Open a personal pension with Nutmeg

Get total visibility of your personal pension when you open or transfer to Nutmeg and step into the pension glow.

With investment, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

Recognised

Nutmeg has been awarded Boring Money Best Buy Pensions 2023

Protected

Client assets are held separately with Barclays and State Street, per regulatory requirements

Trusted

Chosen and trusted by our clients for over 10 years

What is a personal pension?

A personal pension - also called a private pension - is a tax-efficient way of saving for your retirement. The money you build up during your working years, is to provide you with an income in later life, when you may reduce or stop working. The income you receive at retirement is based on the amount you have contributed and the performance of those investments. You can either open a personal pension and contribute yourself, or transfer existing personal or workplace pensions. You can choose how your pension is invested and what level of risk you’d like it to be set at.

Personal pensions if you're self-employed

Opening a personal pension can also be great if you’re self-employed as, thanks to tax relief, a contribution of £100 turns into £125 - or even more if you are a higher rate taxpayer.

Tax treatment depends on your individual circumstances and may change in the future.

Why open a personal pension with Nutmeg?

Take control

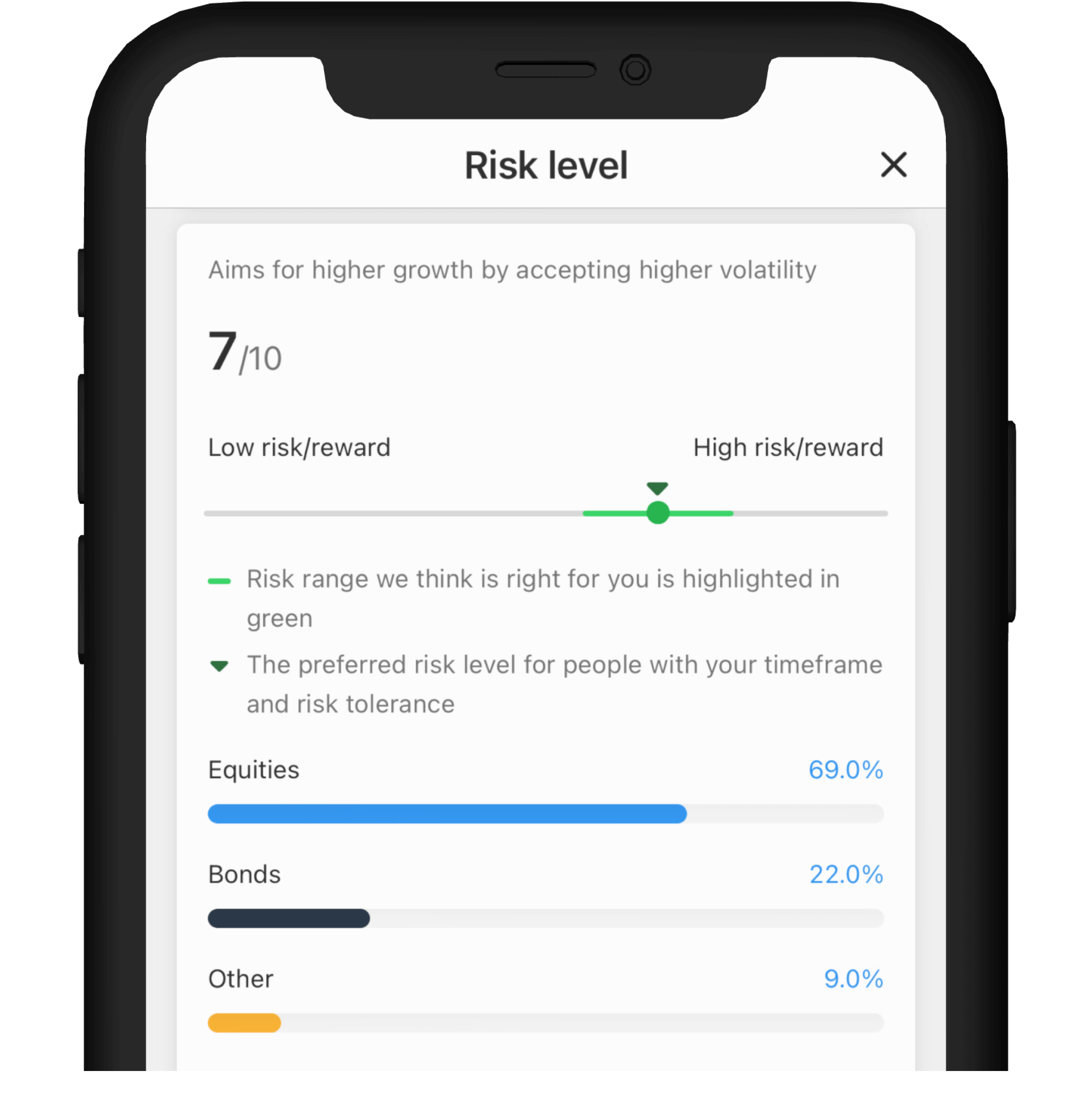

Choose how you want us to manage your pension and what risk profile is right for your goals.

