Whether you’re saving for retirement or building your investment portfolio, it can be tempting to hit “pause” when things don’t quite go to plan. Before you stop your monthly contributions take a moment to consider your options and make sure you’re making the right choice for your future.

Taking a long-term approach to managing your investments can be beneficial. But, when markets dip or your financial situations change, it can be tempting to stop your monthly contributions. We all worry about covering bills in the here and now and sometimes forget about planning for our future. However, despite the immediate pressure, often the best solution can be to see through the market volatility and keep making investment contributions towards our goals.

Understandably, long-term finances are a major cause of stress for younger generations. While not every investment decision can be the next Amazon or Apple, investing over the long-term might help you prepare for the future and ease some financial stress. By using a diversified portfolio, you’ll give yourself a good chance of capturing some of the growth trajectory of the next Amazon – and likely with much less risk than if you were to put all your investment into just one stock.

So, if you’re worried about markets and thinking about pausing your monthly contributions, take a moment to consider whether it’s the right decision.

The eighth wonder of the world: What is compounding and why can it be so powerful?

It is reported that Einstein referred to the maths behind compounding as the eighth wonder of the world. This sounds a little dramatic but, given enough time, compounding can have a transformative effect on investments.

Compounding significantly helps investments to build value over the long-term through the effect of regular re-investments, allowing you to see an accumulated return on recurring monthly contributions.

We can see this happening even over a relatively short time period.

For example, using simulated historical data, if you had held a Nutmeg fixed allocation stocks and shares ISA at risk level 5 at the end of July 2013, holding £20,000 from previous investment, and then made regular £250 monthly payments, you would have seen the portfolio’s value to grow to £75,647 by 26th February 2021 – a return on top of your deposits of £32,897.

So far, so good. But let’s say you decided to forgo some monthly treats and invest it instead: doubling your regular monthly payments to £500. You would have seen the portfolio’s value to grow to £109,683 by 26th February 2021 – a return on top of your deposits of £44,183.

To further illustrate this, if you had been able to make regular contributions of £1,000 your investments could have grown to £177,754 by February 2021 – a return of £66,754 (although you would be subject to some tax as for the first year you would have exceeded the £11,520 tax-free ISA allowance at the time). If we made this cash sacrifice of £1,000 every month until retirement, we would see much more of our money working for much longer.

If you started today, we estimate that £500 invested monthly from March 2021, on top of previous years’ ISA contributions and growth worth £20,000, and in a risk level 5 fixed allocation Nutmeg stocks and shares ISA, could have reached a value of £276,718 in 20 years’ time – that’s a return on top of what you have invested (£140,000) of £136,718. These predictions are simulations of future and past performance, not guarantees, but they show the potential of regular contributions. You can work out your own calculations for potential future performance and see all the assumptions using our ISA Calculator.

