The world of investing can be complex, but there are certain principles that can aid us all. Whether you have £1,000 or £1m to put to work, the following six behaviours will stand you in good stead in the years to come.

1: Remember the trade-off between risk and return

Understanding the relationship between risk and return is crucial when investing.

Different types of investments have different levels of risk. Equities can be higher risk than bonds, for example, while emerging market equities tend to be riskier than developed market equities. In many cases, the higher the risk, the greater potential there is for higher return on your investment, but the value of your investment may go down as well as up.

Finding and maintaining the level of risk that you’re comfortable can make your investment strategy more consistent – and give you a better investment experience.

Choosing a high-risk strategy because you want high returns, but then struggling to sleep at night because you’re worried about losses in your portfolio, is unlikely to set you up for success – so go for something that feels right for you.

Your attitude to risk may change at different points in your financial life – for example, as you get closer to retirement, you may be more focused on preserving your wealth rather than adding to it. While a good investment provider should let you review and potentially change your risk profile (see how you can do this with a Nutmeg account here), you should always invest at a risk level that gives you peace of mind.

Unlike savings accounts, investment portfolios can experience volatility. Volatility, when investment values change rapidly, is a natural part of every investment journey and navigating it successfully requires patience and a long-term mindset.

Volatility and risk are different but closely linked. While the vast majority of investors in markets will experience a degree of volatility, how much turbulence you see in your portfolio over the long term is likely to be determined by your chosen risk level.

A high-risk investor who only invests in emerging market equities is likely to experience greater volatility than a lower risk investor who invests in a portfolio of developed market equities and bonds – and may also see greater swings in their returns. However, please consider that during a long-term investment journey, there may also be periods where asset classes do not behave in a manner fitting their historical risk profile – for instance, bonds performed particularly poorly in 2022.

2: Be diversified

The phrase ‘not putting all your eggs in one basket’ has been used in the context of investing for years, and the idea behind it still rings true. The concept is simple: if you want to invest, spread your risk across multiple companies and asset classes. This reduces the chance of being overexposed to one company, sector, or asset class, where poor performance could disproportionally impact your returns.

Diversification is frequently called ‘the only free lunch in investing’ – and for good reason. By investing in a diverse range of asset types, you can help spread risk and improve your chances of higher returns.

In a diversified investment portfolio, the less correlated, or similar, the assets, the better. Again, the principle is quite simple. If you invest everything in one sector – like technology – and that suddenly bottoms out because of a change in regulation around these companies, then the bulk of your investment goes with it.

3: Invest for the long-term

Jumping in and out of the market can lead to missed opportunities. Investing should be considered as a long-term activity – we recommend three years at a minimum. Sudden losses or volatile markets can stir your emotional impulse to withdraw or suddenly change tack. No-one likes to see their portfolio go down in value – but staying calm and resisting the temptation to tinker can pay off in the end.