Stay on track

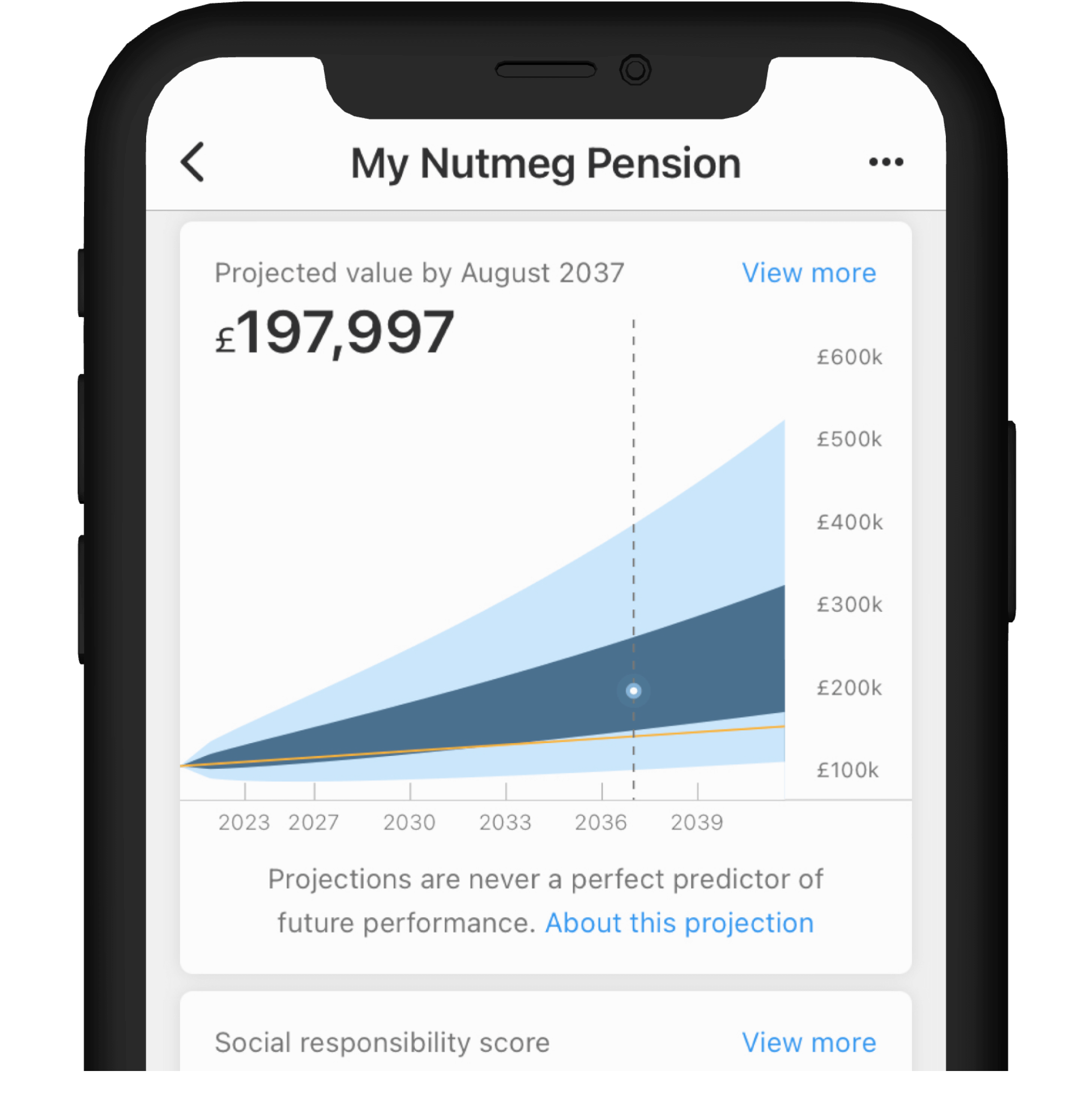

See how much your pension could be, and exactly where it's invested with our easy to use tools.

