Concerns around the so-called ‘three R words’ – the conflict in Russia, the threat of Recession, and the impact of rising interest Rates – is unsettling for many people. But how should investors react?

In acknowledging the uncertainty that these threats bring, we have seen turbulence in markets and consequently a drop in Nutmeg portfolios. Given this volatility – which has led to a ‘bear market in the S&P 500 in the US – it’s easy to second-guess what action, if any, you should take. Should you reduce the risk level of your portfolio, or cash out of the market? Or should you take no action at all?

It goes without saying that nobody likes to see the value of their portfolios going down. As professional investors, this is a feeling our investment team is very familiar with. In all market conditions, it’s our job to guide your portfolio through these environments and you can rest assured that we are working hard to ensure your portfolio is positioned appropriately.

But at times like this we know that the fear, the alarm, the annoyance investors feel can be visceral. We won’t pretend to be soothsayers; we can’t guarantee when markets will reverse the downward trend we are seeing at the moment. But what we can do is learn from the past and use prior experience to help us prepare intelligently for the future.

What’s happening?

Current market conditions feel unsettling because we stand in the eye of a storm. Global stock markets are rattled because of geopolitical and economic uncertainty – and if there’s one thing that markets hate, it’s uncertainty.

In this state of market sell-off, with portfolio values falling, many people’s gut response is to engage in damage control, to limit losses. But is this the right response?

Think about it this way. If your portfolio has gone down, this fall in value is not a confirmed loss – not yet anyway. It’s a potential loss, based on the sum value of your holdings at their current market price.

It becomes real, and confirmed, only if we execute the decision to sell the assets and withdraw our money. Only then will the loss become crystallised, both in time and in our pocket.

In difficult times, it’s easy to lose sight of this. But don’t forget that as well as moving down, markets do move up. That’s inherent in the meaning of that uncomfortable word, volatility. Over the long term, history shows us that markets tend to increase in value. Remaining invested over longer periods of time reduces the probability of confirmed losses.

History on our side

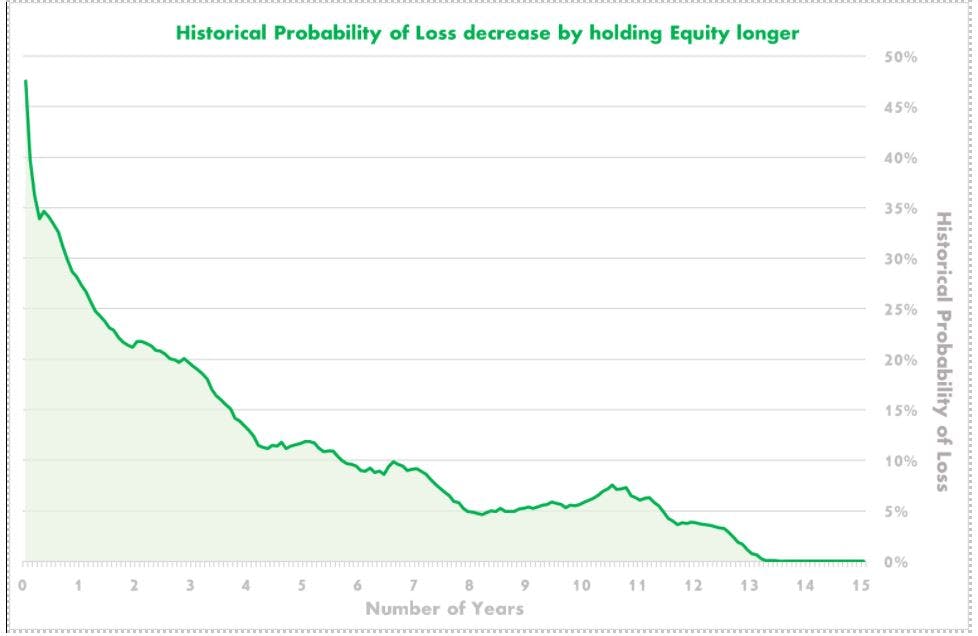

Data on global developed market stocks over the past 50 years shows us that the probability of losing money on your investment goes down the longer you stay invested. The chart below is based on data from 1972 to 2021. See how the green line falls over time. What this shows is that no matter when you entered the market during the period, long-term investing significantly decreased your chance of losses.

