3. Resist the lure of cash

It may be tempting to keep your savings in cash. Being invested in financial markets exposes your savings to potential sudden changes in their value. Sitting on a cash pile might seem like – and in certain situations, may be – the safer option.

Cash still has a role

It’s still a good idea to have a cash buffer to meet your short-term needs: both planned and unplanned.

Firstly, you should always have a rainy-day fund for potential financial emergencies, as you don't want to have to sell your investments at the wrong time in order to stay financially afloat in these periods.

Exactly how much emergency cash saving you might need will depend on your personal circumstances. We would usually suggest between three and six months’ essential spending.

Cash can also become important as you approach important financial milestones that you have been investing towards. If you are nearing the purchase of something, then it makes sense to de-risk your savings, by gradually increasing the portion allocated to cash.

Align your investments with your time horizon. If you're retiring in the next few years, work out what your annual expenditure may be, along with any capital expenditure, and consider having cash available for this period. While everyone's circumstances are different, you may wish to adopt a medium level of risk to build for the midpoint of your retirement, with higher risk investments for your latter stages, when these savings will have had longer to potentially withstand the higher volatility associated with investments that carry more risk. This process, by which we apportion different risk levels to parts of our savings, is known as cashflow bucketing.

Inflation is not your friend

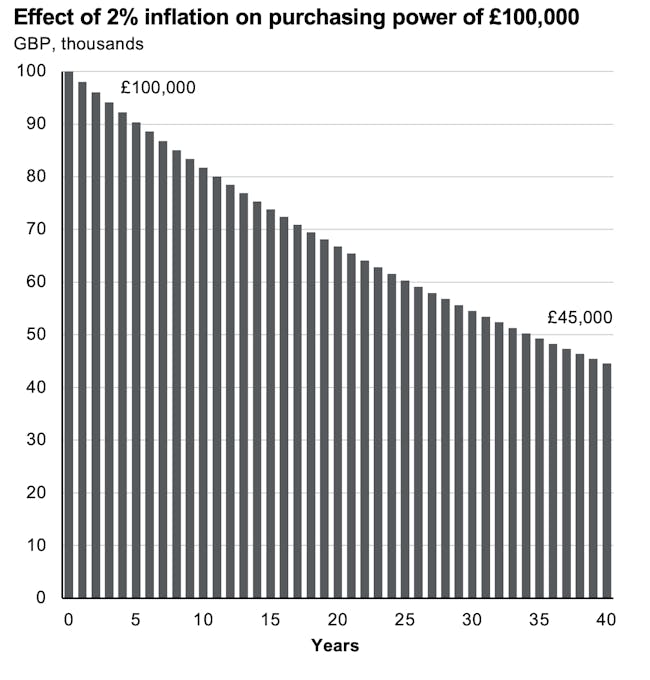

Beware of the impact of inflation, which reduces the value of your cash over time. If your money is not invested, its purchasing power – the amount of goods that your money can buy – can fall by more than half over a 40-year time horizon if inflation is 2% per year. It's worth bearing in mind that inflation can exceed 2% – the Bank of England's target rate, as set by the UK government – which can pose an even greater threat to cash.

As inflation trends upwards, interest rates will often follow, lifting rates in savings accounts that can make it tempting to stay in cash. While you stand to make a bit more money in that savings account than in an environment of lower rates, we still think there's a strong case for investing in financial markets than for hoarding cash, if you have a cash buffer in place.

Source: J.P. Morgan Asset Management. For illustrative purposes only, assumes no return on cash and an inflation rate of 2%. Past performance is not a reliable indicator of current and future results. Guide to the Markets – UK. Data as of 31 December 2024

Equities have historically delivered far higher returns than cash over the long term, while yields on bonds are usually higher than those available for cash deposits. You may wish to make sure you don’t miss out on the growth potential offered by gains in the stock market – or lose out on steady income provided by bonds – by staying on the sidelines in cash.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules vary by individual status and may change. Pension, ISA, JISA and LISA eligibility rules apply. With LISAs, govt withdrawal charges may apply.

Nutmeg does not provide tax advice. For personalised advice tailored to your specific situation please consult with a qualified tax adviser or financial planner. If you are unsure if a pension is right for you, please seek financial advice.

Nutmeg provides 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.