In today’s environment of rising inflation and interest rates, which might be the best option for you – a stocks and shares ISA, a cash ISA, a savings account, or all three?

The past two years have been defined by a surge in price rises that have been impacting all areas of our lives. This inflation has been caused by a combination of macroeconomic factors, including a return to normality after lockdown and the impact of energy prices amid the conflict in Ukraine.

While many commentators believe inflation may have peaked, this does not necessarily mean that day-to-day prices are likely to come down anytime soon.

The Bank of England sets an explicit target for inflation at 2% – some inflation is important to stimulate a healthy economy, but this target has clearly been breached in recent years. As it stands, the Bank, which uses monetary policy to either stimulate or cool price rises, is more likely to raise than cut its base interest rate in the near future – it stood at 4.25% as of April 2023.

With each rate rise from the Bank of England, our high street banks often follow suit with their savings accounts. While the Annual Equivalent Rate (AER) you can achieve on your cash savings may not be as high as 4.25%, it’s still higher than what you would have achieved in the decade prior to 2021, when interest rates were at record low levels (the UK base rate was at 0.1% in March 2020).

The best options for savers

Those looking to save should first consider the differences between a regular savings account and a cash ISA. The latter option is tax efficient – you do not pay tax on interest, dividends or investment returns on money held in an ISA. Note that there is an annual total contribution limit of £20,000. We cover the differences between accounts in more detail in our recent ‘ISA vs savings’ blog.

Both types of accounts can offer either instant access, or a potentially higher fixed rate of interest should you be prepared to leave the money untouched for a certain period of time.

The rate you can achieve on your cash savings varies across providers and can also depend on how long you are happy to put your money away for. For example, if you are happy not to access your savings for two years, a fixed rate cash ISA can be opened offering around 4.28% interest, though for an easy access cash ISA this falls to around 3.3% (as of 27 April 2023). These rates change often, and T&Cs apply, so it is best to do your research to find the best option for you.

While a cash ISA is the closest you can get to a guaranteed return, be aware that providers can and invariably will change interest rates and not necessarily for your benefit.

A high headline interest rate may entice you to open a cash ISA with a certain provider, but this will often be reduced after a set period – usually a year – meaning it is important to keep on top of your finances and be aware that the option to transfer your ISA is available (including to a stocks and shares ISA) without losing its tax-efficient status.

Should I invest today?

Investing is not for everyone. It is always advisable to have some cash readily available for emergencies, and you should only invest with money you can afford to put away for a longer time frame, preferably at least three years.

Still, if you are willing to invest, you open up the possibility of potentially better than bank rate returns over the longer term. Just remember that as with all investing returns are not guaranteed and you may end up with less than you invested.

While the current level of inflation in the UK may now be beginning to decline – the consumer prices index (CPI) was at 10.1% in the 12 months to March, down from 10.4% in February, according to official data – we have come through an exceptional period for price rises.

