We've been totting up the figures on how to retire comfortably at 55 in the UK (though the nominal minimum pension age will rise to 57 in 2028). To retire at 55 with financial freedom, and some luxuries such as overseas holidays, it is estimated that an individual would need annual income of around £37,300 per year. A couple would need £54,500. We explore how much you will need to give your pension a boost, including estimates for monthly contributions and total pot size.

Key Facts about retiring early (at a glance)

Frequently asked questions about retirement | Key facts |

|---|---|

How much income per year does a single person need to live on in retirement? (according to: https://retirementlivingstandards.org.uk) | Minimum: £12,800 |

How much income per year do couples need to live on in retirement? (according to: https://retirementlivingstandards.org.uk) | Minimum: £19,900 |

What is the State Pension age in the UK? | The State Pension is currently 66 years old for both men and women but will start gradually increasing again from 6 May 2026. It will gradually rise to 67 for those born on or after April 1960. |

How much will I get in a State Pension? | The full UK State Pension is £203.85 per week. You can check your forecast at https://www.gov.uk/check-state-pension |

What is the average life expectancy of men and women in the UK? | Men: 79.0 |

With most of us able to access our personal pensions and workplace pensions from 55 (rising to 57 in 2028), it makes sense to ask how much money you would need to retire in your fifties.

How much do I need to retire at 55?

It really depends on what you plan to do with your retirement. Are you planning on jetting around the world, or do you have more modest ambitions?

According to the Pensions and Lifetime Savings Association's Retirement Living Standards, for those looking to fund a 'minimum' standard of living - covering essential spending requirements such as bills and food, with only a small amount left over for discretionary spending - an individual pensioner would need around £12,800 per year. The figure comes in at £19,900 for a couple.

For a 'moderate' standard of living, this rises to £23,300 for an individual and £34,000 for a couple. In addition to all essential spending requirements, this also allows for more financial security and stability for a few extra treats.

If instead the aim is for a 'comfortable' standard of living - with additional luxuries such as three weeks of holiday in Europe every year - an individual would need around £37,300 per year with the amount for couples at £54,500.

In its research, the Pensions and Lifetime Savings Association has made a number of assumptions about what is needed for a minimum, moderate, or comfortable lifestyle, and these will differ from person to person. You should therefore treat the figures with caution and consider how they apply to you. However, that being said, they can provide a useful steer on what you need to be saving now for retirement.

What is a good pension pot at 55?

Let's say you started contributing seriously to a personal pension as an investment from the age of 20 with the intention of a 'comfortable' retirement at 55. For this example, we'll disregard that the age of retirement will likely be higher by the time you reach your 50s. We'll also be excluding the State Pension from our estimates.

To reach the figure of £37,300 per year, Nutmeg estimates* you would need to contribute around £1,560 per month for 35 years.

While no investment is ever guaranteed, a long-term commitment of regular contributions may also give you the best opportunity in building a sizeable pension pot. Taking into account average investment returns, the impact of inflation (in this case an average of 2% per year over the longer term, despite inflation being higher today), and fees, in this example we estimate you could end up with a total pot at retirement of £1,864,900.