Trust the experts

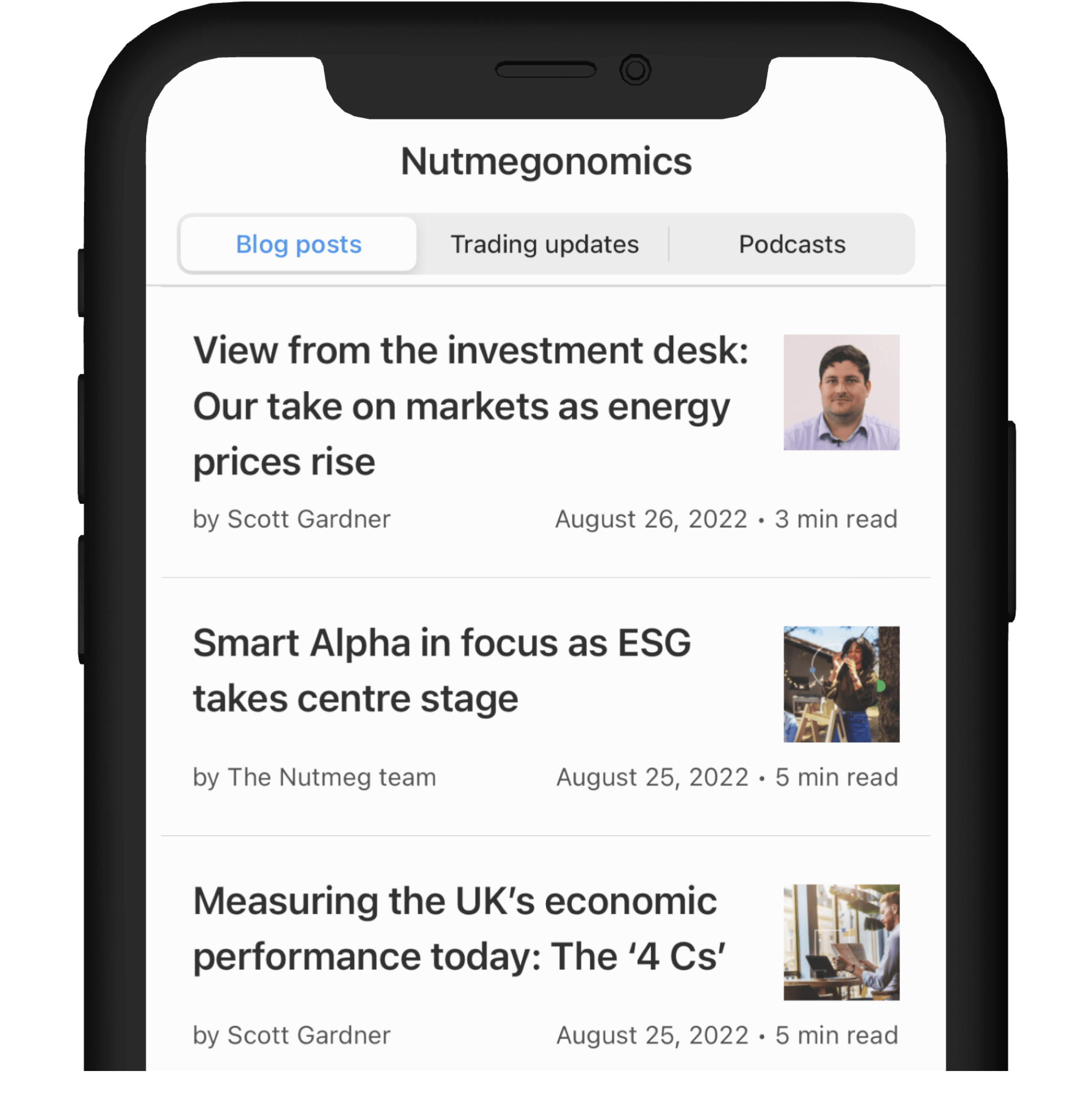

Our expert investment team will manage your pension for you and keep you updated.

Projections are never a perfect predictor of future performance, and are intended as an aid to decision-making, not as a guarantee. The projection includes the effect of Nutmeg’s fees, investment fund costs, and market spread – personalised to your planned contributions.