Why you should keep making regular payments even if markets wobble

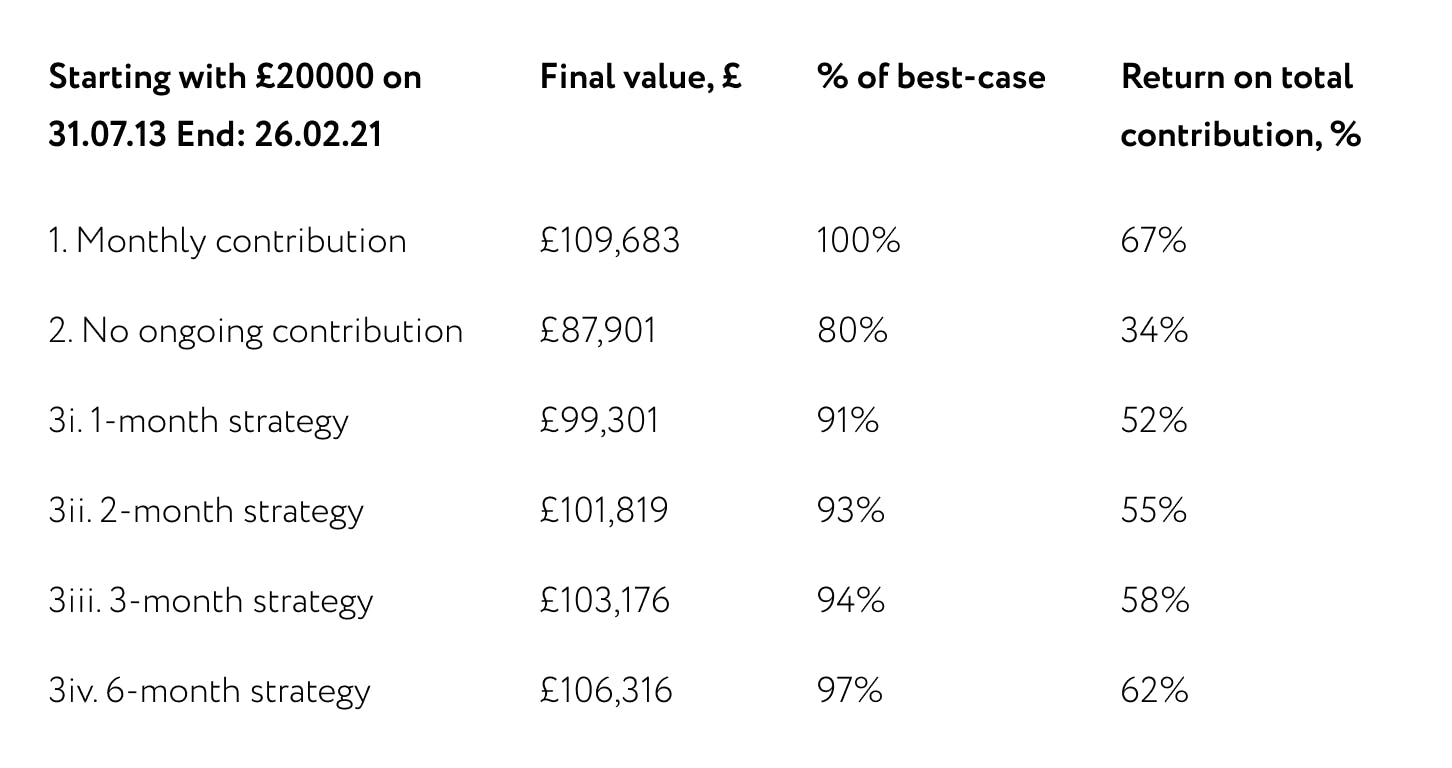

So now we know how powerful regular contributions can be, let’s take a look at how stopping monthly contributions would impact your investment pot. For this we will assume any cancelled contributions are held in a cash account earning the Bank of England interest rate of 0.1%. The table below shows how three different contribution strategies would have worked out between July 2013 and 26th February 2021 for a fixed allocation stocks & shares ISA that had come to be worth £20,000 in 2013.

1) £500 monthly contributions on your £20,000.

2) No contributions: £20,000 invested but then with the missed £500 monthly contributions accumulating as idle cash in a bank account.

3) Timing the market: some contributions on top of the existing £20,000 but then cancelling all future monthly contributions when the value of your portfolio (minus your contributions) falls below its high-point (stops growing) for a set period of time (see examples i,ii,iii,iv). The money not invested then sits as idle cash in a bank account.

Within this third strategy, the table shows the impact of waiting one, two, three or six months before deciding to cancel the monthly contributions.

For example: the two-month strategy is when a customer stops contributions once the value of the portfolio (excluding previous contributions) has been below the market high-point for over two months. As you can see, keeping the monthly contributions going for six months before deciding to drop them is much better than stopping after just one month of lesser market performance. But it will still leave you £3,367 poorer than had you left your monthly contributions alone.

Clearly, the best strategy is to just leave your monthly contributions to work away. Remember, one of the core tenets of investing for the long-term is to have patience and to look through the volatility.

Things to consider if you’re thinking about pausing your monthly contributions

While it’s helpful to understand the benefits of maintaining your monthly contributions, you may also want to consider these four points:

Timeframe matters

With compound investments, you want to take a long-term view and start early. The longer you can give your funds to grow and weather market volatility, the better.

Count the costs

Investments come with costs, some of which aren’t always clear at first glance. You want to make sure you fully understand associated costs like inflation and account charges. You also want to consider non-monetary costs like your risk appetite and any stress caused by not having the money immediately available or, worst comes to worst, losing it altogether. At Nutmeg we strive to always been transparent about our fees and make sure all our costs and returns are easy to understand.

Make the most of contributions

You can also make sure you get the most from your contributions by taking advantage of HMRC’s tax-free benefits for pensions, ISAs, LISAs and Junior ISAs wrappers. Leveraging any tax benefits available to you can make sure you’re not essentially missing out by passing money to HMRC when you could be adding it to your investment pot for the future. leaving cash on the table or missing out on opportunities for greater returns by pausing your monthly contributions.

Choose the right risk level

When making investments or deciding to continue your current contributions, take a moment to consider your risk level. Your risk appetite may change during your life and it’s essential to understand the level you feel comfortable with. Higher risk can result in greater returns, but it also means you have a higher chance of losing your investment. After all, there’s no reward without risk.

It’s essential to make a decision you feel comfortable with, which is something only you and you alone can decide – but be aware that changing your risk level frequently once the portfolio is set up, can have a negative impact on your returns. It is better to think carefully first and stay with your risk level.

Our conclusion on managing long-term investments

With investments, and keeping the maths of compounding in mind, it’s often better to think twice before cancelling monthly contributions, as regular payments continue to build your investment portfolio and typically allow you to see better results in the long-run.

Our analysis suggests that keeping up contributions would be the best-case scenario for your investment pot, even if there is a dip in the market. Dropping the number of contributions you make and the amount of money you’re investing can lessen the opportunity for your portfolio to grow.: As we’ve shown here, the best option might be to simply keep making regular contributions.

Risk Warning:

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past and simulated performance is not a reliable indicator of future performance.As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. A stocks and shares ISA may not be right for everyone and tax rules may change in the future. If you are unsure if an ISA is the right choice for you, please seek financial advice.