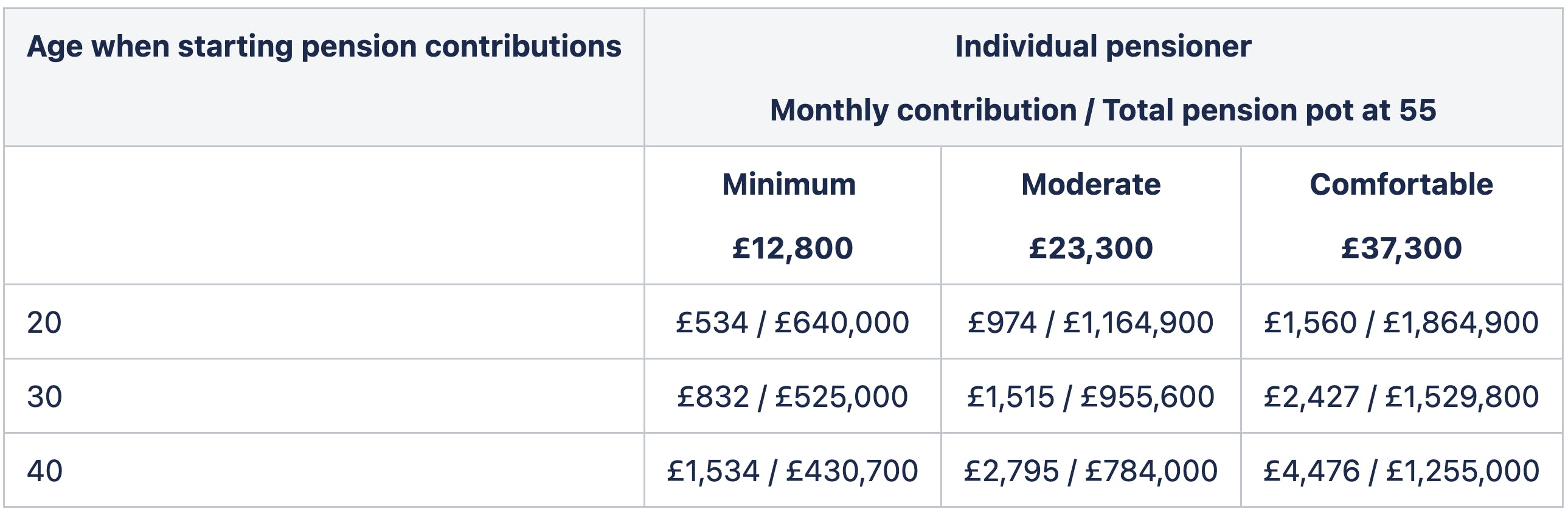

Table 1: How much do I need to contribute to a pension to retire at 55?

Source: Nutmeg, *Calculations assume a starting pension value of £500, an annual return of 5% with costs of 1% and factors in inflation at 2%. Calculations assume people will retire at 55 and do not take into account any State Pension entitlement.

Remember that achieving a consistent 5% return for each and every year that you invest is not realistic, and that costs and inflation rates are likely to vary.

What is the minimum amount needed to retire early?

A common definition of early retirement is stopping work before the State Pension age (for those retiring today it is 66 for men and women, but if you were born after 5th April 1960, there will be a phased increase in State Pension age to 67, and eventually 68). At 55, rising to 57 in 2028, you will be able to access your personal and workplace pensions (including potential employer contributions to your workplace pots). This age is considered to be an early retirement for most.

To reach the aforementioned 'minimum' retirement annual income of £12,800 for an individual, the same 20-year old that we spoke about earlier should be looking to contribute around £534 per month to their pension, according to Nutmeg estimates*. This may result in a total pot at 55 of an estimated £640,000.

However, more realistically it may be that an individual may not be able to afford to (or even want to) contribute meaningfully to a pension until a later age. Let's say then, that the first contribution was made at 30. According to the same Nutmeg estimates, they would need to contribute £832 per month from this age to then reach a total pot at 55 of £525,000.

How about if they didn't start contributing until the age of 40? In this case, based on the same workings, they should be contributing £1,534 per month which might result in a total pot at the age of 55 of £430,700.

It's important to note that the size of your total pension pot at 55 can be impacted by many variables, including the impact of investment returns and compounding - the longer you invest for, the bigger impact this could have. Also, note the figures will change if you are a couple, with the need for a larger pot overall (see Table 3).

How much would I need for a 'moderate' retirement at 55?

Let's say you wanted to reach a little further with a retirement pot with more financial stability and some money left over for the occasional holiday, say, or some meals out and other treats. You'll remember, the Pensions and Lifetime Savings Association estimates a desired income for an individual at £23,300 per year.

Again, we'll run through the scenarios for investing in a personal pension at different ages, and Nutmeg's estimates for required monthly contributions and total pension pot sizes.

