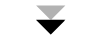

Environmental

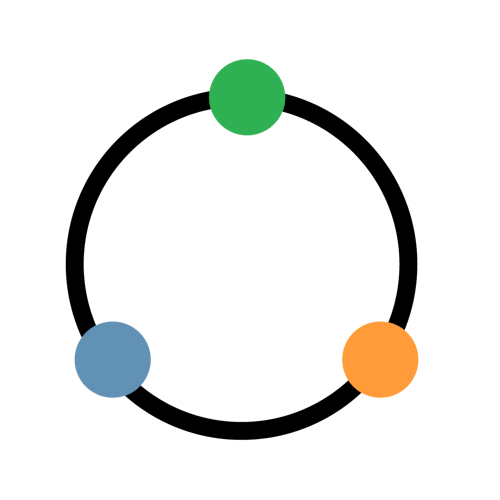

- Carbon emissions

- Water stress

- Climate change

- Pollution and waste

- Renewable energy

Our Socially responsible investment (SRI) portfolios aim to help you to achieve your financial goals while focusing on investments in companies and bond issuers that take into account certain environmental, social and governance (ESG) considerations.

With investment, your capital is at risk.

With continuous oversight from our in-house investment team, our SRI portfolios place an emphasis on investments in companies and bond issuers that take into account certain environmental, social and governance considerations.

You can read more about how we developed the ESG scoring of our SRI portfolios.

“I want my portfolio to be proactively managed by experts and invested in companies that are better positioned to manage the risks that come from environmental, social and governance factors.”

Our SRI portfolios lean towards companies and bond issuers that have high environmental, social and governance (ESG) standards. We invest SRI portfolios in exchange traded funds (or ETFs) that avoid companies engaged in controversial activities, while focusing on those that lead their peers on ESG.

Yes. Like our Fully managed style, our team of investment experts will monitor your SRI portfolio for you. This means rebalancing when necessary, to ensure your SRI portfolio is aligned at all times to your long-term objectives, and making strategic adjustments to the mix of investments.

Choose from 10 risk levels, low to high, to reflect your risk appetite.

No. You can have access to your money in a few days, at any time, with a stocks and shares ISA or general investment account. Pension, Lifetime ISA and Junior ISA have withdrawal restrictions and conditions that may apply.

Radically transparent, focused on the long term, and focused on companies with good environmental, social and governance credentials, our SRI portfolios meet our criteria for what the future of investing should look like.

We recognise the importance of ESG factors in delivering sustainable long-term returns and work alongside MSCI, a global leader in ESG research, to do so. We believe that to ignore the risks and opportunities arising from ESG would be a failure of our fiduciary responsibilities. By engaging with these important issues, we build and manage SRI portfolios to include investments that take into account certain ESG considerations.

We score all Nutmeg portfolios – not just SRI portfolios – against a range of environmental, social and governance factors. We hope to set a new standard for the industry, that all investments should be assessed with ESG factors in mind, not just returns.

All five Nutmeg investment styles are built by experts and use exchange traded funds (more on ETFs here) to diversify across stocks, bonds, industries, even countries.

Choose the one that works for you.

Environmental

Social

Governance

Below you can see a detailed breakdown of our performance, as well as an indication of how our investments are allocated across global financial markets.

Explore our track record for each of our 10 risk-based Socially responsible investment portfolios.

The past performance shown represents a composite of asset-weighted average returns for Nutmeg client portfolios, net of all fees. A composite return represents the average return of all client accounts for a given risk level on a given day, weighted by assets. Past performance is not a reliable indicator of future performance.

*The annualised figure is the return since inception expressed as a compound annual rate. For example, a portfolio with an annualised return of 6% corresponds to an actual return of 19.1% over three years (rather than 18% as you might expect) due to the effect of compounding. Please note, for the Nutmeg vs ARC comparison we are comparing Nutmeg SRI portfolio data vs ARC Non-SRI data.

Capital at risk.

Input estimated investment

The industry is awash with different labels for this kind of investing, which can be very confusing for investors. At Nutmeg, we’re using the term socially responsible investing (SRI). We believe this term fairly reflects our clients’ interests in limiting exposure to companies that engage in controversial activities while increasing exposure to companies that lead their peers in social responsibility.

Read more: How we developed our socially responsible scoring and portfolios

Our analysis has shown that there are no meaningful (statistically reliable) differences in the performance of strategies incorporating an SRI focus and those that don’t*.

Rather than assume that incorporating these factors into an investment process will lead to lower returns, there is increasing evidence that socially responsible investing could in fact lead to higher returns. The premise is simple: the companies that are best placed to operate successfully in the future are those with strong social responsibility profiles, that do business in a fair and progressive way, with a management team that addresses short-term risks while ensuring the company is positioned to adapt to long-term transformational changes – such as climate change.

*Accurate as of September 2021

We use industry-leading ESG research and analytics from MSCI to calculate scores for every single one of our investment portfolios against a range of ESG factors. We’ve also used this same data, combined with Nutmeg’s investment expertise, to build ten portfolios with social responsibility at heart, while remaining true to Nutmeg’s investment philosophy.

Rather than use an over-simplified label and leave things to interpretation, we’re using Environmental, Social and Governance (ESG) criteria – an accepted framework for analysis in this area.

Read more: The investment philosophy behind our socially responsible portfolios