and uncertain than equities, which can be more volatile.

Because of these characteristics, bonds are popular among lower-risk investors, or those who may be approaching retirement, and want to see less volatility in their portfolio.

However, it is important to understand that, while income returns from bonds can be more consistent than returns from equities, bond prices can rise and fall in value. Bond prices are highly sensitive to interest rates and inflation, which we’ll come onto later.

What are the main types of bonds?

Bonds are issued by governments or companies. Government bonds help finance public spending. When you read in the news about the government ‘borrowing’ money, they do so by issuing bonds to the market. National governments issue their own government bonds, including UK ‘gilts’, US ‘treasuries’, German ‘bunds’, and others.

Corporate bonds help companies finance projects, expansion, debt, and more. They are seen as riskier than government bonds, but offer higher returns as a result.

How are bonds priced?

When you buy an equity share, you are mainly hoping for the price to appreciate, or increase. The volatility of equities comes mainly from the price of the share moving as the market opinion of the company or share’s value changes.

When you buy a bond, there are several values to consider. Because of their income component, figuring out the return you get on a bond is a little more complex.

Coupon

A bond’s coupon is the annual fixed rate of interest it pays once it has been issued. For any given bond, the £-value of its regular coupon will never change. This is why they are called “fixed income” assets.

If interest rates rise or fall, coupon rates on newly issued bonds will change accordingly, but coupon payments on bonds that have already been issued will stay the same.

Price

When a company first issues a bond worth, say, £100, this is known as primary market issuance i.e. where the bond is first created. But when this bond is traded on the secondary market, it will not necessarily be bought by an investor for that amount. The bond’s price will be debated by participants in the bond market.

As with any market, different participants will have different views about the attractiveness of a bond. This is influenced by its yield, the creditworthiness of the issuer, inflation, interest rates, and other factors.

The most important factor is the interest rate set by the central bank of the country of issue. In 2022, central banks around the world raised their interest rates swiftly. Old bonds with lower interest rates became less attractive, so investors sold them, which meant that their prices declined.

Yield

An existing bond’s yield is the annual rate of return on the bond itself. One simple yield calculation divides the coupon income by the market price of the bond. Prices and yields are inversely related, so when the price of a bond goes up, the yield of its (fixed) coupon goes down.

A bond’s relative value is best understood by looking at its yield. This is because a bond’s yield is the summary statement about all the underlying elements of value. When comparing two bonds, investors often select a pair with the same term to maturity because this, along with credit quality, is a major element driving bond price.

Imagine that you have a 10-year US government bond with a 4% yield, and a 10-year corporate bond with a 6% yield. The 2% difference – also known as the ‘credit spread’ – is the premium that the investor receives for taking on the risk of loaning money to a company, and not the US government. But if the government bond had a maturity of 30 years and the company bond only five years, the 2% difference in yield would not be a like-for-like comparison.

Investors analyse credit spreads to compare the value of different bonds and review the performance of different parts of the bond market. If spreads widen, one sector may be outperforming the other. If spreads narrow, one sector may be underperforming.

Credit rating

As you may know from personal experience, your credit worthiness determines the type of loan you can get. It’s the same for bond issuers.

Bonds are assigned ratings by specialist agencies. AAA is the highest rating and indicates a strong likelihood that you’ll get your money back. Bonds rated AAA-BBB are ‘investment grade’ (lower risk), while those rated ‘BB’ and below are ‘high yield’, meaning that they are speculative with a high risk of default, but compensate investors for these risks by offering greater yields. Because of their credit rating, ‘high yield’ bonds can sometimes be referred to as ‘junk bonds’.

In general, government bonds from developed markets are thought to have a low risk of default and therefore have good credit ratings. This is because developed governments are generally reliable lenders with tax bases to ensure they can pay back their creditors.

The US bond market is by far the largest in the world. US government bonds make up a sizeable proportion of that market, and are regarded as relatively safe and low risk. This is why they are the benchmark for the global bond market: they determine how riskier bonds are priced and demand for US government bonds indicates whether investors are in ‘risk on’ or ‘risk off’ mode.

In emerging markets, where the political environment can be more unstable, the credit rating of government bonds is usually lower. In turn, yields on these government bonds are higher to compensate investors for taking on more risk.

Emerging markets issue bonds in their local currencies and in major currencies like the US dollar. The former can be higher risk, as emerging market currencies are more prone to fluctuations, while the latter helps them attract investors as the dollar is usually more stable. This means that emerging markets can be impacted if the dollar falls or rises, the likes of which we saw last year.

In the corporate bond market, developed market corporate bonds are usually given higher ratings than emerging market corporate bonds. But there is much variation within these markets, which contain many company bonds of all shapes, sizes, and credit ratings.

What is the yield curve, and why does it matter?