Starting investing at 20, we estimate* you would need to invest around £974 per month into your pension, and given average investment returns, this might give you a total pot at 55 of £1,164,900 putting you into the bracket of a pension millionaire.

Starting your contributions a decade later at 30? In this case, you will need to increase your contributions to £1,515 per month to give you a total pot that might fall just under the magic million at £955,600. Remember, though as with all these scenarios, these are purely estimates and investing offers no guarantee of positive returns.

Starting a personal pension a little later in life, at 40, would mean more sizeable monthly contributions of £2,795 and a total pot in 15 years' time of £784,000.

How much will I need for a 'comfortable' retirement at 55?

How we define 'comfortable' depends on the individual, of course. Maybe not a life filled with luxurious stretch limos and caviar lunches, the Pensions and Lifetime Savings Association talks of a comfortable monthly retirement income for an individual of £37,300.

A more extreme approach to pension contributions may appeal to proponents of the FIRE movement (Financial Independence, Retire Early). Defined by frugality and extreme savings and investment, those following this approach are known to put up to 70% of their annual income away at a young age in order to fund an early retirement.

According to our estimates*, at 20 you would be looking at monthly contributions of £1,560 to achieve a total pot at 55 of £1,864,900. However, given the average salary for those aged 18-21 in the UK is just £22,932 (according to ONS/Forbes), that would probably be difficult for most at that age.

Starting at 30, again there's another steep climb in required monthly contributions of £2,427 with a total pot coming in at £1,529,800.

At 40, you would need to make a considerable contribution to your pot of £4,476 per month, with a total pot at £1,255,000.

However, remember, all of these illustrations are for personal pension contributions only and do not take into account the money you may be entitled to from a State Pension. You may also have workplace schemes separate from your personal pension pot(s).

What is the average pension pot in the UK?

According to the most recent data from the Office for National Statistics, average pension pots in the UK in different age groups are in descending order as follows:

- Average pension pot for 55-64 year olds: £107,300

- Average pension pot for 45-54 year olds: £75,000

- Average pension pot for 35-44 year olds: £30,000

- Average pension pot for 25-34 year olds: £9,300

- Average pension pot for 16-24 year olds: £2,700

How much does a couple need to retire at 55?

