1. Set investment goals

Having financial objectives can make it easier to decide how to invest. Your approach to investing will differ depending on what you’re trying to achieve with your money, whether you’re looking to put down a deposit for a property in a few years’ time, or if you’re instead saving for your retirement 40 years from now (or both). It is sensible to have both long-term objectives and the capacity to spend money at shorter notice.

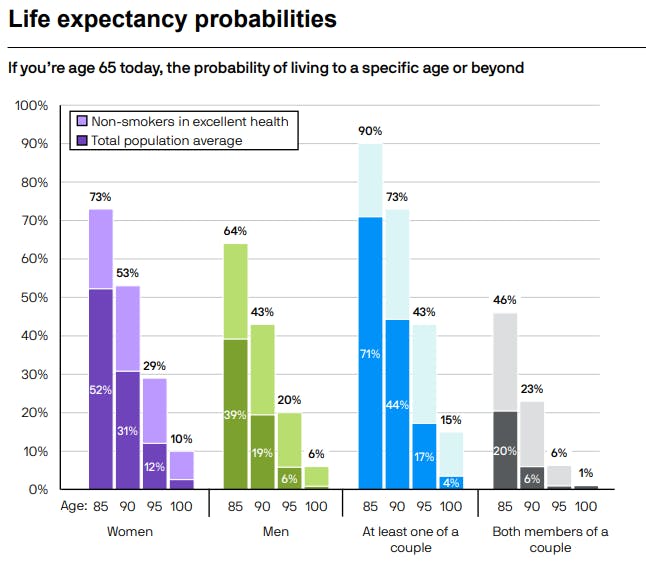

Plan to live for a long time

Thanks to advances in healthcare, most of us are now living longer in retirement than what we are budgeting for financially. It's important to be planning for a retirement of around 35 years. While that may sound excessive, the maths isn't crazy: some people retire at 65 and live until they are 100.

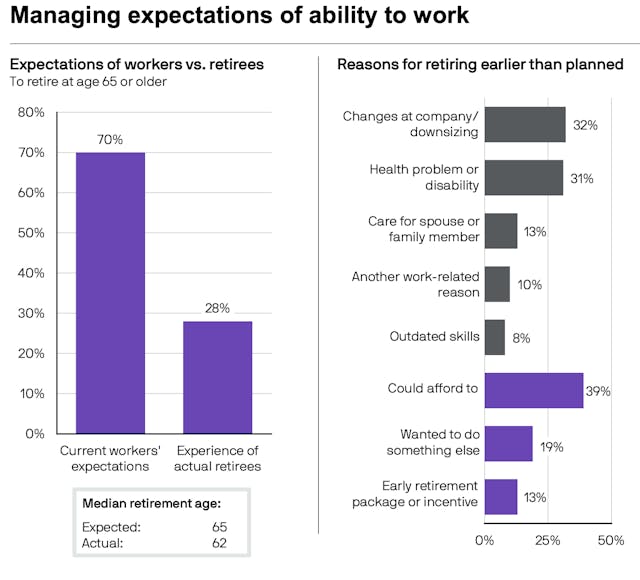

You may have a set age in mind at which you want to retire that is different from the above. But just as you aren't in control of your lifespan, the age at which you do eventually retire could also be impacted by factors outside of your control.

You should also be prepared for the possibility that government support may become less generous in the future, and so you are better off not factoring this income into your planning. Having a portion of your money set aside with the goal of long-term growth can be important in living the lifestyle you want in your later years.

Source: Social Security Administration, Period Life Table, 2021 (published in the 2024 OASDI Trustees Report); American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, http://www.longevityillustrator.org/ (accessed December 2024). Cited by J.P. Morgan Asset Management

Workers' expectations of their ability to retire at 65 or older – versus reality – are significantly wide apart, according to J.P. Morgan Asset Management.

Source: Employee Benefit Research Institute, Greenwald Research: 2024 Retirement Confidence Survey. Individuals may have given more than one answer. Latest available data as of 31 December 2024. Cited by J.P. Morgan Asset Management. Data from US workers

Balance long-term goals with short-term-objectives

Few of us will only invest for our retirement. Depending on where you are in your journey, more pressing financial objectives include saving for a mortgage or paying for a wedding. Even when approaching or in retirement, you might still have investment goals with shorter time horizons than others.

For these objectives, you still need to make sure you are giving yourself enough time to ride out market downturns, so you should consider planning to put money away for at least three, but preferably five, years for each goal.

Shorter-term goals also typically require a more conservative approach to risk, as you have less time to make back any losses. The longer your time horizon, the more time there is for you to accumulate investment returns.

If you’re looking to save for the long-term, you may wish to embrace a higher level of risk and allow your investments to experience greater ups and downs over a long time horizon, knowing that you don’t need to access your savings anytime soon.

If you are juggling multiple goals with different timelines, it can be helpful to separate your money into different portfolios or 'pots', so that you can tailor your risk tolerance towards each. With different pots, you can better keep on top of how long you have been investing towards each goal, and what level of risk the money you're putting aside for that goal is exposed to.

Having clear goals is an important step in ensuring you are making good decisions about your investment timelines and risk tolerance. You can read more about risk in principle 4.

Stick to your plan

It’s important to avoid deviating from your investment goals unless your financial circumstances change. Market volatility can unsettle investors, and it might be tempting to dispose of an investment that is losing its value.

But this could be the worst move you can make, unless you urgently need the money. Crystallising the loss – effectively, locking in the decrease in investment value by selling – is an irreversible decision. Markets have a habit of recovering, and more experienced investors may look to capitalise on nervous investors who have sold during times of volatility and pick up assets at lower prices.

Tinkering with your plan can put you further away from meeting your investment objectives. If you need support with devising a plan, we have two services that can help:

Financial guidance

Our financial guidance service is free for both new and existing clients. This offering can help you explore your options, understand the markets and volatility, and learn more about the products available to you.

Financial advice

Our paid financial advice service conducts an in-depth assessment to create a personalised plan that's tailored to you, with recommendations for how you could achieve your individual financial goals. Advice is particularly suitable for those whose financial circumstances have changed significantly, prompting a rethink of their financial objectives.

We provide 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules vary by individual status and may change. Pension, ISA, JISA and LISA eligibility rules apply. With LISAs, govt withdrawal charges may apply.

Nutmeg does not provide tax advice. For personalised advice tailored to your specific situation please consult with a qualified tax adviser or financial planner. If you are unsure if a pension is right for you, please seek financial advice.

Nutmeg provides 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.