2. Start early and be consistent to have the greatest potential for returns

Time in the market, not timing the market

We do not recommend trying to ‘time the market’, or constantly trying to identify buying and selling opportunities. We see little evidence that timing the market works for most investors. Being able to accurately predict events that move markets is almost impossible, and we do not believe timing the market is a useful way to think about investing and achieving your financial objectives.

We instead advocate time in the markets. In fact, the longer you stay invested, the less likely you are to lose money.

The below chart displays data from developed equity markets between January 1972 and December 2023. No matter when you invested during this period, long-term investing would have dramatically increased your probability of avoiding losses. Although future market performance can never be guaranteed to play out the same way as it has in the past, as investors we can still gain a sense of longer-term perspective from this.

While big market movements can seem significant in the short run, they are more likely to appear as a blip when viewed over several years. Historically, the probability of loss has decreased the longer you hold equities.

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 4 January 1972 - 8 December 2023

Benefits of compound returns

'Compounding', or compound returns, essentially refers to the importance of patience and commitment in investing.

The basic concept is as follows. In the first year of investing, you may generate returns on your initial investment. In the second year, you invest the capital (your initial investment) plus the returns, and you may generate further returns on the total. And so this cycle continues.

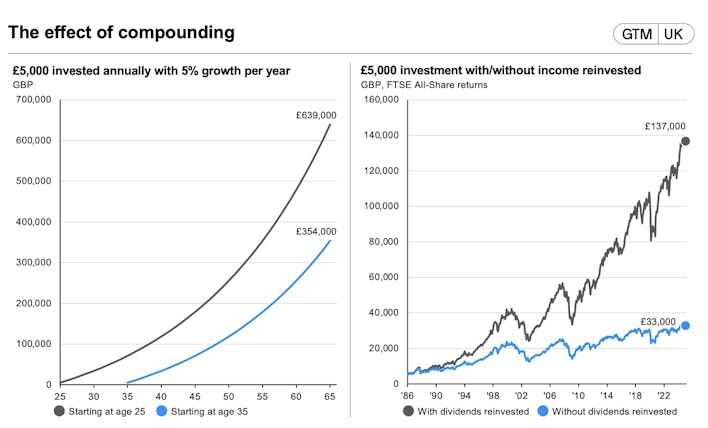

The below charts demonstrate the power of investing earlier in life and of compounding, by reinvesting the income from your investments. If you start to save at the age of 25 and invest £5,000 annually in an investment that grows at 5% a year, you'll have nearly £300,000 more by the age of 65 than if you started at 35, even though overall you would only have invested an extra £50,000. As the right-hand chart shows, there is also a significant difference between reinvesting and not reinvesting your income. But don't be discouraged if you're starting a little later. Compounding can reward investors of all ages who choose to start today and not a decade down the road.

Of course, investing is subject to the ups and downs of the stock market and there’s a risk you’ll lose some or all of the money you’ve put in, so returns aren’t guaranteed. However, by investing over a long timeframe, you can give your investment time to make up for any losses.

Source: (Left) J.P. Morgan Asset Management. For illustrative purposes only. Assumes all income reinvested. Actual investments may incur higher or lower growth rates and charges.

(Right) Bloomberg, FTSE, J.P. Morgan Asset Management. Based on FTSE All-Share Index and assumes no charges. Past performance is not a reliable indicator of current and future results. Guide to the Markets – UK. Data as of 31 December 2024.

Pound-cost averaging can shield you from market shocks

Investors might consider what is called ‘pound-cost averaging’ – effectively drip-feeding money into their portfolios at regular intervals either by making investing a regular habit, setting a reminder, or an automatic direct debit. This buys you into the markets during the various ups-and-downs, meaning you can be less exposed to short-term market movements.

Our drip-feed feature allows you to maximise your annual tax allowance with a cash pot within an ISA and then invest your money gradually over the months to come, or when is most convenient.

This means that you can enjoy the tax benefits of a stocks and shares ISA while remaining assured your money can be invested slowly but steadily, rather than all at once. You can reduce the risk of buying in just before markets drop and instead stay invested for the market recovery – the speed of which can be very difficult to predict.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules vary by individual status and may change. Pension, ISA, JISA and LISA eligibility rules apply. With LISAs, govt withdrawal charges may apply.

Nutmeg does not provide tax advice. For personalised advice tailored to your specific situation please consult with a qualified tax adviser or financial planner. If you are unsure if a pension is right for you, please seek financial advice.

Nutmeg provides 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.