In short, dividends reward shareholders by giving them a cut of the company’s profits. But there’s more to it than that. They can be of great benefit to portfolios in the long-term, especially when re-invested – that’s why they form a crucial part of our investment management strategy at Nutmeg.

In 2018, UK companies paid out the largest ever headline dividend, totalling £99.8bn [1]. US firms are also keen to reward their shareholders – with companies like Coca-Cola, Johnson & Johnson and 3M, increasing their dividends for 50 or more consecutive years [2]. But why are these dividends so important and how can they be best used by investors?

Explaining dividends

Dividend payments are the shareholder’s ‘share’ of the company’s annual profits. The amount you’ll receive depends on how many shares you hold. People buy shares in companies not just to make a return by selling them at a higher price in the future, but to receive a good, regular dividend.

Dividends can make up a large chunk of the return you can get from investing in a company and for that reason are seen by many investors as a key reason for owning stock. On the flip side, a high dividend in relation to the price of a company’s stock (known as the dividend yield) can serve as a warning that the company’s share price might be depressed for some reason. It could also mean that the dividend will be cut, so it acts as an indicator of a company’s future growth prospects too.

Re-investing dividends

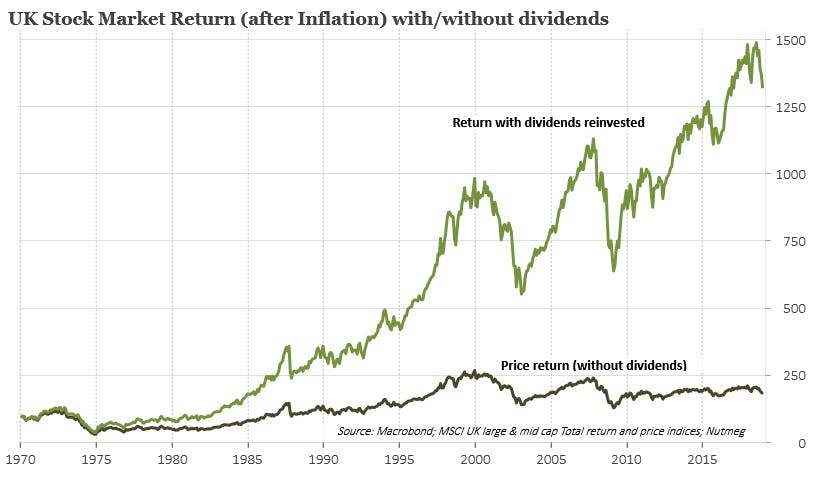

Re-investing dividends has been a powerful driver of stock market returns. The graph below shows the staggering difference between an investor who re-invests dividends and one who doesn’t. Investing £100 in 1970 would now be worth £140, without re-investing the dividends – that’s after inflation is taken into account. But when re-investing those dividends back into the market, that £100 would be worth an incredible £827 (again, after inflation). Put another way, the annual compound return for UK equities with dividends re-invested was 5.0% per year after inflation, but just 0.8% per year without dividends [3].

Source: Macrobond, MSCI UK Net Total Return and Price Return indices, 1st January 1970–31st December 2018

While the UK stock market is still below the level we saw before the financial crisis in 2008 (inflation adjusted), with dividends re-invested, the total return since June 2007 is in fact +20%. This is a clear triumph over cash returns in the same period [4].

Dividends at Nutmeg

Dividends are a cornerstone of our investment management strategy at Nutmeg. The vast majority of the funds we invest in on behalf of Nutmeg customers pay income – that is, dividends – from equity funds and income from fixed interest funds. These dividends are automatically re-invested back into our customers’ portfolios in our monthly rebalancing process, without any extra charge. This increases our collective buying power and gives you the chance to benefit even more from the power of compound returns.

Sources

[1] Financial Times, UK corporate dividends break new record in 2018 – 21 January 2019

[2] USA Today, These 25 companies have over 40 consecutive years of dividend hikes – 30th August 2018

[3] Nutmeg calculations using data from Macrobond based on MSCI UK indices, 1st January 1970–31 December 2018. Figures exclude fees but are net of withholding tax on dividends

[4] Nutmeg calculations using data from Macrobond, MSCI UK indices, Bank of England data on average ‘sight’ deposit rates and the Consumer Price Index, 30th June 2007-31st. The return on cash deposits was 15.0% (nominal) compared to a 29.5% gain in consumer prices

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past and future performance indicators are not a reliable indicator of future performance.