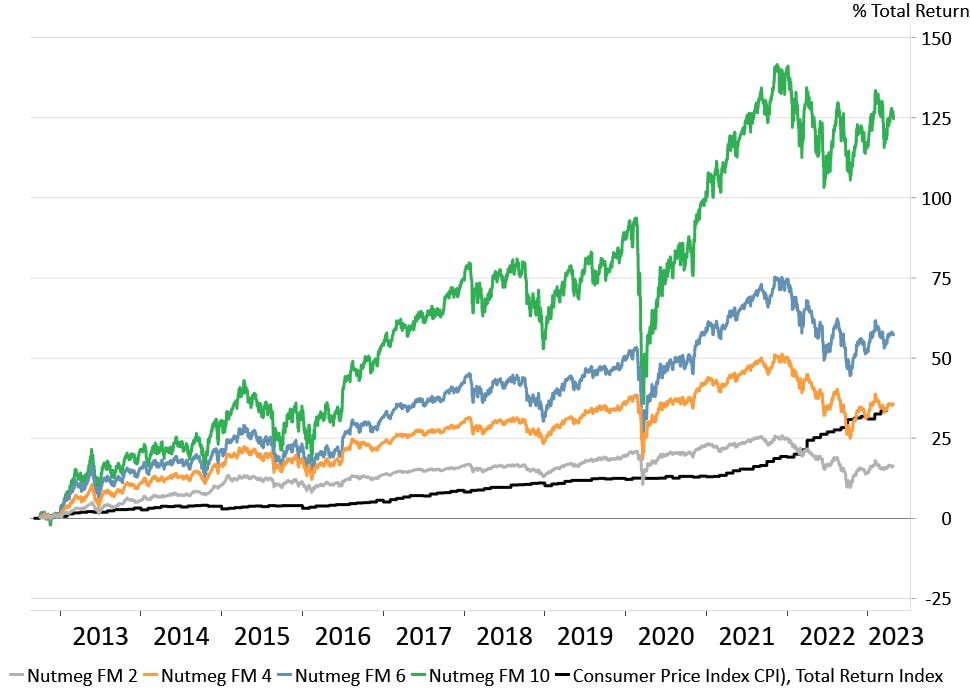

Those expecting their investments to have beaten inflation during this period, concurrent with a volatile time for markets, are likely to have been disappointed. However, taking a longer-term view, investing has historically often delivered better results than inflation, though this is not always the case and depends upon the time period selected.

Chart 1 shows the performance of Nutmeg’s different risk level multi-asset portfolios versus UK CPI over the past decade.

Chart 1: Nutmeg fully managed portfolios versus UK CPI (10 years)

While markets have been turbulent in recent months, that doesn’t necessarily mean it’s the wrong time to invest. Taking on a perspective of ‘time in’ the market rather ‘timing’ markets has its advantages.

As we explored in our recent ‘Is now a good time to invest?’ blog, from our investment team’s perspective, it’s never a bad time to invest, and stay invested, so long as you have reviewed your current financial situation to ensure you will retain enough cash on hand for emergencies and have chosen the appropriate risk level and timescale that suits your goals.

Being savvy with your ISA allowance

It’s worth noting that anyone can contribute to both a stocks and shares ISA and a cash ISA in any tax year, though this is subject to a combined annual allowance of £20,000 with no tax paid on growth, returns or interest.

Dependent upon your personal circumstances – your attitude to risk, how much you can afford to contribute, and when you might need the money – it may make sense to balance contributions to both a cash ISA and a stock and shares ISA: taking advantage of the higher interest rates on offer from cash accounts today, while also putting some money to work in the investment markets.

If this is your strategy, then in future years, if available interest rates on cash accounts do start to fall, you may then decide to begin contributing more towards your stocks and shares ISA, though again this is of course entirely based on your personal circumstances, and you may wish to seek financial advice.

Our guide to the accounts you need in your financial life may help you in considering your options and the different types of ISA available. Should you need more help, Nutmeg has its own team of experts on hand, who are available should you wish to book a free call, while we also offer a paid for financial planning service.

Options for long-term investors

While a high interest rate cash account certainly has its appeal – whether that’s easy access or fixed for one or two years – those looking to put their money away for a much longer time frame of at least three years may want to look at other options.

For instance, those wishing to build up a pot for their retirement may be looking to put their money to work for decades. It’s rare to find a workplace scheme or personal pension product that does not take some degree of risk in investing in equities and bonds over such a longer time frame, and for good reason.

In taking on a genuine long-term investment such as this, investors will hope to ride out different market cycles, with a return that could outperform cash over time.

