Although markets always experience a degree of volatility, the past two years have seen some particularly high levels of price fluctuations as both bad and good news around Covid-19 has hit the headlines. Our director of investment risk, Pacome Breton, details why this is the case and explains why volatility is not inherently a negative thing for investors.

What is volatility?

Volatility is a measure of the amount of price variation we might expect in a market. If there is high volatility this will tell investors that a market is unsettled and that a high degree of uncertainty is reflected in the daily price variation. While all markets inherently have a degree of volatility at any given time, this may increase and decrease significantly based on investor confidence and outside events.

Uncertainty is often what causes volatility in the market. However, uncertainty can take different forms. It can be very obvious, such as the uncertainty of an election or a pandemic or it can be more subtle, such as an unexpected change in inflation outlook or a policy change by central banks or even political rhetoric.

There are different ways to measure volatility. The most basic one is to use the standard deviation of past returns over a specific period of time. However, this method risks an over-focusing on historic returns.

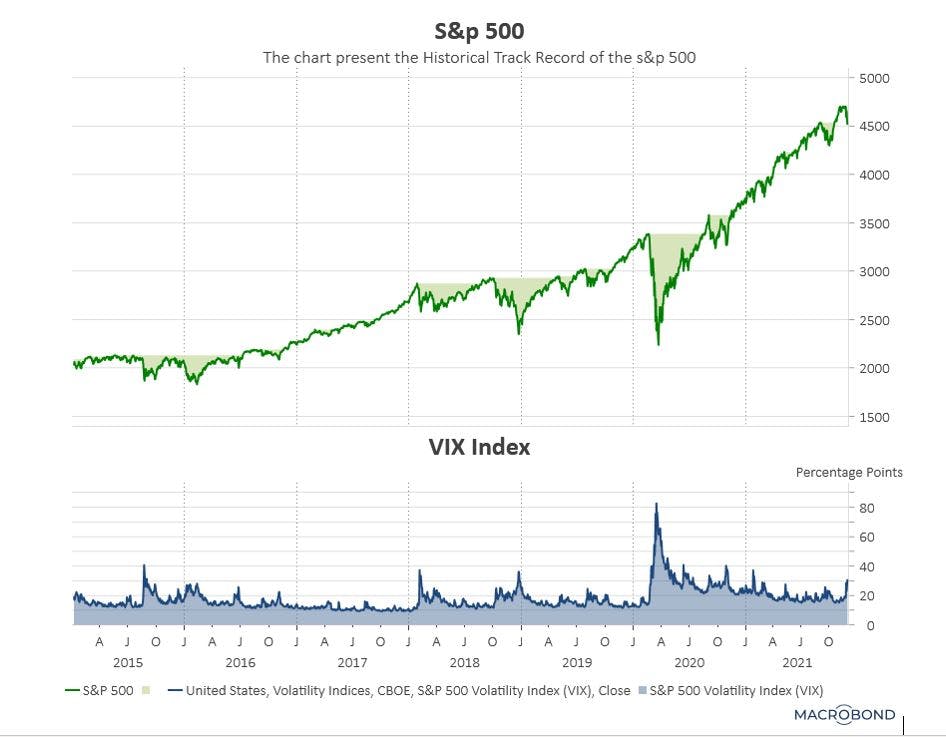

The Vix Index is often the way to highlight the most recent level of real-time volatility in the market. The Vix Index is based not on past market fluctuation but on the current level of volatility implied by the price of a basket of equity options¹. It is often the preferred method used to track volatility.

The Vix has the benefit of providing a more up-to-date measure of the current level of volatility. A measure below 15 is considered moderate to low and a measure above 20/25 is considered high.

Why has the pandemic created so much volatility?

It’s easy to see why markets have been so volatile. The ‘known unknown’ nature of the global Covid pandemic clearly gave markets a major shock during the early months of 2020, while there was a big rally later in the year after the news broke in November that Pfizer and BioNTech announced that their vaccine was 90% effective against the virus. Investors have since been trying to price-in how vaccination rates and public safety measures will safeguard economic value against the continuing threat of further waves of the virus.

What can we expect going forward?

Very likely we will continue to see uncertainty and probably a higher level of volatility than average. The big variable is how the world responds to further, potentially more lethal, mutations of the virus. The virus has affected almost every aspect of our lives, from travel to consumption, however even before Covid the global economy had a number of growing volatile elements in geopolitics, well-valued equity markets and record-low interest rates.

We should also note the emergence of technological disruption and the impact of environmental, social and highly scrutinised corporate governance considerations (ESG). These new trends were already providing elements for further uncertainty and consequently price disruption and increased volatility.

Closer to home, FTSE volatility, the value of the pound and predictions for the UK’s GDP are tied to ongoing disruption caused by Brexit. On a global scale, there have been concerns around supply chain blockages caused by the Covid lockdowns, and energy price rises, which have created uncomfortable inflationary pressures. These issues are likely to remain centre stage in 2022. The actions of the world’s central banks will be crucial as well, and more hawkish reaction than expected by the market could easily lead to more volatility.

Volatility is not all bad

So, should we worry? Not necessarily. While we’ve identified the key volatility variables here it’s worth emphasising that volatility, by its very nature, is never a one-way street. A look at economic trends shows us the negative impacts that markets can expect from the likes of Covid can be offset by growth in US jobs and earnings as well as optimism in economies around the world that government stimulus is protecting businesses.

While sudden volatility is rarely welcomed by investors (the old saying “stocks take the stairs up and the elevator down” has some truthfulness), it is important to remember that a rise in volatility does not necessarily equate to markets spiralling into a prolonged downturn.

If that was the case, we would not have seen the remarkable recovery in global markets that we’ve seen since March 2020. Finally, volatility is a natural state for markets that are constantly moving in price, while we should always be wary of it, it is the variable nature of markets that makes them investable in the first instance.

Nutmeg’s investment team monitor and model how market volatility might affect all our portfolios. We are always ready to make the adjustments we believe are necessary to protect portfolios and move them into positions of growth.

Source

- The VIX index is using a basket of short-term equity options to “imply” the level of volatility in the market. An option is a financial instrument that gives the owner the ability to buy something at a future date. Some equity options are listed on exchanges. Normally to calculate the price of an option, the level of volatility is an input parameter. The Vix index is based on the inverse concept. It uses the price of those listed option to “imply” the level of volatility needed to get this price. It gives a very dynamic and up to date view of market volatility expected by the different financial institutions active in the option market.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.