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 1 January 1972- December 2021

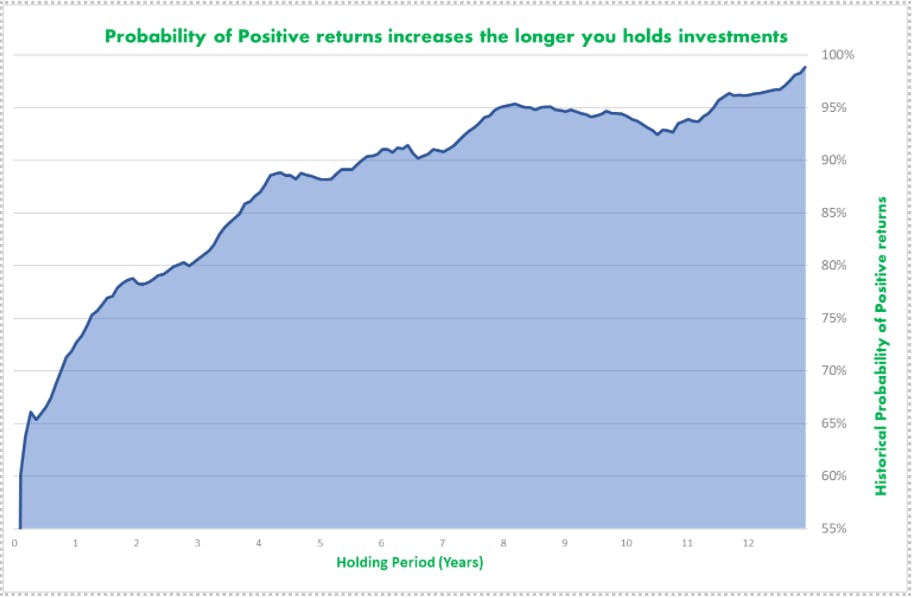

The following chart emphasis this point further – the probability of positive returns goes up the longer you stay in the markets. If you had invested your money for a quarter, or 65 days, during that same 50-year period, your chances of making a profit sat at 66.1%. Investing for any one year would have generated a positive return 72.7% of the time, while investing for ten years increased your chances to 94.15%.

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, January 1971- December 2021

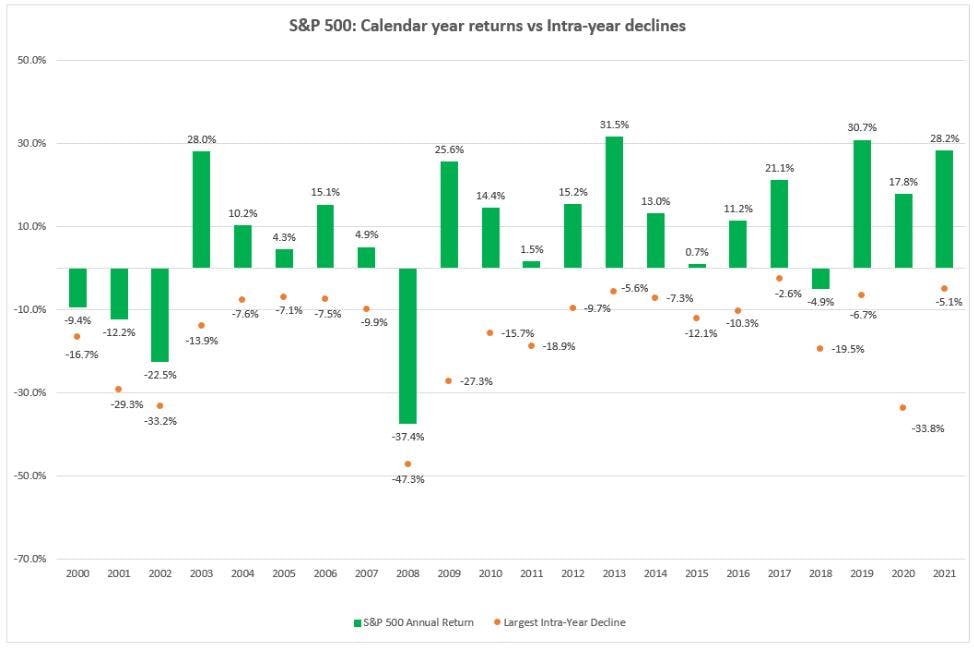

Even looking at shorter periods, we see that by and large, staying invested and focused on the longer-term generates a better outcome. Take the aforementioned S&P 500 index of the US equity market over the past 20 years prior to the current crisis, for example. The maximum potential loss (drawdown) one could make in each year looks bad – they are the red dots. But the maximum potential gain over the calendar year is always preferable to selling after the drawdown, see the green bars. In many cases, the full-year return was positive despite a large drawdown during the year.

Source: Macrobond, S&P Financial, FTSE. 31/12/1999 to 31/12/2021. Annual returns & drawdowns use total return indices in local currency but do not account for fees.

You have the power

This kind of analysis does not take away from the stress we feel in the moment. Nonetheless, it’s important to put short-term movements into perspective. Neither losses nor gains are certain until we sell, withdraw and confirm them. So even when we feel we are at the mercy of the markets, the power is always with the investor.

You can read more of our thoughts around volatility in a number of blogs which are linked to here.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.