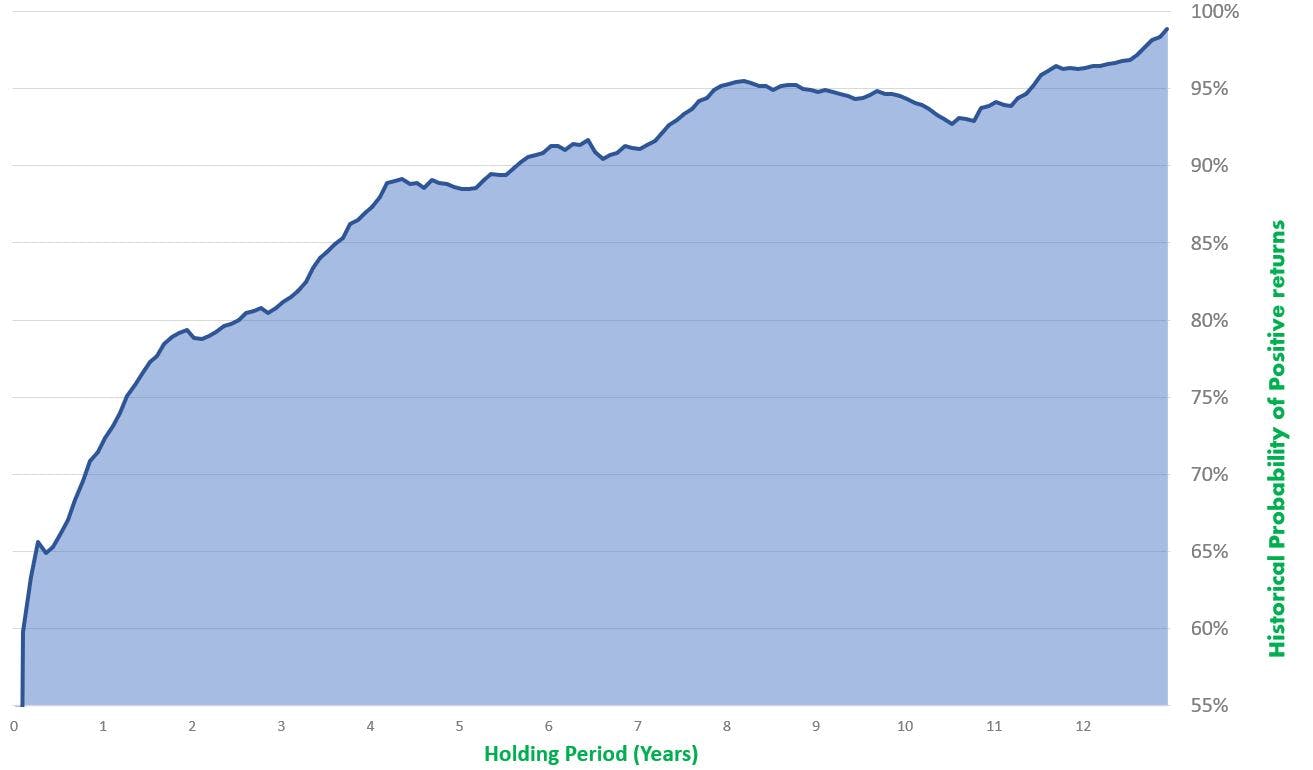

Indeed, history is on their side in this regard. As the chart below shows, the probability of positive returns has historically increased the longer you hold your investment, though of course history is not a guarantee of future performance.

Chart 2 – The probability of positive returns increases the longer you hold investments

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, January 1972- March 2023

The same principle may also apply to investing for children. With a Junior ISA (JISA), for example, a child will ordinarily not be able to access the investment until they turn 18. Opening a stocks and shares JISA at a young age could mean investing for close to two decades and, again going by the chart above, have a high degree of chance of delivering a positive return.

Those more cautious about investing or wanting to take advantage of the higher interest rates on offer right now, should note that, just as an adult can contribute to both cash and stocks and shares ISAs, a child can have both a stocks and shares JISA and a cash JISA in their name. However, the annual amount that can be invested in a JISA without paying tax on growth, returns and interest remains currently at £9,000.

We should also mention the Lifetime ISA (LISA) as a potential long-term investment product, available to open for those aged 18 to 39 and intended for use when buying a first home or in retirement. You can read more details about LISA’s in our latest guide, which also contains details of the 25% government bonus that is available on contributions. However, there is a penalty for withdrawing in circumstances other than buying your first home or retirement.

Note the annual limit for LISA contributions is £4,000 and is counted towards your annual total ISA allowance of £20,000, though this means it could sit next to other investments or savings if you wish to put more money away.

Making your money work for you

The tough inflationary environment that we are living through only goes to emphasise the importance of making your money work harder for you.

Whether it is keeping on top of higher savings rates, putting your money to work in markets, or a combination of both, planning for your financial future can give you greater peace of mind.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. Tax treatment depends on your individual circumstances and may be subject to change in the future.