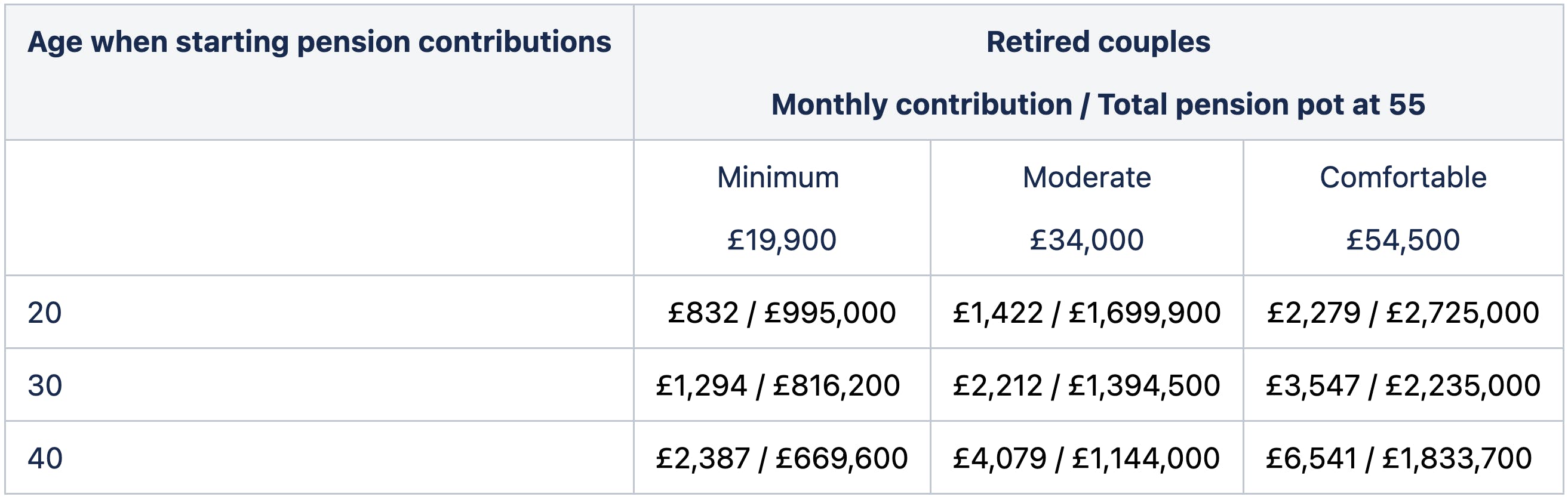

As we have done for individuals, we can also estimate contributions and total pot sizes for couples who wish to retire together at 55 (assuming for the sake of data simplicity that they are the same age).

This is again based on the Pensions and Lifetime Savings Association's Retirement Living Standards, which estimates annual incomes for 'minimum' (£19,900), 'moderate' (£34,000), and 'comfortable' (£54,500) lifestyles in retirement.

Table 3 below outlines these scenarios, but let's run through an example scenario. Say a couple, Sita and Jake, meet in their twenties, perhaps getting married soon after. At 30, they both have separate workplace pensions and start personal pensions at the same time, again held individually. In this case, we're only looking at combined figures for personal pots.

After meeting a financial adviser, they prioritise aiming for a comfortable retirement at 55. Both are keen cyclists and want to start travelling the world on their bikes after they finish work, stopping off in spa resorts after for relaxation and good food. At home, they want the financial freedom for day trips while also financing the cost of higher education for their two children.

In this case, a 'comfortable' joint income would be estimated at £54,500 per year. To achieve that, Nutmeg estimates* they would need to contribute a combined amount of £3,547 to their pensions monthly (in this case, let's say it's split evenly at £1,773 each). Providing they continue these contributions for the 25 years from 30 to 55 - and taking into account assumptions of an annual return of 5% with costs of 1% and inflation at 2% over that period - the total pot would come in at around £2,235,000.

Table 2: How much do couples need to contribute to a pension to retire at 55?

Source: Nutmeg, *Calculations assume a starting pension value of £500, an annual return of 5% with costs of 1% and factors in inflation at 2%. Calculations assume people will retire at 55 and do not take into account any State Pension entitlement.

Remember that achieving a consistent 5% return for each and every year that you invest is not realistic, and that costs and inflation rates are likely to vary.

Is a £500k pension pot enough to retire at 55?

Yes, in many cases this would be enough. In its research, separate from Nutmeg's estimates, Which suggests that an individual may need a pot of £173,000 if they opt for drawdown or £182,000 if they were to opt for an annuity at 55.

This is based on Which's own definition of a 'comfortable' lifestyle at £20,000 income per year, including essentials plus regular short-haul holidays, recreation and leisure, tobacco, gifts to family and friends, alcohol and charity donations.

Factoring in the State Pension into your early retirement plans

The research we've presented here focuses on personal pensions, and so doesn't take into account any State Pension entitlements. While you'll have access to workplace and private pensions at 55, you won't be able to receive State Pension until you reach a certain age for men and women and this has to be factored in.

How much you will get from State Pension depends on when you were born and you can check your State Pension forecast on the government website.

The full basic State Pension is £156.20 per week for the 2023/24 tax year, though this is dependent upon your National Insurance record. If you’re a man born on or after 6 April 1951 or a woman born on or after 6 April 1953, you’ll get the new State pension instead. The new State Pension was introduced on 6 April 2016. The full amount claimable is £203.85 per week, though this is dependent upon your National Insurance record.

The Government is legally required to increase the basic and new State Pension each year at least in line with average earnings. Under its ‘triple lock’ commitment, the Government will increase State Pensions by whichever is highest of average earnings growth, CPI inflation, or 2.5% - by April 2024, State Pensions are expected to rise by 8.5% in line with earnings.

