Investing should be considered a long-term undertaking. Short-term losses can cause stress, after all no-one likes to see their portfolio go down in value. However, staying in the market and resisting the temptation to tinker can pay off in the long term.

Maximising your chances of positive returns

Let’s widen the picture to look at global stock market data between January 1971 and July 2022. If you had randomly picked one day during this period and chosen to invest for just those 24 hours, you would have had a 52.4% chance of making gains — similar odds to the toss of a coin.

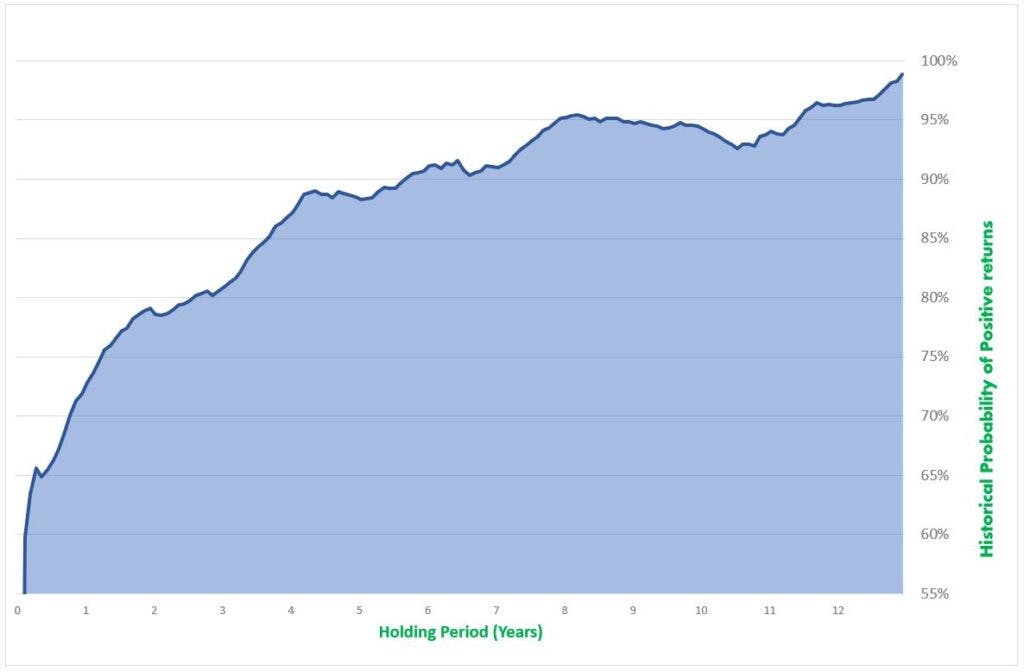

Long-term investing dramatically increases your chances of returns. Just weeks more in the market can make a considerable difference, as chart 1 shows.

If you had invested your money for any random quarter (65 trading days, excluding weekends) during that same 50-year period, your chances of making a profit increased to 65.6%. Investing for any one year would have generated a positive return 72.8% of the time, while investing for 10 years increased your chances to 94.2%.

These findings make for compelling reading, however please remember, past performance is not a guarantee of future performance. Also, you may want to keep in mind our six principles of investing.

This analysis, including the chart, looks at the probability of generating returns during this long-term period, though is not an indication of the actual level of return.

Chart 1: Probability of positive returns increases the longer you hold your investment

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 1 January 1972- July 2022

Time in the market, not timing the market

The longer you invest, the less likely you are to lose money. It’s as simple as that. Looking at data from developed equity markets in the same period between 1971 and 2022, your chances of suffering a loss go down over time.

As shown in chart 2, no matter when you invested during this period, long-term investing dramatically increased your probability of avoiding losses.

Chart 2: Historical probability of loss decreases when holding equities for longer

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 1 January 1972- July 2022

Clearly, the first year can be stressful because a year in isolation is more likely to show losses than a longer timeframe. This is when anyone new to investing may feel stressed about the ups and downs in financial markets.

The likelihood of making a loss should go down over time, and so too can those feelings of anxiety – particularly as you grow familiar with the natural ebb and flow of market prices. Taking the big picture view and understanding the fundamentals of investing over several years can make one day’s volatility seem insignificant, so long as you have emergency funds in place and do not need to access the money immediately.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.