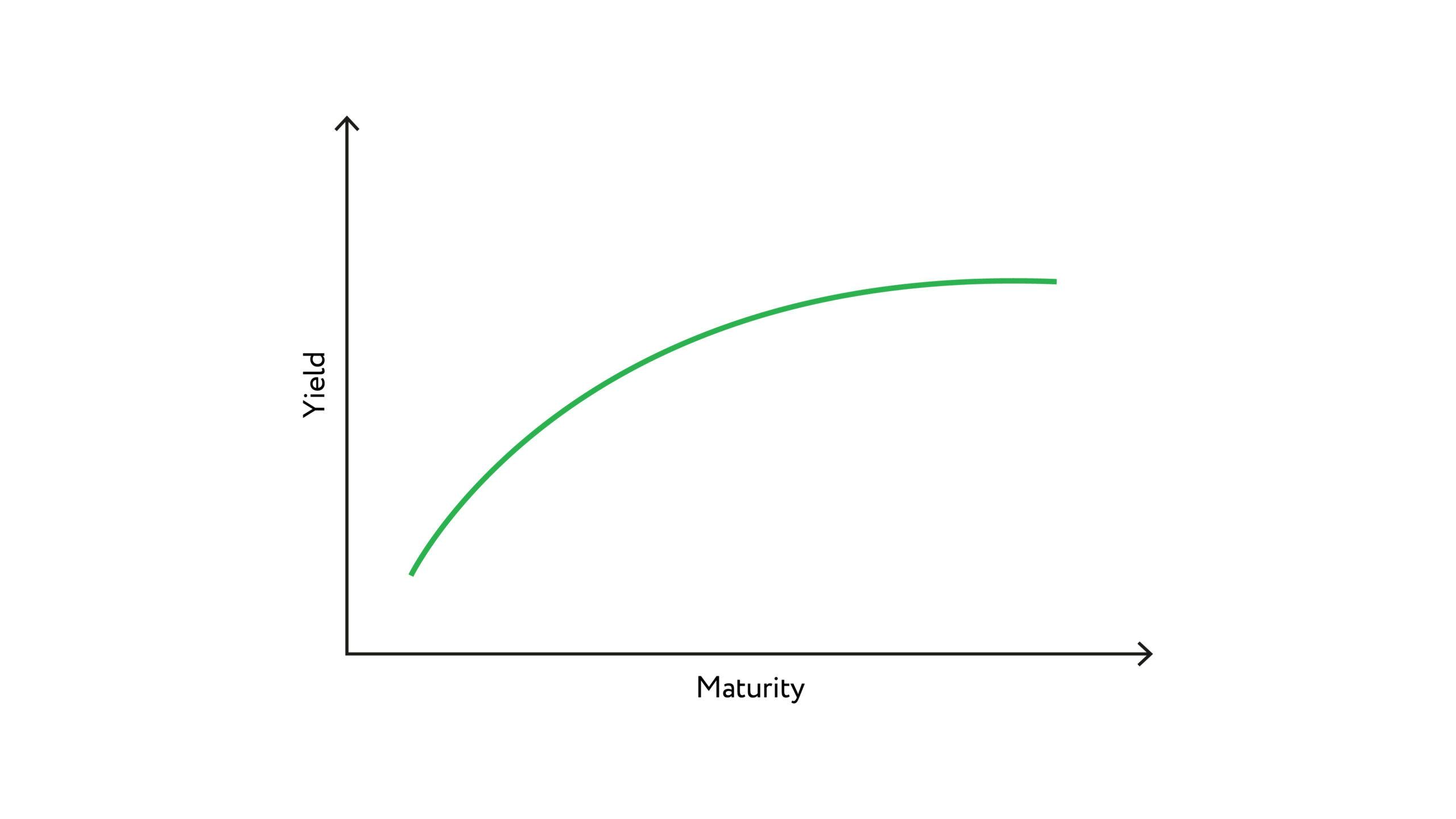

You may also have heard of something called the ‘yield curve’. This plots the yields of bonds that have the same credit quality but different maturities. The shape of the curve usually indicates the bond market’s optimism or pessimism about the health of the economy.

A normal yield curve – shown below – displays bonds with longer maturities having higher yields than shorter-term bonds. This is because the longer the term, the higher the uncertainty about what might happen to the bond’s price.

Over 10 years, for example, the issuer may experience a material change in circumstances, or a prolonged rise in inflation may significantly erode the value of the principle and coupon payments. As compensation for these risks, investors expect lower prices and higher yields.

But when the yield curve inverts, shorter-term bond yields are higher than long-term bond yields. This can be a sign of future monetary policy by central banks, investor pessimism about the near-term prospects for the economy, maybe even the start of a recession.

The yield curve is therefore closely watched by investors, economists, and analysts around the world for signs of change in market sentiment.

What role do bonds play in the Nutmeg portfolios?

Government bonds and corporate bonds play an important role in our low to medium-risk portfolios. They help provide a more stable source of income and can act as ballast against equity market price-volatility.

Our investment team spend a lot of time researching and selecting bond ETFs for our portfolios. If you’d like to look at which specific bond ETFs we use, click here.

How have bonds performed so far this year?

In 2022, investors sold bonds, meaning prices fell, and yields rose. It was a brutal year for the asset class as central banks reversed over a decade of low levels of interest rates. But the silver lining is that now, because interest rates are higher, so are starting bond yields.

At the start of 2023, we wrote that this year could see a bond renaissance. We argued that better prospects for the bond market would be dependent on two factors: central banks ending their tightening cycles, and inflation returning to more normal levels.

The collapse of some smaller US banks have – under the strain of higher interest rates and lower bond prices – created some doubts in the minds of the bond market about just how far central banks are willing to keep raising rates. The thinking is that the cost of beating inflation may be too high, and result in more bank instability.

This uncertainty temporarily created a challenging environment for bonds, and so we have seen government bond market volatility as a result.

The Nutmeg portfolios are cautiously positioned and are slightly underweight to bonds and equities. In our medium-risk portfolios, we recently increased our exposure to corporate bonds, where we see opportunities, and also think that high-yield bonds are selectively attractive for higher-risk portfolios.

Our investment team continues to monitor the macroeconomic environment, rebalancing the portfolios when necessary to make sure they are appropriately diversified across not just the bond market, but different asset classes, regions, and sectors too.

Want to learn more about bonds, or the other asset classes in your portfolio? We have more insights content on our website, where you can find regular updates from the investment team.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.