Pension planning, financial guidance and advice

Need some help getting started?

It’s free to speak to one of our experts, who can talk you through your best options and how to set up your pension to achieve your future goals.

Book a free call

Looking for a retirement plan?

We offer restricted financial planning and advice where one of our experienced financial planners will get to know you and your goals, and recommend a strategy to help you reach them.

Find out more

Do you have a pension to transfer?

If you would like to speak to someone before you transfer a pension, we can talk to you about what we offer in more detail.

Book a free callOpen a personal pension on our app

It’s easy to open or transfer your existing pensions, top up and track performance, all in our Nutmeg app.

How much will you have for retirement?

See how much you should be saving to achieve your dream retirement with our easy-to-use pension calculator.

Pension calculatorChoose your investment style

All Nutmeg investment styles are built by experts and use exchange traded funds (more on ETFs here) to diversify across stocks, bonds, industries, even countries.

Choose the one that works for you.

Our personal pension fees

As with any private pension, there are underlying costs. But rather than burying our fees in the small print, we want to be clear and up front about exactly what we charge.

Input estimated investment

Learn more about pensions

Past performance and allocation

Below you can see a detailed breakdown of our performance over the past few years, as well as how our investments are allocated across countries and assets.

- Track record

- Asset allocation

- Countries allocation

Track record

Explore our full 10-year track record for each of our 10 risk-based, Fully managed portfolios and see how our results compare against our competitors.

The past performance shown represents a composite of asset-weighted average returns for Nutmeg client portfolios, net of all fees. A composite return represents the average return of all client accounts for a given risk level on a given day, weighted by assets. Past performance is not a reliable indicator of future performance.

*The annualised figure is the return since inception expressed as a compound annual rate. For example, a portfolio with an annualised return of 6% corresponds to an actual return of 19.1% over three years (rather than 18% as you might expect) due to the effect of compounding.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. A pension may not be right for everyone and tax rules may change in the future. Please note that during any transfer, your investments will be out of the market. If you are unsure if a pension is right for you, please seek financial advice.

Most people ask us

What are some pension key facts?

What are some pension key facts?

Most people in the UK can get tax relief on pension contributions up to 100% of their earnings or up to the government-set annual allowance, whichever is lower.*

The annual allowance is the amount of money you can contribute to your pensions without incurring any tax charges. For most people, the annual allowance is £60,000 for the current tax year.

It may be lower if:

- you’ve already started to flexibly access your pension

- you’re a high earner and have an adjusted income of £260,000 or above

Tax relief comes in the form of government ‘top-ups’ of the contributions into your pension pot.

Everyone can get at least 20% tax relief, equivalent to the basic income tax rate, on contributions. Higher-rate and additional-rate taxpayers may be able to claim more.

If you’re not working or not earning enough to pay income tax, you’re still able to receive tax relief on up to £3,600 of pension contributions in a tax year.

By using pension carry forward, you can use any unused annual allowance from the previous three tax years to make pension contributions in the current tax year.

Learn more about the Nutmeg pension.

*Tax treatment depends on your individual circumstances and may be subject to change in the future.

What are the different types of pension?

What are the different types of pension?

Provided you have the qualifying national insurance record, most people in the UK are able to claim a state pension.

If you’re employed, you’ve likely been auto-enrolled into your employer’s workplace pension scheme.

If you’re self-employed, or even if you already have a workplace pension, you can also have a personal pension.

A workplace pension can be set up as a defined benefit scheme or a defined contribution scheme, while a personal pension is usually operated as a defined contribution scheme.

You’ll need to work out which type of pension is right for you.

What are my retirement options?

What are my retirement options?

In most cases, once you turn 55 (rising to 57 from 2028) you have a number of options for what to do with the money in your workplace and personal pension pots. But you don’t have to start taking your benefits when you’re 55 — you could leave it until you’re older if you want. You could even start withdrawing from your pension and continue to work, if you wish to.

You can start claiming your state pension once you reach state pension age.

How and when you withdraw your pension will depend on your personal circumstances and your retirement goals, and whether it’s a defined contribution pension, a defined benefit pension, or a state pension. Learn more about your pension pot and retiring at 55.

How do I combine pensions?

How do I combine pensions?

Pensions and their rules can be confusing. It can also be tough to keep track of things if you have different pension pots with different providers.

Consolidating your pension pots into one easy-to-manage personal pension may be more convenient, allow you to keep better track of it, and should reduce your paperwork.