The triple lock has been in play for more than a decade, except for a temporary suspension in 2022/23. However, there is no guarantee that this will continue indefinitely.

Why should I invest in a personal pension?

A personal pension can be a very prudent and tax efficient way of investing for your post-work life. You can either open a personal pension and contribute yourself, or transfer existing personal or workplace pensions. You can choose how your pension is invested and what level of risk you’d like it to be set at.

A big incentive for using a personal pension is tax relief. If you’re a basic rate taxpayer, contributions you make to your workplace or personal pension benefit from 20% tax relief. This means that every pound in your pension only costs you 80 pence, with the other 20p coming from the basic rate of income tax you would have paid. Instead of HMRC receiving that tax, it goes straight into your pension pot.

Tax relief can be applied 'at source' with a pension provider, such as Nutmeg, automatically adding the 20% to your pot once you've made your contributions. For workplace pensions there is also the 'net pay' method whereby contributions are deducted from the employee’s gross salary (i.e. before tax has been deducted).

Tax relief is linked to the highest band of income tax you pay and you may claim back tax relief over the 20% basic rate from HMRC if you're a higher-rate tax payer. Tax relief is not available on contributions made after the age of 75. We outline full details of this and the difference between pensions, ISAs and Lifetime ISAs (LISAs) in our recent blog Understanding Tax Relief on Pensions.

Tips to help you achieve your goal of retiring at 55

We asked Claire Exley, senior manager, wealth services, at Nutmeg, for her top tips on helping you to achieve your goal of early retirement:

- "Know what you have and make a plan. This sounds simple but lots of people don’t understand their existing pensions, where they're invested, what the charges are, and how much they will need for a comfortable retirement. Getting advice or guidance can make a real difference here.

- "Consider consolidating your pensions. If you have your pensions in one place it can make it easier to manage and potentially reduce fees (providing you don’t lose any valuable benefits – see point 1, know what you have!)

- "Make the most of employer contributions from workplace pensions. Often your employer will match your contributions so if you’re not making the most of this you could be missing out on free money.

- "Take the right level of risk for your time horizon. If retiring is a long way away you may be able to take more risk as you have time to ride out the ups and downs of the market – the default option for your pension might not be right for you (point 1 again!)"

Need further financial guidance? We're here to help

We appreciate that planning for retirement can be a complex undertaking, regardless of your age or when you plan to retire. This blog may act as a rough guide to get you started, but all individuals have different financial circumstances. You may wish to speak with a professional to tailor a plan specific to your retirement goals. You can read more in our recent blog, Do I Need A Financial Adviser For My Pension?

Nutmeg has a team of qualified financial planners on hand who offer restricted financial advice. This service is regulated, and you can expect a full personalised recommendation on your finances. Just remember that as this is restricted, we can only advise on Nutmeg products and services.

You can book a free initial consultation with a member of the team; they will get to know a bit about you and your circumstances, and then recommend whether or not advice could be right for you. If you choose to go ahead, we'll build your financial plan and help you implement it for a one-off fee of £575.

If alternatively you'd just like some guidance, you can book a call with an expert, free of charge. Financial guidance means we can provide you with useful factual information on what each investment product does, enabling you to make your own decisions.

We're here to help you make the decisions that are right for you, your circumstances, and your money.

*Calculations assume a starting pension value of £500, an annual return of 5% with costs of 1% and factors in inflation at 2%. Calculations assume people will retire at 65 and do not take into account any State Pension entitlement.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Before you transfer, check you won’t lose any guarantees or benefits and that you know what charges you may incur. Please note that during any transfer, your investments will be out of the market.

If you are unsure if a pension is right for you, please seek financial advice. Forecasts are not a reliable indicator of future performance. and are intended as an aid to decision-making, not as a guarantee.

The PLSA/Loughborough University Retirement Living Standards are the property of and are provided by Pension and Lifetime Savings Association and Loughborough University.