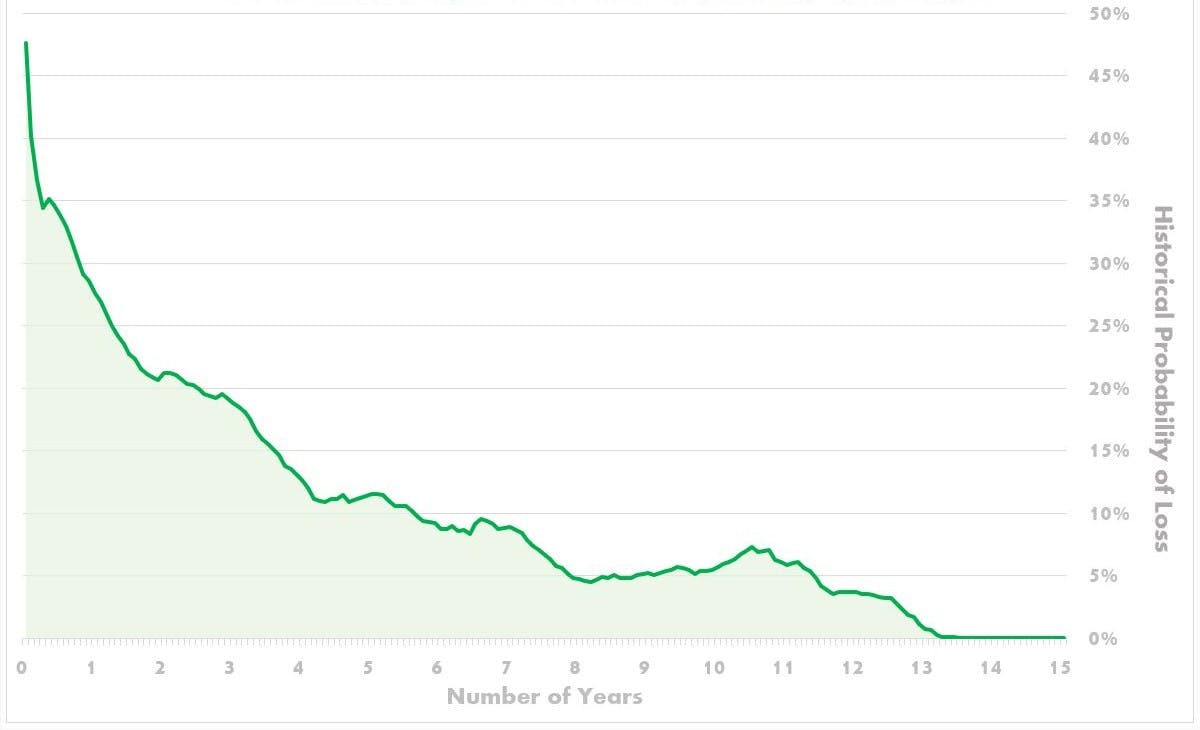

Data on global developed market stocks going back over the last 50 years demonstrates that the probability of losing money on your investment goes down the longer you stay invested. The green line on the chart below, based on data from 1972 to 2023, shows the power of long-term investing in drastically reducing your chance of losses.

Chart 1: The probability of loss decreases by holding equities for longer (50 years)

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 3 January 1972- March 2023

4: Rebalance regularly

Rebalancing is an investment management practice that ensures a portfolio stays aligned to its objectives and risk profile. It involves buying and selling assets within a portfolio to retain the right proportion or ‘weighting’ of different assets in the portfolio so it can continue to match its original objective.

Over time, as the value of each holding in a portfolio rises or falls (because of market performance), that holding will come to represent a larger or smaller proportion of a portfolio.

As a portfolio deviates from its original weightings, the risk of the portfolio changes too. And because higher-returning assets tend to be higher risk, over long periods your holdings in higher-risk investments are likely to become an ever-greater part of your portfolio, raising your risk level above your starting point.

Our investment team monitor your portfolio for you, regularly rebalancing to make sure your investments stay aligned with your chosen risk level.

5: Keep costs in line with your investment approach

Investment products can be ‘active’ or ‘passive’ in their approach. Active funds try to beat the market – typically through an individual fund manager who picks stocks – while passive funds (such as the exchange-traded funds that Nutmeg uses) aim to deliver the market return. Given the efficiency of markets, history suggests you’re much less likely to find an active manager that outperforms the market than one who underperforms.

And at the same time, fees for active funds are typically much greater than those for passive funds, eating into your potential returns. Morningstar reports that the average fee for an active stock picking fund was 1.03% as of December 2021, whilst the average passive fund charged just 0.55%. At Nutmeg, we aim to keep costs low and invest efficiently by using passive exchange-traded funds in our portfolios.

6: Use your tax-free allowances: ISAs, pensions, and much more

Every tax year, you receive a set of annual allowances from the government that enable you to invest in a tax-efficient way. From making the most of your ISA allowance to reviewing your pension contributions, we can help you build up a portfolio of tax-efficient investments. Book a free call with one of our team of experts to see where your money could take you.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.