One combined pension could also potentially save you fees and charges, and help you assess whether you’re maximising the tax relief you’re entitled to. Learn more about how pensions work. Some pensions may have protected benefits that you could lose if you transfer, so it's important to check any benefits before you transfer your pension.

What is pension drawdown?

What is pension drawdown?

Pension drawdown is a way of using your pension to maintain a regular income in retirement by reinvesting your pot in funds specifically designed and managed for this purpose.

Flexible-access drawdown allows you to have control over your pension income and to make withdrawals as and when you need to. While it doesn’t offer the option of a guaranteed income, flexible-access drawdown can be used to provide a regular adjustable income. But remember, any income or further withdrawals over the original tax-free 25% are taxable at your rate of income tax. There may also be a number of associated fees and charges associated with drawdown that you need to be aware of.

Nutmeg offers drawdown in partnership with our pension administrator Hornbuckle. If you hold a pension with Nutmeg, you’ll receive an information pack, or ‘wake-up pack’, on reaching your 50th birthday containing details of your pension. You’ll also receive a wake-up pack on reaching your 55th birthday and every five years on from that point, until your pension fund is fully crystallised.

How do I withdraw money from my pension?

How do I withdraw money from my pension?

You can usually start drawing down your pension from the age of 55, rising to 57 from 2028. The first 25% is tax free and the remainder is subject to income tax.

Nutmeg offers flexible drawdown, this means you’re in control as you can choose how much of your pension pot you take and when you’d like to withdraw from it.

For more information on withdrawing money from your pension, read our dedicated support page.

Why choose a Nutmeg personal pension?

Why choose a Nutmeg personal pension?

Our personal pension is easy to use and transparent. It is straightforward to start a Nutmeg pension or transfer an existing pension. Nutmeg charges no hidden fees, and it will always be clear how much we’re charging you for our services.

Our pension portfolios are expertly designed.

- Your pension is proactively managed by our experienced investment team. They’ll regularly make strategic adjustments to try to protect against losses and boost returns, to keep your pension on track with your retirement goals.

- If you’d prefer to, you can choose to invest your pension with a socially responsible focus, with a view to investing in companies that do business in a fair and progressive way.

- You'll receive your 20% tax relief on personal contributions, subject to your tax status..

It’s accessible.

- You can log in whenever you want on web or mobile, to see where your pension pot is invested, how it’s performing, and how close you are to reaching your retirement target.

- When you open a Nutmeg pension, you can get started with as little as £500.

- It’s easy to manage and control your contribution levels and risk settings for your pension pot as your lifestyle and personal circumstances change.

It’s seamless.

- It’s quick to start or transfer a pension with our user-friendly online interface.

- You can transfer to consolidate old pension pots from other providers so that you have all your pension pots in one place.

- You can set up automatic personal and employer contributions, and also top up your pension whenever you want.

It’s personalised.

- We’ll communicate with you regularly about the investment decisions we make on your behalf and send you pension quarterly and anniversary statements.

- Whenever you have any questions or concerns, our friendly support team is there to help out by phone, email or web chat.

- If you’re not sure how best to manage and maximise your pension contributions for tax relief, our financial advisers are here to help.

What does a Nutmeg pension cost?

What does a Nutmeg pension cost?

Across all fully managed, socially responsible and Smart Alpha portfolios in your Nutmeg account, you pay a management fee of 0.75% on your first £100k and 0.35% for everything beyond. For any fixed allocation portfolios, you pay a management fee of 0.45% on your first £100k and 0.25% on anything beyond. Any underlying fund costs and the effect of market spread are kept as low as possible to help keep overall fees low. Any VAT applicable is included in the fees. Find out more about our fees.

How safe is my pension?

How safe is my pension?

Nutmeg invests and manages your personal pension. While we use a third party provider, Embark and Hornbuckle, to operate and administer the pension, you’ll only ever talk to us – we can help you with any questions and problems.

Your pension assets are held by State Street Corporation, one of the world's largest custodian banks, and Barclays Bank. This means that your money is always kept separate from Nutmeg’s assets. So, if Nutmeg is ever declared bankrupt, your pension pot will still be safe.

Nutmeg is a member of the Financial Services Compensation Scheme (FSCS) and you may be protected up to the value of £85,000.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. A pension may not be right for everyone and tax rules may change in the future. Please note that during any transfer, your investments will be out of the market. If you are unsure if a pension is right for you, please seek financial advice.

Our most recent awards